Electricity News in May 2017

Maritime Link almost a reality, as first power cable reaches Nova Scotia

Maritime Link Subsea Cable enables HVDC grid interconnection across the Cabot Strait, linking Nova Scotia with Newfoundland and Labrador to import Muskrat Falls hydroelectric power and expand renewable energy integration and reliability.

Key Points

A 170-km HVDC subsea link connecting Nova Scotia and Newfoundland and Labrador for Muskrat Falls power and renewables

✅ 170-km HVDC subsea route across Cabot Strait

✅ Connects Nova Scotia and Newfoundland and Labrador grids

✅ Enables Muskrat Falls hydro and renewable energy trade

The longest sub-sea electricity cable in North America now connects Nova Scotia and Newfoundland and Labrador, according to the company behind the $1.7-billion Maritime Link project.

The first of the project's two high-voltage power transmission cables was anchored at Point Aconi, N.S., on Sunday.

The 170-kilometre long cable across the Cabot Strait will connect the power grids in the two provinces. The link will allow power to flow between the two provinces, as demonstrated by its first electricity transfer milestone, and bring to Nova Scotia electricity generated by the massive Muskrat Falls hydroelectric project in Labrador.

Ultimately, the Maritime Link will help Nova Scotia reach the renewable energy goals set out by the federal government, said Rick Janega, the president and CEO of Emera Newfoundland and Labrador, whose subsidiary owns the Maritime Link.

"If not for the Maritime Link then really the province would not have the ability to meet those requirements because we're pretty much tapped out of all the hydro in province and all the wind generation without creating new interconnections like the Maritime Link," said Janega.

Not everyone wanted the link

Fishermen in Cape Breton had objected to the Maritime Link. They were concerned about how the undersea cable might affect fish in the area.

The laying of the cable and other construction closed a three-kilometre long and 600-metre wide swath of ocean bottom to fishermen for the entire 2017 lobster season.

But the company came to an agreement to compensate a group of 60 Cape Breton lobster and crab fishermen affected by the project this season. The terms of the compensation deal were not released.

Long cable, big job

The transmission cable runs northwest of the Marine Atlantic ferry route between North Sydney, N.S., and Port aux Basques, N.L.

Installation of the second cable is set to begin in June, a major step comparable to BC Hydro's Site C transmission milestone achieved recently. The entire link should be completed by late 2017 and should go into full service by January 2018.

"We're quite confident as soon as the Maritime Link is in service there will be energy transactions between Nova Scotia Power and Newfoundland Hydro. Both utilities have already identified opportunities to save money and exchange energy between the two provinces," said Janega.

That's two years before power is expected to flow from the Muskrat Falls hydro project. The Labrador-based power generating facility has been hampered by delays.

Those kinds of transmission project delays are expected for such a large project, said Janega, and won't stop the Maritime Link from being used.

"With the Maritime Link going in service this year providing Nova Scotia the opportunity that it needs to be able to reach carbon reductions and to adapt to climate change and to increase renewable energy content and we're very pleased to be at this state today," said Janega.

Related News

New Alberta bill enables consumer price cap on power bills

Alberta Electricity Rate Cap shields RRO customers with a 6.8 cents/kWh price ceiling, stabilizing power bills amid capacity market transition, using carbon tax funding to offset spikes and enhance consumer protection from volatility.

Key Points

A four-year 6.8 cents/kWh ceiling on Alberta's RRO power price, backed by carbon tax to stabilize bills.

✅ Applies to RRO customers from Jun 2017 to May 2021

✅ Caps rates at 6.8 cents/kWh; lower RRO still applies

✅ Funded by carbon tax when market prices exceed cap

The Alberta government introduced a bill Tuesday, part of new electricity rules that will allow it to place a cap on regulated electricity rates for the next four years.

The move to cap consumer power rates at a maximum of 6.8 cents per kilowatt-hour for four years was announced in November 2016 by Premier Rachel Notley, although it was later scrapped by the UCP during a subsequent policy shift.

The cap is intended to protect consumers from price fluctuations from June 1, 2017, to May 31, 2021, as the province moves from a deregulated to a capacity power market amid a power market overhaul that is underway.

The price ceiling will apply to people with a regulated rate option. If the RRO is below 6.8 cents, they will still pay the lower rate.

The government isn't forecasting price fluctuations above 6.8 cents in this four-year period. If the price goes above that amount, funding would come from the carbon tax if required.

Funding may come from carbon tax

"We're taking a number of steps to keep prices low," said Energy Minister Marg McCuaig-Boyd. "But in the event that prices were to spike, the cap would automatically prevent the energy rate from going over 6.8 cents to give Albertans even more peace of mind."

The government isn't forecasting price fluctuations above 6.8 cents in this four-year period. If the price goes above that amount, funding would come from the carbon tax.

McCuaig-Boyd said this would be an appropriate use for the carbon tax as the cap helps Albertans move to a greener energy system and change how the province produces and pays for electricity without relying as much on coal-fired electricity.

The government estimates the program will cost $10 million a month for each cent the rate goes above 6.8 cents per kilowatt-hour. If rates remain below that amount, the program may not cost anything.

Wildrose electricity and renewables critic Don MacInytre said the move shows the government expects retail electricity rates will double over the next four years.

MacIntyre argued a rate cap simply shifts increasing electricity costs away from consumers to the Alberta government. But ultimately everyone pays.

"It's simply a shift of a burden from the ratepayer to the taxpayer, which is essentially the same person," he said.

The City of Medicine Hat runs its own electrical system without a regulated rate option. The government will talk with the city to see if it is interested in taking part in the price cap protection.

About 60 per cent of eligible Albertans or one million households use the regulated rate option in their electricity contracts.

The current regulated rate option averages less than three cents per kilowatt-hour.

Related News

Ontario opens first ever electric vehicle education centre in Toronto

Toronto EV Discovery Centre offers hands-on EV education, on-site test drives, and guidance on Ontario incentives, rebates, charging, and dealerships, helping drivers switch to electric vehicles and cut emissions through provincial climate programs.

Key Points

A public hub in Toronto for EV education, test drives, and guidance on Ontario incentives, rebates, and charging options.

✅ Free entry; neutral info on EV models and charging.

✅ On-site test drives; referrals to local dealerships.

✅ Backed by Ontario's cap-and-trade, utilities, and partners.

A centre where people can learn about electric vehicles and take them for a test drive has opened in Toronto, as similar EV events in Regina highlight growing public interest.

Ontario's Environment Minister Glen Murray says the Plug'n Drive Electric Vehicle Discovery Centre is considered the first of its kind and his government has pitched in $1 million to support it, alongside efforts to expand charging stations across Ontario.

Ontario's Environment Minister Glen Murray helps cut the ribbon on the first ever electric vehicle discovery centre. (CBC News)

Murray says the goal of the centre is to convince people to switch to electric vehicles in order to fight climate change, a topic gaining momentum in southern Alberta as well.

Visitors to the centre learn about how electric vehicles work and about Ontario government subsidies and rebates for electric car owners, as well as the status of the provincial charging network and infrastructure.

Visitors can test-drive vehicles from different companies and those who see something they like will receive a referral to an electric car dealership in their area.

The province hopes to have electric vehicles make up five per cent of all new vehicles sold by 2020. (Oliver Walters/CBC)

The Ontario government's Climate Change Action Plan includes a goal to have electric vehicles make up five per cent of all new vehicles sold by 2020, amid debate over whether the next wave will run on clean power in Ontario, and the discovery centre is part of that plan.

The centre is free for visitors. It's a public-private partnership funded from the provincial government's cap-and-trade revenue, with other funding from TD Bank Group, Ontario Power Generation, Power Workers' Union, Toronto Hydro and Bruce Power.

Related News

St. Albert touts green goals with three new electric buses

St. Albert electric buses debut as zero-emission, quiet public transit, featuring BYD technology, long-range batteries, and charging stations, serving Edmonton routes while advancing sustainable transportation goals and a future fleet expansion.

Key Points

They are zero-emission BYD transit buses that cut noise and air pollution, with long-range batteries and city charging.

✅ Up to 250-280 km range per charge

✅ Quiet, zero-emission operations reduce urban pollution

✅ Backed by provincial GreenTRIP funding and BYD tech

The city of St. Albert is going green — both literally and esthetically — with three electric buses on routes in and around the city this week.

"They're virtually silent," Wes Brodhead, chair of the Capital Region Board transit committee and a St. Albert city councillor, said. "This, as opposed to the diesel buses and the roar that accompanies them as they drive down the street."

You may not hear them coming but you'll definitely see them, as electric school buses in B.C. hit the road as well.

The 35-foot electric buses are painted bright green to represent the city's goal of adopting sustainable transportation.

"There's no noise pollution, there's no air pollution, and it just kind of fit with the whole theme of the city," said St. Albert Transit director Kevin Bamber.

'The conversation around the conference was not if but when the industry will fully embrace electrification,' - Wes Brodhead, St. Albert city councillor

The buses cost about $970,000 each. Adding in the required infrastructure, including charging stations, the project cost a total of $3.1 million, with two-thirds of the funding coming from the provincial government's Green Transit Incentives Program.

The electric buses are estimated to go between 250 and 280 kilometres on a single charge.

"That would mean any of the routes that we currently have through St. Albert or into Edmonton, an electric bus could do the morning route, come back, park in the afternoon and go back out and do the afternoon route without a charge," Bamber said.

St. Albert councillor Wes Brodhead envisions having a full fleet of 60 electric buses in years to come, a scale informed by examples like the TTC's electric bus fleet operating in North America. (Supplied)

Brodhead went to an international transit conference in Montreal, where STM electric buses have begun rolling out and he said manufacturers presented various electric bus designs.

"The conversation around the conference was not if but when the industry will fully embrace electrification," Brodhead said.

The vehicles were built in California by BYD Ltd., one of only two companies making the long-endurance electric buses.

The city has ordered four more of the buses and hopes to be running all seven by the end of the year, as battery-electric buses in Metro Vancouver continue to hit the roads nationwide.

Eventually, Brodhead envisions having a full fleet of 60 electric buses in St. Albert.

Edmonton is expected to operate as many as 40 electric buses, and while city staff are still in the planning stages, Edmonton's first electric bus has already hit city streets.

Related News

Montreal's first STM electric buses roll out

STM Electric Buses Montreal launch a zero-emission pilot with rapid charging stations on the 36 Monk line from Angrignon to Square Victoria, winter-tested for reliability and aligned with STM's 2025 fully electric fleet plan.

Key Points

STM's pilot deploys zero-emission buses with charging on the 36 Monk line, aiming for a fully electric fleet by 2025.

✅ 36 Monk route: Angrignon to Square Victoria with rapid charging

✅ Winter-tested performance; 15-25 km range per charge

✅ Quebec-built: motors Boucherville; buses Saint-Eustache

The first of three STM electric buses are rolling in Montreal, similar to initiatives with Vancouver electric buses elsewhere in Canada today.

The test batch is part of the city's plan to have a fully electric fleet by 2025, mirroring efforts such as St. Albert's electric buses in Alberta as well.

Over the next few weeks, one bus at a time will be put into circulation along the 36 Monk line, a rollout approach similar to Edmonton's first electric bus efforts in that city, going from Angrignon Metro station to Square Victoria Metro station.

Rapid charging stations have been set up at both locations, a model seen in TTC's battery-electric rollout to support operations, so that batteries can be charged during the day between routes. The buses are also going to be fully charged at regular charging stations overnight.

Each bus can run from 15 to 25 kilometres on a single charge. The Monk line was chosen in part for its length, around 11 kilometres.

The STM has been testing the electric buses to make sure they can stand up to Montreal's harsh winters, drawing on lessons from peers such as the TTC electric bus fleet in Toronto, and now they are ready to take on passengers.

Keeping it local

The motors were designed in Boucherville, and the buses themselves were built in Saint-Eustache.

No timeline has been set for when the STM will be ready to roll out the whole fleet, but Montreal Mayor Denis Coderre, who was on hand at Tuesday's unveiling, told reporters he has confidence in the $11.9-million program.

"We start with three. Trust me, there will be more." said Coderre.

Related News

Idaho Power Settlement Could Close Coal Plant, Raise Rates

Idaho Power Valmy Settlement outlines early closure of the North Valmy coal-fired plant in Nevada, accelerated depreciation recovery, a 1.17% base-rate increase, and impacts for customers, NV Energy co-ownership, and Idaho Public Utilities Commission review.

Key Points

A proposed agreement to close North Valmy early, recover costs via a 1.17% rate hike, and seek PUC approval.

✅ Unit 1 closes 2019; Unit 2 closes 2025 in Nevada.

✅ 1.17% base-rate hike; about $1.20 per 1,000 kWh monthly bill.

✅ Idaho PUC comment deadline May 25; NV Energy co-owner.

State regulators have set a May 25 deadline for public comment on a proposed settlement related to the early closure of a coal-fired plant co-owned by Idaho Power, even as some utilities plan to keep a U.S. coal plant running indefinitely in other jurisdictions.

The settlement calls for shuttering Unit 1 of the North Valmy Power Plant in Nevada in 2019, with Unit 2 closing in 2025, amid regional coal unit retirements debates. The units had been slated for closure in 2031 and 2035, respectively.

If approved by the Idaho Public Utilities Commission, the settlement would increase base rates by approximately $13.3 million, or 1.17 percent, in order to allow the company to recover its investment in the plant on an accelerated basis.

That equates to an additional $1.20 on the monthly bill of the typical residential customer using 1,000 kilowatt-hours of energy per month.

Idaho Power, which co-owns the plant with NV Energy, maintains that closing Valmy early rather than continuing to operate it until it is fully depreciated in 2035, will ultimately save customers $103 million in today's dollars.

The company said a significant decrease in market prices for electricity has made it uneconomic to operate the plant except during extremely cold or hot weather, when the demand for energy peaks, a trend underscored by transactions involving the San Juan Generating Station deal elsewhere. The company also said plant balances have increased by approximately $70 million since its last general rate case in 2011, due to routine maintenance and repairs, as well as investments required to meet environmental regulations.

The proposed settlement reflects a number of changes to Idaho Power's original proposal regarding Valmy, and comes in the wake of discussions with interested parties in February and April, against the backdrop of a broader energy debate over plant closures and reliability.

In its initial application, filed in October, Idaho Power proposed closing both units in 2025. The original proposal would have increased base rates by $28.5 million, or about 2.5 percent, in order to allow the company to recover its costs associated with the plant's accelerated depreciation, decommissioning and anticipated investments, with cautionary examples such as the Kemper power plant costs illustrating potential risks.

Concurrently, Idaho Power asked for commission approval to adjust depreciation rates for its other plants and equipment based on the result of a study it conducts every five years, as outlined in Case IPC-E-16-23. The adjustment would have led to a $6.7 million increase to base rates.

The two requests filed in October would have increased customer costs by a total of $35.2 million or 3.1 percent, leading to a $3.08 increase on the bills of the typical residential customer who uses 1,000 kilowatt-hours per month.

The proposed settlement submitted to the Commission on May 4 calls for $13,285,285 to be recovered from all customer classes through base rates until 2028, all related to the Valmy shutdown. That is an increase of 1.17 percent and would result in a $1.20 increase on the bills of the typical residential customer who uses 1,000 kilowatt-hours per month.

Related News

Clean energy's dirty secret

Renewable Energy Market Reform aligns solar and wind with modern grid pricing, tackling intermittency via batteries and demand response, stabilizing wholesale power prices, and enabling capacity markets to finance flexible supply for deep decarbonization.

Key Points

A market overhaul that integrates variable renewables, funds flexibility, and stabilizes grids as solar and wind grow.

✅ Dynamic pricing rewards flexibility and demand response

✅ Capacity markets finance reliability during intermittency

✅ Smart grids, storage, HV lines balance variable supply

ALMOST 150 years after photovoltaic cells and wind turbines were invented, they still generate only 7% of the world’s electricity. Yet something remarkable is happening. From being peripheral to the energy system just over a decade ago, they are now growing faster than any other energy source and their falling costs are making them competitive with fossil fuels. BP, an oil firm, expects renewables to account for half of the growth in global energy supply over the next 20 years. It is no longer far-fetched to think that the world is entering an era of clean, unlimited and cheap, abundant electricity for all. About time, too.

There is a $20trn hitch, though. To get from here to there requires huge amounts of investment over the next few decades, to replace old smog-belching power plants and to upgrade the pylons and wires that bring electricity to consumers. Normally investors like putting their money into electricity because it offers reliable returns. Yet green energy has a dirty secret. The more it is deployed, the more it lowers the price of power from any source. That makes it hard to manage the transition to a carbon-free future, during which many generating technologies, clean and dirty, need to remain profitable if the lights are to stay on. Unless the market is fixed, subsidies to the industry will only grow.

Policymakers are already seeing this inconvenient truth as a reason to put the brakes on renewable energy. In parts of Europe and China, investment in renewables is slowing as subsidies are cut back, even as Europe’s electricity demand continues to rise. However, the solution is not less wind and solar. It is to rethink how the world prices clean energy in order to make better use of it.

Shock to the system

At its heart, the problem is that government-supported renewable energy has been imposed on a market designed in a different era. For much of the 20th century, electricity was made and moved by vertically integrated, state-controlled monopolies. From the 1980s onwards, many of these were broken up, privatised and liberalised, so that market forces could determine where best to invest. Today only about 6% of electricity users get their power from monopolies. Yet everywhere the pressure to decarbonise power supply has brought the state creeping back into markets. This is disruptive for three reasons. The first is the subsidy system itself. The other two are inherent to the nature of wind and solar: their intermittency and their very low running costs. All three help explain why power prices are low and public subsidies are addictive.

First, the splurge of public subsidy, of about $800bn since 2008, has distorted the market. It came about for noble reasons—to counter climate change and prime the pump for new, costly technologies, including wind turbines and solar panels. But subsidies hit just as electricity consumption in the rich world was stagnating because of growing energy efficiency and the financial crisis. The result was a glut of power-generating capacity that has slashed the revenues utilities earn from wholesale power markets and hence deterred investment.

Second, green power is intermittent. The vagaries of wind and sun—especially in countries without favourable weather—mean that turbines and solar panels generate electricity only part of the time. To keep power flowing, the system relies on conventional power plants, such as coal, gas or nuclear, to kick in when renewables falter. But because they are idle for long periods, they find it harder to attract private investors. So, to keep the lights on, they require public funds.

Everyone is affected by a third factor: renewable energy has negligible or zero marginal running costs—because the wind and the sun are free. In a market that prefers energy produced at the lowest short-term cost, wind and solar take business from providers that are more expensive to run, such as coal plants, depressing wholesale electricity prices, and hence revenues for all.

Get smart

The higher the penetration of renewables, the worse these problems get—especially in saturated markets. In Europe, which was first to feel the effects, utilities have suffered a “lost decade” of falling returns, stranded assets and corporate disruption. Last year, Germany’s two biggest electricity providers, E.ON and RWE, both split in two. In renewable-rich parts of America, power providers struggle to find investors for new plants, reflecting U.S. grid challenges that slow a full transition. Places with an abundance of wind, such as China, are curtailing wind farms to keep coal plants in business.

The corollary is that the electricity system is being re-regulated as investment goes chiefly to areas that benefit from public support. Paradoxically, that means the more states support renewables, the more they pay for conventional power plants, too, using “capacity payments” to alleviate intermittency. In effect, politicians rather than markets are once again deciding how to avoid blackouts. They often make mistakes: Germany’s support for cheap, dirty lignite caused emissions to rise, notwithstanding huge subsidies for renewables. Without a new approach the renewables revolution will stall.

The good news is that new technology can help fix the problem. Digitalisation, smart meters and batteries are enabling companies and households to smooth out their demand—by doing some energy-intensive work at night, for example. This helps to cope with intermittent supply. Small, modular power plants, which are easy to flex up or down, are becoming more popular, as are high-voltage grids that can move excess power around the network more efficiently, aligning with common goals for electricity networks worldwide.

The bigger task is to redesign power markets to reflect the new need for flexible supply and demand. They should adjust prices more frequently, to reflect the fluctuations of the weather. At times of extreme scarcity, a high fixed price could kick in to prevent blackouts. Markets should reward those willing to use less electricity to balance the grid, just as they reward those who generate more of it. Bills could be structured to be higher or lower depending how strongly a customer wanted guaranteed power all the time—a bit like an insurance policy. In short, policymakers should be clear they have a problem and that the cause is not renewable energy, but the out-of-date system of electricity pricing. Then they should fix it.

Related News

Building Energy Celebrates the Beginning of Operations and Electricity Generation

Building Energy Iowa Wind Farm delivers 30 MW of renewable energy near Des Moines, generating 110 GWh annually with wind turbines, a long-term PPA, CO2 reduction, and community benefits like jobs and clean power.

Key Points

Building Energy Iowa Wind Farm is a 30 MW project generating 110 GWh a year, cutting CO2 and supporting local jobs.

✅ 30 MW capacity, 10 onshore turbines (3 MW each)

✅ ~110 GWh per year; power for 11,000 households

✅ Long-term PPA; jobs and emissions reductions in Iowa

With 110 GWh generated per year, the plant will be beneficial to Iowa's environment, reflecting broader Iowa wind power investment trends, contributing to the reduction of 100,000 tons of CO2 emissions, as well as providing economic benefits to host local communities.

Building Energy SpA, multinational company operating as a global integrated IPP in the Renewable Energy Industry, amid milestones such as Enel's 450 MW U.S. wind project, through its subsidiary Building Energy Wind Iowa LLC, announces the inauguration of its first wind farm in Iowa, which adds up to 30 MW of wind distribution generation capacity. The project, located north of Des Moines, in Story, Boone, Hardin and Poweshiek counties, will generate approximately 110 GWh per year. The beginning of operations has been celebrated on the occasion of the Wind of Life event in Ames, Iowa, in the presence of Andrea Braccialarghe, MD America of Building Energy, Alessandro Bragantini, Chief Operating Officer of Building Energy and Giuseppe Finocchiaro, Italian Consul General.

The overall investment in the construction of the Iowa distribution generation wind farms amounted to $58 million and it sells its energy and related renewable credits under a bundled, long-term power purchase agreement with a local utility, reflecting broader utility investment trends such as WEC Energy's Illinois wind stake in the region.

The wind facility, developed, financed, owned and operated by Building Energy, consists of ten 3.0 MW geared onshore wind turbines, each with a rotor diameter of 125 meters mounted on an 87.5 meter steel tower. The energy generated will satisfy the energy needs of 11,000 U.S. households every year, similar in community impact to North Carolina's first wind farm, while avoiding the emission of about 70,000 tons of CO2 emissions every year, according to US Environmental Protection Agency methodology, which is equivalent to taking 15,000 cars off the road each year.

Besides the environmental benefits, the wind farm also has advantages for the local community, providing it with clean energy and creating jobs for local Iowans. The project involved more than a hundred of local skilled workers during the construction phase. Some of those jobs will be also permanent as necessary for the operation and maintenance activities as well as for additional services such as delivery, transportation, spare parts management, landscape mitigation, and further environmental monitoring studies.

The Company is present in many US states since 2013 with more than 500 MW of projects under development, spread across different renewable energy technologies, and aligning with federal initiatives like DOE wind energy awards that support innovation.

Related News

Asset Management Firm to Finance Clean Coal Technologies Inc.

Clean Coal Technologies Pristine Funding secures investment from a New York asset manager via Black Diamond, advancing commercialization, Tulsa testing, Wyoming relocation, PRB coal enhancement, and cleaner energy innovation to support global coal exports.

Key Points

Capital from a New York asset manager backs Pristine commercialization, testing, and Wyoming relocation to boost PRB coal.

✅ Investment via Black Diamond funds Tulsa test operations.

✅ Permanent relocation planned near a Wyoming mine site.

✅ First Pristine M module to enhance PRB coal quality.

Clean Coal Technologies, Inc., an emerging cleaner-energy company utilizing patented and proven technology to convert untreated coal into a cleaner burning and more efficient fuel, announced today that the company has secured funding for their Pristine technology through commercialization, a move reminiscent of Bruce C project funding activity, from a major New York-based Asset Management company. This investment will be made through Black Diamond with all funds earmarked for test procedures at the plant near Tulsa, OK, at a time when rare new coal plants are appearing, and the plant's move to a permanent location in Wyoming. The first tranche is being paid immediately.

"Securing this investment will confidently carry us through to the construction of our first commercial module enabling management to focus on the additional tests that have been requested from multiple parties, even as US coal demand faces headwinds across the market," stated CEO of Clean Coal Technologies, Inc., Robin Eves. "At this time we have begun scheduling plant visits with both US government agency and coal industry officials along with key international energy consortiums that are monitoring transitions such as Alberta's coal phaseout policies."

"We're now able to finalize our negotiations in Wyoming where the permitting process has begun and where we will permanently relocate the test facility later this year following completion of the aforementioned tests," added CCTI COO/CFO, Aiden Neary. "This event also paves the way forward to commence the process of constructing the first commercial Pristine M facility. That plant is planned to be in Wyoming near an operating mine where our process can be used to enhance the quality of PRB coal to make it more competitive globally, even as regions like western Europe see coal-to-renewables conversions at legacy plants, and help restore the US coal export market."

Related News

Aboitiz receives another award for financing for its Tiwi and Makban geothermal plant

AP Renewables Inc. Climate Bond Award recognizes Asia-Pacific project finance, with ADB and CNBC citing the first Climate Bond, geothermal refinancing in local currency, and CGIF-backed credit enhancement for emerging markets.

Key Points

An award for APRI's certified Climate Bond, highlighting ADB-backed financing and geothermal assets across Asia-Pacific.

✅ First Climate Bond for a single project in an emerging market

✅ ADB credit enhancement and CGIF risk participation

✅ Refinanced Tiwi and MakBan geothermal assets via local currency

The Asian Development Bank (ADB) and CNBC report having given the Best Project For Corporate Finance Transaction award to a the renewable energy arm of Aboitiz Power, AP Renewables Inc. (APRI), for its innovative and impactful solutions to key development challenges.

In March 2016, APRI issued a local currency bond equivalent to $225 million to refinance sponsor equity in Tiwi and MakBan. ADB said it provided a partial credit enhancement for the bond as well as a direct loan of $37.7 million, a model also seen in EIB long-term financing for Indian solar projects.

The bond issuance was the first Climate Bond—certified by the Climate Bond Initiative—in Asia and the Pacific and the first ever Climate Bond for a single project in an emerging market.

“The project reflects APRI’s commitment to renewable energy, as outlined in the IRENA report on decarbonising energy in the region,” ADB said in a statement posted on its website.

The project also received the 2016 Bond Deal of the Year by the Project Finance International magazine of Thomson Reuters, Asia Pacific Bond Deal of the Year from IJGlobal and the Best Renewable Deal of the Year by Alpha Southeast Asia, reflecting momentum alongside large-scale energy projects in New York reported elsewhere.

ADB’s credit enhancement was risk-participated by the Credit Guarantee Investment Facility (CGIF), a multilateral facility established by Asean + 3 governments and ADB to develop bond markets in the region.

APRI is a subsidiary of AboitizPower, one of Philippines’ biggest geothermal energy producers, and the IRENA study on the Philippines' electricity crisis provides broader context as it owns and operates the Tiwi and Makiling Banahaw (MakBan) geothermal facilities, the seventh and fourth largest geothermal power stations in the world, respectively.

“The awards exemplify the ever-growing importance of the private sector in implementing development work in the region,” ADB’s Private Sector Operations Department Director General Michael Barrow said.

“Our partners in the private sector provide unique solutions to development challenges — from financing to technical expertise — and today’s winners are perfect examples of that,” he added.

The awarding ceremony took place in Yokohama, Japan during an event co-hosted by CNBC and ADB at the 50th Annual Meeting of ADB’s Board of Governors.

The awards focus on highly developmental transactions and underline the important work ADB clients undertake in developing countries in Asia and the Pacific.

Related News

African Development Bank examines Senegal coal-fired power plant

Sendou Coal Plant Compliance Review examines AfDB oversight in Senegal's Bargny, addressing environmental and social safeguards, public consultation, resettlement concerns, air pollution, coastal erosion, SENELEC grid impacts, and CES implementation of ESAP.

Key Points

An AfDB review assessing environmental, social, and consultation compliance at Senegal's Sendou coal plant in Bargny.

✅ Independent experts to investigate community complaints.

✅ Focus on air pollution, coastal erosion, livelihoods, resettlement.

✅ Actions by SENELEC and CES under a social action plan.

The Board of Directors of the African Development Bank Group approved the eligibility assessment for compliance review of the Bank-financed 125-MW Sendou coal-fired power plant project in the village of Bargny Minam in Senegal, which at 125 MW contrasts with Quebec's 1,000 MW authorizations for industrial projects.

Independent experts will carry out further investigations to clarify issues raised by two groups of residents from the community of Bargny.

Both groups raised questions over government policy and the National Code of the Environment, and the potential vulnerability of communities and a heritage site to air pollution, coastal erosion and the disruption of livelihoods. The groups expressed concern over the level of public consultation which had taken place around the project, and over the Bank's environmental, social and human rights standards. In particular, they feared that no resettlement plan had been prepared to mitigate any potential negative social impacts of the project.

“Having received these complaints, which it takes extremely seriously, the Bank has decided to further investigate them,” said Pierre Guislain, Vice-President for Private Sector, Infrastructure and Industrialization at the AfDB.

“At the outset of the project, the Bank carried out in-depth due diligence, and registered many of these important elements in its environmental and social action plan for the project – a plan which is now being carried out by the company managing the project, Compagnie d'Electricité du Sénégal (CES).”

Guislain confirmed that the Bank will continue to follow up on issues raised, including concerns over the potential of disrupted livelihoods for women and other seasonal and temporary workers who dry and package fish, and at complaints over land plots that may have been reclaimed by Government without compensation.

“We last reported to the Board in September 2016 and hope to do so again towards the second semester of 2017. The Bank takes its social and environmental responsibility extremely seriously,” he said.

Working in close collaboration with the Bank, SENELEC and the Project Company CES proactively undertook several actions since the month of July 2016 to significantly enhance the Project surrounding communities' social benefits and living conditions during both the construction and operation phases. A social action plan, part of a tripartite agreement between SENELEC, CES and the Bargny municipality signed in March 2017, was set up alongside an implementation and follow up committee representative of the local population.

The project was approved by the Board in 2009 at a cost of €206 million, far below the overruns at the Kemper power plant in Mississippi, which the Bank co-finances with the Banque Ouest Africaine de Développement (BOAD), the Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), and Compagnie Bancaire de l'Afrique de l'Ouest (CBAO). AfDB's financing comprises a senior loan of €55 million, and a supplementary loan of €5 million.

The project is being developed on a “build, own, and operate” basis and aims to supply up to 40% of Senegal's electricity. Senegal currently generates 80% of its electricity from diesel-fueled power. The Government of Senegal has developed a strategy for diversifying and increasing domestic power generation capacity, similar to efforts where Cape Town builds its own power plants and buys additional electricity, with a combination of conventional thermal base load and renewable energy. Sendou is the first coal-fired plant in Senegal.

The coal will be imported via sea and unloaded at Dakar harbour, from where it will be transported by truck to the coal storage site on the plant. The project aims at producing at least 925 GWh of electricity a year. The power, alongside supply from a Turkish LNG powership operating in Senegal, will be delivered to the national interconnected grid system of SENELEC, Senegal's public electricity utility company.

The project includes the development, design, procurement, construction, operation and maintenance of the 22-hectare site. Power production can be expanded to 250 MW through a second phase project, for which project preparation has not yet started. The project will also build a 1.6-km 225 kV transmission line, reflecting regional investment in grid hardware such as a new electricity poles plant in South Sudan, and associated switchyard to connect the plant to SENELEC.

Related News

Are solar and wind really killing coal, nuclear and grid reliability?

Renewable Energy Impact on Coal and Nuclear examines how wind, solar, and cheap natural gas reshape baseload economics, market design, and grid reliability, improving operations where modernized regulations and flexible generation balance variable output.

Key Points

Wind and solar and cheap gas erode coal and nuclear economics, while grids sustain reliability and cut emissions.

✅ Cheap natural gas undercuts aging coal plants.

✅ Variable renewables lower prices and emissions.

✅ Modern grid rules enhance flexibility and reliability.

U.S. Secretary of Energy Rick Perry in April requested a study to assess the effect of renewable energy policies on nuclear and coal-fired power plants.

Some energy analysts responded with confusion as the subject has been extensively studied by grid operators and the Department of Energy’s own national labs, alongside discussions of clean energy's hidden tradeoffs in broader debates. Others were more critical, saying the intent of the review is to favor the use of nuclear and coal over renewable energy sources.

So, are wind and solar killing coal and nuclear? Yes, but not by themselves and not for the reasons most people think. Are wind and solar killing grid reliability? No, not where the grid’s technology and regulations have been modernized to enhance grid resilience across operations. In those places, overall grid operation has improved, not worsened.

To understand why, we need to trace the path of electrons from the wall socket back to power generators and the markets and policies that dictate that flow. As energy scholars based in Texas – the national leader in wind – we’ve seen these dynamics, and renewables' growing share shape markets over the past decade, including when Perry was governor.

Wrong question

There has been a lot of ink spilled on why coal is in trouble. A quick recap: Natural gas is plentiful and cheap. Our coal fleet is old and depreciated. Energy use in the U.S. has flatlined, so there’s less financial incentive to build big new power plants.

Part of Perry’s review is aimed at establishing how wind and solar, which are variable sources of power, and help explain why the grid isn’t 100% renewable yet under present constraints, are affecting so-called baseload sources – the power plants that provide the steady flow of electricity needed to meet the minimum demand.

Posing the question whether wind and solar are killing baseload generators, including coal plants, reveals an antiquated mindset about power markets that hasn’t been relevant in many places for at least a decade. It would be similar to asking in the late 1990s whether email was killing fax machines and snail mail. The answer would have been an unequivocal “yes” followed by cheers of “hallelujah” and “it’s about time” because both had bumped into the limits of their utility. How quickly 1990s consumers leaped to something faster, less impactful and cheaper than the older approach was a sign that they were ready for it.

Something similar is happening in today’s power markets, as customers again choose faster, less impactful, cheaper options – supported by falling wholesale electricity prices – namely wind, solar and natural gas plants that quickly boost or cut their output – as opposed to clinging to the outdated, lumbering options developed decades before. Even the Department of Energy’s own analysis states that “many of the old paradigms that govern the (electricity) sector are also evolving.”

Wind and solar are making older generators less viable because their low, stable prices and emissions-free operation are desirable. And they aren’t hurting grid reliability the way critics had assumed because other innovations have happened simultaneously.

Related News

Gas could be the most expensive, least reliable path to grid stability

Grid Inertia and Stability underpin synchronous generation, frequency control, and voltage resilience, with virtual inertia, fast governor response, and hydro ramping mitigating oscillations when gas turbines or large generators trip or interconnectors fail.

Key Points

Grid inertia and stability show how synchronous assets resist frequency swings and damp oscillations in AC grids.

✅ Synchronous machines and loads collectively stiffen system frequency.

✅ Fast governor, hydro ramps, and virtual inertia arrest deviations.

✅ Excess inertia is costly; smart controls can replace part of it.

The discussion on inertia and synchronous generation is rather confused. Inertia is necessary because it provides stability to the grid. “Strength” and “stiffness” are terms that are used to show that lots of rotating inertia is “good’ or even essential to a stable grid. Because it was free it is often assumed that the system needs as much generator inertia as it always had, though some argue for keeping electricity options open to manage reliability during transition.

But inertia is just one way to supply stability and it can be argued that beyond more than a certain minimum level, generator inertia is an expensive and anachronistic way of providing stability.

Stability is required to protect timing circuits, minimise mechanical loads on motors and generators caused by changing speed, prevent overheating of inductive loads like AC motors and most of all to prevent voltage/frequency oscillations after fast changes in load or generation e.g. from a loss of a connection or generator or even start-up of all the hot water services at 10PM.

Inertia is one simple way of providing stability because the rotating mass of the generators absorbs or disburses energy by small changes in speed.

While the inertia of turbines is large, it is only useful as a store of energy if you can use it. Most of the energy stored in a rotating turbo-generator is unavailable because the energy is 1/2Jω2 where ω is the angular velocity and J the rotary inertia. As the angular velocity is only supposed to vary by 0.15Hz in 50Hz you can only use 0.6% (49.85/50)2 of the inertia in the system to stabilise the load. Even if a 1Hz short term deviation is allowed it is still only 4% of the system inertia.

The key to stability is not so much the inertia itself but the synchronous nature of an AC system which locks all the turbines and loads together at the same frequency, thus inertia is not just that of one generator but all the synchronous generators, the capacitance of the transmission and distribution network and even all the AC motors and loads on the load side. These later contributors are still there, even if some of the generation is no longer synchronous, and recent low-carbon electricity lessons emphasize system-level coordination.

The downside of inertia is that once it is given up it must be replaced. So, if system frequency falls by 1Hz, to recover the frequency a large fraction of the output response from the remaining generators is used just to spin all the generators and loads back up to speed rather than just supply lost power to the grid. In the best case, it will prolong the frequency disturbance. In worst case the extended frequency deviation will trigger protection circuits and more widespread faults.

In a conventional system inertia provides the first 0.1-10 seconds of load disturbance response and it was free. A steam plant is quite good for the next 3-6 seconds after a disturbance because there is a quantity of steam in the steam chest which can be released quickly.

If the lost generation stays off line steam is then limited because it has slow ramping after that first steam dump. Hydro comes up after 20-150 seconds but has excellent stability and very fast ramps, especially in pumped storage hydro configurations where response is rapid. The combination of inertia of water in the penstock and rotary inertia of the generator gives very stable ramping and for large scale power changes, hydro seems to offer the best combination of ramp rate and stability.

Gas turbines respond quite well after 8-30 seconds, then ramp quickly if they don’t stall or oscillate which they are prone to do at low loads. It is clear that “the straw that broke the camel’s back” in the SA blackout was the failure of gas turbine generators at the Quarantine station to respond properly to rapidly increasing demand, a contrast to California shutdowns that raised questions about grid management practices.

However, even if inertia is seen as desirable at the plant level, gas turbine plants have no more inertia per MW than wind and many of them are operated slaved to the largest generator(s) because it is simpler and more efficient, and recent moves like new Ontario gas plants aim to boost capacity.

But if the key large generator(s) are for some reason isolated from the grid, the gas turbines will sag under the increased load and they will have limited mechanism or perhaps, if they are already at full load, even capacity, to respond. So, within fractions of a second their frequency will start to fall just as quickly as a group of wind turbines.

Even if governor response is fast, maximum stable ramp rates are around 5-10% per minute usually starting at less than that (they tend to have S shaped response curves) Gas turbines have another weakness which means that their inertia is of less value to the grid.

If frequency falls the compressors slow down reducing compression ratio and thus power so even more so more of the governor response is needed just to compensate for reduced air flow.

Related News

Yale Report on Western Grid Integration: Just Say Yes

Western Grid Integration aligns CAISO with a regional transmission operator under FERC oversight, boosting renewables, reliability, and cost savings while respecting state energy policy, emissions goals, and utility regulation across the West.

Key Points

Western Grid Integration lets CAISO operate under FERC to cut costs, boost reliability, and accelerate renewables.

✅ Lowers wholesale costs via wider dispatch and resource sharing

✅ Improves reliability with regional balancing and reserves

✅ Preserves state policy authority under FERC oversight

A strong and timely endorsement for western grid integration forcefully rebuts claims that moving from a balkanized system with 38 separate entities to a regional operation could introduce environmental problems, raise costs, or, as critics warn, export California’s energy policies to other western states, or open state energy and climate policies to challenge by federal regulators. In fact, Yale University’s Environmental Protection Clinic identifies numerous economic and environmental benefits from allowing the California Independent System Operator to become a regional grid operator.

The groundbreaking report comprehensively examines the policy and legal merits of allowing the California Independent System Operator (CAISO) to become a regional grid operator, open to any western utility or generator that wants to join, as similar market structure overhauls proceed in New England.

The Yale report identifies the increasing constraints that today’s fragmented western grid imposes on system-wide electricity costs and reliability, addresses the potential benefits of integration, and evaluates potential legal risks for the states involved. California receives particular attention because its legislature is considering the first step in the grid integration process, which involves authorizing the CAISO to create a fully independent board, even as it examines revamping electricity rates to clean the grid (other western states are unlikely to approve joining an entity whose governance is determined solely by California’s governor and legislature, as is the case now).

Elements of the report

The analysis examined all of California’s key energy and climate policies, from its cap on carbon emissions to its renewable energy goals and its pollution standards for power plants, and concludes that none would face additional legal risks under a fully integrated western grid. The operator of such a grid would be regulated by an independent federal agency (the Federal Energy Regulatory Commission)—but so is the CAISO itself, now and since its inception, by virtue of its extended involvement in interstate electricity commerce throughout the West.

And if empowered to serve the entire region, the CAISO would not interfere with the longstanding rights of California and other states to regulate their utilities’ investments or set energy and climate policies. The study points out that grid operators don’t set energy policies for the states they serve; they help those states minimize costs, enhance reliability in the wake of California blackouts across the state, and avoid unnecessary pollution.

And as to whether an integrated grid would help renewable energy or fossil fuels, the report finds that renewable resources would be the inevitable winners, thanks to their lower operating costs, although the most important winners would be western utility customers, through lower bills, expanded retail choice options, and improved reliability.

Call to action

The Yale report concludes with what amounts to a call to action for California’s legislators:

“In sum, enhanced Western grid integration in general, and the emergence of a regional system operator in particular, would not expose California’s clean energy policies to additional legal risks. Shifting to a regional grid operator would enable more efficient, affordable and reliable integration of renewable resources without increasing the legal risk to California’s clean energy policies.”

The authors of the analysis, from the Yale Law School and the Yale School of Forestry and Environmental Studies, are Juliana Brint, Josh Constanti, Franz Hochstrasser. and Lucy Kessler. They dedicated months to the project, consulted with a diverse group of reviewers, and made the trek from New Haven to Folsom, CA, to visit the California Independent System Operator and interview key staff members.

Related News

Secret Liberal cabinet document reveals Electricity prices to soar

Ontario Hydro Rate Relief Plan delivers short-term electricity bill cuts, while leaked cabinet forecasts show inflation-linked hikes, borrowing costs, and a Clean Energy Adjustment under the province's long-term energy plan.

Key Points

A provincial plan that cuts bills now but defers costs, projecting rate hikes and adding a Clean Energy Adjustment.

✅ 25% cut now, after 8% HST relief; extra 17% reduction applied.

✅ Forecast: inflation-linked hikes later; borrowing adds long-term costs.

✅ Clean Energy Adjustment line to repay deferred system costs.

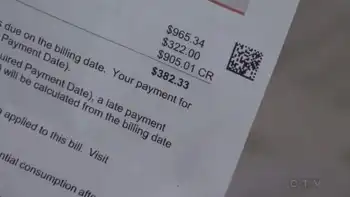

The short-term gain of a 25 per cent hydro rate cut this summer could lead to long-term pain as a leaked cabinet document forecasts prices jumping again in five years.

In the briefing materials leaked and obtained by the Progressive Conservatives, rates will start rising 6.5 per cent a year in 2022 and top out at 10.5 per cent in 2028, when average monthly bills hit $215.

That would be up from $123 this year once the rate cut — the subject of long-awaited legislation to lower electricity rates unveiled Thursday by Energy Minister Glenn Thibeault — takes full effect. There will be another 17-per-cent cut in addition to the 8 per cent taken off bills in January when the provincial portion of the HST was waived.

The leaked papers overshadowed Thibeault’s efforts to tout the price break, which will be followed with four years of hydro rate increases at 2 per cent, roughly the rate of inflation.

Thibeault charged that the Conservatives used an “outdated” document to distract from the fact that they are the only major party without a plan for dealing with skyrocketing hydro rates, with a year to go until next June’s provincial election.

“It’s not a coincidence,” he told reporters, denying any plans for an eventual 10.5-per-cent rate hike and promising the government’s new long-term energy plan, due in a few months, will have better numbers.

“We are working hard right now to continue to pull costs out of the system.”

Opposition parties said the Liberal plan doesn’t deal with the underlying problems that have made electricity expensive and simply borrows money to spread the costs over a longer period of time, with $25 billion in interest charges over 30 years.

Some observers also noted that a deal with Quebec would not reduce hydro bills, highlighting concerns about lasting affordability.

“The price of electricity is going to skyrocket after the next election,” warned Conservative MPP Todd Smith (Prince Edward—Hastings).

“The government isn’t being honest with the people of Ontario when it comes to the price of electricity.”

The documents show average monthly bills peaking at $231 in the year 2047, before falling back to $210 the following year once the 30 years of interest payments are over.

Conservative sources say they obtained the papers stamped “confidential cabinet document” from a whistleblower after Thibeault’s rate cut plan was presented to cabinet ministers at a meeting in early March.

There is no date on the document, which the energy minister alternately dismissed as “inaccurate” or possibly one of many that have been prepared with different options in mind.

“We’ve had hundreds of briefings with hundreds of documents … I can’t comment on one graph when we’ve been looking at hundreds of scenarios.”

New Democrats, who have proposed a scheme to cut rates, if elected, also called the government plan an election ploy with Liberals lagging in the polls.

“We’re going to take on a huge debt so (Premier) Kathleen Wynne can look good on the hustings in the next few months, and for decades we’re going to pay for it,” said MPP Peter Tabuns (Toronto-Danforth).

Thibeault acknowledged the Liberal plan will start repaying borrowed money in the mid- or late 2020s and it will show up separately on hydro bills as the “Clean Energy Adjustment”, a kind of electricity recovery rate that could raise costs.

Related News

Ontario tables legislation to lower electricity rates

Ontario Clean Energy Adjustment lowers hydro bills by shifting global adjustment costs, cutting time-of-use rates, and using OPG debt financing; ratepayers get inflation-capped increases for four years, then repay costs over 20 years.

Key Points

A 20-year line item repaying debt used to lower rates for 10 years by shifting global adjustment costs off hydro bills.

✅ 17% average bill cut takes effect after royal assent

✅ OPG-managed entity assumes debt for 10 years

✅ 20-year surcharge repays up to $28B plus interest

Ontarians will see lowered hydro bills for the next 10 years, but will then pay higher costs for the following 20 years, under new legislation tabled Thursday.

Ten weeks after announcing its plan to lower hydro bills, the Liberal government introduced legislation to lower time-of-use rates, take the cost of low-income and rural support programs off bills, and introduce new social programs.

It will lower time-of-use rates by removing from bills a portion of the global adjustment, a charge consumers pay for above-market rates to power producers. For the next 10 years, a new entity overseen by Ontario Power Generation will take on debt to pay that difference.

Then, the cost of paying back that debt with interest -- which the government says will be up to $28 billion -- will go back onto ratepayers' bills for the next 20 years as a "Clean Energy Adjustment."

An average 17-per-cent cut to bills will take effect 15 days after the hydro legislation receives royal assent, even as a Nov. 1 rate increase was set by the Ontario Energy Board, but there are just eight sitting days left before the Ontario legislature breaks for the summer. Energy Minister Glenn Thibeault insisted that leaves the opposition "plenty" of time for review and debate.

Premier Kathleen Wynne promised to cut hydro bills and later defended a 25% rate cut after widespread anger over rising costs helped send her approval ratings to record lows.

Electricity bills in the province have roughly doubled in the last decade, due in part to green energy initiatives, and Thibeault said the goal of this plan is to better spread out those costs.

"Like the mortgage on your house, this regime will cost more as we refinance over a longer period of time, but this is a more equitable and fair approach when we consider the lifespan of the clean energy investments, and generating stations across our province," he said.

NDP critic Peter Tabuns called it a "get-through-the-election" next June plan.

"We're going to take on a huge debt so Kathleen Wynne can look good on the hustings in the next few months and for decades we're going to pay for it," he said.

The legislation also holds rate increases to inflation for the next four years. After that, they'll rise more quickly, as illustrated by a leaked cabinet document the Progressive Conservatives unveiled Thursday.

The Liberals dismissed the document as containing outdated projections, but confirmed that it went before cabinet at some point before the government decided to go ahead with the hydro plan.

From about 2027 onward -- when consumers would start paying off the debt associated with the hydro plan -- Ontario electricity consumers will be paying about 12 per cent more than they would without the Liberal government's plan to cut costs in the short term, even though a deal with Quebec was not expected to reduce hydro bills, the government document projected.

But that was just one of many projections, said Energy Minister Glenn Thibeault.

"We have been working on this plan for months, and as we worked on it the documents and calculations evolved," he said.

The government's long-term energy plan is set to be updated this spring, and Thibeault said it will provide a more accurate look at how the hydro plan will reduce rates, even as a recovery rate could lead to higher hydro bills in certain circumstances.

Progressive Conservative critic Todd Smith said the "Clean Energy Adjustment" is nothing more than a revamped debt retirement charge, which was on bills from 2002 to 2016 to pay down debt left over from the old Ontario Hydro, the province's giant electrical utility that was split into multiple agencies in 1999 under the previous Conservative government.

"The minister can call it whatever he wants but it's right there in the graph, that there is going to be a new charge on the line," Smith said. "It's the debt retirement charge on steroids."

Related News

Manitoba has clean energy to help neighboring provinces

East-West Power Transmission Grid links provinces via hydroelectric interconnects, clean energy exports, and reliable grid infrastructure, requiring federal funding, multibillion-dollar transmission lines, and coordinated planning across Manitoba, Saskatchewan, Ontario, and Newfoundland.

Key Points

A proposed interprovincial grid to share hydro power, improve reliability, and cut emissions with federal funding.

✅ Hydroelectric exports from Manitoba to prairie and eastern provinces

✅ New interconnects and transmission lines require federal funding

✅ Enhances grid reliability and supports coal phase-out

Manitoba's energy minister is recharging the idea of building an east-west power transmission grid and says the federal government needs to help.

Cliff Cullen told the Energy Council of Canada's western conference on Tuesday that Manitoba has "a really clean resource that we're ready to share with our neighbours" as new hydro generation projects, including new turbines come online.

"This is a really important time to have that discussion about the reliability of energy and how we can work together to make that happen," said Cullen, minister of growth, enterprise and trade.

"And, clearly, an important component of that is the transmission side of it. We've been focused on transmission ... north and south, and we haven't had that dialogue about east-west."

Most hydro-producing provinces currently focus on exports to the United States, though transmission constraints can limit incremental deliveries.

Saskatchewan Energy Minister Dustin Duncan said his province, which relies heavily on coal-fired electricity plants, could be interested in getting electricity from Manitoba, even as a Manitoba Hydro warning highlights limits on serving new energy-intensive customers.

"They're big projects. They're multibillion-dollar projects," Duncan said after speaking on a panel with Cullen and Alberta Energy Minister Margaret McCuaig-Boyd.

"Even trying to do the interconnects to the transmission grid, I don't think they're as easy or as maybe low cost as we would just imagine, just hooking up some power lines across the border. It takes much more work than that."

Cullen said there's a lot of work to do on building east-west transmission lines if provinces are going to buy and sell electricity from each other. He suggested that money is a key factor.

"Each province has done their own thing in terms of transmission within their jurisdiction and we have to have that dialogue about how that interconnectivity is going to work. And these things don't happen overnight," he said.

"Hopefully the federal government will be at the table to have a look at that, because it's a fundamental expense, a capital expense, to connect our provinces."

The 2016 federal budget said significant investment in Canada's electricity sector will be needed over the next 20 years to replace aging infrastructure and meet growing demand for electricity, with Manitoba's demand potentially doubling over that period.

The budget allocated $2.5 million over two years to Natural Resources Canada for regional talks and studies to identify the most promising electricity infrastructure projects.

In April, the government told The Canadian Press that Natural Resources Canada has been talking with ministry representatives and electric utilities in the western and Atlantic provinces.

The idea of developing an east-west transmission grid has long been talked about as a way to bring energy reliability to Canadians.

At their annual meeting in 2007, Canada's premiers supported development and enhancement of transmission facilities across the country, although the premiers fell short of a firm commitment to an east-west energy grid.

Manitoba, Ontario and Newfoundland and Labrador are the most vocal proponents of east-west transmission, even as Quebec's electricity ambitions have reopened old wounds in Newfoundland and Labrador.

Manitoba and Newfoundland want the grid because of the potential to develop additional exports of hydro power, while Ontario sees the grid as an answer to its growing power needs.

Related News

BC's Kootenay Region makes electric cars a priority

Accelerate Kootenays EV charging stations expand along Highway 3, adding DC fast charging and Level 2 plugs to cut range anxiety for electric vehicles in B.C., linking communities like Castlegar, Greenwood, and the Alberta border.

Key Points

A regional network of DC fast and Level 2 chargers along B.C.'s Highway 3 to reduce range anxiety and boost EV adoption.

✅ 13 DC fast chargers plus 40 Level 2 stations across key hubs

✅ 20-minute charging stops reduce range anxiety on Highway 3

✅ Backed by BC Hydro, FortisBC, and regional districts

The Kootenays are B.C.'s electric powerhouse, and as part of B.C.'s EV push the region is making significant advances to put electric cars on the road.

The region's dams generate more than half of the province's electricity needs, but some say residents in the region have not taken to electric cars, for instance.

Trish Dehnel is a spokesperson for Accelerate Kootenays, a multi-million dollar coalition involving the regional districts of East Kootenay, Central Kootenay and Kootenay Boundary, along with a number of corporate partners including Fortis B.C. and BC Hydro.

She says one of the major problems in the region — in addition to the mountainous terrain and winter driving conditions — is "range anxiety."

That's when you're not sure your electric vehicle will be able to make it to your destination without running out of power, she explained.

Now, Accelerate Kootenays is hoping a set of new electric charging stations, part of the B.C. Electric Highway project expanding along Highway 3, will make a difference.

No more 'range anxiety'

The expansion includes 40 Level 2 stations and 13 DC Quick Charging stations, mirroring BC Hydro's expansion across southern B.C. strategically located within the region to give people more opportunities to charge up along their travel routes, Dehnel said.

"We will have DC fast-charging stations in all of the major communities along Highway 3 from Greenwood to the Alberta border. You will be able to stop at a fast-charging station and, thanks to faster EV charging technology, charge your vehicle within 20 minutes," she said.

Castlegar car salesman Terry Klapper — who sells the 2017 Chevy Bolt electric vehicle — says it's a great step for the region as sites like Nelson's new fast-charging station come online.

"I guarantee that you'll be seeing electric cars around the Kootenays," he said.

"The interest the public has shown … [I mean] as soon as people found out we had these Bolts on the lot, we've had people coming in every single day to take a look at them and say when can I finally purchase it."

The charging stations are set to open by the end of next year.

Related News

NL Consumer Advocate says 18% electricity rate hike 'unacceptable'

Newfoundland and Labrador electricity rate hike examines a proposed 18.6% increase under the PUB's Rate Stabilization Plan, driven by oil prices at Holyrood, with Consumer Advocate concerns over rate shock and use of RSP balances.

Key Points

A proposed 18.6% July 2017 increase under the RSP, driven by oil prices, now under PUB review for potential mitigation.

✅ PUB flags potential rate shock from proposed adjustment

✅ RSP balances cited to offset increases without depleting fund

✅ Oil-fired Holyrood volatility drives fuel cost uncertainty

How much of a rate hike is reasonable for users of electricity in Newfoundland and Labrador?

That's a question before the Public Utilities Board (PUB) as it examines an application by Newfoundland and Labrador Hydro, which could see consumers pay up to 18.6 per cent more as of July 1, reflecting regional pressures seen in Nova Scotia, where regulators approved a 14% rate hike earlier this year.

"The estimated rate increase for July 2017 is such a significant increase that it may be argued that it would cause rate shock," said the PUB, asking the company to revise its application.

NL Hydro said the price adjustment is part of what happens every year through the Rate Stabilization Plan (RSP), which is used to offset the ups and downs of oil prices.

"The cost of fuel is volatile and as long as we rely on oil-fired generation at Holyrood, customers will continue to be impacted by this electricity price uncertainty," said the company in a statement to CBC News.

It noted that customers received a break from RSP adjustments in 2015 and 2016, even as costs from the Muskrat Falls project begin to be reflected.

The PUB noted that under the rate stabilization plan, prices have gone up or down by about 10 per cent in the past.

The regulatory board said the impact of the latest request would be a 27.6 per cent hike to Newfoundland Power, with "an estimated average end customer impact of 18.6 per cent."

Hydro's estimates are based on an average price for oil of $81.40 per barrel from July 2017 to June 2018, according to the PUB.

'Unacceptable' burden: Consumer Advocate

"To burden ratepayers with an 18 per cent rate increase is unacceptable," said Consumer Advocate Dennis Browne, echoing pushback in Nova Scotia, where the premier urged regulators to reject a 14% hike at the time.

Browne is arguing that there is money in the RSP to reduce the proposed increase, including the possibility of a lump-sum bill credit for customers.

"These ratepayer balances — which, according to NL Power, totals $77.4 million — are not the property of Hydro," he wrote in a letter to the PUB.

"No utility has the right to squirrel away ratepayers' money to be used by that utility for some future purpose. The Board has jurisdiction over those balances," Browne said.

Browne also wants the RSP overhauled so that it can be applied to price fluctuations every quarter, as opposed to annually.

Hydro has expressed concern that depleting the rate stabilization fund would lead to other, more significant, rate increases in the future.

It said several alternatives to mitigate high rates have been provided to the PUB, which has final say, similar to how Manitoba Hydro scaled back a planned increase in the next year.

Related News

Alberta's electricity future blowin' in the wind

Alberta Wind Power underpins the province's clean energy shift with renewable electricity, wind turbines, competitive costs, and grid integration, as coal phase-out and CanWEA forecasts drive capacity, jobs, and export opportunities.

Key Points

Alberta Wind Power is the province's wind energy sector, delivering low-cost, low-carbon electricity as coal exits.

✅ Cheapest non-GHG electricity; costs rival natural gas.

✅ 1,479 MW from 901 turbines; room for rapid growth.

✅ Supports coal phase-out, jobs, exports, grid reliability.

Alberta has huge potential to produce clean energy from wind, and is considered a powerhouse for both green and fossil energy by many, but so far it is largely untapped, delegates to a conference on wind-generated electricity were told in Edmonton Tuesday.

Even though Alberta was the site of Canada's first commercial wind farm in 1993, it has fallen behind other provinces in wind power. Ontario is the top wind-power producer among provinces, followed by Quebec and then Alberta.

Right now, Alberta has 901 wind turbines with total capacity to generate 1,479 megawatts of electricity, about six per cent of electricity demand.

But with the province phasing out coal-generated electricity, there is big potential for growing the wind-power industry. The province is the largest market in Canada for new wind-power generating capacity.

"Wind is now a highly competitive source of non-greenhouse gas emitting electricity in Canada and along with natural gas, it's the cheapest source of electricity generation, period," Robert Hornung, president of the Canadian Wind Energy Association (CanWEA), told the organization's Alberta Summit conference.

Wind no longer a 'niche' energy source

Over the last 10 years, there's been more new wind generating electricity capacity built than any other form of generation, Hornung said.

"So it's really moved from being a niche source of energy like it was when Alberta got started, to now it's very much in the mainstream and one of the fastest growing sources of electricity in the world."

Even more traditional sources of electricity are getting on board with wind power, said Mark Salkeld, president and CEO of the Petroleum Services Association of Canada.

"It's business opportunity, absolutely," Salkeld said. "It's the entrepreneurial spirit of Albertans, of Canadians to see these opportunities. They're not being kicked and dragged into this energy mixed future. They're leading the charge."

Mix of energy sources needed

Canada needs a mix of different types of energy in the future, he said, especially given Alberta's limited hydro capacity today and regional constraints.

"We're going to need wind, we're going to need oil and gas, for generations yet to come."

CanWEA says Alberta's demand for energy from renewable, green sources is expected to triple to as much as 30 per cent in the next 15 years.

The industry is also looking at the possibility of one day selling renewable energy beyond Alberta, said Hornung.

He said wind power could provide a lot of benefits to the Alberta economy, including thousands of jobs over the coming years.

"That promises some real benefits for Albertans, the communities that host the projects, but Alberta overall in terms of new economic opportunities."