Inflation Reduction Act climate provisions accelerate clean energy, EV tax credits, methane fee, hydrogen incentives, and a green bank, cutting carbon emissions, boosting manufacturing, and advancing environmental justice and net-zero goals through 2030.

Key Points

They are U.S. policies funding clean energy, EV credits, a methane fee, hydrogen, and justice programs to cut emissions.

✅ Up to $7,500 new and $4,000 used EV tax credits with income limits

✅ First federal methane fee to curb oil and gas emissions

✅ $60B for clean energy manufacturing and environmental justice

The Biden administration this year signed a historic climate and tax deal that will funnel billions of dollars into programs designed to speed the country’s clean energy transition, with ways to tap new funding available to households and businesses, and battle climate change.

As the U.S. this year grappled with climate-related disasters from Hurricane Ian in Florida to the Mosquito Fire in California, the Inflation Reduction Act, which contains $369 billion in climate provisions, was a monumental development to mitigate the effects of climate change across the country, with investment incentives viewed as essential to accelerating clean electricity this decade.

The bill, which President Joe Biden signed into law in August, is the most aggressive climate investment ever taken by Congress and is expected to slash the country’s planet-warming carbon emissions by about 40% this decade and move the country toward a net-zero economy by 2050, aligning with a path to net-zero electricity many analyses lay out.

The IRA’s provisions have major implications for clean energy and manufacturing businesses, climate startups and consumers in the coming years. As 2022 comes to a close, here’s a look back at the key elements in the legislation that climate and clean energy advocates will be monitoring in 2023.

Incentives for electric vehicles

The deal offers a federal tax credit worth up to $7,500 to households that buy new electric vehicles, as well as a used EV credit worth up to $4,000 for vehicles that are at least two years old. Starting Jan. 1, people making $150,000 a year or less, or $300,000 for joint filers, are eligible for the new car credit, while people making $75,000 or less, or $150,000 for joint filers, are eligible for the used car credit.

Despite a rise in EV sales in recent years, the transportation sector is still the country’s largest source of greenhouse gas emissions, with the lack of convenient charging stations being one of the barriers to expansion. The Biden administration has set a goal of 50% electric vehicle sales by 2030, as Canada pursues EV sales regulations alongside broader oil and gas emissions limits.

The IRA limits EV tax credits to vehicles assembled in North America and is intended to wean the U.S. off battery materials from China, which accounts for 70% of the global supply of battery cells for the vehicles. An additional $1 billion in the deal will provide funding for zero-emissions school buses, heavy-duty trucks and public transit buses.

Stephanie Searle, a program director at the nonprofit International Council on Clean Transportation, said the combination of the IRA tax credits and state policies like New York's Green New Deal will bolster EV sales. The agency projects that roughly 50% or more of passenger cars, SUVs and pickups sold in 2030 will be electric. For electric trucks and buses, the number will be 40% or higher, the group said.

In the upcoming year, Searle said the agency is monitoring the Environmental Protection Agency’s plans to propose new greenhouse gas emissions standards for heavy-duty vehicles starting in the 2027 model year.

“With the IRA already promoting electric vehicles, EPA can and should be bold in setting ambitious standards for cars and trucks,” Searle said. “This is one of the Biden administration’s last chances for strong climate action within this term and they should make good use of it.”

Taking aim at methane gas emissions

The package imposes a tax on energy producers that exceed a certain level of methane gas emissions. Polluters pay a penalty of $900 per metric ton of methane emissions emitted in 2024 that surpass federal limits, increasing to $1,500 per metric ton in 2026.

It’s the first time the federal government has imposed a fee on the emission of any greenhouse gas. Global methane emissions are the second-biggest contributor to climate change after carbon dioxide and come primarily from oil and gas extraction, landfills and wastewater and livestock farming.

Methane is a key component of natural gas and is 84 times more potent than carbon dioxide, but doesn’t last as long in the atmosphere. Scientists have contended that limiting methane is needed to avoid the worst consequences of climate change.

Robert Kleinberg, a researcher at Columbia University’s Center on Global Energy Policy, said the methane emitted by the oil and gas industry each year would be worth about $2 billion if it was instead used to generate electricity or heat homes.

“Reducing methane emissions is the fastest way to moderate climate change. Congress recognized this in passing the IRA,” Kleinberg said. “The methane fee is a draconian tax on methane emitted by the oil and gas industry in 2024 and beyond.”

In addition to the IRA provision on methane, the Biden Interior Department this year proposed rules to curb methane leaks from drilling, which it said will generate $39.8 million a year in royalties for the U.S. and prevent billions of cubic feet of gas from being wasted through venting, flaring and leaks.

Boosting clean energy manufacturing

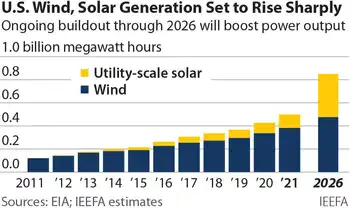

The bill provides $60 billion for clean energy manufacturing, including $30 billion for production tax credits to accelerate domestic manufacturing of solar panels, wind turbines, batteries and critical minerals processing, and a $10 billion investment tax credit to manufacturing facilities that are building EVs and clean energy technology, reinforcing the view that decarbonization is irreversible among policymakers.

There’s also $27 billion going toward a green bank called the Greenhouse Gas Reduction Fund, which will provide funding to deploy clean energy across the country, particularly in overburdened communities, and guide utility carbon-free electricity investments at scale. And the bill has a hydrogen production tax credit, which provides hydrogen producers with a credit based on the climate attributes of their production methods.

Emily Kent, the U.S. director of zero-carbon fuels at the Clean Air Task Force, a global climate nonprofit, said the bill’s support for low-emissions hydrogen is particularly notable since it could address sectors like heavy transportation and heavy industry, which are hard to decarbonize.

“U.S. climate policy has taken a major step forward on zero-carbon fuels in the U.S. and globally this year,” Kent said. “We look forward to seeing the impacts of these policies realized as the hydrogen tax credit, along with the hydrogen hubs program, accelerate progress toward creating a global market for zero-carbon fuels.”

The clean energy manufacturing provisions in the IRA will also have major implications for startups in the climate space and the big venture capital firms that back them. Carmichael Roberts, head of investment at Breakthrough Energy Ventures, has said the climate initiatives under the IRA will give private investors more confidence in the climate space and could even lead to the creation of up to 1,000 companies.

“Everybody wants to be part of this,” Roberts told CNBC following the passage of the bill in August. Even before the measure passed, “there was already a big groundswell around climate,” he said.

Investing in communities burdened by pollution

The legislation invests more than $60 billion to address the unequal effects of pollution and climate change on low-income communities and communities of color. The funding includes grants for zero-emissions technology and vehicles, and will help clean up Superfund sites, improve air quality monitoring capacity, and provide money to community-led initiatives through Environmental and Climate Justice block grants.

Research published in the journal Environmental Science and Technology Letters found that communities of color are systematically exposed to higher levels of air pollution than white communities due to redlining, a federal housing discrimination practice. Black Americans are also 75% more likely than white Americans to live near hazardous waste facilities and are three times more likely to die from exposure to pollutants, according to the Clean Air Task Force.

Biden signed an executive order after taking office aimed to prioritize environmental justice and help mitigate pollution in marginalized communities. The administration established the Justice40 Initiative to deliver 40% of the benefits from federal investments in climate change and clean energy to disadvantaged communities.

More recently, the EPA in September launched an office focused on supporting and delivering grant money from the IRA to these communities.

Cutting ag emissions

The deal includes $20 billion for programs to slash emissions from the agriculture sector, which accounts for more than 10% of U.S. emissions, according to EPA estimates.

The president has pledged to reduce emissions from the agriculture industry in half by 2030. The IRA funds grants for agricultural conservation practices that directly improve soil carbon, as well as projects that help protect forests prone to wildfires.

Separately, this year the U.S. Department of Agriculture announced it will spend $1 billion on projects for farmers, ranchers and forest landowners to use practices that curb emissions or capture and store carbon. That program is focusing on projects for conservation practices including no-till, cover crops and rotational grazing.

Research suggests that removing carbon already in the atmosphere and replenishing soil worldwide could result in a 10% carbon drawdown.

Related News