Fuel cell cars at least 15 years away at best

By The National Post

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Under a best-case scenario, automakers will only be able to sell about two million electric vehicles powered by fuel cells by 2020, according to the study by the National Research Council. That would mean that less than 1% of the vehicles on U. S. roads by that date would be powered by fuel cells.

General Motors, Honda and other automakers are in the process of testing limited fleets of hydrogen-powered fuel cell cars.

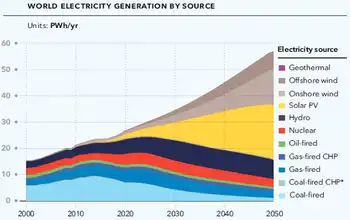

Advocates see the still-emerging technology as a way to cut oil use and carbon dioxide emissions since fuel cells combine stored hydrogen with oxygen to produce electricity. As a result, fuel cell vehicles emit only water vapour.

But many environmental advocates argue that hybrids and fully battery-powered electric vehicles, such as the upcoming Chevrolet Volt from GM, are the most reliable and cheapest ways to reduce oil consumption in the short term.

Success for fuel cell technology hinges on building facilities to generate, transport and store hydrogen at filling stations. It will also require automakers to build cheap and durable hydrogen vehicles that consumers would buy.

Another challenge is that the key ingredient in fuel cell stacks is platinum, an expensive metal that represents almost 60% of the cost of producing a fuel cell.

The study found that future platinum supply was a critical issue in forward projections of fuel cell costs.

The study concluded that the best way to reduce oil consumption and greenhouse gas emissions over the next 20 years would be a range of alternatives, including hybrids and improvements in the efficiency of gas-powered engines.

"We shouldn't be picking winners and losers in these technologies because they will probably all be important in the future," says Michael Ramage, a retired Exxon Mobil researcher who chaired the study committee.

To jump-start the fuel cell market, the U. S. government needs to provide (US) $55-billion in subsidies to the technology over the next decade and a half, according to the study.

That could be accomplished if the government opts for fuel cell technology in half of the vehicles it uses in its fleets, Ramage says.

"There needs to be substantial and sustainable government help just to make this happen, just as there is for ethanol," he says.

Paul Scott, a co-founder of Plug In America, a California-based nonprofit organization that advocates rechargeable cars, says the study showed federal policy needed to shift toward support for electric vehicles.

"It's obviously ridiculous to put all the emphasis on a technology that's decades away when our needs are imminent," Scott says.

GM has a test group of about 100 fuel cell-powered Chevy Equinox SUVs on the road that the automaker calls the largest experimental fleet of its kind. The company is now on the fourth generation of this technology.

Honda has begun leasing up to 200 of its FCX Clarity fuel cell vehicles in Southern California. The automaker is charging (US) $600 monthly for the car, which represents a fraction of its cost for the company.