Biden's interior dept. acts quickly on Vineyard Wind

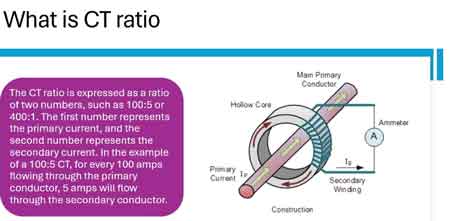

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Vineyard Wind I advances as BOEM issues a final environmental impact statement for the 800 MW offshore wind farm south of Martha's Vineyard, delivering clean energy, jobs, and carbon reductions to Massachusetts toward net-zero.

Key Points

An 800 MW offshore wind project near Martha's Vineyard supplying clean power to Massachusetts.

✅ 800 MW capacity; power for 400,000+ homes and businesses

✅ BOEM final EIS; record of decision pending within 30+ days

✅ 1.68M metric tons CO2 avoided annually; jobs and lower rates

Federal environmental officials have completed their review of the Vineyard Wind I offshore wind farm, moving the project that is expected to deliver clean renewable energy to Massachusetts by the end of 2023 closer to becoming a reality.

The U.S. Department of the Interior said Monday morning that its Bureau of Ocean Energy Management completed the analysis it resumed about a month ago, published the project's final environmental impact statement, and said it will officially publish notice of the impact statement in the Federal Register later this week.

"More than three years of federal review and public comment is nearing its conclusion and 2021 is poised to be a momentous year for our project and the broader offshore wind industry," Vineyard Wind CEO Lars Pedersen said. "Offshore wind is a historic opportunity to build a new industry that will lead to the creation of thousands of jobs, reduce electricity rates for consumers and contribute significantly to limiting the impacts of climate change. We look forward to reaching the final step in the federal permitting process and being able to launch an industry that has such tremendous potential for economic development in communities up and down the Eastern seaboard."

The 800-megawatt wind farm planned for 15 miles south of Martha's Vineyard was the first offshore wind project selected by Massachusetts utility companies with input from the Baker administration to fulfill part of a 2016 clean energy law. It is projected to generate cleaner electricity for more than 400,000 homes and businesses in Massachusetts, produce at least 3,600 jobs, reduce costs for Massachusetts ratepayers by an estimated $1.4 billion, and eliminate 1.68 million metric tons of carbon dioxide emissions annually.

Offshore wind power, informed by the U.S. offshore wind outlook, is expected to become an increasingly significant part of Massachusetts' energy mix. The governor and Legislature agree on a goal of net-zero carbon emissions by 2050, but getting there is projected to require having about 25 gigawatts of offshore wind power. That means Massachusetts will need to hit a pace in the 2030s where it has about 1 GW of new offshore wind power on the grid coming online each year.

"I think that's why today's announcement is so historic, because it does represent that culmination of work to understand how to permit and build a cost-effective and environmentally-responsible wind farm that can deliver clean energy to Massachusetts ratepayers, but also just how to do this from start to finish," said Energy and Environmental Affairs Secretary Kathleen Theoharides. "As we move towards our goal of probably [25 GW] of offshore wind by 2050 to hit our net-zero target, this does give us confidence that we have a much clearer path in terms of permitting."

She added, "There's a huge pipeline, so getting this project out really should open the door to the many additional projects up and down the East Coast, such as Long Island proposals, that will come after it."

According to the American Wind Energy Association, there are expected to be 14 offshore projects totaling 9,112 MW of capacity in operation by 2026.

Susannah Hatch, the clean energy coalition director for the Environmental League of Massachusetts and a leader of the broad-based New England for Offshore Wind Regional group, called offshore wind farms like Vineyard Wind "the linchpin of our decarbonization efforts in New England." She said the Biden administration's quick action on Vineyard Wind is a positive sign for the burgeoning sector.

"Moving swiftly on responsibly developed offshore wind is critical to our efforts to mitigate climate change, and offshore wind also provides an enormous opportunity to grow the economy, create thousands of jobs, and drive equitable economic benefits through increased minority economic participation in New England," Hatch said.

With the final environmental impact statement published, Vineyard Wind still must secure a record of decision from BOEM, which processes wind lease requests, an air permit from the Environmental Protection Agency and sign-offs from the U.S. Army Corps of Engineers and the National Marine Fisheries Service to officially clear the way for the project that is on track to be the nation's first utility-scale offshore wind farm. BOEM must wait at least 30 days from the publication of the final environmental impact statement to issue a record of decision.

Project officials have said they expect the final impact statement and then a record of decision "sometime in the first half of 2021." That would allow the project to hit its financial close milestone in the second half of this year, begin on-shore work quickly thereafter, start offshore construction in 2022, begin installing turbines in 2023 and begin exporting power to the grid, marking Vineyard Wind first power, by late 2023, Pedersen said in January.

"Offshore energy development provides an opportunity for us to work with Tribal nations, communities, and other ocean users to ensure all decisions are transparent and utilize the best available science," BOEM Director Amanda Lefton said.

The commercial fishing industry has been among the most vocal opponents of aspects of the Vineyard Wind project and the Responsible Offshore Development Alliance (RODA) has repeatedly urged the new administration to ensure the voices of the industry are heard throughout the licensing and permitting process.

In comments submitted earlier this month in response to a BOEM review of an offshore wind project that is expected to deliver power to New York, including the recent New York offshore wind approval, RODA said the present is "a time of significant confusion and change in the U.S. approach to offshore wind energy (OSW) planning" and detailed mitigation measures it wants to see incorporated into all projects.

"To be clear, none of these requests are new -- nor hardly radical. They have simply been ignored again, and again, and again in a political push/pull between multinational energy companies and the U.S. government, leaving world-famous seafood, and the communities founded around its harvest, off the table," the group said in a press release last week. Some of RODA's suggestions were analyzed as part of BOEM's Vineyard Wind review.

Vineyard Wind has certainly taken a circuitous path to get to this point. The timeline for the project was upended in August 2019 when the Trump administration decided to conduct a much broader assessment of potential offshore wind projects up and down the East Coast, which delayed the project by almost a year.

When the Trump administration delayed its action on a final environmental impact statement last year, Vineyard Wind on Dec. 1 announced that it was pulling its project out of the federal review pipeline in order to complete an internal study on whether the decision to use a certain type of turbine would warrant changes to construction and operations plan. The Trump administration declared the federal review of the project "terminated."

Within two weeks of President Joe Biden being inaugurated, Vineyard Wind said its review determined no changes were necessary and the company resubmitted its plans for review. BOEM agreed to pick up where the Trump administration had left off despite the agency previously declaring its review terminated.

"It would appear that fishing communities are the only ones screaming into a void while public resources are sold to the highest bidder, as BOEM has reversed its decision to terminate a project after receiving a single letter from Vineyard Wind," RODA said.

The final environmental impact statement that BOEM published Monday showed that the federal regulators believe the Vineyard Wind I development as proposed will have "moderate" impacts on commercial fisheries and for-hire recreational fishing outfits, and that the project combined with other factors not related to wind energy development will have "major" impacts on commercial and recreational fishing ventures.

Vineyard Wind pointed Monday to the fishery mitigation agreements it has entered into with Massachusetts and Rhode Island, a fishery science collaboration with the University of Massachusetts Dartmouth's School of Marine Science and Technology, and an agreement with leading environmental organizations around the protection of the endangered right whale.

Responding to concerns about safe navigation among RODA and others in the fishing sector, Vineyard Wind and the four other developers holding leases for offshore wind sites off New England agreed to orient their turbines in fixed east-to-west rows and north-to-south columns spaced one nautical mile apart. Last year, the U.S. Coast Guard concluded that the grid layout was the best way to maintain maritime safety and ease of navigation in the offshore wind development areas south of Martha's Vineyard and Nantucket.

Since a 2016 clean energy law kicked off the state's foray into the offshore wind world, Massachusetts utilities have contracted for a total of about 1,600 MW between two projects, Vineyard Wind I and Mayflower Wind.

A joint venture of Shell and Ocean Winds North America, Mayflower Wind was picked unanimously in 2019 by utility executives to build and operate a wind farm approximately 26 nautical miles south of Martha's Vineyard and 20 nautical miles south of Nantucket, with South Coast construction activity expected as the project progresses. The 804-megawatt project is expected to be operational by December 2025.

Massachusetts and its utilities are expected to go out to bid for up to another 1,600 MW of offshore wind generation capacity later this year using authorization granted by the Legislature in 2018.

The climate policy bill that Gov. Charlie Baker returned to the Legislature with amendments more than a month ago would require that the executive branch direct Massachusetts utilities to buy an additional 2,400 MW of offshore wind power.