Burning wood debris for generation

By National Post

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

But no longer. Today, those piles are a vision of a future in which forests not only build houses but light streets, and in which forestry companies are no longer simple hewers of wood but rather power players.

It is already happening under Mr. Wagner's watch, as Edmonton-based power producer Epcor Power LP transforms chipped bark and railway ties into a constant stream of electricity powering this part of central B.C.

Soon, it will be happening elsewhere as the West's biggest forestry companies race to build new facilities that will turn wasted wood into cash. B.C. Hydro estimates companies could produce 470 megawatts of power this way, or about 10% of the province's annual energy production.

Forestry companies say this could be just be the beginning, as B.C. serves as the pilot for a model of forest power that could be replicated across the country.

It is, however, Mr. Wagner's plant that is in many ways the pilot for B.C. The largest biomass power plant on the continent, the Williams Lake facility produces 66 megawatts of electricity - enough to power 65,000 homes - from a steady stream of chipped wood burning in a 1,000-degree Celsius inferno.

The plant was built 15 years ago as an air-quality measure to replace industrial "beehive burners" that incinerated waste at local sawmills into a smoky haze that shrouded the community.

"There was a purpose to it," says Mr. Wagner, the plant manager. "But it's an economic plant and it's been an economic plant since Day One."

Now the question is whether other wood-fired plants can be equally economic.

The province certainly hopes so. B.C. has begun pushing bio-energy as a way to make use of its huge stands of pine beetle-killed timber, and as part of its bid to become energy self-sufficient from carbon-neutral power sources by 2016.

This year, B.C. Hydro collected 20 proposals from firms that together are bidding to produce 4,100 gigawatt-hours of bio-electricity - roughly equivalent to the province's estimated potential - per year.

Many of them are forestry players. Mercer International Inc. has already made down payments on a $55-million generator that will sell 35 megawatts to the grid. Tolko Industries Ltd. already sells 20 megawatts to the grid, and is looking to build more.

Nexterra Energy Corp. is moving to build small wood-powered generators in urban areas. Canfor Pulp LP is considering at least four projects. In May, West Fraser Timber Co. Ltd. announced a partnership with Epcor to develop a 50-to 70-megawatt project. The company is also proposing to sell 15 megawatts of electricity through its partnership with Cariboo Pulp& Paper Co.

Electrical production is nothing new for the industry. West Fraser, for example, already produces a total of 100 megawatts to power its own mills, and the company sees the new electrical rush as little more than an extension of how things are already done.

"What we do is we cut trees and make products and sell them," says Bill LeGrow, West Fraser's vice-president of transportation and energy. "This is just another product, really. So if there's an economic opportunity on that product, it seems like a logical extension."

Perhaps most attractive - apart from the green benefits, which environmentalists have lauded - is the prospect of creating treasure from trash. Only 45% of a typical sawlog actually becomes lumber. The rest is left as residue. Much is used as chips that fuel pulp mills, but a substantial portion of the wood - in some areas, as much as 20% - is burned off or left to rot in clearcuts.

In other areas, bio-electricity could tip the economic balance in favour of timber stands now considered too short on lumber potential, and could even lead to changes in forestry practice to more fully use existing trees.

"There's a certain amount of biomass potential in the forest, and we don't harvest or utilize a fraction of that potential," says Wayne Clogg, West Fraser's senior vice-president of woodlands.

"We don't do a lot of intermediate thinning in our stands, which the Europeans do, because we don't really have a market for that small product there. But if you had a bioenergy demand, there's an opportunity there."

It is, however, difficult to calculate how much power production will affect the industry's bottom line.

Zoltan Szucs, West Fraser's vice-president of panelboards, admits that "the return on these type of projects is probably lower than what you would anticipate in an industrial manufacturing process."

Others in the industry are nervous about whether there will be much of a return at all.

"The economics are not as simple and straightforward as some people think," says Tom Sitar, Canfor Corp.'s chief financial officer. "Everybody presumes that fibre is just readily available in the form that it can be burned. It's there, and we all know it's there, but it takes significant dollars to bring that fibre into a source that will generate electricity."

Building electrical plants is not cheap, either. The rule of thumb used to be $2-million or $3-million per megawatt, "but the numbers have gone way up. It's probably upwards of four now," says Michael Towers, the manager of energy and supply systems at Tolko.

Ultimately, the success or failure of the wood electricity production will come down to the rates that provincial utilities are willing to pay, and those rates are likely to be steep.

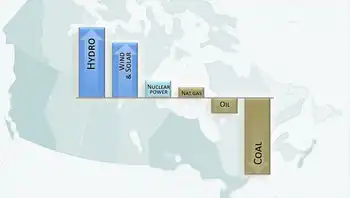

B. C. Hydro estimates that the cost of producing bio-electricity will exceed the cost of all other forms of power save offshore wind. And those numbers are likely conservative, West Fraser executives say.

Provincial Cabinet members have made it clear that the province is more than willing to raise electricity rates, although the industry is currently tussling with B.C. Hydro over who will shoulder the financial risk if the cost of wood fibre rises unexpectedly.

Still, the prospect of stable new revenues is a rare glimmer of hope for an industry mired in a downturn that has been called the worst ever.

"Bio-energy," Epcor's Mr. Wagner says, as he looks out over a line of trucks delivering chopped trees that will soon fill the power lines, "is a great way to make electricity."