Electricity News in April 2017

Alberta power grid operator prepares to accept green energy bids

Alberta Renewable Energy Auction invites bids as AESO adds wind and solar capacity, targeting 5,000 MW by 2030, with 400 MW online by 2019 to replace coal, stabilize prices, and cut greenhouse gas emissions.

Key Points

A program to procure wind and solar for Alberta’s grid, replacing coal and scaling to 5,000 MW by 2030.

✅ 400 MW online by 2019 to backfill retiring coal units

✅ Timed additions to avoid price distortion on the grid

✅ Targets 5,000 MW of renewables by 2030

The operator of Alberta's electricity grid will start taking bids at the end of this month from companies interested in generating and selling renewable energy in the province.

The provincial government wants to add 5,000 megawatts of renewable electricity, supporting new jobs across the province by 2030.

The renewables, including wind power and solar power, will replace coal-fired power plants, which will be shutting down as part of the province's strategy to lower greenhouse gas emissions.

Energy Minister Marg McCuaig-Boyd announced Friday the first competition will be for 400 megawatts, which is enough to power about 170,000 houses.

"We're known as the energy hub of Canada, and make no mistake, green energy is a big part of that," she said.

Mike Deising with the Alberta Electric System Operator (AESO) says the new green power has to be developed gradually.

The new green power must be developed gradually, says Alberta Electric System Operator’s Mike Deising. (CBC)

"We don't want to put on too much generation because what we're going to see is, if we have too much generation all at once, we're going to drive down the market price and it's going to distort the electricity market that we have," he said.

Deising says from their perspective as the grid operator, they want to make sure the addition of new capacity is timed with when they are losing capacity.

AESO wants the 400 megawatts of new green power including solar generation to go onto the grid by the end of 2019 to replace electricity from coal-fired plants that will start shutting down by late 2020.

Related News

OPG, Ontario First Nation Hdroelectric project comes online

Peter Sutherland Sr. Generating Station delivers 28 MW hydroelectric, renewable energy in Ontario via an Indigenous partnership, on-budget and ahead of schedule, supplying the provincial grid near the Abitibi River at New Post Creek.

Key Points

An OPG-Indigenous hydropower plant generating 28 MW in northern Ontario, feeding the provincial grid from New Post Creek.

✅ 28 MW hydropower on Abitibi River at New Post Creek.

✅ OPG and Taykwa Tagamou Nation partnership, on-budget and ahead of schedule.

✅ $300 million project delivers jobs, skills, and long-term revenue to community.

Ontario Power Generation, which has also partnered on new nuclear technology with TVA, says a new hydroelectric plant in the northern part of the province is now online, and the First Nation it has partnered with stands to benefit.

In a written release issued Friday, OPG announced the completion of the Peter Sutherland Sr. Generating Station on New Post Creek. The project is a partnership between the provincial power company and Coral Rapids Power, an Indigenous-owned company of the Taykwa Tagamou Nation, near Cochrane.

"This project has gone well due to the relationship we've built on a foundation of respect and trust," Coral Rapids President Wayne Ross was quoted as saying in the OPG release.

"There have been many benefits for our community including good paying jobs, transferable skills and a long term revenue stream."

The generating station, which is located about 80 kilometres north of Smooth Rock Falls, near where New Post Creek meets the Abitibi River, is named after a respected elder of the Taykwa Tagamou Nation. It generates 28 megawatts of power for the provincial grid, according to OPG, complementing modernization at the Niagara Falls powerhouse upgrade as well.

The project was finished ahead of schedule and on-budget, OPG said, as other Ontario initiatives like a pumped storage project advance.

According to the announcement and recent financial results, the project cost around $300 million.

Related News

Labrador power flowing through Quebec

Labrador Hydro Open Access could enable non-discriminatory electricity transmission through Quebec, unlocking wheeling rights for Muskrat Falls and Gull Island, boosting green energy exports to Ontario and U.S. markets under interprovincial trade rules.

Key Points

Applying open, non-discriminatory transmission rules so Labrador power can wheel through Quebec to U.S. markets.

✅ Aligns with U.S. open access and non-discrimination standards

✅ Enables wheeling rights for Muskrat Falls and Gull Island

✅ Expands export routes to Ontario and Northeast U.S. grids

There's growing optimism that hydroelectric power from Labrador may soon be flowing through Quebec and into other markets in Canada and the United States as demand grows.

That was one of the revelations in a new interprovincial free trade agreement that was unveiled Friday.

If such an agreement on electricity transmission were reached, it would open the door to huge markets for Labrador hydroelectric power, including excess power from the controversial Muskrat Falls Project, and possibly end a bitter stalemate that has long soured relations between the two neighbouring provinces.

"The best-case scenario is we move electricity through Quebec and into markets. It could be Ontario among others. It could be the U.S. It could be anywhere," Ball said Friday.

Rules based on principle of open access

The new trade deal sets out specific rules around the transmission of electricity across provincial borders, and are based on open access and non-discrimination rules in the United States.

The Muskrat Falls transmission network will bypass Quebec in moving power to the North American market, but at a considerable cost, though a ratepayer agreement aims to shield consumers. (Jacques Boissinot/Canadian Press)

Those rules allow Quebec to freely export electricity from the Upper Churchill and other power sources into the U.S., and Dwight Ball says this province wants the same rules to apply to power from the Muskrat Falls project, and potential projects such as Gull Island.

As part of the trade talks, Ottawa and other provinces asked that Newfoundland and Labrador and Quebec engage in talks about electricity transmission, including what are known as wheeling rights, and related rate mitigation talks are ongoing. Ball said that will happen.

"I'm not here to pre-judge what the outcome will be. All I'm saying is if there's an opportunity to bring benefit to our province we want to be at that table," said Ball.

"Right now we're seeing support from other provinces. We're seeing support from the federal government. We believe in using the resources that we have to support a national policy on green energy. And if that leads us into a development in Labrador, so be it. That would be a good thing for our economy. But we have to get at that table first."

Deal comes into effect in July

The new, open access rules will come into force if either of the two provinces sign off on them within 36 months of the trade deal coming into effect on July 1.

It's nearly a certainty that the Ball government will endorse such a framework, since the province has long argued for permission to use excess transmission line capacity in Quebec to send Labrador power to other markets.

"You could argue that the U.S. rules would apply right now, but we all know that's not happening in the way we'd like to see it happen," said Ball. "So we're going to get at the table and see if we can get that access more streamlined."

As part of the trade deal, both Newfoundland and Labrador and Quebec will maintain their monopolies over power production and the right to sell it, which means Labrador power can only be transmitted through Quebec.

Related News

10 new electric vehicle fast-charging stations planned on Trans-Canada in N.B.

New Brunswick EV Fast-Charging Stations expand along the Trans-Canada Highway, with NB Power and federal funding adding Level 3 chargers to cut range anxiety, boost EV infrastructure, and lower emissions via a renewable, low-carbon grid.

Key Points

NB Power and Ottawa are installing Level 3 EV chargers on the Trans-Canada to cut range anxiety and emissions.

✅ 10 Level 3 fast chargers along the Trans-Canada by July

✅ NB Power will add Level 2 chargers beside each site

✅ Backed by $335k and $120M programs to cut EV emissions

Motorists in New Brunswick will see 10 new fast-charging stations installed this year along the Trans-Canada Highway as the result of a partnership between the federal government and NB Power.

Fisheries and Oceans Minister Dominic LeBlanc announced $335,000 to build the new station and said it was to help address "range anxiety."

"Some Canadians are hesitant to buy these cleaner vehicles because they fear that the infrastructure is not there, particularly where Labrador's infrastructure lags to support their choice to drive an electric vehicle," he said. "It's a fair point in a province where there's a high percentage of rural residents."

In partnering with NB Power and utilities elsewhere in Canada, including Newfoundland and Labrador's fast-charging network development, to build the proper infrastructure, the government hopes to instill in people — including would-be electric-vehicle owners in New Brunswick — the confidence that they can get from Point A to Point B driving one of these vehicles.

NB Power estimates there about about 100 electric vehicles in use in the province.

The federal government announced $120 million in similar infrastructure projects across Canada on Tuesday.

In addition to financing electric vehicle (EV) charging stations, the government will use the balance of the $120 million to help fund refuelling stations for alternative fuel vehicles and, it said in a release, "support technology demonstration projects" such as vehicle-to-grid integration pilots.

As LeBlanc noted Tuesday, the transportation sector generates almost 25 per cent of Canada's total greenhouse gas emissions. More specifically, cars and trucks and commercial vehicles produce about three-quarters of the sector's emissions. Electric and alternative fuel vehicles — those that run on natural gas or hydrogen, for example — can considerably reduce these emissions.

A growing network

NB Power's Keith Cronkhite, senior vice-president of business development and strategic planning, said the new fast-charging corridor will become part of the utility's existing charging network for electric vehicles.

"We are confident it will help New Brunswickers make the switch from gas to electric vehicles and reduce that range anxiety," Cronkhite said.

"Encouraging more New Brunswickers to drive EVs [electric vehicles], supported by a rebate program, is an essential part of our plan to support the climate change action," Cronkhite said. "In New Brunswick, an electric vehicle owner can shrink their carbon footprint by approximately 80 per cent thanks to our renewable and non-emitting grid."

Currently, there are nine NB Power-branded charging stations across the province. Unlike those announced Tuesday, those are Level 2 chargers — or those for use by hybrid vehicles.

By comparison, the fast-charging (or Level 3) stations NB Power will install this year typically service entirely electric vehicles. Using those chargers, drivers will be able to recharge their EVs to approximately 80 per cent within 30 minutes.

NB Power hasn't decided where it will install the stations along the Trans-Canada or what it will charge drivers to use them, but is aiming to have all 10 in operation in July.

The utility will install Level 2 chargers beside each of the 10 new fast-charging stations "so that we can meet the needs of all New Brunswickers," Cronkhite said.

Altogether, there are some 50 charging stations in New Brunswick.

Related News

Trump declares end to 'war on coal,' but utilities aren't listening

US Utilities Shift From Coal as natural gas stays cheap, renewables like wind and solar scale, Clean Power Plan uncertainty lingers, and investors, state policies, and emissions targets drive generation choices and accelerate retirements.

Key Points

A long-term shift by utilities from coal to cheap natural gas, expanding renewables, and lower-emission generation.

✅ Cheap natural gas undercuts coal on price and flexibility.

✅ Renewables costs falling; wind and solar add competitive capacity.

✅ State policies and investors sustain emissions reductions.

When President Donald Trump signed an executive order last week to sweep away Obama-era climate change regulations, he said it would end America's "war on coal", usher in a new era of energy production and put miners back to work.

But the biggest consumers of U.S. coal - power generating companies - remain unconvinced about efforts to replace Obama's power plant overhaul with a lighter-touch approach.

Reuters surveyed 32 utilities with operations in the 26 states that sued former President Barack Obama's administration to block its Clean Power Plan, the main target of Trump's executive order. The bulk of them have no plans to alter their multi-billion dollar, years-long shift away from coal, suggesting demand for the fuel will keep falling despite Trump's efforts.

The utilities gave many reasons, mainly economic: Natural gas - coal’s top competitor - is cheap and abundant; solar and wind power costs are falling; state environmental laws remain in place; and Trump's regulatory rollback may not survive legal challenges, as rushed pricing changes draw warnings from energy groups.

Meanwhile, big investors aligned with the global push to fight climate change – such as the Norwegian Sovereign Wealth Fund – have been pressuring U.S. utilities in which they own stakes to cut coal use.

"I’m not going to build new coal plants in today’s environment," said Ben Fowke, CEO of Xcel Energy, which operates in eight states and uses coal for about 36 percent of its electricity production. "And if I’m not going to build new ones, eventually there won’t be any."

Of the 32 utilities contacted by Reuters, 20 said Trump's order would have no impact on their investment plans; five said they were reviewing the implications of the order; six gave no response. Just one said it would prolong the life of some of its older coal-fired power units.

North Dakota's Basin Electric Power Cooperative was the sole utility to identify an immediate positive impact of Trump's order on the outlook for coal.

"We're in the situation where the executive order takes a lot of pressure off the decisions we had to make in the near term, such as whether to retrofit and retire older coal plants," said Dale Niezwaag, a spokesman for Basin Electric. "But Trump can be a one-termer, so the reprieve out there is short."

Trump's executive order triggered a review aimed at killing the Clean Power Plan and paving the way for the EPA's Affordable Clean Energy rule to replace it, though litigation is ongoing. The Obama-era law would have required states, by 2030, to collectively cut carbon emissions from existing power plants by 30 percent from 2005 levels. It was designed as a primary strategy in U.S. efforts to fight global climate change.

The U.S. coal industry, without increases in domestic demand, would need to rely on export markets for growth. Shipments of U.S. metallurgical coal, used in the production of steel, have recently shown up in China following a two-year hiatus - in part to offset banned shipments from North Korea and temporary delays from cyclone-hit Australian producers.

RETIRING AND RETROFITTING

Coal had been the primary fuel source for U.S. power plants for the last century, but its use has fallen more than a third since 2008 after advancements in drilling technology unlocked new reserves of natural gas.

Hundreds of aging coal-fired power plants have been retired or retrofitted. Huge coal mining companies like Peabody Energy Corp and Arch Coal fell into bankruptcy, and production last year hit its lowest point since 1978.

The slide appears likely to continue: U.S. power companies now expect to retire or convert more than 8,000 megawatts of coal-fired plants in 2017 after shutting almost 13,000 MW last year, according to U.S. Energy Information Administration and Thomson Reuters data.

Luke Popovich, a spokesman for the National Mining Association, acknowledged Trump's efforts would not return the coal industry to its "glory days," but offered some hope.

"There may not be immediate plans for utilities to bring on more coal, but the future is always uncertain in this market," he said.

Many of the companies in the Reuters survey said they had been focused on reducing carbon emissions for a decade or more while tracking 2017 utility trends that reinforce long-term planning, and were hesitant to change direction based on shifting political winds in Washington D.C.

"Utility planning typically takes place over much longer periods than presidential terms of office," Berkshire Hathaway Inc-owned Pacificorp spokesman Tom Gauntt said.

Several utilities also cited falling costs for wind and solar power, which are now often as cheap as coal or natural gas, thanks in part to government subsidies for renewable energy and recent FERC decisions affecting the grid.

In the meantime, activist investors have increased pressure on U.S. utilities to shun coal.

In the last year, Norway's sovereign wealth fund, the world's largest, has excluded more than a dozen U.S. power companies - including Xcel, American Electric Power Co Inc and NRG Energy Inc - from its investments because of their reliance on coal-fired power.

Another eight companies, including Southern Co and NorthWestern Corp, are "under observation" by the fund.

Wyoming-based coal miner Cloud Peak Energy said it doesn't blame utilities for being lukewarm to Trump's order.

"For eight years, if you were a utility running coal, you got the hell kicked out of you," said Richard Reavey, a spokesman for the company. "Are you going to turn around tomorrow and say, 'Let's buy lots of coal plants'? Pretty unlikely."

Related News

With New Distributed Energy Rebate, Illinois Could Challenge New York in Utility Innovation

Illinois NextGrid redefines utility, customer, and provider roles with grid modernization, DER valuation, upfront rebates, net metering reform, and non-wires alternatives, leveraging rooftop solar, batteries, and performance signals to enhance reliability and efficiency.

Key Points

Illinois NextGrid is an ICC roadmap to value DER and modernize the grid with rebates and non-wires solutions.

✅ Upfront Value-of-DER rebates reward location, time, and performance.

✅ Locational DER reduce peak demand and defer wires and substations.

✅ Encourages non-wires alternatives and data-driven utility planning.

How does the electric utility fit in to a rapidly-evolving energy system? That’s what the Illinois Commerce Commission is trying to determine with its new effort, "NextGrid". Together, we’re rethinking the roles of the utility, the customer, and energy solution providers in a 21st-century digital grid landscape.

In some ways, NextGrid will follow in the footsteps of New York’s innovative Reforming the Energy Vision process, a multi-year effort to re-examine how electric utilities and customers interact. A new approach is essential to accelerating the adoption of clean energy technologies and building a smarter electricity infrastructure in the state.

Like REV, NextGrid is gaining national attention for stakeholder-driven processes to reveal new ways to value distributed energy resources (DER), like rooftop solar and batteries. New York and Illinois’ efforts also seek alternatives, such as virtual power plants, to simply building more and more wires, poles, and power plants to meet the energy needs of tomorrow.

Yet, Illinois is may go a few steps beyond New York, creating a comprehensive framework for utilities to measure how DER are making the grid smarter and more efficient. Here is what we know will happen so far.

On Wednesday, April 5, at the second annual Grid Modernization Forum in Chicago, I’ll be discussing why these provisions could change the future of our energy system, including insights on grid modernization affordability for stakeholders.

Value of distributed energy

The Illinois Commerce Commission’s NextGrid plans grew out of the recently-passed future energy jobs act, a landmark piece of climate and energy policy that was widely heralded as a bipartisan oddity in the age of Trump. The Future Energy Jobs Act will provide significant new investments in renewables and energy efficiency over the next 13 years, redefine the role and value of rooftop solar and batteries on the grid, and lead to significant greenhouse gas emission reductions.

NextGrid will likely start laying the groundwork for valuing distributed energy resources (DER) as envisioned by the Future Energy Jobs Act, which introduces the concept of a new rebate. Illinois currently has a net metering policy, which lets people with solar panels sell their unused solar energy back to the grid to offset their electric bill. Yet the net metering policy had an arbitrary “cap,” or a certain level after which homes and businesses adding solar panels would no longer be able to benefit from net metering.

Although Illinois is still a few years away from meeting that previous “cap,” when it does hit that level, the new policy will ensure additional DER will still be rewarded. Under the new plan, the Value-of-DER rebate will replace net metering on the distribution portion of a customer’s bill (the charge for delivering electricity from the local substation to your house) with an upfront payment, which credits the customer for the value their solar provides to the local grid over the system’s life. Net metering for the energy supply portion of the bill would remain – i.e. homes and businesses would still be able to offset a significant portion of their electric bills by selling excess energy.

What is unique about Illinois’ approach is that the rebate is an upfront payment, rather than on ongoing tariff or reduced net metering compensation, for example. By allowing customers to get paid for the value solar provides to the system at the time it is installed, in the same way new wires, poles, and transformers would, this upfront payment positions DER investments as equally or more beneficial to customers and the electric grid. This is a huge step not only for regulators, but for utilities as well, as they begin to see distributed energy as an asset to the system.

This is a huge step for utilities, as they begin to see distributed energy as an asset to the system.

The rebate would also factor-in the variables of location, time, and performance of DER in the rebate formula, allowing for a more precise calculation of the value to the grid. Peak electricity demand can stress the local grid, causing wear and tear and failure of the equipment that serve our homes and businesses. Power from DER during peak times and in certain areas can alleviate those stresses, therefore providing a greater value than during times of average demand.

In addition, factoring-in the value of performance will take into account the other functions of distributed energy that help keep the lights on. For example, batteries and advanced inverters can provide support for helping avoid voltage fluctuations that can cause outages and other costs to customers.

Related News

Wind Turbine Operations and Maintenance Industry Detailed Analysis and Forecast by 2025

Wind Turbine Operations and Maintenance Market is expanding as offshore and onshore renewables scale, driven by aging turbines, investment, UAV inspections, and predictive O&M services, despite skills shortages and rising logistics costs.

Key Points

Sector delivering inspection, repair, and predictive services to keep wind assets reliable onshore and offshore.

✅ Aging turbines and investor funding drive service demand

✅ UAV inspections and predictive analytics cut downtime

✅ Offshore growth offsets skills and logistics constraints

Wind turbines are capable of producing vast amounts of electricity at competitive prices, provided they are efficiently maintained and operated. Being a cleaner, greener source of energy, wind energy is also more reliable than other sources of power generation, with growth despite COVID-19 recorded across markets. Therefore, the demand for wind energy is slated to soar over the next few years, fuelling the growth of the global market for wind turbine operations and maintenance. By application, offshore and onshore wind turbine operations and maintenance are the two major segments of the market.

Global Wind Turbine Operations and Maintenance Market: Key Trends

The rising number of aging wind turbines emerges as a considerable potential for the growth of the market. The increasing downpour of funds from financial institutions and public and private investors has also been playing a significant role in the expansion of the market, with interest also flowing toward wave and tidal energy technologies that inform O&M practices. On the other hand, insufficient number of skilled personnel, coupled with increasing costs of logistics, remains a key concern restricting the growth of the market. However, the growing demand for offshore wind turbines across the globe is likely to materialize into fresh opportunities.

Global Wind Turbine Operations and Maintenance Market: Market Potential

A number of market players have been offering diverse services with a view to make a mark in the global market for wind turbine operations and maintenance. For instance, Scotland-based SgurrEnergy announced the provision of unmanned aerial vehicles (UAVs), commonly known as drones, as a part of its inspection services. Detailed and accurate assessments of wind turbines can be obtained through these drones, which are fitted with cameras, with four times quicker inspections than traditional methods, claims the company. This new approach has not only reduced downtime, but also has prevented the risks faced by inspection personnel.

The increasing number of approvals and new projects is preparing the ground for a rising demand for wind turbine operations and maintenance. In March 2017, for example, the Scottish government approved the installation of eight 6-megawatt wind turbines off the coast of Aberdeen, towards the northeast. The state of Maryland in the U.S. will witness the installation of a new offshore wind plant, encouraging greater adoption of wind energy in the country. The U.K., a leader in UK offshore wind deployment, has also been keeping pace with the developments, with the installation of a 400-MW offshore wind farm, off the Sussex coast throughout 2017. The Rampion project will be developed by E.on, who has partnered with Canada-based Enbridge Inc. and the UK Green Investment Bank plc.

Global Wind Turbine Operations and Maintenance Market: Regional Outlook

Based on geography, the global market for wind turbine operations and maintenance has been segmented into Asia Pacific, Europe, North America, and Rest of the World (RoW). Countries such as India, China, Spain, France, Germany, Scotland, and Brazil are some of the prominent users of wind energy and are therefore likely to account for a considerable share in the market. In the U.S., favorable government policies are backing the growth of the market, though analyses note that a prolonged solar ITC extension could pressure wind competitiveness. For instance, in 2013, a legislation that permits energy companies to transfer the costs of offshore wind credits to ratepayers was approved. Asia Pacific is a market with vast potential, with India and China being major contributors aiding the expansion of the market.

Global Wind Turbine Operations and Maintenance Market: Competitive Analysis

Some of the major companies operating in the global market for wind turbine operations and maintenance are Gamesa Corporacion Tecnologica, Xinjiang Goldwind Science & Technologies, Vestas Wind Systems A/S, Upwind Solutions, Inc, GE Wind Turbine, Guodian United Power Technology Company Ltd., Nordex SE, Enercon GmbH, Siemens Wind Power GmbH, and Suzlon Group. A number of firms have been focusing on mergers and acquisitions to extend their presence across new regions.

Related News

Visualizing nuclear radiation at Fukushima Nuclear Plant

Electron Tracking Compton Camera enables gamma-ray imaging spectroscopy for radiation mapping, revealing micro hot spots, surface radioactivity, and ground-dose distribution to guide Fukushima decontamination, nuclear cleanup, and quantitative monitoring of contamination sources.

Key Points

An ETCC is a gamma-ray imager that maps surface radioactivity and ground dose for precise nuclear decontamination.

✅ Quantitative gamma imaging reveals micro hot spots missed by surveys

✅ Directional and energy-resolved mapping reduces background interference

✅ Converts radioactivity distribution to ground-dose for cleanup planning

Extraordinary decontamination efforts are underway in areas affected by the 2011 nuclear accidents in Japan. The creation of total radioactivity maps is essential for thorough cleanup, echoing data-driven advances in the energy transition that depend on precise mapping, but the most common methods, according to Kyoto University's Toru Tanimori, do not 'see' enough ground-level radiation.

"The best methods we have currently are labor intensive, and to measure surface radiation accurately," he says, "complex analysis is needed."

In their latest work published in Scientific Reports, Tanimori and his group explain how gamma-ray imaging spectroscopy is more versatile and robust, and related work on power from falling snow highlights cross-disciplinary innovation, resulting in a clearer image.

"We constructed an Electron Tracking Compton Camera (ETCC) to detect nuclear gamma rays quantitatively. Typically this is used to study radiation from space, but we have shown that it can also measure contamination, such as at Fukushima."

The imaging revealed what Tanimori calls "micro hot spots" around the Fukushima Daiichi Nuclear Power Plant, even in regions that had already been considered decontaminated. In fact, the cleaning in some regions appeared to be far less than what could be measured by other means.

Current methods for measuring gamma rays do not reliably pinpoint the source of the radiation, a challenge mirrored in geothermal energy safety where precise source localization is vital. According to Tanimori, "radiation sources including distant galaxies can disrupt the measurements."

The key to creating a clear image is taking a color image including the direction and energy of all gamma rays emitted in the vicinity, and rapidly digitizing signals informed by advances in ultrafast conduction in detector materials.

"Quantitative imaging produces a surface radioactivity distribution that can be converted to show dosage on the ground," says Tanimori. "The ETCC makes true images of the gamma rays based on proper geometrical optics."

This distribution can then be used to relatively easily measure ground dosage levels, showing that most gamma rays scatter and spread in the air, while reliable electricity supply remains essential for deploying monitoring systems, putting decontamination efforts at risk.

"Our ETCC will make it easier to respond to nuclear emergencies," continues Tanimori. "Using it, we can detect where and how radiation is being released. This will not only help decontamination, but also the eventual dismantling of nuclear reactors."

Related News

Energy Efficiency and Demand Response Can Nearly Level Southeast Electricity Demand for More than a Decade

Southeast Electricity Demand Forecast examines how energy efficiency, photovoltaics, electric vehicles, heat pumps, and demand response shape grid needs, stabilize load through 2030, shift peaks, and inform utility planning across the region.

Key Points

An outlook of load shaped by efficiency, solar, EVs, with demand response keeping usage steady through 2030.

✅ Stabilizes regional demand through 2030 under accelerated adoption

✅ Energy efficiency and demand response are primary levers

✅ EVs and heat pumps drive growth post 2030; shift winter peaks

Electricity markets in the Southeast are facing many changes on the customer side of the meter. In a new report released today, we look at how energy efficiency, photovoltaics (solar electricity), electric vehicles, heat pumps, and demand response (shifting loads from periods of high demand) might affect electricity needs in the Southeast.

We find that if all of these resources are pursued on an accelerated basis, electricity demand in the region can be stabilized until about 2030.

After that, demand will likely grow in the following decade because of increased market penetration of electric vehicles and heat pumps, but energy planners will have time to deal with this growth if these projections are borne out. We also find that energy efficiency and demand response can be vital for managing electricity supply and demand in the region and that these resources can help contain energy demand growth, reducing the impact of expensive new generation on consumer wallets.

National trends

This is the second ACEEE report looking at regional electricity demand. In 2016, we published a study on electricity consumption in New England, finding an even more pronounced effect. For New England, with even more aggressive pursuit of energy efficiency and these other resources, consumption was projected to decline through about 2030, before rebounding in the following decade.

These regional trends fit into a broader national pattern. In the United States, electricity consumption has been characterized by flat electricity demand for the past decade. Increased energy efficiency efforts have contributed to this lack of consumption growth, even as the US economy has grown since the Great Recession. Recently, the US Energy Information Administration (EIA – a branch of the US Department of Energy) released data on US electricity consumption in 2016, finding that 2016 consumption was 0.3% below 2015 consumption, and other analysts reported a 1% slide in 2023 on milder weather.

Five scenarios for the Southeast

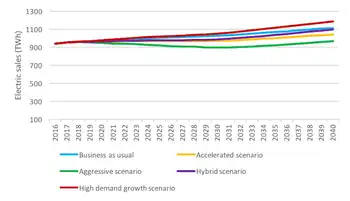

ACEEE’s new study focuses on the Southeast because it is very different from New England, with warmer weather, more economic growth, and less-aggressive energy efficiency and distributed energy policies than the Northeast. For the Southeast, we examined five scenarios: a business-as-usual scenario; two alternative scenarios with progressively higher levels of energy efficiency, photovoltaics informed by a solar strategy for the South that is emerging regionally, electric vehicles, heat pumps, and demand response; and two scenarios combining high numbers of electric vehicles and heat pumps with more modest levels of the other resources. This figure presents electricity demand for each of these scenarios:

Over the 2016-2040 period, we project that average annual growth will range from 0.1% to 1.0%, depending on the scenario, much slower than historic growth in the region. Energy efficiency is generally the biggest contributor to changes in projected 2040 electricity consumption relative to the business-as-usual scenario, as shown in the figure below, which presents our accelerated scenario that is based on levels of energy efficiency and other resources now targeted by leading states and utilities in the Southeast.

To date, Entergy Arkansas has achieved the annual efficiency savings as a percent of sales shown in the accelerated scenario and Progress Energy (a division of Duke Energy) has nearly achieved those savings in both North and South Carolina. Sixteen states outside the Southeast have also achieved these savings statewide.

The efficiency savings shown in the aggressive scenario have been proposed by the Arkansas PSC. This level of savings has already been achieved by Arizona as well as six other states. Likewise, the demand response savings we model have been achieved by more than 10 utilities, including four in the Southeast. The levels of photovoltaic, electric vehicle, and heat pump penetration are more speculative and are subject to significant uncertainty.

We also examined trends in summer and winter peak demand. Most utilities in the Southeast have historically had peak demand in the summer, often seeing heatwave-driven surges that stress operations across the Eastern U.S., but our analysis shows that winter peaks will be more likely in the region as photovoltaics and demand response reduce summer peaks and heat pumps increase winter peaks.

Why it’s vital to plan broadly

Our analysis illustrates the importance of incorporating energy efficiency, demand response, and photovoltaics into utility planning forecasts as utility trends to watch continue to evolve. Failing to include these resources leads to much higher forecasts, resulting in excess utility system investments, unnecessarily increasing customer electricity rates. Our analysis also illustrates the importance of including electric vehicles and heat pumps in long-term forecasts. While these technologies will have moderate impacts over the next 10 years, they could become increasingly important in the long run.

We are entering a dynamic period of substantial uncertainty for long-term electricity sales and system peaks, highlighted by COVID-19 demand shifts that upended typical patterns. We need to carefully observe and analyze developments in energy efficiency, photovoltaics, electric vehicles, heat pumps, and demand response over the next few years. As these technologies advance, we can create policies to reduce energy bills, system costs, and harmful emissions, drawing on grid reliability strategies tested in Texas, while growing the Southeast’s economy. Resource planners should be sure to incorporate these emerging trends and policies into their long-term forecasts and planning.

Related News

Wave and Tidal Energy Market Studies Research 2025 Detailed Analysis of Restrain and Growth Factors

Wave and Tidal Energy Market drives ocean energy and marine renewables, advancing clean power via tidal lagoons and wave converters, boosted by policy support, subsidies, investments, and rising installed capacity across Europe, Asia Pacific.

Key Points

A sector harvesting ocean energy via wave and tidal tech, driven by clean power demand, policy support, and investment.

✅ Europe leads with tidal lagoons and arrays like MeyGen

✅ Growth fueled by subsidies, R&D, and private investments

✅ Installed capacity rising despite fragmented competition

With effective strategies and technologies, ocean could be used as one of the largest and inexhaustible sources of environmentally-neutral and sustainable energy. Wave and tidal energy technologies serve as two of the present times' key ways of harnessing energy from oceans, as companies using oceans and rivers advance pilot and commercial projects worldwide. Wave and tidal energy technologies are relatively new power generation technologies with significant scope for development in the near future.

As research and development activities focused on the commercial development of clean energy resources intensify, the two sectors are expected to witness significant market growth in terms of technological advancement and rise in terms of investment and installed capacity in the near future. However, owing to their emerging nature, further development of wave and tidal energy technologies requires constant support from government bodies in terms of subsidies and encouraging regulation.

Global Wave and Tidal Energy Market: Trends and Opportunities

The rising consumption of electricity across developed, developing, and well as less-developed economies is undoubtedly the primary factor encouraging developments in the global market for wave and tidal energy. Other important factors driving the market include the shrinking banks of conventional power resources such as oil, natural gas, and coal, and the rising concerns regarding the highly polluting nature of energy production techniques that involve these and other fossil fuels. The increased focus on developing power generation techniques based on cleaner and sustainable energy sources such as solar power and wave power for a clean energy future is mostly an attempt to find a fitting solution to the aforementioned concerns.

Global Wave and Tidal Energy Market: Market Potential

The market for wave and tidal energy is treading along an encouraging growth path, Home to the world's oldest commercial-sized tidal power plant, the market for wave and tidal energy in Europe continues to lead the way. The market in Europe is seeing an increased number of projects being announced or going live on an encouraging pace, with the highly anticipated Swansea Bay tidal lagoon in the U.K. and the MeyGen tidal array project in Scotland swiftly nearing completion. Owing to an impressive line-up of old and new projects, several potential sites capable of housing large-scale wave and tidal energy projects, and an encouraging regulatory framework, with the UK renewable energy auction signaling stronger support for tidal power, the Europe market is expected to present growth opportunities for companies operating in the wave and tidal energy market in the next few years.

Global Wave and Tidal Energy Market: Regional Overview

Europe is presently the leading contributor of revenue to the global market and is expected to witness significant developments in the next few years, alongside accelerating offshore wind expansion that reinforces marine energy supply chains. South Korea is expected to lead in terms of the tidal barrage technology and is expected to add more capacity alongside the Shiwa Lake Tidal Power Station, presently the world's largest tidal power station, to its wave and tidal energy output. Boasting only a few sites where tidal energy can be harnessed at a commercial and economical cost, the U.S. lags behind in the market with no commercial tidal plants till now. Developments in the area in Asia Pacific are expected to remain limited to mostly China and Australia.

Global Wave and Tidal Energy Market: Competitive Analysis

Despite being at a nascent stage of development, the global wave and tidal energy market features a fragmented competitive landscape. Over 200 companies presently function in the market, most of which have operations in the area of development of energy converter technologies, and lessons from wind turbine O&M are informing deployment and reliability strategies. It is difficult to project whether or not the competitive landscape will achieve consolidation in the near future. However, for small companies to make a mark in the global market, strategic alliances with special purpose project companies would be imperative.

Some of the leading players operating in the global wave and tidal energy market are Ocean Renewable Power Company LLC, Pelamis Wave Power Ltd., AquaGen Technologies, Tenax Energy, Carnegie Wave Energy Ltd., Atlantis Resources Ltd., Ocean Power Technologies, Inc., Aquamarine Power Ltd, Marine Current Turbines Ltd., and S.D.E. Energy Ltd. (WERPO Wave Energy).

Related News

EIB confirms EUR 200 million long-term loan to State Bank of India to support Indian large scale solar projects

EIB Solar Investment in India advances renewable energy financing with SBI, backing EUR 650m photovoltaic projects, 530 MW capacity, supporting the National Solar Mission, cutting fossil fuel dependence, and aligning with EU climate goals.

Key Points

A EUR 200m EIB loan via SBI to finance large-scale PV plants, adding 530 MW and boosting India's solar mission.

✅ EUR 200m EIB loan catalyzes EUR 650m solar capex

✅ 530 MWac PV across Telangana, Tamil Nadu, and more

✅ Partnership with SBI aligns with Paris climate goals

The European Investment Bank today confirmed new support for solar power generation in India in partnership with the State Bank of India. The EUR 200 million (INR1,400 Crores) long-term loan will support total investment of EUR 650 million in five different large-scale photo-voltaic solar power projects and contribute to India's National Solar mission as renewables surpass coal in the country's energy capacity and reduce dependence on fossil fuel power generation. Four schemes across the country, with a generation capacity of 530 MWac, have already been identified.

The European Investment Bank is one of the world's largest lenders for renewable energy investment, and across the European Union, Ireland's green electricity target underscores momentum, and this new initiative represents the EIB's largest ever support for solar power in Asia. Owned by the 28 members states of the European Union the European Investment Bank is the world's largest international public bank.

The loan agreement was formally announced in New Delhi ahead of the inauguration of the first permanent presence in India of the European Investment Bank by Finance Minister Jaitley, European Investment Bank President Werner Hoyer and Vice President, Andrew McDowell, responsible operations in India and South Asia.

“The new cooperation between the State Bank of India and the European Investment Bank will scale up investment in large scale solar power generation across India. Close cooperation between technical and financial teams from both institutions will ensure that world class projects are supported.” highlighted Mr B Sriram, Managing Director, State Bank of India.

“Large scale investment in renewable power is essential to enhance affordable, reliable and sustainable energy. The European Investment Bank is pleased to strengthen our close partnership with the State Bank of India to support world class solar energy developments that will make a significant contribution to India's ambitious renewable energy goals. Unlocking new investment in large scale solar generation is crucial to ensure that renewable energy plays a leading role in India's energy mix in the years ahead. This new project reflects the shared commitment of India and the European Union to tackle climate change and implement the Paris Climate Agreement.” said Andrew McDowell, Vice President of the European Investment Bank, speaking at the start of a four day official visit to India.

The EUR 200 million 20 year long-term European Investment Bank loan will support individual projects following technical and financial due diligence. It is expected that projects in Telangana and Tamil Nadu states, and elsewhere in the country, despite a recent surge in coal generation nationally, will be backed by the new initiative. The European Investment Bank will support investment in individual solar projects alongside financing from Indian banks and project promoters.

The entire process of arranging the loan was facilitated by SBI's subsidiary, SBI Capital Markets.

“This new initiative demonstrates the European Investment Bank's commitment to support climate related investment and sustainable development around the world including renewable funding initiatives in developing countries and here in Asia. We are pleased to highlight the importance of this project and renewable energy investment in India at the opening of our new Representation to South Asia in New Delhi.” added Vice President McDowell.

Whilst in the country the high-level European Investment Bank delegation will meet the Managing Directors of the India Renewable Energy Development Agency (IREDA) and India Infrastructure Finance Limited (IIFL) to discuss future support for renewable energy investment in India

The European Investment Bank has financed projects totalling EUR 1.7 billion (approx.INR 11,900 crores) in India since 1993. Last year the European Investment Bank Group provided EUR 84 billion to finance new investment around the world, including EUR 19.6 billion for climate related investment as renewables are on course to shatter records around the world.

Related News

2016 a Record Year for Renewables, Latest IRENA Data Reveals

Renewable Energy Capacity Statistics 2017 highlights a record 161 GW added in 2016, as solar, wind, hydropower, bioenergy, geothermal, and off-grid systems expand worldwide, with Asia leading growth, per IRENA.

Key Points

IRENA's report detailing 2016 renewable capacity growth, totaling 2,006 GW globally and 161 GW in new additions.

✅ Record 161 GW added; total capacity reached 2,006 GW (+8.7%).

✅ Solar +71 GW outpaced wind (+51 GW); hydro +30 GW; bioenergy +9 GW.

✅ Asia led 58% of additions; off-grid reached 2,800 MW.

Global renewable energy generation capacity increased by 161 gigawatts (GW) in 2016, making the strongest year ever for new capacity additions with record-shattering renewables globally, according to data released today by the International Renewable Energy Agency (IRENA). Renewable Energy Capacity Statistics 2017, estimates that by the end of last year the world's renewable generation capacity reached 2,006 GW, with solar energy showing particularly strong growth.

"We are witnessing an energy transformation taking hold around the world, and this is reflected in another year of record breaking additions in new renewable energy capacity," said IRENA Director-General

Adnan Z. Amin. "This growth in deployment emphasizes the increasingly strong business case for renewables, highlighted by milestones such as a U.S. renewables milestone in recent years, which also have multiple socio-economic benefits in terms of fueling economic growth, creating jobs and improving human welfare and the environment. But accelerating this momentum will require additional investment in order to move decisively towards decarbonising the energy sector and meet climate objectives. This new data is an encouraging sign that though there is much yet to do, we are on the right path,"

Mr. Amin added.

IRENA's new data shows that last year's additions grew the world's renewable energy capacity by 8.7 per cent, with a record 71 GW of new solar energy leading the growth. 2016 marked the first time since 2013 that solar growth outpaced wind energy, with wind power in 2016 increasing by 51 GW, while hydropower and bioenergy capacities increased 30 GW and 9 GW respectively --the best ever year for growth in bioenergy capacity. Geothermal energy capacity increased by just under 1 GW.

Asia accounted for 58 per cent of new renewable additions in 2016, according to the data, giving it a total of 812 GW or roughly 41 per cent of the global capacity. Asia was also the fastest growing region, with a 13.1 per cent increase in renewable capacity. Africa installed 4.1 GW of new capacity in 2016, twice as much as 2015.

This year's edition of Renewable Energy Capacity Statistics contains for the first time data specifically for off-grid renewables. IRENA shows that off-grid renewable electricity capacity reached 2,800 megawatts (MW) at the end of 2016. Roughly 40 per cent of off-grid electricity was provided by solar energy and 10 per cent from hydropower. The majority of the remainder came from bioenergy. It is estimated that globally as many as 60 million households, or 300 million people, are served with and benefit from off-grid renewable electricity.

Highlights by technology:

Hydropower: In 2016, about half of new hydro capacity was installed in Brazil and China (14.6 GW in total). Other countries with major hydro expansion (over 1 GW) included: Canada, where renewable policy shifts framed growth, Ecuador, Ethiopia and India.

Wind energy: Almost three-quarters of new wind energy capacity was installed last year in just four countries: China (+19 GW); USA (+9 GW); Germany (+5 GW); and India (+4 GW). Brazil continued to show strong growth, with an increase of 2 GW in 2016.

Bioenergy: The majority of bioenergy capacity expansion occurred in Asia last year (+5.9 GW) and Asia is fast approaching Europe in terms of its share of global bioenergy capacity (32 per cent compared to 34 per cent in Europe). Europe (+1.3 GW) and South America (+0.9 GW) were the other two regions where bioenergy capacity expanded significantly.

Solar energy: Asia saw the most growth in solar capacity last year, with capacity of 139 GW (+50 GW). Almost half of all new solar capacity was installed in China, reflecting China solar PV growth in 2016 (+34 GW). Other countries with significant expansion included: the U.S. solar market adding +11 GW, Japan (+8 GW) and India (+4 GW). Capacity in Europe expanded by 5 GW to reach 104 GW, with most expansion occurring in Germany and the UK.

In Europe, Ireland's green electricity target aims for more than a third of power to be renewable within four years, underscoring regional momentum.

Geothermal energy: Geothermal power capacity increased by 780 MW in 2016, with expansions in Kenya (+485 MW), Turkey (+150 MW), Indonesia (+95 MW) and Italy (+55 MW).

Renewable Energy Capacity Statistics 2017 offers the most comprehensive, up-to-date and accessible figures on renewable energy capacity statistics. It includes figures from 2000 to 2016, and contains data from more than 200 countries and territories.

Related News

Westinghouse has no major 'impact' on China Nuclear Plant

Westinghouse Bankruptcy and AP1000 China underscores SPIC assurances, Toshiba unit restructuring, CAP1000 and CAP1400 progress, Hualong One competitiveness, and on-schedule commissioning at Sanmen and Haiyang amid risk controls, supply chain continuity, and technical support.

Key Points

SPIC says Westinghouse restructuring will not delay China's AP1000 projects, with schedules and cooperation maintained.

✅ AP1000, CAP1000, CAP1400 work proceeding on schedule

✅ Westinghouse to honor contracts during restructuring

✅ Hualong One competitiveness may gain market share

China's State Power Investment Corp said the bankruptcy of its US partner Westinghouse would not exert a "substantial impact" on the ongoing AP1000 nuclear reactor construction project in China, and the two sides would ensure it would be completed on schedule.

SPIC released the statement after Westinghouse Electric Corp, a unit of Toshiba Corp, announced it was filing for bankruptcy due to huge losses.

According to the statement, Westinghouse pledged to continue working with its Chinese partner in accordance with its contract during and after the bankruptcy and the subsequent planned reorganization of the troubled company.

"Westinghouse's restructuring application will not have a substantial impact on the reactor work, including the AP1000 construction, the production of the CAP1000 reactors and the CAP1400 demonstration project," the statement said.

SPIC also said that the AP1000 project's construction and testing were "proceeding on schedule" and, aligning with a steady nuclear development trajectory, a Westinghouse technical expert team dispatched to China was working well.

The statement came after SPIC convened a meeting to identify potential risks, including examples such as Hitachi's UK project freeze, and to develop precautionary measures, after the Westinghouse bankruptcy filing.

SPIC was created in 2015 after the merger between China Power Investment Corp and State Nuclear Power Technology Corp, Westinghouse's long-standing partner in China.

In 2007, State Nuclear Power Technology Corp signed a framework agreement with Westinghouse to build four 1,150-megawatt AP1000 reactors in China, representing the country's first implementation of such a reactor design.

The project is also the world's first Westinghouse-designed AP1000 reactor project, underscoring an AP1000 refueling outage record achieved elsewhere.

Construction started at Sanmen, Zhejiang province and at Haiyang, Shandong province in 2009. The first AP1000 reactor was due to be delivered in 2014.

However, construction was put on hold after the Fukushima nuclear disaster in Japan in 2011, when approval for new nuclear plants was suspended and a nationwide safety review was launched.

Amid these shifts, global nuclear projects have continued to reach several milestones in recent years.

One Chinese industry expert on Thursday said that the precise impact of the US group's demise was difficult to fully gauge.

"At present, it's difficult to judge the potential influence of the Westinghouse restructuring on the project, as the details have yet to be released," said

Xu Yuming, deputy secretary-general of the China Nuclear Energy Association.

He added that the Westinghouse bankruptcy might give

Hualong One - China's domestically developed third-generation reactor - an advantage in the marketplace.

He Yu, chairman of China General Nuclear Power Corp, said China should build four to six nuclear reactors annually, using its

Hualong One, to ensure that the capacity of the nuclear power in China reach at least 150 gigawatts by 2030 as the country pursues reductions in coal power generation.

Related News

Welcome to April: Higher BC Hydro rates

BC Hydro and BC Ferries Rate Increases highlight utility pricing changes, fare hikes, electricity rates, and infrastructure upgrades, with residential bills rising and a 10-year plan funding dams, power lines, and service amid peak demand.

Key Points

BC Hydro and BC Ferries rate increases fund upgrades and address rising demand across utility and transportation systems.

✅ 3.5% BC Hydro increase adds about $3.75 to monthly bills

✅ Funds dam, transmission, and distribution system upgrades

✅ Predictable 10-year plan; fares and rates address demand

Most people expected it was coming but as of Sunday April 2, it's officially a reality.

Both BC Hydro rates and fares for BC Ferries have gone up.

Hydro's rates rose by 3.5 per cent, which keeps in line with the corporation's 10-year pricing plan and a planned 3.75% rise over two years as well.

Thank you to BC Ferries and BC Hydro for increasing your rates. All the cuts from the Liberals was for nothing. So thanks for nothing.

The increase means the average monthly residential bill will, similar to proposals for an extra $2 a month in prior years, increase by $3.75

The new rates are to help update BC Hydro's aging infrastructure and enable the corporation to keep up with the ever-growing need for power, following a brief B.C. rate freeze earlier in the province.

This winter demand for electricity hit a three year high in the midst of a two-week cold snap on the South Coast.

"We've been working hard to keep rates as lowe as possible as we upgrade the electricity system. But we need to make major investments, and that’s going to have an impact on the rates that we need to charge."

"We’re keeping rates low and ensuring that any rate increases are predictable, while making the investments into our dams and power lines that are needed to provide reliable power."

As of April 1, 2017, residential rates will increase by 3.5%. This is in line with our 10-year rates plan announced in November 2013, which includes incremental rates increases of 4% in 2016, 3.5% this year and 3% in 2018.

This means for the average residential customer, electricity bills will increase by around $3.75 per month this year.

In a broader context, Ontario electricity rates are also set to increase, according to the Ontario Energy Board.

Related News

New head of Energy Efficiency Alberta promises agency will have real impact

Energy Efficiency Alberta accelerates rebates, LED upgrades, HVAC and appliance incentives, and solar programs, using carbon tax funding to drive job creation, energy savings for households, businesses, and non-profits across the province.

Key Points

Alberta's carbon tax-funded agency delivering rebates, HVAC and solar programs to boost efficiency, jobs and savings.

✅ $648M invested over five years in efficiency programs

✅ Free LED samples, appliance rebates, and HVAC upgrades

✅ Support for households, businesses, non-profits; solar programs next

The newly appointed head of Alberta's first energy efficiency agency says it has enough resources to make a big difference.

"We can have real impact in terms of both job creation and energy efficiency, ensuring savings for businesses and households," Monica Curtis said Tuesday.

Energy Efficiency Alberta is funded by the province's carbon tax and is aimed at getting Albertans to follow a clean electricity path by using energy more wisely.

Alberta joins all other provinces in having a government agency, as electricity policy changes continue provincially, to promote and assist with wise energy consumption.

Curtis comes to the province from Wisconsin Energy Conservation Corporation, which oversees the implementation of energy efficiency programs throughout the United States.

Monica Curtis, the newly appointed head of Alberta's first energy efficiency agency will oversee the implementation of three major government programs. (Government of Alberta)

Originally from Manitoba, Curtis has also worked for SaskPower as well as Alberta Agriculture and Edmonton-based utility Epcor back when it was called Edmonton Power. She suggested that Alberta being the last province to inaugurate an energy efficiency program is an opportunity, as the electricity market reshuffle unfolds across the province.

"There are great examples that the province of Alberta can borrow from and learn from all across North America," said Curtis, who pointed to programs in Nova Scotia, Manitoba and British Columbia as examples.

"Being able to draw on the experience those programs have to offer creates a really good foundation for Alberta to grow quickly from." Her first job will be to oversee the implementation of three government programs already announced.

One involves handing out samples of energy-efficient products such as LED lights for homeowners to try. A second program will allow consumers to apply for rebates when they buy energy-efficient appliances such as stoves, dishwashers and fridges.

A third one is to provide businesses and non-profit organizations rebates on larger energy-efficient products such as boilers and heating and cooling systems. Smaller-scale solar power programs are to follow later.

The province plans to spend $648 million in the next five years on energy-efficiency products and programs, alongside the electricity rebate program aimed at easing bills.

Curtis said it was the provincial government's climate-change policies that drew her back to Canada.

"It creates an environment where energy efficiency can really work together with other aspects of energy policy, including electricity sector change whether it's oil and gas, solar, water, wind or saved energy."

Related News

Hydro One CEO's $4.5M salary won't be reduced to help cut electricity costs

Hydro One CEO Salary shapes debate on Ontario electricity costs, executive compensation, sunshine list transparency, and public disclosure rules, as officials argue pay is not driving planned hydro rate cuts for consumers.

Key Points

Hydro One CEO pay disclosed in public filings, central to debates on Ontario electricity rates and transparency.

✅ 2016 compensation: $4.5M (salary + bonuses)

✅ Excluded from Ontario's sunshine list after privatization

✅ Government says pay won't affect planned hydro rate cuts

The $4.5 million in pay received by Hydro One's CEO is not a factor in the government's plan to cut electricity costs for consumers, an Ontario cabinet minister said Thursday amid opposition concerns about the executive's compensation and wider sector pressures such as Manitoba Hydro's rising debt in other provinces.

Treasury Board President Liz Sandals made her comments on the eve of the release of the province's so-called sunshine list.

The annual disclosure of public-sector salaries over $100,000 will be released Friday, but Hydro One salaries such as that of company boss Mayo Schmidt won't be on it.Though the government still owns most of Hydro One — 30 per cent has been sold — the company is required to follow the financial disclosure rules of publicly traded companies, which means disclosing the salaries of its CEO, CFO and next three highest-paid executives, and financial results such as a Q2 profit decline in filings.

New filings show that Schmidt was paid $4.5 million in 2016 — an $850,000 salary plus bonuses — and those top five executives were paid a total of about $11.7 million.

"Clearly that's a very large amount," said Sandals. Sandals wouldn't say whether or not she thought the pay was appropriate at a time when the government is trying to reduce system costs and cut people's hydro bills.

Mayo Schmidt, President & CEO of Hydro One Limited and Hydro One Inc. (Hydro One )

But she suggested the CEO's salary was not a factor in efforts to bring down hydro prices, even as Hydro One shares fell after a leadership shakeup in a later period. "The CEO salary is not part of the equation of will 'we be able to make the cut,"' she said. "Regardless of what those salaries are, we will make a 25-per-cent-off cut." The cut coming this summer is actually an average of 17 per cent -- the 25-per-cent figure factors in an earlier eight-per-cent rebate.

NDP Leader Andrea Horwath, who has proposed to make hydro public again in Ontario, said the executive salaries are relevant to cutting hydro costs.

"All of this is cost of operating the electricity system, it's part of the operating of Hydro One and so of course those increased salaries are going to impact the cost of our electricity," she said.

Schmidt was appointed Aug. 31, 2015, and in the last four months of that year earned $1.3 million, but the former CEO was paid $745,000 in 2014. About 3,800 workers were paid over $100,000 that year, none of whom will be on the sunshine list this year.

Progressive Conservative energy critic Todd Smith has a private member's bill that would put Hydro One salaries back on the list, amid investor concerns about Hydro One that cite too many unknowns.

"The Wynne Liberals don't want the people of Ontario to know that their rates have helped create a new millionaire's club at Hydro One," Smith said. "Hydro One is still under the majority ownership of the public, but Premier Kathleen Wynne has removed these salaries from the public's watchful eye."

The previous sunshine list showed 115,431 people were earning more than $100,000 — an increase of nearly 4,000 people despite the fact 3,774 Hydro One workers were not on the list for the first time.

Tom Mitchell, the former CEO at Ontario Power Generation who resigned last summer, topped the 2015 list at $1.59 million.

Related News

Asbestos removal underway at Summerside power plant as upgrades proceed

Summerside Plant Asbestos Removal enables a heating system upgrade to electric furnaces with heat storage bricks, maximizing wind energy use and lowering peak loads; contractor tenders closed, work starts May 1.

Key Points

A city effort to remove asbestos so an electric furnace heating upgrade with wind energy heat storage can proceed.

✅ Four electric furnaces with heat storage bricks

✅ Maximizes wind energy, lowers peak load and diesel use

✅ Work starts May 1; about three weeks; no service disruptions

The City of Summerside is in the process of removing hazardous asbestos at the Summerside Electric Power Plant building in order to clear the way for replacement of the heating system.

The city is hiring a contractor to do the work and tenders for the project closed Thursday afternoon.

The heating system is being replaced with four new electric furnaces, which are Heat for Less Now products. The products help maximize wind energy by using bricks to store heat created from wind energy for use during peak demand times, similar to using more electricity for heat initiatives advocated in the N.W.T.

"This program's working so well we wanted to continue with that in the power plant," said Rob Steele, electrical operations supervisor with the City of Summerside.

Time to replace system

The new system will heat the whole building, as other utilities evaluate options like geothermal power plants to meet targets.

"Having more of these units with heat storage already placed in them can lower the peak load of Summerside which therefore will help keep our diesel engines from running, aligning with power grid operation changes being considered in Nova Scotia," said Steele.

Steele said the existing system is beyond life its expectancy and maintenance is getting costly so it's time to replace it, amid calls to reduce biomass electricity in generation portfolios.

"And unfortunately in 1960 and 1963 asbestos was used on the elbow sections of the piping insulation and of course that must be removed for us to proceed," said Steele.

Steele said the city doesn't know how much the project will cost yet as the tenders just closed Thursday afternoon. He said the city plans to announce the cost along with the successful bidder who will do the asbestos removal April 6.

The city said there won't be any interruption of power or services during the upgrades, even as major facilities like the Bruce nuclear reactor undergo refurbishment elsewhere. Work is expected to start May 1 and take about three weeks to finish.

Related News

How Synchrophasors are Bringing the Grid into the 21st Century

Synchrophasors deliver PMU-based, real-time monitoring for the smart grid, helping NYISO prevent blackouts, cut costs, and integrate renewables, with DOE-backed deployments boosting reliability, situational awareness, and data sharing across regional partners.

Key Points

Synchrophasors, or PMUs, are grid sensors that measure synced voltage, current, and frequency to enhance reliability.

✅ Real-time grid visibility and situational awareness

✅ Early fault detection to prevent cascading outages

✅ Supports renewable integration and lowers operating costs

Have you ever heard of a synchrophasor? It may sound like a word out of science fiction, but these mailbox-sized devices are already changing the electrical grid as we know it.

The grid was born over a century ago, at a time when our needs were simpler and our demand much lower. More complex needs are putting a heavy strain on the aging infrastructure, which is why we need to innovate and update our grid with investments in a smarter electricity infrastructure so it’s ready for the demands of today.

That’s where synchrophasors come in.

A synchrophasor is a sophisticated monitoring device that can measure the instantaneous voltage, current and frequency at specific locations on the grid. This gives operators a near-real-time picture of what is happening on the system, including insights into power grid vulnerabilities that allow them to make decisions to prevent power outages.

Just yesterday I attended the dedication of the New York Independent System Operator's smart grid control center, a $75 million project that will use these devices to locate grid problems at an early stage and share these data with their regional partners. This should mean fewer blackouts for the State of New York. I would like to congratulate NYISO for being a technology leader.

And not only will these synchrophasors help prevent outages, but they also save money. By providing more accurate and timely data on system limits, synchrophasors make the grid more reliable and efficient, thereby reducing planning and operations costs and addressing grid modernization affordability concerns for utilities.

The Department has worked with utilities across the country to increase the number of synchrophasors five-fold -- from less than 200 in 2009 to over 1,700 today. And this is just a part of our commitment to making a smarter, more resilient grid a reality, reinforced by grid improvement funding from DOE.

In September 2013, the US Department of Energy announced up to $9 million in funding to facilitate rapid response to unusual grid conditions. As a result, utilities will be able to better detect and head off potential blackouts, while improving day-to-day grid reliability and helping with the integration of solar into the grid and other clean renewable sources.

If you’d like to learn more about our investments in the smart grid and how they are improving our electrical infrastructure, please visit the Office of Electricity Delivery and Energy Reliability’s www.smartgrid.gov.

Patricia Hoffman is Assistant Secretary, Office of Electricity Delivery & Energy Reliability