San Diego utility offers $10,000 off Nissan Leaf, BMW i3 electric cars

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

San Diego Gas & Electric EV incentives deliver $10,000 utility discounts plus a $200 EV Climate Credit, stackable with California rebates and federal tax credits on BMW i3 and Nissan Leaf purchases through participating dealers.

Key Points

Utility-backed rebates that cut EV purchase costs and stack with California and federal tax credits for added savings.

✅ $10,000 off BMW i3 or Nissan Leaf via SDG&E partner dealers

✅ Stack with $7,500 federal and up to $4,500 California rebates

✅ $200 annual EV Climate Credit for eligible account holders

For southern California residents, it's an excellent time to start considering the purchase of a BMW i3 or Nissan Leaf electric car as EV sales top 20% in California today.

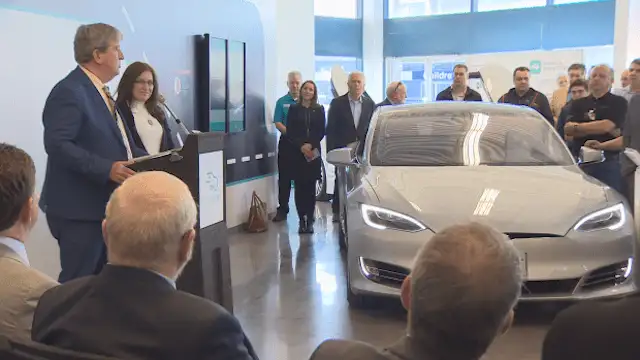

San Diego Gas & Electric has joined a host of other utility companies in the state in offering incentives towards the purchase of an i3 or a Leaf as part of broader efforts to pursue EV grid stability initiatives in California.

In total, the incentives slash $10,000 from the purchase price of either electric car, and an annual $200 credit to reduce the buyer's electricity bill is included through the EV Climate Credit program, which can complement home solar and battery options for some households.

SDG&E's incentives may be enough to sway some customers into either electric car, but there's better news: the rebates can be combined with state and federal incentives.

The state of California offers a $4,500 purchase rebate for qualified low-income applicants, while others are eligible for $2,500

Additionally, the federal government income-tax credit of up to $7,500 can bring the additional incentives to $10,000 on top of the utility's $10,000.

While the federal and state incentives are subject to qualifications and paperwork established by the two governments, the utility company's program is much more straight forward.

SDG&E simply asks a customer to provide a copy of their utility bill and a discount flyer to any participating BMW or Nissan dealership.

Additional buyers who live in the same household as the utility's primary account holder are also eligible for the incentives, although proof of residency is required.

Nissan is likely funding some of the generous incentives to clear out remaining first-generation Nissan Leafs.

The 2018 Nissan Leaf will be revealed next month and is expected to offer a choice of two battery packs—one of which should be rated at 200 miles of range or more.

SDG&E joins Southern California Edison as the latest utility company to offer discounts on electric cars as California aims for widespread electrification and will need a much bigger grid to support it, though SCE has offered just $450 towards a purchase.

However, the $450 incentive can be applied to new and used electric cars.

Up north, California utility company Pacific Gas & Electric offers $500 towards the purchase of an electric car as well, and is among utilities plotting a bullish course for EV charging infrastructure across the state today.

Two Hawaiian utilities—Kaua'i Island Utility Cooperative and the Hawaiian Electric Company—offered $10,000 rebates similar to those in San Diego from this past January through March.

Those rebates once again were destined for the Nissan Leaf.

SDG&E's program runs through September 30, 2017, or while supplies of the BMW i3 and Nissan Leaf last at participating local dealers.