Electricity News in February 2018

Two huge wind farms boost investment in America’s heartland

MidAmerican Energy Wind XI expands Iowa wind power with the Beaver Creek and Prairie farms, 169 turbines and 338 MW, delivering renewable energy, grid reliability, rural jobs, and long-term tax revenue through major investment.

Key Points

MidAmerican Energy Wind XI is a $3.6B Iowa wind buildout adding 2,000 MW to enhance reliability, jobs, and tax revenue.

✅ 169 turbines at Beaver Creek and Prairie deliver 338 MW.

✅ Wind supplies 36.6 percent of Iowa electricity generation.

✅ Projects forecast $62.4M in property taxes over 20 years.

Power company MidAmerican Energy recently announced the beginning of operations at two huge wind farms in the US state of Iowa.

The two projects, called Beaver Creek and Prairie, total 169 turbines and have a combined capacity of 338 megawatts (MW), enough to meet the annual electricity needs of 140,000 homes in the state.

“We’re committed to providing reliable service and outstanding value to our customers, and wind energy accomplishes both,” said Mike Fehr, vice president of resource development at MidAmerican. “Wind energy is good for our customers, and it’s an abundant, renewable resource that also energizes the economy.”

The wind farms form part of MidAmerican Energy’s major Wind XI project, which will see an extra 2,000MW of wind power built, and $3.6 billion invested amid notable wind farm acquisitions shaping the market by the end of 2019. The company estimates it is the largest economic development project in Iowa’s history.

Iowa is something of a hidden powerhouse in American wind energy. The technology provides an astonishing 36.6 percent of the state’s entire electricity generation and plays a growing role in the U.S. electricity mix according to the American Wind Energy Association (AWEA). It also has the second largest amount of installed capacity in the nation at 6917MW; Texas is first with over 21,000MW.

Along with capital investment, wind power brings significant job opportunities and tax revenues for the state. An estimated 9,000 jobs are supported by the industry, something a U.S. wind jobs forecast stated could grow to over 15,000 within a couple of years.

MidAmerican Energy is also keen to stress the economic benefits of its new giant projects, claiming that they will bring in $62.4 million of property tax revenue over their 20-year lifetime.

Tom Kiernan, AWEA’s CEO, revealed last year that, as the most-used source of renewable electricity in the U.S., wind energy is providing more than five states in the American Midwest with over 20 percent of electricity generation, “a testament to American leadership and innovation”.

“For these states, and across America, wind is welcome because it means jobs, investment, and a better tomorrow for rural communities”, he added.

Related News

Portsmouth residents voice concerns over noise, flicker generated by turbine

Portsmouth Wind Turbine Complaints highlight noise, shadow flicker, resident impacts, Town Council hearings, and Green Development mitigation plans near Portsmouth High School, covering renewable energy output, PPAs, and community compliance.

Key Points

Resident reports of noise and shadow flicker near Portsmouth High School, prompting review and mitigation efforts.

✅ Noise exceeds ambient levels seasonally, residents report fatigue.

✅ Shadow flicker lasts up to 90 minutes on affected homes.

✅ Town tasks developer to meet neighbors and propose mitigation.

The combination of the noise and shadows generated by the town’s wind turbine has rankled some neighbors who voiced their frustration to the Town Council during its meeting Monday.

Mark DePasquale, the founder and chairman of the company that owns the turbine, tried to reassure them with promises to address the bothersome conditions.

David Souza, a lifelong town resident who lives on Lowell Drive, showed videos of the repeated, flashing shadows cast on his home by the three blades spinning.

“I am a firefighter. I need to get my sleep,” he said. “And now it’s starting to affect my job. I’m tired.”

Town Council President Keith Hamilton tasked DePasquale with meeting with the neighbors and returning with an update in a month. “What I do need you to do, Mr. DePasquale, is to follow through with all these people.”

DePasquale said he was unaware of the flurry of complaints lodged by the residents Monday. His company had only heard of one complaint. “If I knew there was an issue before tonight, we would have responded,” he said.

His company, Green Development LLC, formerly Wind Energy Development LLC, installed the 279-foot-tall turbine near Portsmouth High School that started running in August 2016, as offshore developers like Deepwater Wind in Massachusetts plan major construction nearby. It replaced another turbine installed by a separate company that broke down in 2012.

In November 2014, the town signed an agreement with Wind Energy Development to take down the existing turbine, pay off the remaining $1.45 million of the bond the town took out to install it and put up a new turbine, amid broader legal debates like the Cornwall wind farm ruling that can affect project timelines.

In exchange, Wind Energy Development sells a portion of the energy generated by the turbine to the town at a rate of 15.5 cents per kilowatt hour for 25 years. Some of the energy generated is sold to the town of Coventry.

“We took down (the old turbine) and paid off the debt,” DePasquale said, noting that cancellations can carry high costs as seen in Ontario wind project penalties for scrapping projects. “I have no problem doing whatever the council wants … There was an economic decision made to pay off the bond and build something better.”

The turbine was on pace to produce 4 million-plus kilowatt hours per year, Michelle Carpenter, the chief operating officer of Wind Energy Development, said last April. It generates enough energy to power all municipal and school buildings in town, she said, while places like Summerside’s wind power show similarly strong output.

The constant stream of shadows cast on certain homes in the area can last for as long as an hour-and-a-half, according to Souza. “We shouldn’t have to put up with this,” he said.

Sprague Street resident John Vegas said the turbine’s noise, especially in late August, is louder than the neighborhood’s ambient noise.

“Throughout the summer, there’s almost no flicker, but this time of year it’s very prominent,” Vegas added. “It can be every day.”

He mentioned neighbors needed to be better organized to get results.

“When the residents purchased our properties we did not have this wind turbine in our backyard,” Souza said in a memo. “Due to the wind turbine … our quality of life has suffered.”

After the discussion, the council unanimously voted to allow Green Development to sublease excess energy to the Rhode Island Convention Center Authority, a similar agreement to the one the company struck with Coventry, as regional New England solar growth adds pressure on grid upgrade planning.

“This has to be a sustainable solution,” DePasquale said. “We will work together with the town on a solution.”

Related News

NTPC bags order to supply 300 MW electricity to Bangladesh

NTPC Bangladesh Power Supply Tender sees NVVN win 300 MW, long-term cross-border electricity trade to BPDB, enabled by 500 MW HVDC interconnection; rivals included Adani, PTC, and Sembcorp in the competitive bidding process.

Key Points

It is NTPC's NVVN win to supply 300 MW to Bangladesh's BPDB for 15 years via a 500 MW HVDC link.

✅ NVVN selected as L1 for short and long-term supply

✅ 300 MW to BPDB; delivery via India-Bangladesh HVDC link

✅ Competing bidders: Adani, PTC, Sembcorp

NTPC, India’s biggest electricity producer in a nation that is now the third-largest electricity producer globally, on Tuesday said it has won a tender to supply 300 megawatts (MW) of electricity to Bangladesh for 15 years.

Bangladesh Power Development Board (BPDP), in a market where Bangladesh's nuclear power is expanding with IAEA assistance, had invited tenders for supply of 500 MW power from India for short term (1 June, 2018 to 31 December, 2019) and long term (1 January, 2020 to 31 May, 2033). NTPC Vidyut Vyapar Nigam (NVVN), Adani Group, PTC and Singapore-bases Sembcorp submitted bids by the scheduled date of 11 January.

Financial bid was opened on 11 February, the company said in a statement, amid rising electricity prices domestically. “NVVN, wholly-owned subsidiary of NTPC Limited, emerged as successful bidder (L1), both in short term and long term for 300 MW power,” it said.

Without giving details of the rate at which power will be supplied, NTPC said supply of electricity is likely to commence from June 2018 after commissioning of 500 MW HVDC inter-connection project between India and Bangladesh, and as the government advances nuclear power initiatives to bolster capacity in the sector. India currently exports approximately 600 MW electricity to Bangladesh even as authorities weigh coal rationing measures to meet surging demand domestically.

Related News

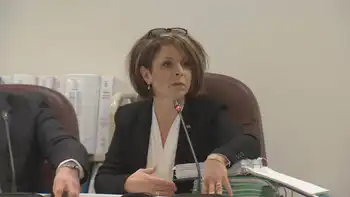

Restrict price charged for gas and electricity - British MPs

UK Energy Price Cap aims to protect consumers on gas and electricity bills, tackling Big Six overcharging on default and standard variable tariffs, with Ofgem and MPs pushing urgent reforms to the broken market.

Key Points

A temporary absolute limit on default energy tariffs to shield consumers from overcharging on gas and electricity bills.

✅ Caps standard variable and default tariffs to protect loyalty.

✅ Targets Big Six pricing; oversight by Ofgem and BEIS MPs.

✅ Aims for winter protection while maintaining competition.

MPs are calling for a cap on the price of gas and electricity, with questions over the expected cost of a UK price cap amid fears consumers are being ripped off.

The Business, Energy and Industrial Strategy (BEIS) Select Committee says the Big Six energy companies have been overcharging for years.

MPs on the committee backed plans for a temporary absolute cap, noting debates over EU gas price cap strategies to fix what they called a "broken" energy market.

Labour's Rachel Reeves, who chairs the committee, said: "The energy market is broken. Energy is an essential good and yet millions of customers are ripped off for staying loyal to their energy provider.

"An energy price cap is now necessary and the Government must act urgently to ensure it is in place to protect customers next winter.

"The Big Six energy companies might whine and wail about the introduction of a price cap but they've been overcharging their customers on default and SVTs (standard variable tariffs) for years and their recent feeble efforts to move consumers off these tariffs has only served to highlight the need for this intervention."

The Committee also criticised Ofgem for failing to protect customers, especially the most vulnerable.

Draft legislation for an absolute cap on energy tariffs was published by the Government last year, and later developments like the Energy Security Bill have kept reform on the agenda.

But Business Secretary Greg Clark refused to guarantee that the flagship plans would be in place by next winter, despite warnings about high winter energy costs for households.

Committee members said there was a "clear lack of will" on the part of the Big Six to do what was necessary, including exploring decoupling gas and electricity prices, to deal with pricing problems.

A report from the committee found that customers are paying £1.4bn a year more than they should be under the current system.

Around 12 million households are stuck on poor-value tariffs, according to the report.

National assistance charity Citizens Advice said "loyal and vulnerable" customers had been "ripped off" for too long.

Chief executive Gillian Guy said: "An absolute cap, as recommended by the committee, is crucial to securing protection for the largest number of customers while continuing to provide competition in the market. This should apply to all default tariffs."

Related News

Power firms win UK subsidies for new Channel cables project

UK Electricity Interconnectors secure capacity market subsidies, supporting winter reliability with seabed cables to France and Belgium via the Channel Tunnel, lowering consumer costs, squeezing coal, and challenging new gas plants through cross-border energy trading.

Key Points

High-voltage cables linking Britain to Europe, securing backup capacity, cutting costs and boosting winter reliability.

✅ Won capacity market contracts at record-low prices

✅ Cables to France and Belgium via Channel Tunnel, seabed routes

✅ Squeezes coal, challenges new gas; renewables may join market

New electricity cables across the Channel to France and Belgium will be a key part of keeping Britain’s lights on during winter amid record electricity prices across Europe in the early 2020s, after their owners won backup power subsidies in a government auction this week.

For the first time, interconnector operators successfully bid for a slice of hundreds of millions’ worth of contracts in the capacity market. That will help cut costs for consumers, given how electricity is priced in Europe today, and squeeze out old coal power plants.

Three new interconnectors are currently being built to Europe, almost doubling existing capacity, with one along the Channel Tunnel and two on the seabed: one between Kent and Zeebrugge and one from Hampshire to Normandy.

The interconnectors were success stories in this week’s capacity auction, which saw power firms bid to provide backup electricity in the winter of 2021/22. Prices for the four-year contracts hit a record low of £8.40 per kilowatt per year, which analysts described as a shock and well below expectations.

One industry source said the figure was “miles away” from what is needed to encourage companies to build big new gas power stations, which some argue are necessary to fill the gap when the UK’s ageing nuclear reactors close as Europe loses nuclear power across the region over the next decade.

While bad news for those firms, the low price is good for consumers. The subsidies will add about £525m to energy bills, or £5.68 for the average household, compared with £11 for the year before, according to analysts Cornwall Insight.

Existing gas power stations scooped up most of the contracts, but new gas ones lost out, as did several coal plants. Battery storage plants, a standout success in the last auction, fared comparatively poorly after changes to the rules.

Experts at Bernstein bank said the the misses by coal meant that around half the UK’s remaining coal power capacity could close from October 2019, when existing capacity market contracts run out. Chaitanya Kumar, policy adviser at thinktank Green Alliance, said: “Coal’s exit from the UK’s energy system just moved a step closer as coal contracts fell by half compared with last year.”

Tom Edwards, an analyst at Cornwall Insight, said that more interconnectors were likely to bid into future rounds of the capacity market, such as the cable being laid between Norway and the UK. Relying on foreign power supplies was fine, he said, provided Brexit did not make energy trading more difficult and the interconnectors delivered at times of need, where events like Irish grid price spikes illustrate the stress points.

However, one industry source, who wants to see new gas plants built in the UK, said the results showed that the system was not working, amid UK peak power prices that have climbed in recent trading. “That self-sufficiency doesn’t seem to be a priority at a time when we’re breaking away from Europe is a bit weird,” they said.

But the prospects for new gas plants in future rounds of the capacity market look bleak. They will very likely face a new source of competition next year, if energy regulator Ofgem approves a proposal to allow renewables to compete too.

Related News

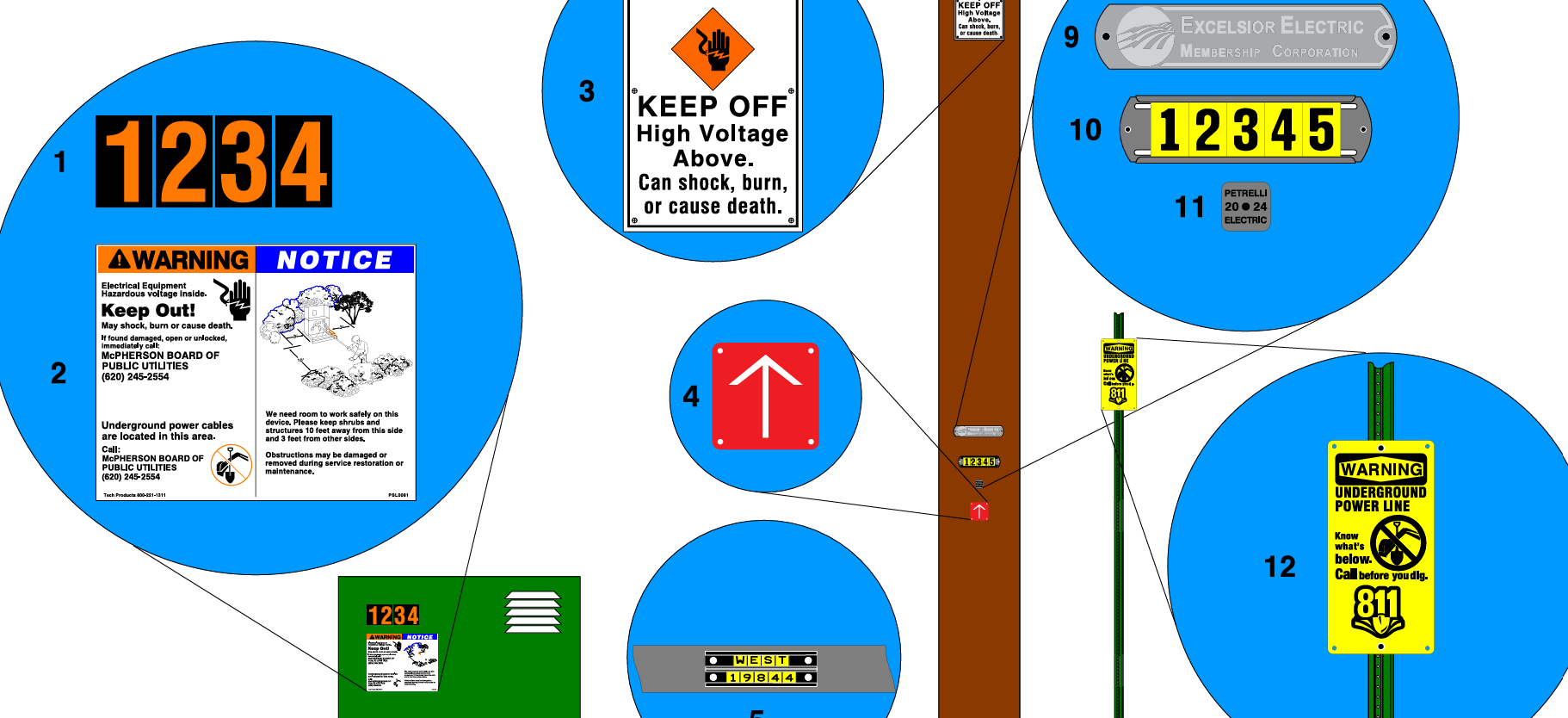

Buyer's Remorse: Questions about grid modernization affordability

Grid Modernization drives utilities to integrate DER, AMI, and battery storage while balancing reliability, safety, and affordability; regulators pursue cost-benefit analyses, new rate design, and policy actions to guide investment and protect customer-owned resources.

Key Points

Upgrading the grid to manage DER with digital tools, while maintaining reliability, safety, and customer affordability.

✅ Cost-benefit analyses guide prudent grid investments

✅ AMI and storage deployments enable DER visibility and control

✅ Rate design reforms support customer-owned resources

Utilities’ pursuit of a modern grid, including the digital grid concept, to maintain the reliability and safety pillars of electricity delivery has raised a lot of questions about the third pillar — affordability.

Utilities are seeing rising penetrations of emerging technologies, highlighted in recent grid edge trends reports, like distributed solar, behind-the-meter battery storage, and electric vehicles. These new distributed energy resources (DER) do not eliminate utilities' need to keep distribution systems safe and reliable.

But the need for modern tools to manage DER imposes costs on utilities, prompting calls to invest in smarter infrastructure even as some regulators, lawmakers and policymakers are concerned those costs could drive up electricity rates.

The result is an increasing number of legislative and regulatory grid modernization actions aimed at identifying what is necessary to serve the coming power sector transformation and address climate change risks across the grid.

The rise of grid modernization

Grid modernization, which is supported by both conservatives and distributed energy resources advocates, got a lot of attention last year. According to the 2017 review of grid modernization policy by the North Carolina Clean Energy Technology Center (NCCETC), 288 grid modernization policy actions were proposed, pending or enacted in 39 states.

These numbers from NCCETC's first annual review of policy activity set a benchmark against which future years' activity can be measured.

The most common type of state actions, by far, were those that focused on the deployment of advanced metering infrastructure (AMI) and battery energy storage. Those are two of the 2017 trends identified in NCCETC’s 50 States of Grid Modernization report. But deployment of those technologies, while foundational to an updated grid, only begins to prepare distribution systems for the coming power sector transformation.

Bigger advances, including the newest energy system management tools, are being held back by 2017’s other policy actions requiring more deliberation and fact-finding, even as grid vulnerability report cards underscore the risks that modernization seeks to mitigate.

Utilities’ proposals to more fully prepare their grids to deliver 21st century technologies are being met with questions about completeness and cost.

Utilities are being asked to address these questions in comprehensive, public utility commission-led cost-benefit analyses and studies. This is also one of NCCETC’s top 2017 policy action trends for grid modernization. The outcome to date appears to be an increased, but still incomplete, understanding of what is needed to build a 21st century grid.

Among the top objectives of those driving the policy actions are resolving questions about private sector participation in grid modernizaton buildouts and developing new rate designs to protect and support customer-owned distributed energy resources. Actions on those topics are also on NCCETC’s list of 2017 policy trends.

Altogether, the trend list is dominated by actions that do not lead to completion of grid modernization but to more work on it.

Related News

Electricity restored to 75 percent of customers in Puerto Rico

Puerto Rico Power Restoration advances as PREPA, FEMA, and the Army Corps rebuild the grid after Hurricane Maria; 75% of customers powered, amid privatization debate, Whitefish contract fallout, and a continuing island-wide boil-water advisory.

Key Points

Effort to rebuild Puerto Rico's grid and restore power, led by PREPA with FEMA support after Hurricane Maria.

✅ 75.35% of customers have power; 90.8% grid generating

✅ PREPA, FEMA, and Army Corps lead restoration work

✅ Privatization debate, Whitefish contract scrutiny

Nearly six months after Hurricane Maria decimated Puerto Rico, the island's electricity has been restored to 75 percent capacity, according to its utility company, a contrast to California power shutdowns implemented for different reasons.

The Puerto Rico Electric Power Authority said Sunday that 75.35 percent of customers now have electricity. It added that 90.8 percent of the electrical grid, already anemic even before the Sept. 20 storm barrelled through the island, is generating power again, though demand dynamics can vary widely as seen in Spain's power demand during lockdowns.

Thousands of power restoration personnel made up of the Puerto Rico Electric Power Authority (PREPA), the Federal Emergency Management Agency (FEMA), industry workers from the mainland, and the Army Corps of Engineers have made marked progress in recent weeks, even as California power shutoffs highlight grid risks elsewhere.

Despite this, 65 people in shelters and an island-wide boil water advisory is still in effect even though almost 100 percent of Puerto Ricans have access to drinking water, local government records show.

The issue of power became controversial after Puerto Rico Gov. Ricardo Rossello recently announced plans to privatize PREPA after it chose to allocate a $300 million power restoration contract to Whitefish, a Montana-based company with only a few staffers, rather than put it through the mutual-aid network of public utilities usually called upon to coordinate power restoration after major disasters, and unlike investor-owned utilities overseen by regulators such as the Florida PSC on the mainland.

That contract was nixed and Whitefish stopped working in Puerto Rico after FEMA raised "significant concerns" over the procurement process, scrutiny mirrored by the fallout from Taiwan's widespread outage where the economic minister resigned.

Related News

Crossrail will generate electricity using the wind created by trains

Urban Piezoelectric Energy Textiles capture wind-driven motion on tunnels, bridges, and facades, enabling renewable microgeneration for smart cities with decentralized power, resilient infrastructure, and flexible lamellae sheets that harvest airflow vibrations.

Key Points

Flexible piezoelectric sheets that convert urban wind and vibration into electricity on tunnels, bridges, and facades.

✅ Installed on London Crossrail to test airflow energy capture

✅ Flexible lamellae panels retrofit tunnels, bridges, facades

✅ Supports decentralized, resilient urban microgrids

Charlotte Slingsby and her startup Moya Power are researching piezo-electric textiles that gain energy from movement, similar to advances like a carbon nanotube energy harvester being explored by materials researchers. It seems logical that Slingsby originally came from a city with a reputation for being windy: “In Cape Town, wind is an energy source that you cannot ignore,” says the 27-year-old, who now lives in London.

Thanks to her home city, she also knows about power failures. That’s why she came up with the idea of not only harnessing wind as an alternative energy source by setting up wind farms in the countryside or at sea, but also for capturing it in cities using existing infrastructure.

The problem

The United Nations estimates that by 2050, two thirds of the world’s population will live in cities. As a result, the demand for energy in urban areas will increase dramatically, spurring interest in nighttime renewable technology that can operate when solar and wind are variable. Can the old infrastructure grow fast enough to meet demand? How might we decentralise power generation, moving it closer to the residents who need it?

For a pilot project, she has already installed grids of lamellae-covered plastic sheets in tunnels on London Crossrail routes; the draft in the tube causes the protrusions to flutter, which then generates electricity.

“If we all live in cities that need electricity, we need to look for new, creative ways to generate it, including nighttime solar cells that harvest radiative cooling,” says Slingsby, who studied design and engineering at Imperial College and the Royal College of Art. “I wanted to create something that works in different situations and that can be flexibly adapted, whether you live in an urban hut or a high-rise.”

The yield is low compared to traditional wind power plants and is not able to power whole cities, but Slingsby sees Moya Power as just a single element in a mixture of urban energy sources, alongside approaches like gravity power that aid grid decarbonization.

In the future, Slingsby’s invention could hang on skyscrapers, in tunnels or on bridges – capturing power in the windiest parts of the city, alongside emerging air-powered generators that draw energy from humidity. The grey concrete of tunnels and urban railway cuttings could become our cities’ most visually appealing surfaces...

Related News

Electricity prices may go up by 15 per cent

Jersey Electricity Standby Charge proposes a grid-backup fee for commercial self-generators of renewable energy, with a review delaying implementation; potential tariff impacts include 10-15 percent price rises, cost recovery, and network reliability.

Key Points

A grid-backup fee for Jersey self-generating businesses to share network costs fairly and curb electricity price rises.

✅ Applies to commercial self-generation using renewables or not

✅ Excludes full exporters and pre-charge installations

✅ Aims to recover grid costs and avoid 10-15% price rises

Electricity prices could rise by ten to 15 per cent if a standby charge for some commercial customers is not implemented, the chief executive of Jersey Electricity has warned.

Jersey Electricity has proposed extending a monthly fee to commercial customers who generate their own power through renewable means but still wish to be connected to Jersey’s grid as a back-up, echoing Ontario energy storage efforts to shore up reliability.

The States recently unanimously backed a proposal lodged by Deputy Carolyn Labey to delay administering the levy until a review could be carried out, as seen in the UK grid's net-zero transformation debates influencing policy. The charge, was due to be implemented next month but will now not be introduced until May, or later if the review has not concluded.

But Chris Ambler, JE chief executive, warned that failing to implement the standby charge could lead to additional costs for customers.

Some of JE’s commercial customers have already been charged a standby fee after generating their own power through non-renewable means.

The charge does not apply to businesses which export all of their electricity back into the system as part of a buy-back scheme or those which install self-generation facilities before the charge is implemented.

Deputy Labey argued that the Island had done ‘absolutely nothing’ to support the use of renewable energies and instead were discouraging locally generated power by allowing JE to set a standby charge.

She added that she was pleased that the Council of Ministers had already starting reviewing the charges but the debate needed to go ahead to ensure the work continued after the May election.

During a States debate last month, she said: ‘It is increasingly concerning that we, as an island in the 21st century, are happy for our electricity to be provided to us by an unregulated, publicly listed for-profit company with a monopoly on energy.

‘I also think that introducing a charge on renewables at a time when the world is experiencing a revolution in renewable energies, including offshore vessel charging solutions, which are becoming increasingly economic, is something that needs to be investigated.

‘Jersey should be looking to diversify our electricity production and supply, to help protect us from price and currency fluctuations and to ensure that we, as an island, receive the best deal possible for Islanders.’

Mr Ambler said that any price increase would be dependent on the future take-up and use of renewable-energy technology in Jersey.

He said: ‘The cost impact would not be significant in the short term but in the long term it could be significant. I think that we are obliged to let our customers know that.

‘It is very difficult to assess but if we are not able to levy a fair charge, then, as electricity shortages in Canada have shown, we could see prices rise by ten to 15 per cent over time.’

Mr Ambler added that his company was in favour of the use of renewable energy, with a third of the company’s electricity being generated by hydroelectric sources, but that the costs of implementing it needed to be fairly distributed, given how big battery rule changes can affect project viability elsewhere in the market.

And he said that, while it was difficult to quantify how much could be lost if the standby charge was not implemented, it could cost the company over £10 million.

‘In 2014, we only increased our prices by one per cent,’ he said. ‘We are reviewing our prices at the moment but if we did put an increase in place it would be modest and it would not be linked to the standby charge.’

Related News

Iceland Cryptocurrency mining uses so much energy, electricity may run out

Iceland Bitcoin Mining Energy Shortage highlights surging cryptocurrency and blockchain data center electricity demand, as hydroelectric and geothermal power strain to cool servers, stabilize grid, and meet rapid mining farm growth amid Arctic-friendly conditions.

Key Points

Crypto mining data centers in Iceland are outpacing renewable power, straining the grid and exceeding residential electricity demand.

✅ Hydroelectric and geothermal capacity nearing allocation limits

✅ Cooling-friendly climate draws energy-hungry mining farms

✅ Grid planning and regulation lag rapid data center growth

The value of bitcoin may have stumbled in recent months, but in Iceland it has known only one direction so far: upward. The stunning success of cryptocurrencies around the globe has had a more unexpected repercussion on the island of 340,000 people: It could soon result in an energy shortage in the middle of the Atlantic Ocean.

As Iceland has become one of the world's prime locations for energy-hungry cryptocurrency servers — something analysts describe as a 21st-century gold-rush equivalent — the industry’s electricity demands have skyrocketed, too. For the first time, they now exceed Icelanders’ own private energy consumption, and energy producers fear that they won’t be able to keep up with rising demand if Iceland continues to attract new companies bidding on the success of cryptocurrencies, a concern echoed by policy moves like Russia's proposed mining ban amid electricity deficits.

Companies have flooded Iceland with requests to open new data centers to “mine” cryptocurrencies in recent months, even as concerns mount that the country may have to slow down investments amid an increasingly stretched electricity generation capacity, a dynamic seen in BC Hydro's suspension of new crypto connections in Canada.

“There was a lot of talk about data centers in Iceland about five years ago, but it was a slow start,” Johann Snorri Sigurbergsson, a spokesman for Icelandic energy producer HS Orka, told The Washington Post. “But six months ago, interest suddenly began to spike. And over the last three months, we have received about one call per day from foreign companies interested in setting up projects here.”

“If all these projects are realized, we won’t have enough energy for it,” Sigurbergsson said.

Every cryptocurrency in the world relies on a “blockchain” platform, which is needed to trade with digital currencies. Tracking and verifying a transaction on such a platform is like solving a puzzle because networks are often decentralized, and there is no single authority in charge of monitoring payments. As a result, a transaction involves an immense number of mathematical calculations, which in turn occupy vast computer server capacity. And that requires a lot of electricity, as analyses of bitcoin's energy use indicate worldwide.

The bitcoin rush may have come as a surprise to locals in sleepy Icelandic towns that are suddenly bustling with cryptocurrency technicians, but there’s a simple explanation. “The economics of bitcoin mining mean that most miners need access to reliable and very cheap power on the order of 2 or 3 cents per kilowatt hour. As a result, a lot are located near sources of hydro power, where it’s cheap,” Sam Hartnett, an associate at the nonprofit energy research and consulting group Rocky Mountain Institute, told the Washington Post.

Top financial regulators briefed a Senate panel on Feb. 6 about their work with cryptocurrencies like Bitcoin, and the risks to potential investors. (Reuters)

Located in the middle of the Atlantic Ocean and famous for its hot springs and mighty rivers, Iceland produces about 80 percent of its energy in hydroelectric power stations, compared with about 6 percent in the United States, and innovations such as underwater kites illustrate novel ways to harness marine energy. That and the cold climate make it a perfect location for new data-mining centers filled with servers in danger of overheating.

Those conditions have attracted scores of foreign companies to the remote location, including Germany's Genesis Mining, which moved to Iceland about three years ago. More have followed suit since then or are in the process of moving.

While some analysts are already sensing a possible new revenue source for the country that is so far mostly known abroad as a tourist haven and low-budget airline hub, others are more concerned by a phenomenon that has so far mostly alarmed analysts because of its possible financial unsustainability, alongside issues such as clean energy's dirty secret that complicate the picture. Some predictions have concluded that cryptocurrency computer operations may account for “all of the world’s energy by 2020” or may already account for the equivalent of Denmark's energy needs. Those predictions are probably too alarmist, though.

Most analysts agree that the real energy-consumption figure is likely smaller, and several experts recently told the Washington Post that bitcoin — currently the world's biggest cryptocurrency — used no more than 0.14 percent of the world’s generated electricity, as of last December. Even though global consumption may not be as significant as some have claimed, it still presents a worrisome drain for a tiny country such as Iceland, where consumption suddenly began to spike with almost no warning — and continues to grow fast.

Some networks are considering or have already pushed through changes to their protocols, designed to reduce energy use. But implementing such changes for the leading currency, bitcoin, won't be as easy because it is inherently decentralized. The companies that provide the vast amounts of computing power needed for these transactions earn a small share, comparable to a processing fee or a reward.

They are the source of the Icelandic bitcoin miners’ income — a revenue source that many Icelanders are still not quite sure what to make of, especially if the lights start flickering.

Related News

The gloves are off - Alberta suspends electricity purchase talks with B.C.

Alberta-BC Pipeline Dispute centers on Trans Mountain expansion, diluted bitumen shipments, federal approval, spill response capacity, and electricity trade, as Alberta suspends power talks and Ottawa insists the Kinder Morgan project proceeds in national interest.

Key Points

Dispute over Trans Mountain expansion, bitumen limits, and jurisdiction between Alberta, B.C., and Canada.

✅ Alberta suspends BC electricity talks as leverage

✅ Ottawa affirms federal approval and spill response

✅ BC plans advisory panel on diluted bitumen risks

Alberta Premier Rachel Notley says her government is suspending talks with British Columbia on the purchase of electricity from the western province.

It’s the first step in Alberta’s fight against the B.C. government’s proposal to obstruct the Kinder Morgan oil pipeline expansion project by banning increased shipments of diluted bitumen to the province’s coast.

Up to $500 million annually for B.C.’s coffers from electricity exports hangs in the balance, Notley said.

“We’re prepared to do what it takes to get this pipeline built — whatever it takes,” she told a news conference Thursday after speaking with Prime Minister Justin Trudeau on the phone.

Notley said she told Trudeau, who’s in Edmonton for a town-hall meeting, that the federal government needs to act decisively to end the dispute.

Speaking on Edmonton talk radio station CHED earlier in the day, Trudeau said the pipeline expansion is in the national interest and will go ahead, even as the federal government undertakes a study on electrification across sectors.

“That pipeline is going to get built,” Trudeau said. “We will stand by our decision. We will ensure that the Kinder Morgan pipeline gets built.”

B.C.’s environment minister has said his minority government plans to ban increased shipments until it can determine that shippers are prepared and able to properly clean up a spill, and, separately, has implemented an electricity rate freeze affecting consumers. He said he will establish an independent scientific advisory panel to study the issue.

The move infuriated Notley, who has accused B.C. of trying to change the rules after the federal government gave the project the green light. B.C. has the right to regulate how any spills would be cleaned up, but can’t dictate what flows through pipelines, she said.

Trudeau said Canada needs to get Alberta’s oil safely to markets other than the U.S. energy market today. He said the federal government did the research and has spent billions on spill response.

“The Kinder Morgan pipeline is not a danger to the B.C. coast,” he said.

Notley said she thanked Trudeau for his assurance that the project will go ahead, but the federal government has to do more to ensure the pipeline’s expansion.

“This is not an Alberta-B.C. issue. This is a Canada-B.C. issue,” she said. “This kind of uncertainty is bad for investment and bad for working people

“Enough is enough. We need to get these things built.”

B.C. Premier John Horgan said his government consulted Alberta and Ottawa about his province’s intentions, noting that Columbia River Treaty talks also shape regional electricity policy.

“I don’t see what the problem is,” Horgan said Thursday at a school opening north of Kelowna, B.C. “It’s within our jurisdiction to put in place regulations to protect the public interest.

“That’s what we are doing.”

He downplayed any possibility of court action or sanctions by Alberta.

“There’s nothing to take to court,” Horgan said. “We are consulting with the people of B.C. It’s way too premature to talk about those sorts of issues.

“Sabre-rattling doesn’t get you very far.”

Speaking in Ottawa, Natural Resources Minister Jim Carr wouldn’t say what Canada might do if British Columbia implements its regulation.

“That’s speculative,” said Carr.

He noted at this point, B.C. has just pledged to consult. He said the federal government heard from thousands of people before the pipeline was approved.

“That’s what they have announced — an intention to consult. We have already consulted.”

B.C.’s proposal creates more uncertainty for Kinder Morgan’s already-delayed Trans Mountain expansion project that would nearly triple the capacity of its pipeline system to 890,000 barrels a day.

Related News

Marine Renewables Canada shifts focus towards offshore wind

Marine Renewables Canada Offshore Wind integrates marine renewables, tidal and wave energy, advancing clean electricity, low-carbon power, supply chain development, and regulatory alignment to scale offshore wind energy projects across Canada's coasts and global markets.

Key Points

An initiative to grow offshore wind using Canada's marine strengths, shared supply chains, and regulatory synergies.

✅ Leverages tidal and wave energy expertise for offshore wind

✅ Aligns supply chain, safety, and regulatory frameworks

✅ Supports low-carbon power and clean electricity goals

With a growing global effort to develop climate change solutions and increase renewable electricity production, including the UK offshore wind growth in recent years, along with Canada’s strengths in offshore and ocean sectors, Marine Renewables Canada has made a strategic decision to grow its focus by officially including offshore wind energy in its mandate.

Marine Renewables Canada plans to focus on similarities and synergies of the resources in order to advance the sector as a whole and ensure that clean electricity from waves, tides, rivers, and offshore wind plays a significant role in Canada’s low-carbon future.

“Many of our members working on tidal energy and wave energy projects also have expertise that can service offshore wind projects both domestically and internationally,” says Tim Brownlow, Chair of Marine Renewables Canada. “For us, offshore wind is a natural fit and our involvement will help ensure that Canadian companies and researchers are gaining knowledge and opportunities in the offshore wind sector as it grows.”

Canada has the longest coastlines in the world, giving it huge potential for offshore wind energy development. In addition to the resource, Canada has significant capabilities from offshore and marine industries that can contribute to offshore wind energy projects. The global offshore wind market is estimated to grow by over 650% by 2030 and presents new opportunities for Canadian business.

“The federal government’s recent inclusion of offshore renewables in legislation, including a plan for regulating offshore wind developed by the government, and support for emerging renewable energy technologies are important steps toward building this industry,” says Elisa Obermann, executive director of Marine Renewables Canada. “There are still challenges to address before we’ll see offshore wind energy development in Canada, but we see a great opportunity to get more involved now, increase our experience, and help inform future development.”

Like wave and tidal energy, offshore wind projects operate in harsh marine environments and development presents many of the same challenges and benefits as it does for other marine renewable energy resources. Marine Renewables Canada has recognized that there is significant overlap between offshore wind and wave and tidal energy when it comes to the supply chain, regulatory issues, and the operating environment. The association plans to focus on similarities and synergies of the resources in order to advance the sector as a whole, leveraging Canada’s opportunity in the global electricity market to ensure that clean electricity from waves, tides, rivers, and offshore wind plays a significant role in Canada’s low-carbon future.

Related News

Power customers in British Columbia, Quebec have faced fees for refusing the installation of smart meters

NB Power Smart Meter Opt-Out Fees reflect cost causation principles set before the Energy and Utilities Board, covering meter reading charges, transmitter-disable options, rollout targets, and education plans across New Brunswick's smart metering program.

Key Points

Fees NB Power may apply to customers opting out of smart meters, reflecting cost causation and meter-reading costs.

✅ Based on cost causation and meter reading expenses

✅ BC and Quebec charge monthly opt-out surcharges

✅ Policy finalized during rollout after EUB review

NB Power customers who do not want a smart meter installed on their home could be facing a stiff fee for that decision, but so far the utility is not saying how much it might be.

"It will be based on the principles of cost causation, but we have not gotten into the detail of what that fee would be at this point," said NB Power Senior Vice President of Operations Lori Clark at Energy and Utilities Board hearings on Friday.

In other jurisdictions that have already adopted smart meters, customers not wanting to participate have faced hundreds of dollars in extra charges, while Texas utilities' pullback from smart-home networks shows approaches can differ.

In British Columbia, power customers are charged a meter reading fee of $32.40 per month if they refuse a smart meter, or $20 per month if they accept a smart meter but insist its radio transmitter be turned off. That's a cost of between $240 and $388.80 per year for customers to opt out.

In Quebec, smart meters were installed beginning in 2012. Customers who refused the devices were initially charged $98 to opt out plus a meter reading fee of $17 per month. That was eventually cut by Quebec's energy board in 2014 to a $15 refusal fee and a $5 per month meter reading surcharge.

NB Power said it may be a year or more before it settles on its own fee.

"The opt out policy will be developed and implemented as part of the roll out. It will be one of the last things we do," said Clark.

Customers need to be on board

NB Power is in front of the New Brunswick Energy and Utilities Board seeking permission to spend $122.7 million to install 350,000 smart meters province wide, as neighboring markets grapple with major rate increases that heighten affordability concerns.

The meters are capable of transmitting consumption data of customers back to NB Power in real time, which the utility said will allow for a number of innovations in pricing and service, and help address old meter inaccuracies that affected some households.

The meters require near universal adoption by customers to maximize their financial benefit — like eliminating more than $20 million a year NB Power currently spends to read meters manually. The utility has said the switch will not succeed if too many customers opt out.

"We certainly wouldn't be looking at making an investment of this size without having the customer with us," said Clark.

On Thursday, Kent County resident Daniel LeBlanc, who along with Roger Richard, is opposing the introduction of smart meters for health reasons, predicted a cool reception for the technology in many parts of the province, given concerns that include health effects and billing disputes in Nova Scotia reported elsewhere.

"If one were to ask most of the people in the rural areas, I'm not sure you would get a lot of takers for this infrastructure," said LeBlanc, who is concerned with the long-term effect microwave frequencies used by the meters to transmit data may have on human health.

That issue is before the EUB next week.

Haven't tested the waters

NB Power acknowledged it has not measured public opinion on adopting smart meters but is confident it can convince customers it is a good idea for them and the utility, even as seasonal rate proposals in New Brunswick have prompted consumer backlash.

"People don't understand what the smart meter is," said Clark. "We need to educate our customers first to allow them to make an informed decision so that will be part of the roll out plan."

Clark noted that smart meters, helped by stiff opting out penalties, were eventually accepted by 98 per cent of customers in British Columbia and by 97.4 per cent of customers in Quebec.

"We will check and adjust along the way if there are issues with customer uptake," said Clark.

"This is very similar to what has been done in other jurisdictions and they haven't had those challenges."

Related News

BC Hydro activates "winter payment plan"

BC Hydro Winter Payment Plan lets customers spread electricity bills over six months during cold weather, easing costs amid colder-than-average temperatures in British Columbia, with low-income conservation support, energy-saving kits, and insulation upgrades.

Key Points

Allows BC Hydro customers to spread winter electricity bills over six months, with added low-income efficiency support.

✅ Spread Dec-Mar bills across six months

✅ Eases costs during colder-than-average temperatures

✅ Includes low-income conservation and energy-saving kits

As colder temperatures set in across the province again this weekend, BC Hydro says it is activating its winter payment plan to give customers the opportunity to spread out their electricity bills as demand can reach record levels during extreme cold periods.

"Our meteorologists are predicting colder-than-average temperatures will continue over the next of couple of months and we want to provide customers with help to manage their payments," said Chris O'Riley, BC Hydro's president.

All BC Hydro customers will be able to spread payments from the billing period spanning Dec. 1, 2017 to March 31, 2018 over a six-month period.

Cold weather in the second half of December 2017 led to surging electricity demand that was higher than the previous 10-year average and has at times hit all-time highs during peak usage periods, according to BC Hydro.

Hydro operations also respond to summer conditions, as drought and low rainfall can force adjustments in power generation strategies.

People who heat their homes with electricity — about 40 per cent of British Columbians — have the highest overall bills in the province, $197 more in December than in July, when air conditioning use can affect energy costs.

This is the second year the Crown corporation has activated a cold-weather payment plan, part of broader customer assistance programs it offers.

BC Hydro has also increased funding for its low-income conservation programs by $2.2 million for a total of $10 million over the next three years.

The low-income program provides energy-saving kits that include things like free energy assessments, insulation upgrades and weather stripping.

Related News

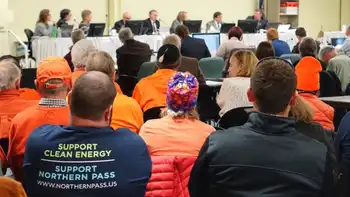

New Hampshire rejects Quebec-Massachusetts transmission proposal

Northern Pass Project faces rejection by New Hampshire regulators, halting Hydro-Quebec clean energy transmission lines to Massachusetts; Eversource vows appeal as the Site Evaluation Committee cites development concerns and alternative routes through Vermont and Maine.

Key Points

A project to transmit Hydro-Quebec power to Massachusetts via New Hampshire, recently rejected by state regulators.

✅ New Hampshire SEC denied the transmission application

✅ Up to 9.45 TWh yearly from Hydro-Quebec to Massachusetts

✅ Eversource plans appeal; alternative routes via Vermont, Maine

Regulators in the state of New Hampshire on Thursday rejected a major electricity project being piloted by Quebec’s hydro utility and its American partner, Eversource.

Members of New Hampshire’s Site Evaluation Committee unanimously denied an application for the Northern Pass project a week after the state of Massachusetts green-lit the proposal.

Both states had to accept the project, as the transmission lines were to bring up to 9.45 terawatt hours of electricity per year from Quebec’s hydroelectric plants to Massachusetts as part of Hydro-Quebec’s export bid to New England, through New Hampshire.

The 20-year proposal was to be the biggest export contract in Hydro-Quebec’s history, in a region where Connecticut is leading a market overhaul that could affect pricing, and would generate up to $500 million in annual revenues for the provincial utility.

Hydro-Quebec’s U.S. partner, Eversource, said in a new release it was “shocked and outraged” by the New Hampshire regulators’ decision and suggested it would appeal.

“This decision sends a chilling message to any energy project contemplating development in the Granite State,” said Eversource. “We will be seeking reconsideration of the SEC’s decision, as well as reviewing all options for moving this critical clean energy project forward, including lessons from electricity corridor construction in Maine.”

The New Hampshire Union Leader reported Thursday the seven members of the evaluation committee said the project’s promoters couldn’t demonstrate the proposed energy transport lines wouldn’t interfere with the region’s orderly development.

Hydro-Quebec spokesman Serge Abergel said the decision wasn’t great news but it didn’t put a end to the negotiations between the company and the state of Massachusetts.

The hydro utility had proposed alternatives routes through Vermont and Maine amid a 145-mile transmission line debate over the corridor should the original plan fall through.

“There is a provision included in the process in the advent of an impasse, which allows Massachusetts to go back and choose the next candidate on the list,” Abergel said in an interview. “There are still cards left on the table.”