Electricity News in November 2017

Nuclear plants produce over half of Illinois electricity, almost faced retirement

Illinois Zero Emission Credits support nuclear plants via tradable credits tied to wholesale electricity prices, carbon costs, created by the Future Energy Jobs Bill to avert Exelon closures and sustain low-carbon power.

Key Points

State credits that value nuclear power's zero-carbon output, priced by market and carbon metrics to keep plants running.

✅ Pegged to wholesale prices, carbon costs, and state averages.

✅ Created by Future Energy Jobs Bill to prevent plant retirements.

✅ Supports Exelon Quad Cities and Clinton nuclear facilities.

Nuclear plants have produced over half of Illinois electricity generation since 2010, but the states two largest plants would have been retired amid the debate over saving nuclear plants if the state had not created a zero emission credit (ZEC) mechanism to support the facilities.

The two plants, Quad Cities and Clinton, collectively delivered more than 12 percent of the states electricity generation over the past several years. In May 2016, however, Exelon, the owner of the plants, announced that they had together lost over $800 million dollars over the previous six years and revealed plans to retire them in 2017 and 2018, similar to the Three Mile Island closure later announced for 2019 by its owner.

In December 2016, Illinois passed the Future Energy Jobs Bill, which established a zero emission credit (ZEC) mechanism

to support the plants financially. Exelon then cancelled its plans to retire the two facilities.

The ZEC is a tradable credit that represents the environmental attributes of one megawatt-hour of energy produced from the states nuclear plants. Its price is based on a number of factors that include wholesale electricity market prices, nuclear generation costs, state average market prices, and estimated costs of the long-term effects of carbon dioxide emissions.

The bill is set to take effect in June, but faces multiple court challenges as some utilities have expressed concerns that the ZEC violates the commerce clause and affects federal authority to regulate wholesale energy prices, amid gas-fired competition in nearby markets that shapes the revenue outlook.

Illinois ranks first in the United States for both generating capacity and net electricity generation from nuclear power, a resource many see as essential for net-zero emissions goals, and accounts for approximately one-eighth of the nuclear power generation in the nation.

Related News

Legislation through House to modernize Oregon hydropower

Hydropower Policy Modernization Act advances FERC-led hydropower licensing reform, streamlining permits, reducing duplicative reviews, and expediting renewable energy projects in Oregon and the Pacific Northwest after a bipartisan House vote.

Key Points

A bill to streamline FERC hydropower licensing, reduce reviews, and speed renewable projects to cut ratepayer costs.

✅ Designates FERC as lead agency for hydropower licensing

✅ Requires timely decisions and streamlines multi-agency reviews

✅ Cuts relicensing costs, benefiting ratepayers and grid reliability

Continuing his efforts to promote renewable hydropower production in Oregon and throughout the Northwest, Rep. Greg Walden (R-Hood River) today voted to pass the Hydropower Policy Modernization Act (H.R. 3043) through the House of Representatives on a strong bipartisan vote. The Hydropower Policy Modernization Act originated in the Energy and Commerce Committee -- where Walden serves as Chairman -- and would modernize and streamline the licensing process for hydropower projects.

"Hydropower plays an enormously important role in electricity generation across the country and especially in my home state of Oregon," said Walden. "Hydropower generates 43% of electricity in my state. It is dependable; it is baseload; it is carbon free; it is renewable; and, alongside initiatives like hydrogen hubs supporting clean energy, it is very important to our region. Nationally, hydropower is the largest source of renewable electricity generation and a recent Department of Energy report found that U.S. hydropower could grow by almost 50 percent by the year 2050. However, as my colleagues from the Pacific Northwest and across the country know, we are not taking full advantage of this valuable resource."

Walden said the legislation will enhance Oregon's ability to utilize hydropower. Specifically, the Hydropower Policy Modernization Act would modernize the permitting process for hydropower projects by:

* Clarifying that hydropower is renewable under federal law,

* Improving administrative efficiency, accountability, and transparency,

* Requiring timely decision making, and;

* Reducing duplicative oversight from the multiple federal agencies that review hydro applications by designating the Federal Energy Regulatory Commission as the lead agency.

The current licensing process of new hydropower facilities and relicensing of existing facilities is often costly and time consuming. Walden said that the Hydropower Policy Modernization Act will improve hydropower licensing, which will ultimately benefit ratepayers and consumers.

"As these entities go to relicense, sometimes it costs tens of millions of dollars just to get a renewal of a government permit to continue doing what you've been doing. And it can take seven-to-ten years to work through the process," said Walden. "By the way, guess who pays for all of those costs? The ratepayers, the people paying their electricity bill end up paying for all of this out of control review and regulation."

The Hydropower Policy Modernization Act passed the House on a bipartisan vote today, and now awaits action in the Senate before moving forward.

Related News

Jordan approves MOU to implement Jordan-Saudi Arabia electricity linkage

Jordan-Saudi Electricity Linkage Project connects NEPCO and Saudi National Electricity Company to launch feasibility studies, advancing cross-border grid interconnection, Arab electricity linkage goals, and enhancing power reliability, stability, and energy security in both countries.

Key Points

A bilateral grid interconnection by NEPCO and Saudi Electricity Co. to improve reliability and stability.

✅ Enables joint technical and financial feasibility studies

✅ Improves cross-border grid reliability and stability

✅ Part of Arab electricity linkage; supports energy security

The Jordanian Cabinet on has approved the memorandum of understanding to implement the electricity linkage project between Jordan and Saudi Arabia, echoing regional steps such as Lebanon's electricity sector reform to modernize power governance.

The memo will be signed between the National Electric Power Company(NEPCO) and the Saudi National Electricity Company, mirroring cross-border efforts like CEA-Mexico electricity cooperation to strengthen regional interconnections.

The agreement will enable the two sides to initiate technical and financial feasibility studies for the project, which aims to enhance the stability and reliability of electricity networks in both countries, aligning with measures to secure power such as Ireland's electricity supply plan pursued internationally.

The initial feasibility studies, which came as part of the comprehensive Arab electricity linkage issued by the Arab League in 2014, had shown the possibility of implementing the Jordanian-Saudi linkage, as electricity markets evolve in places like Alberta electricity market changes toward new designs.

Regional developments, including a Lebanon electricity goodwill gesture that sowed discord, underscore the complexities of power-sector reform.

Also on Wednesday, the Government approved the third amendment to the grant agreement provided by the EU for a programme of financial inclusion through improving the governance and the spread of micro-financing in Jordan.

Jordan and the EU signed the grant agreement on December 14, 2014 to support the general budget.

The Cabinet also approved the recommendations of the ministerial team tasked with overseeing the annual and financial plans of public credit funds in the Kingdom.

The recommendations included establishing a guidance office to introduce the governmental lending programmes and windows within Iradah centres affiliated with the Planning and International Cooperation Ministry.

The Council of Ministers decided to oblige the government institutions to execute all of their correspondences to the Jordan Customs Department (JCD) electronically.

The decision also includes cancelling the provision of 55 JCD services by conventional paper works and to be provided only online.

The council also approved the outcomes of the study to restructure the governmental body.

The outcomes proposed activating the Higher Health Council, cancelling the independence of the Vocational and Technical Employment Training Fund transferring its functions to the Employment and Development Fund, and activating the National ICT Centre.

The government has cancelled the National Fund to Support Sports and the Scientific Support Fund.

Related News

Lawmakers question FERC licensing process for dams in West Virginia

FERC Hydropower Licensing Dispute centers on FERC authority, Clean Water Act compliance, state water quality certifications, Federal Power Act timelines, and Army Corps dams on West Virginia's Monongahela River licenses.

Key Points

An inquiry into FERC's licensing process and state water quality authority for hydropower at Monongahela River dams.

✅ Questions on omitted state water quality conditions

✅ Debate over starting Clean Water Act certification timelines

✅ Potential impacts on states' rights and licensing schedules

As federal lawmakers, including Democrats pressing FERC, plan to consider a bill that would expand Federal Energy Regulatory Commission (FERC) licensing authority, questions emerged on Tuesday about the process used by FERC to issue two hydropower licenses for existing dams in West Virginia.

In a letter to FERC Chairman Neil Chatterjee, Democratic leaders of the House Energy and Commerce Committee, as electricity pricing changes were being debated, raised questions about hydropower licenses issued for two dams operated by the U.S. Army Corps of Engineers on the Monongahela River in West Virginia.

U.S. Reps. Frank Pallone Jr. (D-NJ), the ranking member of the Subcommittee on Energy, Bobby Rush (D-IL), the ranking member of the Subcommittee on Environment, and John Sarbanes (D-MD), amid Maryland clean energy enforcement concerns, questioned why FERC did not incorporate all conditions outlined in a West Virginia Department of Environmental Protection water quality certificate into plans for the projects.

“By denying the state its allotted time to review this application and submit requirements on these licenses, FERC is undermining the state’s authority under the Clean Water Act and Federal Power Act to impose conditions that will ensure water quality standards are met,” the letter stated.

The House of Representatives was slated to consider the Hydropower Policy Modernization Act of 2017, H.R. 3043, later in the week. The measure would expand FERC authority over licensing processes, a theme mirrored in Maine's transmission line debate over interstate energy projects. Opponents of the bill argue that the changes would make it more difficult for states to protect their clean water interests.

West Virginia has announced plans to challenge FERC hydropower licenses for the dams on the Monongahela River, echoing Northern Pass opposition seen in New Hampshire.

Related News

Florida PSC approves Gulf Power’s purchase of renewable energy produced at municipal solid waste plant

Gulf Power renewable energy contract underscores a Florida PSC-approved power purchase from Bay County's municipal solid waste plant, delivering 13.65 MW at a fixed price, boosting fuel diversity, lowering landfill waste, and saving customers money.

Key Points

A fixed-price PPA for 13.65 MW from Bay County's waste-to-energy plant, approved by Florida PSC to cut costs.

✅ Fixed-price purchase; pay only for energy produced.

✅ 13.65 MW from Bay County waste-to-energy facility.

✅ Cuts landfill waste and natural gas dependency.

The Florida Public Service Commission (PSC) approved Tuesday a contract under which Gulf Power Company will purchase all the electricity generated by the Bay County Resource Recovery Facility, a municipal solid waste plant, similar to SaskPower-Manitoba Hydro deal structures seen elsewhere, over the next six years.

“Gulf’s renewable energy purchase promotes Florida’s fuel diversity, further reducing our dependency on natural gas,” PSC Chairperson Julie Brown said. “This renewable energy option also reduces landfill waste, saves customers money, and serves the public interest.”

The contract provides for Gulf to acquire the Panama City facility’s 13.65 megawatts of renewable generation for its customers beginning in July 2017. Gulf will pay a fixed price, aligned with approaches in Alberta's clean electricity RFP programs, and only pays for the energy produced. The contract is expected to save approximately $250,000 and provides security for customers, a contrast to overruns at the Kemper power plant project, because if the plant does not supply energy, Gulf does not have to provide payment.

This contract is the third renewable energy contract between Gulf and Bay County, at a time when the Southern California plant closures may be postponed, continuing agreements approved in 2008 and 2014. In making the decision, the PSC considered Gulf’s need for power and developments such as the Turkey Point license renewal process, as well as the contract’s cost-effectiveness, payment provisions, and performance guarantees, as required by rule.

Related News

ACORE tells FERC that DOE Proposal to Subsidize Coal, Nuclear Power Plants is unsupported by Record

FERC Grid Resiliency Pricing Opposition underscores industry groups, RTOs, and ISOs rejecting DOE's NOPR, warning against out-of-market subsidies for coal and nuclear, favoring competitive markets, reliability, and true grid resilience.

Key Points

Coalition urging FERC to reject DOE's NOPR subsidies, protecting reliability and competitive power markets.

✅ Industry groups, RTOs, ISOs oppose DOE NOPR

✅ PJM reports sufficient reliability and resilience

✅ Reject out-of-market aid to coal, nuclear

A diverse group of a dozen energy industry associations representing oil, natural gas, wind, solar, efficiency, and other energy technologies today submitted reply comments to the Federal Energy Regulatory Commission (FERC) continuing their opposition to the Department of Energy's (DOE) proposed rulemaking on grid resiliency pricing and electricity pricing changes within competitive markets, in the next step in this FERC proceeding.

Action by FERC, as lawmakers urge movement on aggregated DERs to modernize markets, is expected by December 11.

In these comments, this broad group of energy industry associations notes that most of the comments submitted initially by an unprecedented volume of filers, including grid operators whose markets would be impacted by the proposed rule, urged FERC not to adopt DOE'sproposed rule to provide out-of-market financial support to uneconomic coal and nuclear power plants in the wholesale electricity markets overseen by FERC.

Just a small set of interests - those that would benefit financially from discriminatory pricing that favors coal and nuclear plants - argued in favor of the rule put forward by DOE in its Notice of Proposed Rulemaking, or NOPR, as did coal and business interests in related regulatory debates. But even those interests - termed 'NOPR Beneficiaries' by the energy associations - failed to provide adequate justification for FERC to approve the rule, and their specific alternative proposals for implementing the bailout of these plants were just as flawed as the DOE plan, according to the energy industry associations.

'The joint comments filed today with partners across the energy spectrum reflect the overwhelming majority view that this proposed rulemaking by FERC is unprecedented and unwarranted, said Todd Foley, Senior Vice President, Policy & Government Affairs, American Council on Renewable Energy.

We're hopeful that FERC will rule against an anti-competitive distortion of the electricity marketplace and avoid new unnecessary initiatives that increase power prices for American consumers and businesses.'

In the new reply comments submitted in response to the initial comments filed by hundreds of stakeholders on or before October 23 - the energy industry associations made the following points: Despite hundreds of comments filed, no new information was brought forth to validate the assertion - by DOE or the NOPR Beneficiaries - that an emergency exists that requires accelerated action to prop up certain power plants that are failing in competitive electricity markets: 'The record in this proceeding, including the initial comments, does not support the discriminatory payments proposed' by DOE, state the industry groups.

Nearly all of the initial comments filed in the matter take issue with the DOE NOPR and its claim of imminent threats to the reliability and resilience of the electric power system, despite reports of coal and nuclear disruptions cited by some advocates: 'Of the hundreds of comments filed in response to the DOE NOPR, only a handful purported to provide substantive evidence in support of the proposal. In contrast, an overwhelming majority of initial comments agree that the DOE NOPR fails to substantiate its assertions of an immediate reliability or resiliency need related to the retirement of merchant coal-fired and nuclear generation.'

Grid operators filed comments refuting claims that the potential retirement of coal and nuclear plants which could not compete for economically present immediate or near-term challenges to grid management, even as a coal CEO criticism targeted federal decisions: 'Even the RTOs and ISOs themselves filed comments opposing the DOE NOPR, noting that the proposed cost-of-service payments to preferred generation would disrupt the competitive markets and are neither warranted nor justified.... Most notably, this includes PJM Interconnection, ... the RTO in which most of the units potentially eligible for payments under the DOE NOPR are located. PJM states that its region 'unquestionably is reliable, and its competitive markets have for years secured commitments from capacity resources that well exceed the target reserve margin established to meet [North American Electric Reliability Corp.] requirements.' And PJM analysis has confirmed that the region's generation portfolio is not only reliable, but also resilient.'

The need for NOPR Beneficiaries to offer alternative proposals reflects the weakness of DOE'srule as drafted, but their options for propping up uneconomic power plants are no better, practically or legally: 'Plans put forward by supporters of the power plant bailout 'acknowledge, at least implicitly, that the preferential payment structure proposed in the DOE NOPR is unclear, unworkable, or both. However, the alternatives offered by the NOPR Beneficiaries, are equally flawed both substantively and procedurally, extending well beyond the scope of the DOE NOPR.'

Citing one example, the energy groups note that the detailed plan put forward by utility FirstEnergy Service Co. would provide preferential payments far more costly than those now provided to individual power plants needed for immediate reasons (and given a 'reliability must run' contract, or RMR): 'Compensation provided under [FirstEnergy's proposal] would be significantly expanded beyond RMR precedent, going so far as to include bailing [a qualifying] unit out of debt based on an unsupported assertion that revenues are needed to ensure long-term operation.'

Calling the action FERC would be required to take in adopting the DOE proposal 'unprecedented,' the energy industry associations reiterate their opposition: 'While the undersigned support the goals of a reliable and resilient grid, adoption of ill-considered discriminatory payments contemplated in the DOE NOPR is not supportable - or even appropriate - from a legal or policy perspective.

About ACORE

The American Council on Renewable Energy (ACORE) is a national non-profit organization leading the transition to a renewable energy economy. With hundreds of member companies from across the spectrum of renewable energy technologies, consumers and investors, ACORE is uniquely positioned to promote the policies and financial structures essential to growth in the renewable energy sector. Our annual forums in Washington, D.C., New York and San Franciscoset the industry standard in providing important venues for key leaders to meet, discuss recent developments, and hear the latest from senior government officials and seasoned experts.

Related News

Energy UK - Switching surge continues

UK Energy Switching Surge sees 600,000 customers change suppliers in October, driven by competition, the Energy Switch Guarantee, and better tariffs, with Electralink's DTN supporting customer switching and Ofgem oversight.

Key Points

A rise in UK customers switching electricity suppliers in October, driven by competition and the Energy Switch Guarantee.

✅ 600,000 switches recorded in October

✅ 32% moved to small and mid-tier suppliers

✅ Energy Switch Guarantee assures simple, safe transfers

More than 600,000 customers took steps to save on their energy bills this winter by switching electricity provider in October, as forecasts such as a 16% bill decrease in April offer further encouragement, the latest figures from Energy UK reveal.

A third (32 per cent) of those changing providers in October moved to small and mid-tier suppliers.

Regional markets have seen changes too, including Irish electricity price increases that highlight wider cost pressures.

With recent research showing that that nine in ten energy switchers were happy with the process of changing suppliers and with the reassurance provided by the Energy Switch Guarantee - a series of commitments ensuring switches are simple, speedy and safe - and amid MPs proposing price restrictions to protect consumers, more and more customers are now confident when looking to move.

Lawrence Slade, chief executive of Energy UK said: 'Switching continues to surge with over 600,000 customers changing supplier to find a better deal last month. Many more will have made savings by checking they are on the best deal with their current supplier. It only takes a few minutes to do this and with over 55 suppliers across the market, there's never been more competition or choice.'

Around 75 per cent of the market are signatories of the Guarantee. This includes: British Gas, Bulb Energy, E.ON, EDF Energy, First Utility, Flow Energy, npower, Octopus Energy, Pure Planet, Sainsbury's Energy, Scottish Power, So Energy and Tonik Energy.

The switching data is supplied by Electralink who provides a secure service to transfer data between the electricity market participants. The company operates the Data Transfer Network (DTN) which underpins customer switching, meter interoperability and other business processes critical to a competitive electricity market, where knowing where your electricity comes from can support informed choices.

The data referenced in these reports is since our collection of data only and is for electricity only.

These figures do not include internal electricity switching, and statistics on this from the larger suppliers and on Standard Variable Tariffs can be viewed on the Ofgem website, while ministers consider ending the gas-electricity price link to reduce bills.

Related News

Effort to make Philippines among best power grids in Asia

NGCP-SGCC Partnership drives transmission grid modernization in the Philippines, boosting high-voltage capacity, reliability, and resilience, while developing engineering talent via the Trailblazers Program to meet Southeast Asia best practices and utility standards.

Key Points

A partnership to modernize the Philippines' grid, boost high-voltage capacity, and upskill NGCP engineers.

✅ Modernizes transmission assets and grid reliability nationwide

✅ Trailblazers Program develops NGCP's engineering leadership

✅ SGCC knowledge transfer on UHV, high-voltage, and best practices

The National Grid Corp. of the Philippines (NGCP) is building on its partnership with State Grid Corp of China (SGCC) to expand and modernize transmission facilities, as well as enhance the capabilities of its personnel to advance the country's grid network, aligning with smart grid transformation in Egypt seen in other markets. NGCP Internal Affairs Department head Edwin Natividad said the grid operator is implementing various development programs with SGCC to make the country's power grid among the best power utilities in Asia.

"We have to look at policies aligned with best global practices, including smart grid solutions increasingly adopted worldwide, that we can choose in adopting in the Philippines too," he said. One of NGCP's flagship development program is the Trailblazers Program, the company's strategy to further develop engineers "who will not just be technical experts, but also be the change agents and movers in the NGCP organization as well as in the Philippines' power sector," Natividad said.

"Having the support of the largest utility in the world gives us comfort that this program is designed and implemented by the best in the power industry," he said. Under the program, high performing personnel participating will be prepared for bigger roles later on in their careers at NGCP.

Business ( Article MRec ), pagematch: 1, sectionmatch: 1 "The advantage of such a pool is that it provides flexibility and, eventually, organizational self-sufficiency around the current and future talent needs of NGCP," Natividad said. Now on its third edition, the Trailblazers Program has already sent 76 personnel since it started in November 2016. Natividad said more than 16 of those who previously attended similar programs have already assumed higher roles in NGCP.

Apart from technical skills development, NGCP's partnership with SGCC also provides technical development to improve on the physical transmission assets. "If you will compare the facilities being handled by SGCC with other countries, in terms of handling high voltage capability, SGCC is way ahead.

The higher the voltage it's going to be more difficult to handle," Natividad said, adding they can handle more power to distribute to power distributors. As an example, SGCC's transmission facilities can handle high voltage to as much as 1,000 kiloVolts (kV), whereas the Philippines only has one high voltage facility, the interconnection between Luzon and Visayas, which can handle 500 kV, echoing proposals for macrogrids in Canada to improve reliability.

Natividad said NGCP was the first and biggest investment of SGCC outside of China before it made investments in other parts of the world, even as cybersecurity concerns in Britain have influenced supplier choices. A consortium among businessmen Henry Sy Jr., Robert Coyuito Jr., and SGCC as technical partner, NGCP holds a 25-year concession contract to operate and maintain the country's transmission grid.

Earlier, Sy, NGCP president and CEO, said the company is targeting to become the best utility firm in Southeast Asia. Since it took over the operations and maintenance of the country's power transmission network in 2009, the grid operator has introduced major physical and technological upgrades to ageing state-owned lines and facilities, while in Great Britain an independent operator model is being advanced to reshape system operations.

Related News

ETP 2017 maps major transformations in energy technologies

Global Energy Electrification drives IEA targets as smart grids, storage, EVs, and demand-side management scale. Paris Agreement-aligned policies and innovation accelerate decarbonization, enabling flexible, low-carbon power systems and net-zero pathways by 2060.

Key Points

A shift to electricity across sectors via smart grids, storage, EVs, and policy to cut CO2 and improve energy security.

✅ Smart grids, storage, DSM enable flexible, resilient power.

✅ Aligns with IEA pathways and Paris Agreement goals.

✅ Drives EV adoption, building efficiency, and net-zero by 2060.

The global energy system is changing, with European electricity market trends highlighting rapid shifts. More people are connecting to the grid as living standards improve around the world. Demand for consumer appliances and electronic devices is rising. New and innovative transportation technologies, such as electric vehicles and autonomous cars are also boosting power demand.

The International Energy Agency's latest report on energy technologies outlines how these and other trends as well as technological advances play out in the next four decades to reshape the global energy sector.

Energy Technology Perspectives 2017 (ETP) highlights that decisive policy actions and market signals will be needed to drive technological development and benefit from higher electrification around the world. Investments in stronger and smarter infrastructure, including transmission capacity, storage capacity and demand side management technologies such as demand response programs are necessary to build efficient, low-carbon, integrated, flexible and robust energy system.

Still, current government policies are not sufficient to achieve long-term global climate goals, according to the IEA analysis, and warnings about falling global energy investment suggest potential supply risks as well. Only 3 out of 26 assessed technologies remain “on track” to meet climate objectives, according to the ETP’s Tracking Clean Energy Progress report. Where policies have provided clean signals, progress has been substantial. However, many technology areas suffer from inadequate policy support.

"As costs decline, we will need a sustained focus on all energy technologies to reach long-term climate targets," said IEA Executive Director Dr Fatih Birol. "Some are progressing, but too few are on track, and this puts pressure on others. It is important to remember that speeding the rate of technological progress can help strengthen economies, boost energy security while also improving energy sustainability."

ETP 2017’s base case scenario, known as the Reference Technology Scenario (RTS), takes into account existing energy and climate commitments, including those made under the Paris Agreement. Another scenario, called 2DS, shows a pathway to limit the rise of global temperature to 2ºC, and finds the global power sector could reach net-zero CO2 emissions by 2060.

A second decarbonisation scenario explores how much available technologies and those in the innovation pipeline could be pushed to put the energy sector on a trajectory beyond 2DS. It shows how the energy sector could become carbon neutral by 2060 if known technology innovations were pushed to the limit. But to do so would require an unprecedented level of policy action and effort from all stakeholders.

Looking at specific sectors, ETP 2017 finds that buildings could play a major role in supporting the energy system transformation. High-efficiency lighting, cooling and appliances could save nearly three-quarters of today’s global electricity demand between now and 2030 if deployed quickly. Doing so would allow a greater electrification of the energy system that would not add burdens on the system. In the transportation system, electrification also emerges as a major low-carbon pathway, with clean grids and batteries becoming key areas to watch in deployment.

The report finds that regardless of the pathway chosen, policies to support energy technology innovation at all stages, from research to full deployment, alongside evolving utility trends that operators need to watch, will be critical to reap energy security, environmental and economic benefits of energy system transformations. It also suggests that the most important challenge for energy policy makers will be to move away from a siloed perspective towards one that enables systems integration.

Related News

China Solar PV grew faster than any other fuel in 2016

Solar PV Growth Forecast 2017-2022 highlights IEA projections of record renewable energy capacity, with China leading additions, wind power expansion, record-low auction prices, and solar surpassing coal in net growth across global electricity markets.

Key Points

An overview of IEA expectations for record solar PV expansion, leading renewables growth, and market trends through 2022.

✅ China, India, US drive two-thirds of capacity additions.

✅ Record-low auctions make solar and wind cost-competitive.

✅ Renewables near 30% of generation; coal gap narrows.

New solar PV capacity grew by 50% last year, with China accounting for almost half of the global expansion, according to the International Energy Agency’s latest renewables market analysis and forecast and IRENA’s 2016 record data highlighting the surge.

Boosted by a strong solar PV market, renewables accounted for almost two-thirds of net new power capacity around the world last year, with almost 165 gigawatts (GW) coming online, according to the new report, Renewables 2017. Renewables will continue to have a strong growth in coming years, with BNEF projections pointing to a 50% electricity share by 2050. By 2022, renewable electricity capacity should increase by 43%.

“We see renewables growing by about 1,000 GW by 2022, which equals about half of the current global capacity in coal power, which took 80 years to build,” said Dr Fatih Birol, the executive director of the IEA. “What we are witnessing is the birth of a new era in solar PV. We expect that solar PV capacity growth will be higher than any other renewable technology through 2022.”

This year’s renewable forecastis 12% higher than last year, keeping global renewable power on course to shatter records as upward revisions in China and India lead the way. Three countries – China, India and the United States – will account for two-thirds of global renewable expansion by 2022. Total solar PV capacity by then would exceed the combined total power capacities of India and Japan today.

In power generation, renewable electricity is expected to grow by more than a third by 2022 to over 8,000 terawatt hours, which is equivalent to the total power consumption of China, India and Germany combined. By then, renewables will account for 30% of power generation, up from 24% in 2016. The growth in renewable generation will be twice as large as that of gas and coal combined. Though coal remains the largest source of electricity generation in 2022, renewables close the generation gap with coal by half in just five years.

The deployment in solar PV and wind last year was accompanied by record-low auction prices, which fell as low as 3 cents per kwh (or kilowatt hour). Low announced prices for solar and wind were recorded in a variety of places, such as India, the United Arab Emirates, Mexico and Chile. These announced contract prices for solar PV and wind power purchase agreements are increasingly comparable or lower than generation cost of newly built gas and coal power plants, supporting the US move towards 30% from wind and solar as cost trends persist.

China remains the undisputed leader of renewable electricity capacity expansion over the forecast period with over 360 GW of capacity coming online, or 40% of the global total. China’s renewables growth is largely driven by concerns about air pollution and capacity targets that were outlined in the country’s 13th five-year plan to 2020. In fact, China already exceeded its 2020 solar PV target three years ahead of time and is set to achieve its onshore wind target in 2019. Still, the growing cost of renewable subsidies and grid integration issues remain two important challenges to further expansion.

Under an accelerated case – where government policy lifts barriers to growth – IEA analysis finds that renewable capacity growth could be boosted by another 30%, totalling an extra 1,150 GW by 2022 led by China. Solar PV and wind capacity in China could by then reach twice the total power capacity of Japan today.

India’s move to address the financial health of its utilities and tackle grid-integration issues drive a more optimistic forecast. By 2022, India renewable capacity will more than double. This growth is enough to overtake renewable expansion in the European Union for the first time. Solar PV and wind together represent 90% of India’s capacity growth as auctions yielded some of the world’s lowest prices for both technologies.

Despite policy uncertainties at the federal level, the United States remains the second-largest growth market for renewables, with one-fourth of US electricity projected to come from renewables soon. The main drivers for onshore wind and solar – such as multi-year federal tax incentives combined with renewable portfolio standards as well as state-level policies for distributed solar PV – remain strong. Still, the current uncertainty over proposed federal tax reforms, international trade and energy policies could alter the economic attractiveness of renewables and hamper their growth over our forecast period.

The report also provides detailed analysis on the renewable consumption of electric cars and off-grid solar deployment in Africa and developing Asia. Off-grid capacity in these regions will more than triple reaching over 3 000 MW in 2022 from industrial applications, solar home systems (SHSs) and mini-grids driven by government electrification programmes and private sector initiatives. While this represents less than 5% of total PV capacity installed in both regions, the economic impact is nonetheless significant, and brings basic electricity services to almost 70 million more people in developing Asia and sub-Saharan Africa in the next five years.

Power consumption of EVs – including cars, two- and-three wheelers and buses – is expected to double over the next five years, with renewable electricity estimated to represent almost 30% of their consumption by 2022, up from 26% today. EVs play a complementary role to biofuels, which represent 80% of growth in renewable energy consumption in transport. However, the share of renewables in total road transport energy consumption remains limited, increasing only from 4% in 2016 to almost 5% in 2022.

Related News

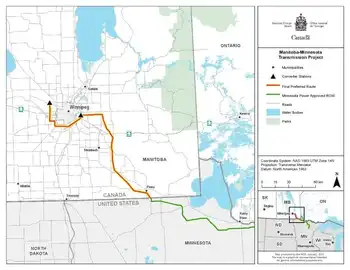

$453M Manitoba Hydro line to Minnesota could face delay after energy board recommendation

Manitoba-Minnesota Transmission Project faces NEB certificate review, with public hearings, Indigenous consultation, and cross-border approval weighing permit vs certificate timelines, potential land expropriation, and Hydro's 2020 in-service date for the 308-MW intertie.

Key Points

A cross-border hydro line linking Manitoba and Minnesota, now under NEB review through a permit or certificate process.

✅ NEB recommends certificate with public hearings and cabinet approval

✅ Stakeholders cite land, health, and economic impacts along route

✅ Hydro targets May-June 2020 in-service despite review

A recommendation from the National Energy Board could push back the construction start date of a $453-million hydroelectric transmission line from Manitoba to Minnesota.

In a letter to federal Natural Resources Minister Jim Carr, the regulatory agency recommends using a "certificate" approval process, which could take more time than the simpler "permit" process Manitoba Hydro favours.

The certificate process involves public hearings, reflecting First Nations intervention seen in other power-line debates, to weigh the merits of the project, which would then go to the federal cabinet for approval.

The NEB says this process would allow for more procedural flexibility and "address Aboriginal concerns that may arise in the circumstances of this process."

The Manitoba-Minnesota Transmission Project would provide the final link in a chain that brings hydroelectricity from generating stations in northern Manitoba, through the Bipole III transmission line and, like the New England Clean Power Link project, across the U.S. border as part of a 308-megawatt deal with the Green Bay-based Wisconsin Public Service.

When Hydro filed its application in December 2016, it had expected to have approval by the end of August 2017 and to begin construction on the line in mid-December, in order to have the line in operation by May or June 2020.

Groups representing stakeholders along the proposed route of the transmission line had mixed reactions to the energy board's recommendation.

A lawyer representing a coalition of more than 120 landowners in the Rural Municipality of Taché and around La Broquerie, Man., welcomed the opportunity to have a more "fulsome" discussion about the project.

"I think it's a positive step. As people become more familiar with the project, the deficiencies with it become more obvious," said Kevin Toyne, who represents the Southeast Stakeholders Coalition.

Toyne said some coalition members are worried that Hydro will forcibly expropriate land in order to build the line, while others are worried about potential economic and health impacts of having the line so close to their homes. They have proposed moving the line farther east.

When the Clean Environment Commission — an arm's-length provincial government agency — held public hearings on the proposed route earlier this year, the coalition brought their concerns forward, echoing Site C opposition voiced by northerners, but Toyne says both the commission and Hydro ignored them.

Hydro still aiming for 2020 in-service date

The Manitoba Métis Federation also participated in those public hearings. MMF president David Chartrand worries about the impact a possible delay, as seen with the Site C work halt tied to treaty rights, could have on revenue from sales of hydroelectric power to the U.S.

"I know that a lot of money, billions have been invested on this line. And if the connection line is not done, then of course this will be sitting here, not gaining any revenue, which will affect every Métis in this province, given our Hydro bill's going to go up," Chartrand said.The NEB letter to Minister Carr requests that he "determine this matter in an expedited manner."

Manitoba Hydro spokesperson Bruce Owen said in an email that the Crown corporation will participate in whatever process, permit or certificate, the NEB takes.

"Manitoba Hydro does not have any information at this point in time that would change the estimated in-service date (May-June 2020) for the Manitoba-Minnesota Transmission Project," he said.

The federal government "is currently reviewing the NEB's recommendation to designate the project as subject to a certificate, which would result in public hearings," said Alexandre Deslongchamps, a spokesperson for Carr.

"Under the National Energy Board Act, an international power line requires either the approval by the NEB through a permit or approval by the Government of Canada by a certificate. Both must be issued by the NEB," he wrote in an email to CBC News.

By law, the certificate process is not to take longer than 15 months.

Related News

Class-action lawsuit: Hydro-Québec overcharged customers up to $1.2B

Hydro-Qu�E9bec Class-Action Lawsuit alleges overbilling and monopoly abuse, citing R�E9gie de l'�E9nergie rate increases, Quebec Superior Court filings, and calls for refunds on 2008-2013 electricity bills to residential and business customers.

Key Points

Quebec class action alleging Hydro-Qu�E9bec overbilled customers in 2008-2013, seeking court-ordered refunds.

✅ Filed in Quebec Superior Court; certification pending.

✅ Alleges up to $1.2B in overcharges from 2008-2013.

✅ Questions R�E9gie de l'�E9nergie rate approvals and data.

A group representing Hydro-Québec customers has filed a motion for a class-action lawsuit against the public utility, alleging it overcharged customers over a five-year period.

Freddy Molima, one of the representatives of the Coalition Peuple allumé, accuses Hydro-Québec of "abusing its monopoly."

The motion, which was filed in Quebec Superior Court, claims Hydro-Québec customers paid more than they should have for electricity between 2008 and 2013, to the tune of nearly $1.2 billion, even as Hydro-Québec later refunded $535 million to customers in a separate case.

The coalition has so far recruited nearly 40,000 participants online as part of its plan to sue the public utility.

A lawyer representing the group said Quebec's energy board, the Régie de l'énergie, also recently approved Hydro-Québec rate increases for residential and business customers without knowing all the facts, even as Manitoba Hydro hikes face opposition in regulatory hearings.

"There's certain information provided to the Régie that isn't true," said Bryan Furlong. "Hydro-Québec has not been providing the Régie the proper numbers."

In its motion, the group asks that overcharged clients be retroactively reimbursed.

Hydro-Québec denies allegations

Hydro-Québec, for its part, denies it ever overbilled any of its clients, while other utilities such as Hydro One plan to redesign bills to improve clarity.

"All our efficiencies have been returned to the government through our profits, and to Quebecers we have billed exactly what we agreed to bill," said spokesperson Serge Abergel, adding that the utility won't seek a rate hike next year according to its current plans.

Quebec Energy Minister Pierre Moreau also came to the public utility's defence, saying it has no choice but to comply with the energy board's regulations, while customer protections are in focus as Hydro One moves to reconnect 1,400 customers in Ontario.

The group says the public utility has overbilled clients by up to $1.2 billion. (Radio-Canada)

It would be "shocking" if customers were charged too much money, he added.

"I know for a fact that Hydro-Québec is respecting the decision of this body," he said.

While the motion has been filed, the group cannot say how much each customer would receive if the class-action lawsuit goes ahead because it all depends on how much electricity was consumed by each client over that five-year period.

The coalition plans to present its motion to a judge next February.

Related News

Hydro One employee suffers 'serious injuries' while replacing pole

Hydro One workplace injury Thunder Bay highlights an Ontario Ministry of Labour investigation after a live power line contact, with burn unit treatment, safety compliance reviews, training records requests, and inspector oversight at utility site.

Key Points

A Hydro One incident in Thunder Bay under Ontario labour investigation, after live line contact and burn unit care.

✅ Ministry of Labour probing live line contact incident

✅ Training records and safety manuals requested from Hydro One

✅ Inspector on site; employer report pending compliance

Ontario's Ministry of Labour has confirmed a Hydro One employee was taken to hospital after being injured on a job site in Thunder Bay, Ont.

The employee was hospitalized after the incident on Oct. 23 during work to replace a hydro pole in the northwestern Ontario city, a ministry spokesperson told CBC News.

"Our investigation will continue," Janet Deline said. "[Further steps] could be anything from examining the incident site, any equipment involved; our inspectors may interview witnesses, so co-workers, supervisors."

Deline added that she's not aware of the worker's current condition

A Hydro One spokesperson confirmed in an email that one of the company's employees suffered a "serious workplace injury," after he contacted a live power line, reflecting the risks of on-the-job electrical injuries in the sector, adding that he has been receiving specialized treatment in a burn unit.

The company would not answer other questions, such as where or when the incident happened, nor provide other details about the nature of the work, but said officials are in contact with the family, while BC Hydro Site C COVID-19 updates illustrate a different approach to public reporting by utilities. The ministry said it can't release any personal information, like a name or where the employee is from, citing privacy legislation.

Training records, policy manuals collected in investigation

The labour ministry and Hydro One both confirmed the incident remains under investigation. The ministry said it has requested training records, qualification certificates and policy and procedure manuals from Hydro One, aligning with federal efforts to support the future of work in the electricity sector nationwide.

An inspector arrived in Thunder Bay on Oct. 26, Deline said, and external investigators at Manitoba Hydro have been engaged in other cases.

As of Tuesday afternoon, "17 of those requirements have been complied with," Deline said, noting that enforcement outcomes in serious cases can include penalties, as in a company fined after fatal electrocution reported previously, and adding that the ministry was still waiting on a submission from the utility about its own investigation into the incident.

"Employers are required to ... provide a written information to us on what happened, sort of their version, if you will," she said.

Deline said it's too soon to tell how long the investigation will take to complete.

Related News

B.C. government freezes provincial electricity rates

BC Hydro Rate Freeze delivers immediate relief on electricity rates in British Columbia, reversing a planned 3% hike, as BCUC oversight, a utility review, and Site C project debates shape provincial energy policy.

Key Points

A one-year provincial policy halting BC Hydro electricity rate hikes while a utility review finds cost savings.

✅ Freeze replaces planned 3% hike approved by BCUC.

✅ Government to conduct comprehensive BC Hydro review.

✅ Critics warn $150M revenue loss impacts capital projects.

British Columbia's NDP government has announced it will freeze BC Hydro rates effective immediately, fulfilling a key election promise.

Energy, Mines and Petroleum Resources Minister Michelle Mungall says hydro rates have gone up by more than 24 per cent in the last four years and by more than 70 per cent since 2001, reflecting proposals such as a 3.75% increase over two years announced previously.

"After years of escalating electricity costs, British Columbians deserve a break on their bills," Mungall said in a news release.

BC Hydro had been approved by the B.C. Utilities Commission to increase the rate by three per cent next year, but Mungall said it will pull back its request in order to comply with the freeze.

In the meantime, the government says it will undertake a comprehensive review of the utility meant to identify cost-savings measures for customers often asked to pay an extra $2 a month on electricity bills.

The Liberal critic, Tracy Redies, says the one year rate freeze is going to cost BC Hydro, calling it a distraction from the bigger issue of the future of the Site C project and the oversight of a BC Hydro fund surplus as well.

"A one year rate freeze costs Hydro $150 million," Redies said. "That means there's $150 million less to invest in capital projects and other investments that the utility needs to make."

"This is putting off decisions that should be made today to the future."

Recommendations from the review — including possible new rates — will be implemented starting in April 2019.

Related News

Metering Pilot projects may be good example for Ontario utilities

Ontario Electricity Pricing Pilot Projects explore alternative rates beyond time-of-use, with LDCs and the Ontario Energy Board testing dynamic pricing, demand management, smart-meter billing, and residential customer choice to enhance service and energy efficiency.

Key Points

Ontario LDC trials testing alternatives to time-of-use rates to improve billing, demand response, and efficiency.

✅ Data shared across LDCs and Ontario Energy Board provincewide

✅ Tests dynamic pricing, peak/off-peak plans, demand management

✅ Insights to enhance customer choice, bills, and energy savings

The results from three electricity pilot projects being offered in southern Ontario will be valuable to utility companies across the province.

Ontario Energy Minister Glenn Thibeault was in Barrie on Tuesday to announce the pilot projects, which will explore alternative pricing plans for electricity customers from three different utility companies, informed by the electricity cost allocation framework guiding rate design.

"Everyone in the industry is watching to see how the pilots deliver.", said Wendy Watson, director of communications for Greater Sudbury Utilities.

"The data will be shared will all the LDCs [local distribution companies] in the province, and probably beyond...because the industry tends to share that kind of information."

Most electricity customers in the province are billed using time-of-use rates, including options like the ultra-low overnight rates that lower costs during off-peak periods, where the cost of electricity varies depending on demand.

The Ontario Energy Board said in a media release that the projects will give residential customers more choice in how much they pay for electricity at different times, reflecting changes for Ontario electricity consumers that expand plan options.

Pilot projects can help improve service

Watson says these kinds of projects give LDCs the chance to experiment and explore new ways of delivering their service, including demand-response initiatives like the Peak Perks program that encourage conservation.

"Any pilot project is a great way to see if in practice if the theory proves out, so I think it's great that the province is supporting these LDCs," she says.

GSU recently completed its own pilot project, the Home Energy Assessment and Retrofit (HEAR) program, which focused on customers who use electric baseboards to heat their homes, amid broader provincial support for electric bills to ease costs."We installed some measures, like programmable thermostats and a few other pieces of equipment into their house," Watson says. "We also made some recommendations about other things that they could do to make their homes more energy efficient."

At the end of the program, GSU provided customers with a report so that they could the see the overall impact on their energy consumption.

Watson says a report on the results of the HEAR program will be released in the near future, for other LDCs interested in new ways to improve their service.

"We think it's incumbent on every LDC...to see what ideas that they can come up with and get approved so they can best serve their customers."