Recession resistant coal industry cuts back

By Associated Press

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Already, mine operators have scaled back production plans for 2009, namely coking coal used for steelmill blast furnaces as manufacturing grounds to a halt.

Peabody Energy Corp., one of the world's largest coal miners, said this week it was cutting its production in Wyoming and Australia because of the economic downturn.

Investors have pulled billions out of the market and coal companies have not been immune.

Wall Street analysts have lowered profit estimates and coal stocks as a group have fallen better than 70 percent since last July, when coal prices were at their peak.

Since then, the average price per ton for Appalachian coal has fallen more than 35 percent, though prices remain high compared with a year ago. Illinois Basin coal prices have fallen as well, but still remain more than double their January 2008 level.

"My sense is just that it's a time of serious adjustment here," said Jim Truman a coal industry analyst with consulting firm Hill & Associates. "They're not worried that the whole situation is going to collapse."

A serendipitous labor shortage may play out to the industry's favor.

The industry as a whole struggled to find experienced miners throughout 2008, leaving production below optimum levels. That inability to up production in response to high prices last year means mines won't have to curtail production as much in a downturn, Truman said.

So far, cutbacks by St. Louis-based Peabody and Consol, of Canonsburg, Pa., have focused on coal used for steel making and lower-energy Powder River Basin coal.

"The demand for coking coal has fallen out of bed," said Charles Bradford, a steel industry analyst with Bradford Research/Soleil Securities. The average steel industry operating rate was 36 percent last week, including electric arc furnaces and blast furnaces, meaning there's precious little demand for coking coal.

Yet the industry is typically not hit as hard as other sectors during recessions.

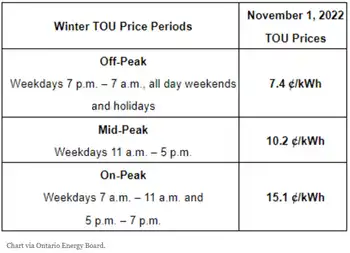

Figures from the U.S. Energy Information Administration show electricity demand has remained relatively flat during the last three U.S. recessions.

What's more, producers such as Richmond, Va.-based Massey Energy Co. and Consol Energy locked in high prices by signing contracts for much of their 2009 production last year.

Woes in the energy and steel sector may actually benefit coal producers. Prices for diesel fuel and steel, two key commodities for the industry, continue to plummet.

Whether or not the industry will escape the economic downturn unscathed remains to be seen.

"It's going to be interesting to see how the profit margins are maintained," said Cal Kent, a Marshall University economist who follows the coal industry. "I would imagine that they will be less profitable."