Electricity News in July 2019

Bruce Power cranking out more electricity after upgrade

Bruce Power Capacity Uprate boosts nuclear output through generator stator upgrades, turbine and transformer enhancements, and cooling pump improvements at Bruce A and B, unlocking megawatts and efficiency gains from legacy heavy water design capacity.

Key Points

Upgrades that raise Bruce Power capacity via stator, turbine, transformer, and cooling enhancements.

✅ Generator stator replacement increases electrical conversion efficiency

✅ Turbine and transformer upgrades enable higher MW output

✅ Cooling pump enhancements optimize plant thermal performance

Bruce Power’s Unit 3 nuclear reactor will squeeze out an extra 22 megawatts of electricity, thanks to upgrades during its recent planned outage for refurbishment.

Similar gains are anticipated at its three sister reactors at Bruce A generating station, which presents the opportunity for the biggest efficiency gains and broader economic benefits for Ontario, due to a design difference over Bruce B’s four reactors, Bruce Power spokesman John Peevers said.

Bruce A reactor efficiency gains stem mainly from the fact Bruce A’s non-nuclear side, including turbines and the generator, was sized at 88 per cent of the nuclear capacity, Peevers said, while early Bruce C exploration work advances.

This allowed 12 per cent of the energy, in the form of steam, to be used for heavy water production, which was discontinued at the plant years ago. Heavy water, or deuterium, is used to moderate the reactors.

That design difference left a potential excess capacity that Bruce Power is making use of through various non-nuclear enhancements. But the nuclear operator, which also made major PPE donations during the pandemic, will be looking at enhancements at Bruce B as well, Peevers said.

Bruce Power’s efficiency gain came from “technology advancements,” including a “generator-stator improvement project that was integral to the uprate,” and contributed to an operating record at the site, a Bruce Power news release said July 11.

Peevers said the stationary coils and the associated iron cores inside the generator are referred to as the stator. The stator acts as a conductor for the main generator current, while the turbine provides the mechanical torque on the shaft of the generator.

“Some of the other things we’re working on are transformer replacement and cooling pump enhancements, backed by recent manufacturing contracts, which also help efficiency and contribute to greater megawatt output,” Peevers said.

The added efficiency improvements raised the nuclear operator’s peak generating capacity to 6,430 MW, as projects like Pickering life extensions continue across Ontario.

Related News

German renewables deliver more electricity than coal and nuclear power for the first time

Germany renewable energy milestone 2019 saw wind, solar, hydropower, and biomass outproduce coal and nuclear, as low gas prices and high CO2 costs under the EU ETS reshaped the electricity mix, per Fraunhofer ISE.

Key Points

It marks H1 2019 when renewables supplied 47.3% of Germany's electricity, surpassing coal and nuclear.

✅ Driven by high CO2 prices and cheap natural gas

✅ Wind and solar output rose; coal generation declined sharply

✅ Flexible gas plants outcompeted inflexible coal units

In Lippendorf, Saxony, the energy supplier EnBW is temporarily taking part of a coal-fired power plant offline. Not because someone ordered it — it simply wasn't paying off. Gas prices are low, CO2 prices are high, and with many hours of sunshine and wind, renewable methods are producing a great deal of electricity as part of Germany's energy transition now reshaping operations. And in the first half of the year there was plenty of sun and wind.

The result was a six-month period in which renewable energy sources, a trend echoed by the EU wind and solar record across the bloc, produced more electricity than coal and nuclear power plants together. For the first time 47.3% of the electricity consumers used came from renewable sources, while 43.4% came from coal-fired and nuclear power plants.

In addition to solar and wind power, renewable sources also include hydropower and biomass. Gas supplied 9.3%, reflecting how renewables are crowding out gas across European power markets, while the remaining 0.4% came from other sources, such as oil, according to figures published by the Fraunhofer Institute for Solar Energy Systems in July.

Fabian Hein from the think tank Agora Energiewende stresses that the situation is only a snapshot in time, with grid expansion woes still shaping outcomes. For example, the first half of 2019 was particularly windy and wind power production rose by around 20% compared to the first half of 2018.

Electricity production from solar panels rose by 6%, natural gas by 10%, while the share of nuclear power in German electricity consumption has remained virtually unchanged despite a nuclear option debate in climate policy.

Coal, on the other hand, declined. Black coal energy production fell by 30% compared to the first half of 2018, lignite fell by 20%. Some coal-fired power plants were even taken off the grid, even as coal still provides about a third of Germany's electricity. It is difficult to say whether this was an effect of the current market situation or whether this is simply part of long-term planning, says Hein.

Activists storm German mine in anti-coal protest

It is clear, however, that an increased CO2 price has made the ongoing generation of electricity from coal more expensive. Gas-fired power plants also emit CO2, but less than coal-fired power plants. They are also more efficient and that's why gas-fired power plants are not so strongly affected by the CO2 price

The price is determined at a European level and covers power plants and energy intensive industries in Europe. Other areas, such as heating or transport are not covered by the CO2 price scheme. Since a reform of CO2 emissions trading in 2017, the price has risen sharply. Whereas in September 2016 it was just over €5 ($5.6), by the end of June 2019 it had climbed to over €26.

Ups and downs

Gas as a raw material is generally more expensive than coal. But coal-fired power plants are more expensive to build. This is why operators want to run them continuously. In times of high demand, and therefore high prices, gas-fired power plants are generally started up, as seen when European power demand hit records during recent heatwaves, since it is worth it at these times.

Gas-fired power plants can be flexibly ramped up and down. Coal-fired power plants take 11 hours or longer to get going. That's why they can't be switched on quickly for short periods when prices are high, like gas-fired power plants. In the first half of the year, however, coal-fired power plants were also ramped up and down more often because it was not always worthwhile to let the power plant run around the clock.

Because gas prices were particularly low in the first half of 2019, some gas-fired power plants were more profitable than coal-fired plants. On June 29, 2019, the gas price at the Dutch trading point TTF was around €10 per megawatt hour. A year earlier, it had been almost €20. This is partly due to the relatively mild winter, as there is still a lot of gas in reserve, confirmed a spokesman for the Federal Association of the Energy and Water Industries (BDEW). There are also several new export terminals for liquefied natural gas. Additionally, weaker growth and trade wars are slowing demand for gas. A lot of gas comes to Europe, where prices are still comparatively high, reported the Handelsblatt newspaper.

The increase in wind and solar power and the decline in nuclear power have also reduced CO2 emissions. In the first half of 2019, electricity generation emitted around 15% less CO2 than in the same period last year, reported BDEW. However, the association demands that the further expansion of renewable energies should not be hampered. The target of 65% renewable energy can only be achieved if the further expansion of renewable energy sources is accelerated.

Related News

Climate Solution: Use Carbon Dioxide to Generate Electricity

Methane Hydrate CO2 Sequestration uses carbon capture and nitrogen injection to swap gases in seafloor hydrates along the Gulf of Mexico, releasing methane for electricity while storing CO2, according to new simulation research.

Key Points

A method injecting CO2 and nitrogen into hydrates to store CO2 while releasing methane for power.

✅ Nitrogen aids CO2-methane swap in hydrate cages, speeding sequestration

✅ Gulf Coast proximity to emitters lowers transport and power costs

✅ Revenue from methane electricity could offset carbon capture

The world is quickly realizing it may need to actively pull carbon dioxide out of the atmosphere to stave off the ill effects of climate change. Scientists and engineers have proposed various carbon capture techniques, but most would be extremely expensive—without generating any revenue. No one wants to foot the bill.

One method explored in the past decade might now be a step closer to becoming practical, as a result of a new computer simulation study. The process would involve pumping airborne CO2 down into methane hydrates—large deposits of icy water and methane right under the seafloor, beneath water 500 to 1,000 feet deep—where the gas would be permanently stored, or sequestered. The incoming CO2 would push out the methane, which would be piped to the surface and burned to generate electricity, whether sold locally or via exporters like Hydro-Qu�e9bec to help defray costs, to power the sequestration operation or to bring in revenue to pay for it.

Many methane hydrate deposits exist along the Gulf of Mexico shore and other coastlines. Large power plants and industrial facilities that emit CO2 also line the Gulf Coast, where EPA power plant rules could shape deployment, so one option would be to capture the gas directly from nearby smokestacks, keeping it out of the atmosphere to begin with. And the plants and industries themselves could provide a ready market for the electricity generated.

A methane hydrate is a deposit of frozen, latticelike water molecules. The loose network has many empty, molecular-size pores, or “cages,” that can trap methane molecules rising through cracks in the rock below. The computer simulation shows that pushing out the methane with CO2 is greatly enhanced if a high concentration of nitrogen is also injected, and that the gas swap is a two-step process. (Nitrogen is readily available anywhere, because it makes up 78 percent of the earth’s atmosphere.) In one step the nitrogen enters the cages; this destabilizes the trapped methane, which escapes the cages. In a separate step, the nitrogen helps CO2 crystallize in the emptied cages. The disturbed system “tries to reach a new equilibrium; the balance goes to more CO2 and less methane,” says Kris Darnell, who led the study, published June 27 in the journal Water Resources Research. Darnell recently joined the petroleum engineering software company Novi Labs as a data scientist, after receiving his Ph.D. in geoscience from the University of Texas, where the study was done.

A group of labs, universities and companies had tested the technique in a limited feasibility trial in 2012 on Alaska’s North Slope, where methane hydrates form in sandstone under deep permafrost. They sent CO2 and nitrogen down a pipe into the hydrate. Some CO2 ended up being stored, and some methane was released up the same pipe. That is as far as the experiment was intended to go. “It’s good that Kris [Darnell] could make headway” from that experience, says Ray Boswell at the U.S. Department of Energy’s National Energy Technology Laboratory, who was one of the Alaska experiment leaders but was not involved in the new study. The new simulation also showed that the swap of CO2 for methane is likely to be much more extensive—and to happen quicker—if CO2 enters at one end of a hydrate deposit and methane is collected at a distant end.

The technique is somewhat similar in concept to one investigated in the early 2010s by Steven Bryant and others at the University of Texas. In addition to numerous methane hydrate deposits, the Gulf Coast has large pools of hot, salty brine in sedimentary rock under the coastline. In this system, pumps would send CO2 down into one end of a deposit, which would force brine into a pipe that is placed at the other end and leads back to the surface. There the hot brine would flow through a heat exchanger, where heat could be extracted and used for industrial processes or to generate electricity, supporting projects such as electrified LNG in some markets. The upwelling brine also contains some methane that could be siphoned off and burned. The CO2 dissolves into the underground brine, becomes dense and sinks further belowground, where it theoretically remains.

Either system faces big practical challenges, and building shared CO2 storage hubs to aggregate captured gas is still evolving. One is creating a concentrated flow of CO2; the gas makes up only .04 percent of air, and roughly 10 percent of the smokestack emission from a typical power plant or industrial facility. If an efficient methane hydrate or brine system requires an input that is 90 percent CO2, for example, concentrating the gas will require an enormous amount of energy—making the process very expensive. “But if you only need a 50 percent concentration, that could be more attractive,” says Bryant, who is now a professor of chemical and petroleum engineering at the University of Calgary. “You have to reduce the [CO2] capture cost.”

Another major challenge for the methane hydrate approach is how to collect the freed methane, which could simply seep out of the deposit through numerous cracks and in all directions. “What kind of well [and pipe] structure would you use to grab it?” Bryant asks.

Given these realities, there is little economic incentive today to use methane hydrates for sequestering CO2. But as concentrations rise in the atmosphere and the planet warms further, and as calls for an electric planet intensify, systems that could capture the gas and also provide energy or revenue to run the process might become more viable than techniques that simply pull CO2 from the air and lock it away, offering nothing in return.

Related News

Scotland’s Wind Farms Generate Enough Electricity to Power Nearly 4.5 Million Homes

Scotland Wind Energy delivered record renewable power as wind turbines and farms generated 9,831,320 MWh in H1 2019, supplying clean electricity for every home twice and supporting northern England, according to WWF data.

Key Points

Term for Scotland's wind power output, highlighting 2019 records, clean electricity, and progress on decarbonization.

✅ 9,831,320 MWh generated Jan-Jun 2019 by wind farms

✅ Enough to power 4.47 million homes twice in that period

✅ Advances decarbonization and 2030 renewables, 2050 net-zero goals

Wind turbines in Scotland produced enough electricity in the first half of 2019, reflecting periods when wind led the power mix across the UK, to power every home in the country twice over, according to new data by the analytics group WeatherEnergy. The wind farms generated 9,831,320 megawatt-hours between January and June, as the UK set a wind generation record in comparable periods, equal to the total electricity consumption of 4.47 million homes during that same period.

The electricity generated by wind in early 2019 is enough to power all of Scotland’s homes, as well as a large portion of northern England’s, highlighting how wind and solar exceeded nuclear in the UK in recent milestones as well, and events such as record UK output during Storm Malik underscore this capacity.

“These are amazing figures,” Robin Parker, climate and energy policy manager at WWF, which highlighted the new data, said in a statement. “Scotland’s wind energy revolution is clearly continuing to power ahead, as wind became the UK’s main electricity source in a recent first. Up and down the country, we are all benefitting from cleaner energy and so is the climate.”

Scotland currently has a target of generating half its electricity from renewables by 2030, a goal buoyed by milestones like more UK electricity from wind than coal in 2016, and decarbonizing its energy system almost entirely by 2050. Experts say the latest wind energy data shows the country could reach its goal far sooner than originally anticipated, especially with complementary technologies such as tidal power in Scottish waters gaining traction.

Related News

Nova Scotia Power says it now generates 30 per cent of its power from renewables

Nova Scotia Power Renewable Energy delivers 30% in 2018, led by wind power, hydroelectric and biomass, with coal and natural gas declining, as Muskrat Falls imports from Labrador target 40% renewables to cut emissions.

Key Points

It is the utility's 30% 2018 renewable mix and plan to reach 40% via Muskrat Falls while reducing carbon emissions.

✅ 18% wind, 9% hydro and tidal, 3% biomass in 2018

✅ Coal reliance fell from 76% in 2007 to 52% in 2018

✅ 58% carbon emissions cut from 2005 levels projected by 2030

Nova Scotia's private utility says it has hit a new milestone in its delivery of electricity from renewable resources, a trend highlighted by Summerside wind generation in nearby P.E.I.

Nova Scotia Power says 30 per cent of the electricity it produced in 2018 came from renewable sources such as wind power.

The utility says 18 per cent came from wind turbines, nine per cent from hydroelectric and tidal turbines and three per cent by burning biomass.

However, over half of the province's electrical generation still comes from the burning of coal or petroleum coke. Another 13 per cent come from burning natural gas and five per cent from imports, even as U.S. renewable generation hits record shares.

The utility says that since 2007, the province's reliance on coal-fired plants has dropped from 76 per cent of electricity generated to 52 per cent last year, as Prairie renewables growth accelerates nationally.

It says it expects to meet the province's legislated renewable target of 40 per cent in 2020, when it begins accessing hydroelectricity from the Muskrat Falls project in Labrador.

"We have made greener, cleaner energy a priority," utility president and CEO Karen Hutt said in a news release.

"As we continue to achieve new records in renewable electricity, we remain focused on ensuring electricity prices stay predictable and affordable for our customers, including solar customers across the province."

Nova Scotia Power also projects achieving a 58 per cent reduction in carbon emissions from 2005 levels by 2030.

Related News

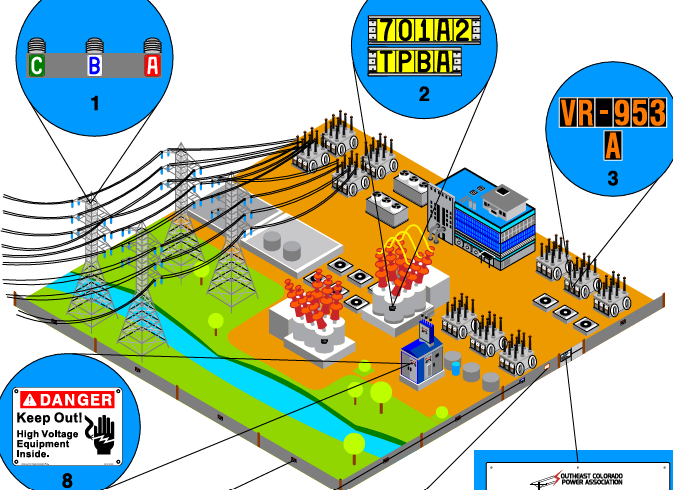

'Unbelievably dangerous': NB Power sounds alarm on copper theft after vandalism, deaths

NB Power copper thefts highlight risks at high-voltage substations, with vandalism, fatalities, infrastructure damage, ratepayer costs, and law enforcement alerts tied to metal prices, stolen electricity, and safety concerns across New Brunswick and Nova Scotia.

Key Points

Substation metal thefts causing fatalities, outages, safety risks, and higher costs that impact NB ratepayers.

✅ Spike aligns with copper price near $3 per pound

✅ Fatal break-ins at high-voltage facilities in Bathurst

✅ Repairs, delays, and safety risks for crews, customers

New Brunswick's power utility is urging people to stay away from its substations, saying the valuable copper they contain is proving hard to resist for thieves.

NB Power has seen almost as many incidents of theft and vandalism to its property in April and May of this year, than in all of last year.

In the 2018-2019 fiscal year, the utility recorded 16 cases of theft and/or vandalism.

In April and May, there have already been 13 cases.

One of those was a fatal incident in Bathurst. On April 13, a 41-year-old man was found unresponsive and later died, after breaking into a substation. It was the second fatality linked to a break-in at an NB Power facility in 10 years.

The investigation is still ongoing, but NB Power believes the man was trying to steal copper.

The power utility has been ramping up its efforts -- finding alternate ways to secure its properties, and educate the public -- on the dangers of copper theft, as utilities work to adapt to climate change that can exacerbate severe weather.

“We really, really, really want to stress that if you’re hitting the wrong wire, cutting the wrong wire, breaking in to or cutting fences, a lot of very bad things can happen,” said NB Power spokesperson Marc Belliveau.

In the 2017-2018 fiscal year, there were 24 recorded cases of theft and/or vandalism.

It also comes at a financial cost for NB Power, and ratepayers -- on average, $330,000 a year. About two-thirds of that is copper. The rest is vehicle break-ins or stolen electricity.

“We’ve done analysis,” Belliveau said. “Often the number of break-ins correspond with the price spiking in copper. So, right now, copper’s about $3 a pound. If it was half of that, there might be half as many incidents.”

New Brunswick Public Safety Minister Carl Urquhart says he knows the utility and police are working to dissuade people from the dangers of the theft, and notes that debates around Site C dam stability issues reflect broader infrastructure safety concerns.

“We all know of incident after incident of major injuries and death caused by, simply by, copper,” he said.

Last November, a Dawson Settlement substation was targeted during a major, storm-related power outage in the province.

It meant NB Power had to divert crews to fix and secure the substation, delaying restoration times for some residents and underscoring efforts to improve local reliability across the grid.

Belliveau says that’s “most frustrating.”

“We’re really trying to take a more proactive approach. And certainly, we encourage people that if you know somebody who’s thinking of doing something like that, to really try and talk them out of it because it’s unbelievably dangerous to break in to a substation,” he said.

Nova Scotia Power, connected through the Maritime Link, was not able to provide details on thefts at their substations, but spokesman David Rodenhiser said "the value of the stolen copper is minor in comparison to the risk that’s created when thieves break into our high-voltage electrical substations."

It's not just risky for the people breaking in, and public opposition to projects like Site C underscores broader community safety concerns.

"It also puts the safety of the workers who maintain our substations at risk, because when thieves steal copper, the protective safety devices in the substations don’t work properly," Rodenhiser said.

Additionally, in Nova Scotia, projects like the Maritime Link have advanced regional transmission, and Nova Scotia Power’s copper components have identifying markers, which make that copper difficult to fence. Anyone who buys or sells stolen propery is at risk of criminal charges.

Related News

N.L. premier says Muskrat Falls costs are too great for optimism about benefits

Muskrat Falls financial impact highlights a hydro megaproject's cost overruns, rate mitigation challenges, and inquiry findings in Newfoundland and Labrador, with power exports, Churchill River generation, and subsea cables shaping long-term viability.

Key Points

It refers to the project's burden on provincial finances, driven by cost overruns, rate hikes, and debt risks.

✅ Costs rose to $12.7B from $6.2B; inquiry cites suppressed risks.

✅ Rate mitigation needed to offset power bill shocks.

✅ Exports via subsea cables may improve long-term viability.

Newfoundland and Labrador's premier says the Muskrat Falls hydro megaproject is currently too much of a massive financial burden for him to be optimistic about its long-term potential.

"I am probably one of the most optimistic people in this room," Liberal Premier Dwight Ball told the inquiry into the project's runaway cost and scheduling issues, echoing challenges at Manitoba Hydro that have raised similar concerns.

"I believe the future is optimistic for Newfoundland Labrador, of course I do. But I'm not going to sit here today and say we have an optimistic future because of the Muskrat Falls project."

Ball, who was re-elected on May 16, has been critical of the project since he was opposition leader around the time it was sanctioned by the former Tory government.

He said Friday that despite his criticism of the Labrador dam, which has seen costs essentially double to more than $12.7 billion, he didn't set out to celebrate a failed project.

He said he still wants to see Muskrat Falls succeed someday through power sales outside the province, but there are immediate challenges -- including mitigating power-rate hikes once the dam starts providing full power and addressing winter reliability risks for households.

"We were told the project would be $6.2 billion, we're at $12.7 (billion). We were never told this project would be nearly 30 per cent of the net debt of this province just six, seven years later," the premier said.

"I wanted this to be successful, and in the long term I still want it to be successful. But we have to deal with the next 10 years."

The nearly complete dam will harness Labrador's lower Churchill River to provide electricity to the province as well as Nova Scotia and potentially beyond through subsea cables, while the legacy of Churchill Falls continues to shape regional power arrangements.

Ball's testimony wraps up a crucial phase of hearings in the extensive public inquiry.

The inquiry has heard from dozens of witnesses, with current and former politicians, bureaucrats, executives and consultants, amid debates over Quebec's electricity ambitions in the region, shedding long-demanded light on what went on behind closed doors that made the project go sideways.

Some witnesses have suggested that estimates were intentionally suppressed, and many high-ranking officials, including former premiers, have denied seeing key information about risk.

On Thursday, Ball testified to his shock when he began to understand the true financial state of the project after he was elected premier in 2015.

On Friday, Ball said he has more faith in future of the offshore oil and gas industry, and emerging options like small nuclear reactors, for example, than a mismanaged project that has put immense pressure on residents already struggling to make ends meet.

After his testimony, Ball said he takes some responsibility for a missed opportunity to mitigate methylmercury risks downstream from the dam through capping the reservoir, in parallel with debates over biomass power in electricity generation, something he had committed to doing before it is fully flooded this summer.

Still to come is a third phase of hearings on future best practices for issues like managing large-scale projects and independent electricity planning, two public feedback sessions and closing submissions from lawyers.

The final report from the inquiry is due before Dec. 31.

Related News

N.S. approves new attempt to harness Bay of Fundy's powerful tides

Bay of Fundy Tidal Energy advances as Nova Scotia permits Jupiter Hydro to test floating barge platforms with helical turbines in Minas Passage, supporting renewable power, grid-ready pilots, and green jobs in rural communities.

Key Points

A Nova Scotia tidal energy project using helical turbines to generate clean power and create local jobs.

✅ Permits enable 1-2 MW prototypes near Minas Passage

✅ Floating barge platforms with patented helical turbines

✅ PPA at $0.50/kWh with Nova Scotia Power

An Alberta-based company has been granted permission to try to harness electricity from the powerful tides of the Bay of Fundy.

Nova Scotia has issued two renewable energy permits to Jupiter Hydro.

Backers have long touted the massive energy potential of Fundy's tides -- they are among the world's most powerful -- but large-scale commercial efforts to harness them have borne little fruit so far, even as a Scottish tidal project recently generated enough power to supply nearly 4,000 homes elsewhere.

The Jupiter application says it will use three "floating barge type platforms" carrying its patented technology. The company says it uses helical turbines mounted as if they were outboard motors.

"Having another company test their technology in the Bay of Fundy shows that this early-stage industry continues to grow and create green jobs in our rural communities," Energy and Mines Minister Derek Mombourquette said in a statement.

The first permit allows the company to test a one-megawatt prototype that is not connected to the electricity grid.

The second -- a five-year permit for up to two megawatts -- is renewable if the company meets performance standards, environmental requirements and community engagement conditions.

Mombourquette also authorized a power purchase agreement that allows the company to sell the electricity it generates to the Nova Scotia grid through Nova Scotia Power for 50 cents per kilowatt hour.

On its web site, Jupiter says it believes its approach "will prove to be the most cost effective marine energy conversion technology in the world," even as other regional utilities consider initiatives like NB Power's Belledune concept for turning seawater into electricity.

The one megawatt unit would have screws which are about 5.5 metres in diameter.

The project is required to obtain all other necessary approvals, permits and authorizations.

It will be located near the Fundy Ocean Research Center for Energy in the Minas Passage and will use existing electricity grid connections.

A study commissioned by the Offshore Energy Research Association of Nova Scotia says by 2040, the tidal energy industry could contribute up to $1.7 billion to Nova Scotia's gross domestic product and create up to 22,000 full-time jobs, a transition that some argue should be planned by an independent body to ensure reliability.

Last month, Nova Scotia Power said it now generates 30 per cent of its power from renewables, as the province moves to increase wind and solar projects after abandoning the Atlantic Loop.

The utility says 18 per cent came from wind turbines, nine per cent from hydroelectric and tidal turbines and three per cent by burning biomass across its fleet.

However, over half of the province's electrical generation still comes from the burning of coal or petroleum coke, even as environmental advocates push to reduce biomass use in the mix. Another 13 per cent come from burning natural gas and five per cent from imports.

Related News

Transformer fire downs power in four University of Kentucky buildings, facilities closed

University of Kentucky Power Outage disrupts Rose Street after a transformer fire, closing Bowman, Breckinridge, Kincaid, and Bradley halls; emergency generator deployed to protect research, no injuries reported, high voltage wiring repairs underway.

Key Points

Campus closures and power loss after a Bowman Hall transformer fire; Rose Street limited during repairs.

✅ Bowman, Breckinridge, Kincaid, Bradley halls closed until Monday

✅ Emergency generator protects research equipment

✅ High voltage wiring and transformer replacements underway

Four University of Kentucky buildings will be closed due to a Thursday morning transformer fire, as utilities elsewhere have faced major power cuts affecting operations as well.

A transformer in Bowman Hall caught fire resulting in power outages in Bowman and other buildings on Rose Street amid shifting electricity demand nationwide, a University of Kentucky press release said.

According to the press release, the fire was contained to the basement of Bowman Hall. Though the fire was contained, power outages are still an issue on campus as peak power prices remain elevated this week.

Along with Bowman, Breckinridge, Kincaid and Bradley halls are also without power and will remain closed until Monday, reflecting broader changes like coal plant retirements across energy systems.

"There were no injuries in the fire, nor has there been any significant structural damage reported to Bowman Hall or the other buildings," UKPR said. "UK Physical Plant workers are working to replace the transformer, along with high voltage wiring, that was damaged, despite supply delays that can affect equipment timelines."

While UK Physical Plant workers are being brought on site to fix the transformer, an emergency generator is being brought in to protect research equipment in the affected buildings, similar to measures taken during power plant upgrades in other regions.

"Administrators with impacted programs will be contacting employees regarding work schedules for the remainder of the week, in line with broader emergency energy planning considerations for continuity," UKPR said.

Related News

Transformer explosion triggers five small fires

Palo Alto Electrical Fires involved a PG&E downed line, East Palo Alto brush fires along San Francisquito Creek, and a transformer blaze near Baylands Athletic Center, causing a power outage; early airplane-crash reports were unfounded

Key Points

Three incidents: a PG&E line downed causing two brush fires and a transformer blaze; no injuries reported.

✅ PG&E power line fell; two small brush fires ignited

✅ Transformer fire at Baylands Athletic Center, quickly contained

✅ 322 customers lost power; no injuries; airplane-crash report false

An initial report of a possible airplane crash at the Palo Alto Airport Monday morning turned out instead to be three electrical fires, two in East Palo Alto and one across San Francisquito Creek in Palo Alto.

A PG&E power line came down in East Palo Alto, sparking two small brush fires around 11:15 a.m. along San Francisquito Creek. In the same minute, a transformer fire broke out at the nearby Baylands Athletic Center baseball field in Palo Alto, fire officials said.

Authorities said there is no indication that the brush fires in East Palo Alto are related to the transformer fire in Palo Alto, but the cause of each fire is under investigation, as utilities debate burying lines for safety and cost reasons.

One East Palo Alto fire occurred near the dead-end of O'Connor Street. The slow-burning blaze consumed vegetation in a 40-foot by 100-foot area, Fire Marshal Jon Johnston said. The fire went up about 30 feet to a home's fence line, where cool temperatures and damp conditions likely prevented flames from extending any farther, even as power utilities adapt to climate change to manage evolving risks.

Residents are urged to follow electrical safety tips when encountering downed lines during storm season, officials said.

The second fire was found at the end of Jasmine Way, Johnston said. Both blazes were extinguished in about 10 minutes.

A PG&E crew was called to respond to the scene, where a power outage affecting 322 customers was reported in the area of Jasmine Way around 11:30 a.m., PG&E spokeswoman Angela Lombardi said. As of 3:20 p.m., power was restored to a majority of the customers except for a few dozen, though events like Typhoon Mangkhut have left hundreds without electricity elsewhere. The cause of the outage is under investigation.

Across the creek, a Palo Alto fire crew was in the middle of wildland fire training near the Baylands Athletic Center baseball field where a transformer caught on fire around 11:15 a.m., interim Fire Chief Geoffrey Blackshire said. The crew quickly extinguished the blaze, which was confined to the transformer.

Despite an early report that a plane had crashed, fire crews determined no aircraft was involved, according to Johnston and Blackshire. No injuries were reported and no evacuation orders were issued for any of the fires.

Related News

Olympia efforts to remove contaminated sediment from Capitol Lake continue

Olympia Brewery Transformer Oil Spill Cleanup shifts from Marathon Park to Heritage Park, with sediment removal, staging areas, traffic control, pedestrian detours, fenced greenspace, and potential evening noise near Capitol Lake during spill response.

Key Points

An ongoing response relocating sediment removal operations to Heritage Park, affecting access, traffic, and noise.

✅ Heritage Park staging area; greenspace fencing and detours.

✅ Periodic paved path closures; gravel path remains open.

✅ Traffic flaggers; possible evening noise from equipment.

Activity related to clean-up from the Olympia Brewery Transformer oil spill will increase in Heritage Park this week, similar to Toronto cleanup efforts following severe flooding, and will begin to wind down in Marathon Park.

Marathon Park has been a staging area for work to remove contaminated sediment from Capitol Lake, with the parking lot closed for public use, a precaution also seen during North Seattle outage response operations in recent months. Spill responders anticipate decommissioning the Marathon Park staging area by the end of next week.

A staging area for the next phase of sediment removal work will be located in Heritage Park. Set up begins today, reflecting practices used during PG&E safety shut-offs in other regions. Impacts will include:

- Greenspace: Some greenspace will be fenced off and inaccessible throughout the duration of the cleanup, as seen after significant windstorm outages in other communities.

- Pedestrian traffic: The paved walkway will periodically be closed off to pedestrian traffic, a pattern also observed during Miami Valley wind outages in recent seasons. The gravel walkway should be accessible throughout the clean-up efforts.

- Traffic: There will be some traffic impacts this week as equipment is moved into location, similar to disruptions after a Little Haiti power pole crash that required detours this year. Flaggers will be on site to direct traffic when needed.

- Noise: There will be noise impacts as equipment is delivered and set up this week. There also may be noise impacts from the sediment removal system after it is activated. Some of the noise impacts may occur in evening hours.

No parking impacts are anticipated, unlike during the BWI airport power outage when access was limited.

There is not a predicted end date for the response at this time.

Related News

Pioneer Reaches Agreement to Sell Transformer Business for Approximately $65 Million

Pioneer Power Solutions Transformer Sale sees a $65.5M divestiture to Mill Point Capital, a private equity firm, via cash and a seller note, while Pioneer retains generator services, switchgear, and data center power solutions.

Key Points

A transaction where Pioneer sells transformer units to Mill Point Capital for $65.5M in cash and notes.

✅ $60.5M cash plus $5M seller note, liabilities assumed

✅ Retains Critical Power and Custom Electrical Products

✅ Focus on switchgear and generator businesses post-close

Pioneer Power Solutions, Inc. (PPSI) ("Pioneer" or the "Company"), a company engaged in the manufacture, sale and service of electrical transmission initiatives such as the Transource project in Missouri and distribution and on-site power generation equipment, has announced that it has reached an agreement to sell its liquid filled and dry type transformer businesses to Mill Point Capital, a middle-market private equity firm, for $65.5 million in cash and notes.

In consideration for all the assets of Pioneer Transformers Ltd. and Pioneer Dry Type Transformer Group, which includes Jefferson Electric, Inc., Bemag Transformer Inc. and Harmonics Limited LLC, Pioneer will receive $65.5 million, including $60.5 million in cash and $5 million in a seller's note. In addition, Mill Point Capital will assume substantially all the current assets and liabilities, including payables for the acquired entities. As a result, Pioneer will retain:

Pioneer Critical Power, a provider of generators, specialized enclosures, automatic transfer switches, uninterruptible power supplies, batteries, remote monitoring solutions, including initiatives like the NYPA-GE software agreement that enhance grid reliability, and RICE/NESHAP modifications, as well as a full suite of engine generator maintenance services. Service customers include several national retailers and cellular service providers.

Pioneer Custom Electrical Products, a supplier of highly specified and engineered solutions for the electrical power generation industry with special focus on the distributed generation and data center markets, where solutions like NYPA thermal storage success are advancing efficiency.

In addition, Pioneer continues to hold 1.75 million shares and warrants to purchase an additional 1 million shares of CleanSpark, Inc. (CLSK).

Nathan Mazurek, Pioneer's Chairman and Chief Executive Officer, said, "Our belief that our assets were worth more individually than the market valuation of our combined organization is validated by this transaction, wherein we will divest a portion of our business for approximately 1.5x our current market capitalization, while retaining two exciting businesses and our status as a publicly traded Nasdaq listed company. Following the closing of this transaction, we plan to focus on streamlining and enhancing our Titan business in Minneapolis and our switchgear business in Los Angeles. With a strong balance sheet, we should be well positioned to assess our retained businesses, potential opportunities in the energy transition, including trends in wind repowering such as the Wyoming wind farm replacement highlighted recently, and the allocation of resources to best benefit shareholders. I am excited about phase two of Pioneer."

Lincoln International acted as the exclusive financial advisor to Pioneer Power Solutions, Inc. Pioneer management expects the transaction to close in the second half of 2019. The transaction is subject to certain customary closing conditions and Mill Point securing financing for the transaction, reflecting wider energy financing activity such as clean coal technologies funding in the sector. Additional details are provided in filings with the Securities and Exchange Commission.

About Pioneer Power Solutions, Inc.

Pioneer Power Solutions, Inc. manufactures, sells and services a broad range of specialty electrical transmission, distribution and on-site power generation equipment for applications in the utility sector, including entities like OPG financial results in Canada, industrial, commercial and backup power markets. The Company's principal products and services include custom engineered electrical transformers, low and medium voltage switchgear and engine-generator sets and controls, complemented by a national field-service organization to maintain and repair power generation assets, as utilities pursue initiatives like the OPG-TVA nuclear partnership to modernize fleets. Pioneer is headquartered in Fort Lee, New Jersey and operates from 12 additional locations in the U.S., Canada and Mexico for manufacturing, centralized distribution, engineering, sales, service and administration. To learn more about Pioneer, please visit its website at www.pioneerpowersolutions.com.

Related News

Transformer Steel Market Sales Volume, Status, Growth, Opportunities and World Market Share Of 2019-2024

Transformer Steel Market delivers a global forecast with regional analysis, SWOT insights, key players, segmentation by material and application, and growth metrics across North America, Europe, Asia-Pacific, LATAM, and Middle East & Africa.

Key Points

The Transformer Steel Market covers global supply-demand, key players, applications, and regional forecasts through 2024.

✅ Global forecast 2019-2024 with size and growth rates

✅ Regional analysis: North America, Europe, Asia-Pacific

✅ Segmentation by grade, application; key players profiled

Transformer Steel Market Report by Material, Application, and Geography – Global Forecast to 2024 is a professional and in-depth research report on the world’s major regional Transformer Steel Market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, united Kingdom, Japan, South Korea and China), where Europe's shift toward green hydrogen steel is influencing supply chains.

Access Global Transformer Steel Market Research Report Details at: at https://www.pioneerreports.com/report/345431

About Transformer Steel Industry

The overviews, SWOT analysis and strategies of each vendor in the Transformer Steel market provide understanding about the market forces and how those can be exploited to create future opportunities, as low-emissions generation growth shifts grid investment priorities.

Key Players in this Transformer Steel market are:

- NSSMC

- Posco

- JFE Steel

- NLMK Group

- ThyssenKrupp

- AK Steel

- Cogent

- ArcelorMittal

- Stalprodukt S.A.

- ATI

- WISCO

- BAO Steel

- Shou Gang

- Anst

Request for Sample Copy of this Transformer Steel Market Report at https://www.pioneerreports.com/request-sample/345431

Important application areas of Transformer Steel are also assessed on the basis of their performance. Market predictions along with the statistical nuances presented in the report render an insightful view of the Transformer Steel market, as surging electricity demand strains grids worldwide. The market study on Global Transformer Steel Market 2018 report studies present as well as future aspects of the Transformer Steel Market primarily based upon factors on which the companies participate in the market growth, key trends and segmentation analysis.

Application of Transformer Steel Market are:

- Transformer

- Power Generator

- Electric Motor

- Others

Product Segment Analysis of the Transformer Steel Market is:

- 23Z

- 27Z

- 30Z

- 35Z

- 23ZH

- 27ZH

- 30ZH

- 35ZH

Look into Table of Content of Transformer Steel Market Report at https://www.pioneerreports.com/TOC/345431

Geographically this report covers all the major manufacturers from India, China, USA, UK, and Japan, aligning with IEA projections that Asia electricity use will account for half the world by 2025, which informs regional demand outlooks. The present, past and forecast overview of Transformer Steel market is represented in this report.

The report offers the market growth rate, size, and forecasts at the global level in addition as for the geographic areas: Latin America, Europe, Asia Pacific, North America, and Middle East & Africa, where regional issues such as the UK's energy transition supply delays affect equipment lead times. Also it analyses, roadways and provides the global market size of the main players in each region. Moreover, the report provides knowledge of the leading market players within the Transformer Steel market. The industry changing factors for the market segments are explored in this report. This analysis report covers the growth factors of the worldwide market based on end-users.

Inquire for further detailed information of Transformer Steel Market Report at: https://www.pioneerreports.com/pre-order/345431

Why should you buy Transformer Steel Market Report?

- Build business strategy by identifying the high growth and attractive Transformer Steel market categories

- Develop competitive strategy based on competitive landscape

- Design capital investment strategies based on forecasted high potential segments as renewables surpass coal in global power generation by 2025

- Identify potential business partners, acquisition targets and business buyers

- Plan for a new product launch and inventory in advance

- Prepare management and strategic presentations using the Transformer Steel market data

Recent Events and Developments

For example, portfolio moves continued as Pioneer reached an agreement to sell its transformer business, with transformer business sale details underscoring consolidation trends.

In this study, the years considered to estimate the market size of Transformer Steel Market are as follows:-

History Year: 2013-2017

- Base Year: 2018

- Estimated Year: 2019

- Forecast Year 2019 to 2024

Related News

Lawsuit alleges EWEB’s faulty transformer caused house fire

Eugene Transformer Fire Lawsuit alleges negligence by local utility EWEB after a faulty electrical transformer and misapplied transmission line load sparked a house fire; claims cite federal safety regulations, forensic investigation, and emotional distress damages.

Key Points

An Oregon case alleging EWEB negligence for a misapplied transformer and line load that caused a destructive home fire.

✅ Claims transformer violated federal safety regulations

✅ Seeks $50,000 to $1,000,000; alleges negligence and distress

✅ Forensic review cites misapplied transmission line load

A Eugene couple filed a lawsuit last month against a local utility company, alleging that a faulty transformer caused a fire that destroyed the couple’s home, a scenario echoed in utility wildfire lawsuits in California.

John and Maria Schaad filed the lawsuit June 26 against the Eugene Water & Electric Board, exactly two years after a fire destroyed the Schaads’ Whitbeck Boulevard home in Eugene’s Friendly neighborhood. The lawsuit alleges negligence and intentional infliction of emotional distress, as Oregon lawmakers back a wildfire-resilient grid bill in Congress. It does not specify a dollar amount, asking instead for a range of more than $50,000 but less than $1 million.

According to the lawsuit, John Schaad was sleeping and was awakened around 3 a.m. June 26, 2017, by a crackling noise and a yellow flickering light outside the window on the deck of the house. Although none of the home’s six smoke alarms were activated, Schaad realized there was a significant fire and ran to wake and rescue his wife, the lawsuit states.

As the couple fled the house, windows exploded and the fire spread inside the residence, engulfing the house “within seconds,” similar to accounts when power lines started fires in California, and destroying the property and all of the couple’s belongings, the lawsuit states. “The two barely escaped with their lives,” it states.

The fire was investigated for 18 months, and although arson was quickly ruled out, the cause of the fire was unknown, and in other cases, victims have sued utilities after catastrophic wildfires. The fire possibly started from an extension cord on the deck, but that was uncertain and undetermined, the lawsuit states.

In January, John Schaad, who is an electrical engineer, began to suspect that the cause of the fire was an unsustainable electrical load on the transformer and transmission system to the residence after he noticed “some unusual electrical behavior” on some appliances in his home and in the neighborhood, amid heightened scrutiny after PG&E’s Camp Fire guilty plea in California. According to the lawsuit, he independently investigated the system, notified his insurance company and requested a forensic expert to investigate.

Schaad’s independent investigation of the system concluded last month that the fire was caused by an “old 12 kilovolt, two-bushing electrical transformer installed and maintained by EWEB” that did not meet federal safety regulations and, amid debates over obligations during crises such as a Texas ruling that power plants are exempt during emergencies, was not designed to work with the transmission line on which it was installed.

Schaad alleges that a drop in electrical usage on the morning of the fire reduced the draw on the electrical transmission system and the misapplied transformer had to sustain the entire load of the transmission line which it was not designed to do, issues that have spurred electricity market bailout proposals in Texas after a winter storm, which caused the fire.

A spokesperson for EWEB declined to comment due to pending litigation.

Related News

Electrical Transformer Market Share and Growth 2019| Siemens, Alstom, GE

Global Electrical Transformer Market outlook highlights trends, segmentation, forecast growth, revenue drivers, key players, regional analysis, R&D investments, and applications across transmission, distribution, welding, voltage regulation, including oil-cooled, dry-type, single and three-phase.

Key Points

Industry overview of transformer products and regions, covering trends, drivers, segmentation, and forecasts.

✅ Segmentation by product, phase, winding, cooling, and installation

✅ Key players: Siemens, ABB, GE, Toshiba, Mitsubishi Electric

✅ Regional outlook: APAC leads; North America, Europe, MEA, LatAm grow

The latest report up for sale by QY Research demonstrates that the global Electrical Transformer market is likely to garner a great pace in the coming years. Analysts have scrutinized the market drivers, confinements, risks, and openings present in the overall market, noting moves such as Tesla entering electricity retail that could reshape utility dynamics. The report shows course the market is expected to take in the coming years along with its estimations. The careful examination is aimed at understanding of the course of the market.

Get PDF brochure of this report: https://www.qyresearch.com/sample-form/form/943131/global-electrical-transformer-depth-research-2019

Global Electrical Transformer Market: Segmentation

The global market for Electrical Transformer is segmented on the basis of product, type, services, and technology. All of these segments have been studied individually. The detailed investigation allows assessment of the factors influencing the market. Experts have analyzed the nature of development, investments in research and development, changing consumption patterns, and a growing number of applications. In addition, analysts have also evaluated the changing economics around the market that are likely affecting its course, such as Ontario rate reductions that influence industrial demand.

Global Electrical Transformer Market Competition by Players :

- Siemens

- Alstom

- GE

- ABB

- Altrafo

- Hyundai Heavy Industries

- Layer Electronics

- MACE

- Ormazabal

- SPX Transformer

- Toshiba

- XD Group

- TBEA

- Ruhstrat

- Mitsubishi Electric

- LS Industrial

- J Schneider Elektrotechnik

Global Electrical Transformer Sales and Revenue by Product Type Segments

- Step Up Transformer & Step Down Transformer

- Three Phase Transformer & Single Phase Transformer

- Two Winding Transformer & Auto Transformer

- Outdoor Transformer & Indoor Transformer

- Oil Cooled & Dry Type Transformer

Global Electrical Transformer Sales and Revenue by Application Segments

- Voltage Regulator

- For Transmission

- For Welding Purposes

Global Electrical Transformer Market: Regional Segmentation

The market is also segmented on the basis of geography. This segmentation allows the readers to get a holistic understanding of the market. It highlights the changing nature of the economies within the geographies that are influencing the global Electrical Transformer market, including regulatory debates over UK network profits that affect infrastructure planning.

Some of the geographical regions studied in the overall market are as follows:

- The Middle East and Africa (GCC Countries and Egypt)

- North America (the United States, Mexico, and Canada)

- South America (Brazil etc.)

- Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

- Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

Regional modernization is also evident in Africa, where Tunisia's smart grid progress underscores ongoing grid upgrades.

Global Electrical Transformer Market: Research Methodology

The analysts at QY Research have used fundamental investigative approaches for a thorough examination of the global Electrical Transformer market. The collected information has It highlights the changing nature of the economies understand subtleties accurately. Moreover, data has been gathered from journals and market research experts, with industry updates such as Ontario manufacturers' support for price cuts informing context, to put together a document that sheds light on the ever-changing nature of market in an unbiased way.

Global Electrical Transformer Market: Competitive Rivalry

Analysts have also discussed the nature of the competition present in the global Electrical Transformer market. Companies have been discussed at great length to ascertain the leading ones and note the emerging ones. The report also mentions the strategic initiatives taken by these companies to get ahead of the game, including developments like Octopus Energy's talks with Ukraine that highlight cross-border collaboration. Analysts look at potential mergers and acquisitions and policy shifts such as U.S. grid privatization proposals that are likely to define the progress of the market in the coming years.

Related News

Electricity and water do mix: How electric ships are clearing the air on the B.C. coast

Hybrid Electric Ships leverage marine batteries, LNG engines, and clean propulsion to cut emissions in shipping. From ferries to cargo vessels, electrification and sustainability meet IMO regulations, Corvus Energy systems, and dockside fast charging.

Key Points

Hybrid electric ships use batteries with diesel or LNG engines to cut fuel and emissions and meet stricter IMO rules.

✅ LNG or diesel gensets recharge marine battery packs.

✅ Cuts CO2, NOx, and particulate emissions in port and at sea.

✅ Complies with IMO standards; enables quiet, efficient operations.

The river is running strong and currents are swirling as the 150-metre-long Seaspan Reliant slides gently into place against its steel loading ramp on the shores of B.C.'s silty Fraser River.

The crew hustles to tie up the ship, and then begins offloading dozens of transport trucks that have been brought over from Vancouver Island.

While it looks like many vessels working the B.C. coast, below decks, the ship is very different. The Reliant is a hybrid, partly powered by electricity, and joins BC Ferries' hybrid ships in the region, the seagoing equivalent of a Toyota Prius.

Down below decks, Sean Puchalski walks past a whirring internal combustion motor that can run on either diesel or natural gas. He opens the door to a gleaming white room full of electrical cables and equipment racks along the walls.

"As with many modes of transportation, we're seeing electrification, from electric planes to ferries," said Puchalski, who works with Corvus Energy, a Richmond, B.C. company that builds large battery systems for the marine industry.

In this case, the batteries are recharged by large engines burning natural gas.

"It's definitely the way of the future," said Puchalski.

The 10-year-old company's battery system is now in use on 200 vessels around the world. Business has spiked recently, driven by the need to reduce emissions, and by landmark projects such as battery-electric high-speed ferries taking shape in the U.S.

"When you're building a new vessel, you want it to last for, say, 30 years. You don't want to adopt a technology that's on the margins in terms of obsolescence," said Puchalski. "You want to build it to be future-proof."

Dirty ships

For years, the shipping industry has been criticized for being slow to clean up its act. Most ships use heavy fuel oil, a cheap, viscous form of petroleum that produces immense exhaust. According to the European Commission, shipping currently pumps out about 940 million tonnes of CO2 each year, nearly three per cent of the global total.

That share is expected to climb even higher as other sectors reduce emissions.

When it comes to electric ships, Scandinavia is leading the world. Several of the region's car and passenger ferries are completely battery powered — recharged at the dock by relatively clean hydro power, and projects such as Kootenay Lake's electric-ready ferry show similar progress in Canada.

Tougher regulations and retailer pressure

The push for cleaner alternatives is being partly driven by worldwide regulations, with international shipping regulators bringing in tougher emission standards after a decade of talk and study, while financing initiatives are helping B.C. electric ferries scale up.

At the same time, pressure is building from customers, such as Mountain Equipment Co-op, which closely tracks its environmental footprint. Kevin Lee, who heads MEC's supply chain, said large companies are realizing they are accountable for their contributions to climate change, from the factory to the retail floor.

"You're hearing more companies build it into their DNA in terms of how they do business, and that's cool to see," said Lee. "It's not just MEC anymore trying to do this, there's a lot more partners out there."

In the global race to cut emissions, all kinds of options are on the table for ships, including giant kites being tested to harvest wind power at sea, and ports piloting hydrogen-powered cranes to cut dockside emissions.

Modern versions of sailing ships are also being examined to haul cargo with minimal fuel consumption.

But in practical terms, hybrids and, in the future, pure electrics are likely to play a larger role in keeping the propellers turning along Canada's coast, with neighboring fleets like Washington State Ferries' upgrade underscoring the shift.