WIPP boasts sterling safety record

By Santa Fe New Mexican

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

It's been 10 years since the Waste Isolation Pilot Plant began operations, and more than 7,200 shipments later the site and its transportation system have had no major problems, including no releases to the environment and no worker contamination, Nelson said proudly.

"Both of those categories have to be zero, or we're not doing our jobs," Nelson said.

After more than 30 years of planning and operations, the site remains the only functioning nuclear waste disposal site in the United States. In the 10 years since it started taking waste, the site has maintained a strong safety record — which has led to some very early discussions, at least by Carlsbad politicians, of the creation of new nuclear waste disposal sites in the area.

That includes a possible alternative to the Yucca Mountain nuclear waste repository that continues to be stalled through political opposition in Nevada.

"WIPP's been a great success story for us," said Carlsbad Mayor Bob Forrest, who added that he plans to lobby for a Yucca Mountain-like facility to come to the area should plans for the current site fail.

Still, some officials from the state government are not particularly fond of that idea, at least not if it involves expanding WIPP's mission to handle high-level waste.

"The federal government must abide by the promise it made to New Mexicans more than a decade ago and focus on WIPP's original purpose to dispose of only transuranic waste" — trash containing radioactive elements such as plutonium — New Mexico Environment Department Secretary Ron Curry said. "We will vigorously oppose any attempt to expand or alter the mission of WIPP to allow high-level waste at the site."

As far as WIPP's current mission, and thinking back on the site's history, Sen. Jeff Bingaman, a Silver City Democrat, said he's impressed by how well things have gone so far. The site has been a valuable national asset for getting rid of some types of defense-related nuclear waste and a boon to the economy of southeastern New Mexico, he said.

"I think the WIPP site has worked out well for the purpose we established it for," said Bingaman, who has worked on legislative aspects of the site since 1981. "It has operated smoothly and our state has benefited economically from the employment."

The city of Carlsbad, the nearest town to WIPP, has an unemployment rate of less than 1 percent, even in this shaky economy. And the per-capita income of Eddy County, where WIPP is located, is rivaled only by the high-tech and science-driven economy of Los Alamos County, Bingaman said.

"These are high-wage jobs," Bingaman said. "Last time I checked, the per-capita income of Eddy County was second only to Los Alamos out of all the counties in our state."

The Carlsbad business community was mostly responsible for drawing WIPP to the location, because it always saw the site as an economic driver, Nelson said.

"Back in the 1970s, the Atomic Energy Commission was looking at a salt mine in central Kansas as the home for a possible facility, but Kansas didn't want it," Nelson said. "Some local business leaders in Carlsbad heard about that, and they went to the AEC to ask them if they'd like to locate WIPP near Carlsbad, instead."

By 1976, the agency agreed, and the Carlsbad area was chosen as WIPP's new home.

Throughout the site's history, the community has grown more supportive, especially because the facility has been so safety-driven, Forrest said.

"About 30 years ago we started out with 30 percent community approval for the project," Forrest said. "But now we have at least 90 percent community approval, I'd say 95 percent."

The site has had a few minor snags along the way, but overall the state's regulatory oversight has helped to make WIPP safe over the past decade, Curry said.

"WIPP has not operated without incident," Curry said. "For example, when it improperly emplaced drums containing liquids prohibited by its permit, Gov. Richardson and NMED ordered the facility to remove those drums. WIPP seems to have learned from this experience. More recently, when a drum containing liquids was improperly placed in the repository, facility managers took the initiative to remove that container voluntarily."

Since the site started receiving waste, Nelson said, the only other minor problems were 14 traffic incidents that occurred over the last 10 years.

Those incidents must be reported to the Department of Transportation and are on record, added Susan Scott, a spokeswoman for WIPP.

Less than a handful of those incidents were chargeable to WIPP drivers, Nelson added.

"A vast majority of our traffic incidents have been caused by other drivers," Nelson said. "The first, actually, was caused by a drunk driver in Carlsbad."

The ones that were charged to WIPP drivers include running into a deer that was crossing the road, skidding into a station wagon during an ice storm in Georgia, and a fender bender in Los Alamos at a stop sign, he said.

There were no serious injuries and no problems with waste in any of the incidents. And the site assessment before WIPP was built predicted 43 total traffic accidents for the 35 years of operation, which puts the facility pretty much dead on track.

WIPP takes shipments and disposes of transuranic nuclear waste, a type of waste that includes plutonium and other radioactive elements that are heavier than uranium.

Most of the trash that comes to the facility emits alpha radiation particles, which are slow-moving and can be stopped by a sheet of paper or the outer layer of a person's skin.

But even beta particles, which can penetrate paper but not aluminum foil, and gamma rays, which are the strongest sort of radiation, can't make it through the thick walls of the Solado Formation, a layer of salt roughly the size of France that stretches under parts of New Mexico, Texas, Oklahoma and Kansas.

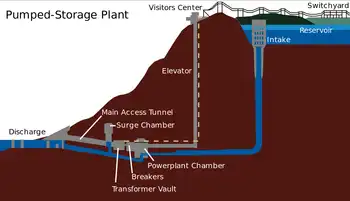

After a few minutes' descent 2,150 feet into the WIPP mine on a refurbished, but somewhat rickety, elevator that was originally built in 1928, Nelson gave visitors a warning.

"For the first time in your life, you are experiencing absolutely no background radiation," he said, raising an eyebrow.

Inside the mine, which contains about 10 miles of tunnels and rooms, there's no radiation from the sun, from the soil, or from the potassium or carbon in things like bananas or ceramic toilet tanks — and yes, those things and many others contribute to the average American's annual radiation dose of about 360 millirems per year.

To get an idea of how much a millirem is, a set of dental X-rays creates a dose of about 40 millirems, and an airplane trip across the country creates a dose of about 5 millirems.

The only radioactive thing present when you enter the mine, actually, is your own body, which contains the elements Potassium-40 and Carbon-14, in small amounts — at least until you reach the rooms where workers put the transuranic waste.

It might be convenient that radiation doesn't penetrate through the thick salt walls, but that's actually not why the Department of Energy chose the salt formation as a home for the WIPP site.

DOE chose the site because of other properties of salt, including that:

• Salt deposits are usually found in areas without a lot of earthquakes or geologic activity.

• Salt deposits are generally dry, with no water moving through them that could take waste to the surface.

• Salt is relatively easy to mine.

• Rock salt under pressure moves very slowly in an almost liquid fashion, so mines and rooms dug in it slowly and progressively fill and seal radioactive waste away from the environment on their own.

Because of the elastic properties of the salt layer, workers have to periodically re-carve hallways, ceilings and rooms every year. If they don't, the salt keeps bowing in and shrinking passageways, moving at a rate of about 5 inches a year, almost as if the whole underground facility was built out of a big blob of Silly Putty.

But that's actually a good thing for the waste.

After it arrives at WIPP, waste is placed in a series of tunnels called panels. Each panel has a series of rooms that are filled, then sealed and left so the rock salt can slowly encase the waste in bubbles far below the surface.

And because the site is in a geologically stable area, the waste will stay there, safely, for a very long time, Nelson said.

Of the eight planned panels, three are full, one is filling, one is being mined and three are set for future mining.

In general, trash going to WIPP consists of contaminated clothing, tools, rags, residues, soils and debris used in nuclear weapons-making processes. All the waste comes from the Department of Defense or from other agencies involved in defense-related activities, such as the Department of Energy.

Most of the trash is put in 55-gallon drums, or what the site calls "drum equivalents," and sealed in specially designed containers at facilities around the United States, such as Los Alamos National Laboratory. After that, it is shipped to WIPP via truck, under convoys with strict regulations.

"We always have teams of two drivers, and they keep sleep and work logs down to the minute," Nelson said. "The drivers only stop for food and fuel, and they have to stop every two hours for a complete walk-around and check of the truck."

Part of the agreement with the state of New Mexico before the facility opened was that the Department of Energy would pay $20 million a year for use of the state's roads and highways. That amount has increased to $28 million this year, Nelson said.

Once the waste gets to WIPP, it's disposed of in one of two ways, depending on how radioactive it is.

Waste that emits less than 200 millirems per hour is considered contact-handled waste. The bulk of the waste at WIPP is that type of waste, which is packed in drums that are moved by workers and heavy machinery into the mine on a larger, more modern elevator than the older one where visitors and some staff enter the mine.

Waste that emits 200 or more millirems per hour is considered remote-handled waste. It's transported by truck as well, in a different style of container that's nested in a larger shipping container. When it arrives at WIPP, the shipping container is moved by heavy equipment, the inner container is removed and then moved by machine into the mine, where the waste and container are literally shoved into a hole in the panel wall and capped with concrete to make sure it is safely disposed of.

Los Alamos National Laboratory was WIPP's first customer. The first shipment left the lab at 8 p.m. March 25, 1999, and arrived at WIPP at 4 the following morning.

Since then, LANL has shipped 2,400 cubic meters of contact-handled waste — which is about 12,000 55-gallon drums worth — to the site, but the lab still has a lot more ready to go.

There are about 9,100 cubic meters of contact-handled waste — or about 45,500 55-gallon drums worth — set to be shipped to WIPP that are currently being stored at LANL's Area G, said Mark Shepard, production manager for the waste disposition project at LANL.

"It's all retrievably stored," Shepard said, noting none of it is in a landfill.

About two-thirds of the lab's contact-handled waste is sitting in 10 tentlike storage domes, above ground. The domes are made of a steel frame overlaid with PVC and plastic coverings, with an average size of 200 feet by 50 feet, he said.

The remaining third of the contact-handled waste is underground, placed on an asphalt pad and covered with soil, Shepard said.

LANL also has 101 cubic meters of remote-handled waste — which is about 500 55-gallon drums worth — buried in 49 concrete-lined shafts at Area G. Those shafts are about 30 feet deep and 3 feet wide.

Of the 49, 16 shafts contain waste that's ready to be shipped to WIPP. The rest contain waste that hasn't been characterized yet, and must be repackaged before shipment, Shepard said.

The lab plans to close Area G by 2015, so the hope is that all the waste can be characterized and shipped to WIPP by that date, he said.

Lately WIPP has taken about two to three shipments a week from LANL, Nelson said.

Each shipment of contact-handled waste contains about forty-two 55-gallon drum equivalents, Scott said.

Most of the material LANL is shipping, like the material many other labs around the country ship to WIPP, is legacy waste — or old waste created from the Manhattan Project through the Cold War.

Los Alamos does, however, create about 600 drums worth of new contact-handled waste a year from its work on nuclear weapons and other nuclear research, Shepard said.

WIPP is a very different type of facility than the planned nuclear waste repository at Yucca Mountain in Nevada.

Yucca Mountain is designed to take spent nuclear fuel rods from power plants and other high-level nuclear waste associated mostly with commercial activity — but the repository at Yucca Mountain hasn't been built yet, and the earliest it could possibly start taking waste is somewhere around 2020.

While delays continue at the site, the need for a high-level waste repository remains.

Across the nation, about 60,000 metric tons of spent fuel are sitting around in temporary storage at 104 nuclear power plants in 31 states, said Andrew Orell, director for Nuclear Energy Programs at Sandia National Laboratories.

Orell has worked on both the WIPP and Yucca Mountain projects.

"The vast majority of the nation's spent fuel is sitting in classic pool storage," Orell said. "It stays there for a few years, then, depending if a power plant has enough room in the pool, they may move it to dry cask storage on site."

All that waste was supposed to go to the Yucca Mountain repository. But communities and officials in Nevada have made several legal and legislative efforts to oppose the opening of the site because they fear the possibility of groundwater contamination and other potential problems.

More recently, the Obama administration cut funding for continued scientific evaluation of Yucca Mountain by $12 million, which could indicate efforts to block the site are gaining federal support.

That drop, which reduced the budget from $59 million to $47 million, has drastically slowed evaluation of the site — but unless Congress changes the Nuclear Waste Policy Act, which was created in 1982 and revised in 1987, work on Yucca Mountain will continue, said Tito Bonano, a senior manager at Sandia who's worked on both WIPP and Yucca Mountain.

"It's a formidable political situation that we're dealing with," Bonano said.

With the success of WIPP, and the generally supportive community of Carlsbad, some — including Mayor Forrest — have suggested the government should look at scrapping Yucca Mountain in favor of a new WIPP-like facility for spent fuel in the same salt layer that houses WIPP in southeastern New Mexico.

"We think salt is the best place to put that waste," Forrest said. "If people want nuclear energy, we need to solve the waste problem, and we think this would be a great place to put it."

Such a facility is possible, but nobody in the federal government seems to be talking about it, Bingaman said.

From a scientific perspective, creating a spent fuel repository in the salt layer would require more study, specifically of how the rock salt would respond to the heat of spent fuel. Waste at WIPP isn't hot like the rods used to make nuclear power. It's just radioactive.

"One of the questions we have now is if we were to put high-level waste in a place like WIPP, we don't know what it would do," Orell said. "Salt behaves differently in the presence of heat."

Another possibility is to reprocess, or essentially recycle, the spent fuel rods into new fuel sources for power plants. Other countries like France already do that with their waste, but because of the threat of terrorists getting their hands on bomb-making materials that come from the recycling process, the United States has banned recyling the fuel rods.

If the fuel were reprocessed, however, the leftover waste would be very similar to the remote-handled waste at WIPP, which is to say it wouldn't be particularly hot and could more easily be stored in the salt, Forrest said.

"It took 30 years to get WIPP, and that won't happen tomorrow, but we think reprocessing and storage could be a fine solution to that problem," Forrest said.

Either way, there are a lot of regulatory changes that would have to happen before Carlsbad or any other alternative to Yucca Mountain is considered, Orell said.

"There hasn't been a lot of talk about Carlsbad, because the law basically says 'you will build a facility at Yucca Mountain,' " Orell said. "And ultimately, they can't do much in the way of alternative sites until Congress decides to change that."

A supportive community, however, and the success of WIPP over its first 10 years, could put Carlsbad in line for a new facility if the situation were to change, Orell said.

"A lot of people say the thing about WIPP is the salt — the salt's fabulous," Orell said. "But the real success of WIPP is the community support, not the geology. It's questionable how supportive Nevada is or isn't of Yucca Mountain. Carlsbad, the community, is very supportive about the current facility and future facilities — but it's not just about raising your hand."