Electricity News in August 2017

Electricity sales in the U.S. actually dropped over the past 7 years

US Electricity Sales Decline amid population growth and GDP gains, as DOE links reduced per capita consumption to energy efficiency, warmer winters, appliances, and bulbs, while hotter summers and rising AC demand may offset savings.

Key Points

US electricity sales fell 3% since 2010 despite population and GDP growth, driven by efficiency gains and warmer winters.

✅ DOE links drops to efficiency and warmer winters

✅ Per capita residential use fell about 7% since 2010

✅ Rising AC demand may offset winter heating savings

Since 2010, the United States has grown by 17 million people, and the gross domestic product (GDP) has increased by $3.6 trillion. Yet in that same time span, electricity sales in the United States actually declined by 3%, according to data released by the U.S. Department of Energy (DOE), even as electricity prices rose at a 41-year pace nationwide.

The U.S. decline in electricity sales is remarkable given that the U.S. population increased by 5.8% in that same time span. This means that per capita electricity use fell even more than that; indeed, the Department of Energy pegs residential electricity sales per capita as having declined by 7%, even as inflation-adjusted residential bills rose 5% in 2022 nationwide.

There are likely multiple reasons for this decline in electricity sales. Department of Energy analysts suggest that, at least in part, it is due to increased adoption of energy-efficient appliances and bulbs, like compact fluorescents. Indeed, the DOE notes that there is a correlation between consumer spending on “energy efficiency” and a reduction in per capita electricity sales, while utilities invest more in delivery infrastructure to modernize the grid.

Yet the DOE also notes that states with a greater increase in warm weather days had a corresponding decrease in electricity sales, as milder weather can reduce power demand across years. In southern states, the effect was most dramatic: for instance, from 2010 to 2016, Florida had a 56% decrease in cold weather days that would require heating and as a result, saw a 9% decrease in per capita electricity sales.

The moral is that warm winters save on electricity. But if global temperatures continue to rise, and summers become hotter, too, this decrease in winter heating spending may be offset by the increased need to run air conditioning in the summer, and given how electricity and natural gas prices interact, overall energy costs could shift. Indeed, it takes far more energy to cool a room than it does to heat it, for reasons related to the basic laws of thermodynamics.

Related News

Parked Electric Cars Earn $1,530 From Europe's Power Grids

Vehicle-to-Grid Revenue helps EV owners earn income via V2G, demand response, and ancillary services by exporting stored energy, supporting grid balancing, smart charging, and renewable integration with two-way charging infrastructure.

Key Points

Income EV owners earn by selling battery power to the grid for balancing, response, and flexibility services.

✅ Earn up to about $1,530 annually in Denmark trials

✅ Requires V2G-compatible EVs and two-way smart chargers

✅ Provides ancillary services and supports renewable integration

Electric car owners are earning as much as $1,530 a year just by parking their vehicle and feeding excess power back into the grid, effectively selling electricity back to the grid under V2G schemes.

Trials in Denmark carried out by Nissan and Italy’s biggest utility Enel Spa showed how batteries inside electric cars could, using vehicle-to-grid technology, help balance supply and demand at times and provide a new revenue stream for those who own the vehicles.

Technology linking vehicles to the grid marks another challenge for utilities already struggling to integrate wind and solar power into their distribution system. As the use of plug-in cars spreads, grid managers will have to pay closer attention and, with proper management, to when motorists draw from the system and when they can smooth variable flows.

For example, California's grid stability efforts include leveraging EVs as programs expand.

“If you blindingly deploy in the market a massive number of electric cars without any visibility or control over the way they impact the electricity grid, you might create new problems,” said Francisco Carranza, director of energy services at Nissan Europe in an interview with Bloomberg New Energy Finance.

While the Tokyo-based automaker has trials with more than 100 cars across Europe, only those in Denmark are able to earn money by feeding power back into the grid. There, fleet operators collected about 1,300 euros ($1,530) a year using the two-way charge points, said Carranza.

Restrictions on accessing the market in the U.K. means the company needs to reach about 150 cars before they can get paid for power sent back to the grid. That could be achieved by the end of this year, he said.

“It’s feasible,” he said. “It’s just a matter of finding the appropriate business model to deploy the business wide-scale.’’

Electric car demand globally is expected to soar, challenging state power grids and putting further pressure on grid operators to find new ways of balancing demand. Power consumption from vehicles will grow to 1,800 terawatt-hours in 2040 from just 6 terawatt-hours now, according to Bloomberg New Energy Finance.

Related News

Taiwan's economic minister resigns over widespread power outage

Taiwan Power Blackout disrupts Taipei and commercial hubs after a Taoyuan natural gas plant error, triggering nationwide outage, grid failure, elevator rescues, power rationing, and the economic minister's resignation, as CPC Corporation restores supply.

Key Points

A nationwide Taiwan outage from human error at a Taoyuan gas plant, triggering rationing and a minister's resignation.

✅ Human error disrupted natural gas supply at Taoyuan plant

✅ 6.68 million users affected; grid failure across cities

✅ Minister Lee resigned; President Tsai ordered a review

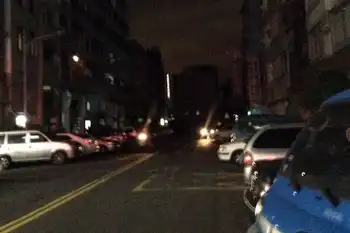

Taiwan's economic minister resigned after power was knocked out in many parts of Taiwan, with regional parallels such as China power cuts highlighting grid vulnerabilities, including capital Taipei's business and high-end shopping district, due to an apparent "human error" at a key power plant.

Economic Affairs minister Lee Chih-kung tendered his resignation verbally to Premier Lin Chuan, United Daily News reported, citing a Cabinet spokesman. Lin accepted the resignation, the spokesman said according to the daily.

As many as 6.68 million households and commercial units saw their power supply cut or disrupted on Tuesday after "human error" disrupted natural gas supply at a power plant in northern Taiwan's Taoyuan, the semi-official Central News Agency reported, citing the government-controlled oil company CPC Corporation as saying.

The company added that power at the plant, Taiwan's biggest natural gas power plant, resumed two minutes later.

In New Taipei City, there were at least 27,000 reported cases of people being stuck in lifts. Photos in social media also showed huge crowds stranded in lift lobby in Taipei's iconic 101-storey Taipei 101 building.

Power rationing was implemented beginning 6pm, and, as seen in the National Grid short supply warning in other markets, such steps aim to stabilize supply, Central News Agency said. Power supply was gradually being restored beginning at about 9:40pm. news reports said.

President Tsai Ing-wen apologised for the blackout, noting parallels with Japan's near-blackouts that underscored grid resilience, and said that she has ordered all relevant departments to produce clear report in the shortest time possible.

"Electricity is not just a problem about people's livelihoods but also a national security issue. A comprehensive review must be carried out to find out how the electric power system can be so easily paralysed by human error," said Ms Tsai in a Facebook post.

Taiwan has been at risk of a power shortage after a recent typhoon knocked down a power transmission tower in Hualien county along the eastern coast of Taiwan, rather than a demand-driven slowdown like the China power demand drop during pandemic factory shutdowns. This reduced the electricity supply by 1.3million kilowatts, or about 4 per cent of the operating reserve.

That was followed by the breakdown of a power generator at Taiwan's largest power plant, which further reduced the operating reserve by 1.5 per cent.

The situation is worsened by the ongoing heatwave that has hit Taiwan, with temperatures soaring to 38 degrees Celsius over the past week.

As a result, the government had imposed the rationing of electricity, and, highlighting how regional strains such as China's power woes can ripple into global markets, switched off all air-conditioning in many of its Taipei offices, a move that drew some public backlash.

Related News

Toshiba, Tohoku Electric Power and Iwatani start development of large H2 energy system

Fukushima Hydrogen Energy System leverages a 10,000 kW H2 production hub for grid balancing, demand response, and renewable integration, delivering hydrogen supply across Tohoku while supporting storage, forecasting, and flexible power management.

Key Points

A 10,000 kW H2 project in Namie for grid balancing, renewable integration, and regional hydrogen supply.

✅ 10,000 kW H2 production hub in Namie, Fukushima

✅ Balances renewable-heavy grids via demand response

✅ Supported by NEDO; partners Toshiba, Tohoku Electric, Iwatani

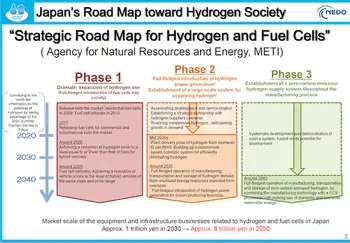

Toshiba Corporation, Tohoku Electric Power Co. and Iwatani Corporation have announced they will construct and operate a large-scale hydrogen (H2) energy system in Japan, based on a 10,000 kilowat class H2 production facility, which reflects advances in PEM hydrogen R&D worldwide.

The system, which will be built in Namie-Cho, Fukushima, will use H2 to offset grid loads and deliver H2 to locations in Tohoku and beyond, while complementary approaches like power-to-gas storage in Europe demonstrate broader storage options, and will seek to demonstrate the advantages of H2 as a solution in grid balancing and as a H2 gas supply.

The product has won a positive evaluation from Japan’s New Energy and Industrial Technology Development Organisation (NEDO), and its continued support for the transition to the technical demonstration phase. The practical effectiveness of the large-scale system will be determined by verification testing in financial year 2020, even as interest grows in nuclear beyond electricity for complementary services.

The main objectives of the partners are to promote expanded use of renewable energy in the electricity grid, including UK offshore wind investment by Japanese utilities, in order to balance supply and demand and process load management; and to realise a new control system that optimises H2 production and supply with demand forecasting for H2.

Hiroyuki Ota, General Manager of Toshiba’s Energy Systems and Solutions Company, said, “Through this project, Toshiba will continue to provide comprehensive H2 solutions, encompassing all processes from the production to utilisation of hydrogen.”

Manager of Tohoku Electric Power Co., Ltd, Mitsuhiro Matsumoto, added, “We will study how to use H2 energy systems to stabilize electricity grids with the aim of increasing the use of renewable energy and contributing to Fukushima.”

Moriyuki Fujimoto, General Manager of Iwatani Corporation, commented, “Iwatani considers that this project will contribute to the early establishment of a H2 economy that draws on our experience in the transportation, storage and supply of industrial H2, and the construction and operation of H2stations.”

Japan’s Ministry of Economy, Trade and Industry’s ‘Long-term Energy Supply and Demand Outlook’ targets increasing the share of renewable energy in Japan’s overall power generation mix from 10.7% in 2013 to 22-24% by 2030. Since output from renewable energy sources is intermittent and fluctuates widely with the weather and season, grid management requires another compensatory power source, as highlighted by a near-blackout event in Japan. The large hydrogen energy system is expected to provide a solution for grids with a high penetration of renewables.

Related News

Student group asking government for incentives on electric cars

PEI Electric Vehicle Incentives aim to boost EV adoption through subsidies and rebates, advocated by Renewable Transport PEI, with MLAs engagement, modeling Norway's approach, offsetting HST gaps, and making electric cars more competitive for Islanders.

Key Points

PEI Electric Vehicle Incentives are proposed subsidies and rebates to make EVs affordable and competitive for Islanders.

✅ Targets EV adoption with rebates up to 20 percent

✅ Modeled on Norway policies; offsets prior HST-era gaps

✅ Backed by Renewable Transport PEI engaging MLAs

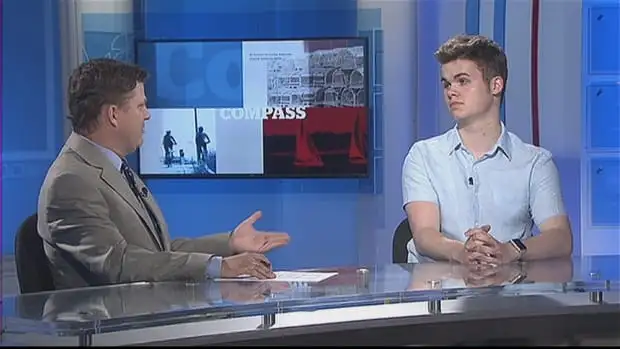

Noah Ellis, assistant director of Renewable Transport P.E.I., is asking government to introduce incentives for Islanders to buy electric cars, as cost barriers remain a key hurdle for many.

RTPEI is a group composed of high school students at Colonel Gray going into their final year."We wanted to give back and contribute to our community and our country and we thought this would be a good way to do so," Ellis told Compass.

Meeting with government

"We want to see the government bring in incentives for electric vehicles, similar to New Brunswick's rebate program, because it would make them more competitive with their gasoline counterparts," Ellis said.

'We wanted to give back and contribute to our community … we thought this would be a good way to do so.'— Noah Ellis

Ellis said the group has spoken with opposition MLAs and is meeting with cabinet ministers soon to discuss subsidies for Islanders to buy electric cars, noting that Atlantic Canadians are less inclined to buy EVs compared to the rest of the country.

He referred to Norway as a prime example for the province to model potential incentives, even as Labrador's EV infrastructure gaps underscore regional challenges — a country that, as of last year, announced nearly 40 per cent of the nation's newly registered passenger vehicles as electric powered.

'Incentives that are fiscally responsible'

Ellis said they group isn't looking for anything less than a 20 per cent incentive on electric vehicles — 10 per cent higher than the provinces cancelled hybrid car tax rebate that existed prior to HST.

"Electric vehicle incentives do work we just have to work with economists and environmentalists, and address critics of EV subsidies, to find the right balance of incentives that are fiscally responsible for the province but will also be effective," Ellis said.

Related News

Sparking change: what Tesla's Model 3 could mean for electric utilities

EV Opportunity for Utilities spans EV charging infrastructure, grid modernization, demand response, time-of-use rates, and customer engagement, enabling predictable load growth, flexible charging, and stronger utility branding amid electrification and resilience challenges.

Key Points

It is the strategy to leverage EV adoption for load growth, grid flexibility, and branded charging services.

✅ Monetizes EV load via TOU rates, managed charging, and V2G.

✅ Uses rate-based infrastructure to expand equitable charging access.

✅ Enhances resilience and DER integration through smart grid upgrades.

Tesla recently announced delivery of the first 30 production units of its Model 3 electric vehicle (EV). EV technology has generated plenty of buzz in the electric utility industry over the past decade and, with last week’s announcement, it would appear that projections of a significant market presence for EVs could give way to rapid growth.

Tesla’s announcement could not have come at a more critical time for utilities, which face unprecedented challenges. For the past 15 years, utilities have been grappling with increasingly frequent “100-year storms,” including hurricanes, snowstorms and windstorms, underscoring the reality that the grid’s aging infrastructure is not fit to withstand increasingly extreme weather, along with other threats, such as cyber attacks.

Coupled with flat or declining load growth, changing regulations, increasing customer demand, and new technology penetration, these challenges have given the electric utility industry good reason to describe its future as “threatened.” These trends, each exacerbating the others, mean essentially that utilities can no longer rely on traditional ways of doing business.

EVs have significant potential to help relieve the industry’s pessimistic outlook. This article will explore what EV growth could mean for utilities and how they can begin establishing critical foundations today to help ensure their ability to exploit this opportunity.

The opportunity

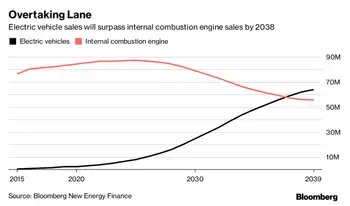

At the Bloomberg New Energy Finance (BNEF) Global Summit 2017, BNEF Advisory Board Chairman Michael Liebreich announced the group’s prediction that electric vehicles will comprise 35-47 percent of new vehicle sales globally by 2040.

U.S. utilities have good reason to be optimistic about this potential new revenue source, as EV-driven demand growth could be substantial according to federal lab analyses. If all 236 million gas-powered cars in the U.S. — average miles driven per year: 12,000 — were replaced with electric vehicles, which travel an average of 100 miles on 34 kWh, they would require 956 billion kWh each year. At a national average cost of $0.12 / kWh, the incremental energy sold by utilities in the U.S. would bring in around $115 billion per year in new revenues. A variety of factors could increase or decrease this number, but it still represents an attractive opportunity for the utility sector.

Capturing this burgeoning market is not simply a matter of increased demand; it will also require utilities to be predictable, adaptable and brandable. Moreover, while the aggregate increase in demand might be only 3-4 percent, demand can come as a flexible and adaptable load through targeted programming. Also, if utilities target the appropriate customer groups, they can brand themselves as the providers of choice for EV charging. The power of stronger branding, in a sector that’s experiencing significant third-party encroachment, could be critical to the ongoing financial health of U.S. utilities.

Many utilities are already keenly aware of the EV opportunity and are speeding down this road (no pun intended) as part of their plans for utility business model reinvention. Following are several questions to be asked when evaluating the EV opportunity.

Is the EV opportunity feasible with today’s existing grid?

According to a study conducted by the U.S. Department of Energy’s Pacific Northwest National Laboratory, the grid is already capable of supporting more than 150 million pure electric vehicles, even as electric cars could challenge state grids in the years ahead, a number equal to at least 63 percent of all gas-powered cars on the road today. This is significant, considering that a single EV plugged into a Level 2 charger can double a home’s peak electricity demand. Assuming all 236 million car owners eventually convert to EVs, utilities will need to increase grid capacity. However, today’s grid already has the capacity to accommodate the most optimistic prediction of 35-47 percent EV penetration by 2040, which is great news.

Should the EV opportunity be owned by utilities?

There’s significant ongoing debate among regulators and consumer advocacy groups as to whether utilities should own the EV charging infrastructure, with fights for control over charging reflecting broader market concerns today. Those who are opposed to this believe that the utilities will have an unfair pricing advantage that will inhibit competition. Similarly, if the infrastructure is incorporated into the rate base, those who do not own electric vehicles would be subsidizing the cost for those who do.

If the country is going to meet the future demands of electric cars, the charging infrastructure and power grid will need help, and electric utilities are in the best position to address the problem, as states like California explore EVs for grid stability through utility-led initiatives that can scale. By rate basing the charging infrastructure, utilities can provide charging services to a wider range of customers. This would not favor one economic group over another, which many fear would happen if the private sector were to control the EV charging market.

If you build it, will they come?

At this point, we can conclude that growth in EV market penetration is a tremendous opportunity for utilities, one that’s most advantageous to electricity customers if utilities own some, if not all, of the charging infrastructure. The question is, if you build it, will they come — and what are the consequences if they don’t?

With any new technology, there’s always a debate centered around adoption timing — in this case, whether to build the infrastructure ahead of demand for EV or wait for adoption to spike. Either choice could have disastrous consequences if not considered properly. If utilities wait for the adoption to spike, their lack of EV charging infrastructure could stunt the growth of the EV sector and leave an opening for third-party providers. Moreover, waiting too long will inhibit GHG emissions reduction efforts and generally complicate EV technology adoption. On the other hand, building too soon could lead to costly stranded assets. Both problems are rooted in the inability to control adoption timing, and, until recently, utilities didn’t have the means or the savvy to influence adoption directly.

How should utilities prepare for the EV?

Beyond the challenges of developing the hardware, partnerships and operational programs to accommodate EV, including leveraging energy storage and mobile chargers for added flexibility, influencing the adoption of the infrastructure will be a large part of the challenge. A compelling solution to this problem is to develop an engaged customer base.

A more engaged customer base will enable utilities to brand themselves as preferred EV infrastructure providers and, similarly, empower them to influence the adoption rate. There are five key factors in any sector that influence innovation adoption:

Relative advantage – how improved an innovation is over the previous generation.

Compatibility – the level of compatibility an innovation has with an individual’s life.

Complexity – if the innovation is to difficult to use, individuals will not likely adopt it.

Trialability – how easily an innovation can be experimented with as it’s being adopted.

Observability – the extent that an innovation is visible to others.

Although much of EV adoption will depend on the private vehicle sector influencing these five factors, there’s a huge opportunity for utilities to control the compatibility, complexity and observability of the EV. According to “The New Energy Consumer: Unleashing Business Value in a Digital World,” utilities can influence customers’ EV adoption through digital customer engagement. Studies show that digitally engaged customers:

have stronger interest and greater likelihood to be early EV adopters;

are 16 percent more likely to purchase home-based electric vehicle charging stations and installation services;

are 17 percent more likely to sign up for financing for home-based electric vehicle charging stations; and

increase the adoption of consumer-focused programs.

These findings suggest that if utilities are going to seize the full potential of the EV opportunity, they must start engaging customers now so they can appropriately influence the timing and branding of EV charging assets.

How can utilities engage consumers in preparation?

If utilities establish the groundwork to engage customers effectively, they can reduce the risks of waiting for an adoption spike and of building and investing in the asset too soon. To improve customer engagement, utilities need to:

Change their customer conversations from bills, kWh, and outages, to personalized, interesting topics, communicated at appropriate intervals and via appropriate communication channels, to gain customers’ attention.

Establish their roles as trusted advisors by presenting useful, personalized recommendations that benefit customers. These tips should change dynamically with changing customer behavior, or they risk becoming stagnant and redundant, thereby causing customers to lose interest.

Convert the perception of the utility as a monopolistic, inflexible entity to a desirable, consumer-oriented brand through appropriate EV marketing.

It’s critical to understand that this type of engagement strategy doesn’t even have to provide EV-specific messaging at first. It can start by engaging customers through topics that are relevant and unique, through established or evolving customer-facing programs, such as EE, BDR, TOU, HER.

As lines of communication open up between utility and users, utilities can begin to understand their customers’ energy habits on a more granular level. This intelligence can be used by business analysts to help educate program developers on the optimal EV program timing. For example, as customers become interested in services in which EV owners typically enlist, utilities can target them for EV program marketing. As the number of these customers grows, the window for program development opens, and their levels of interest can be used to inform program and marketing timelines.

While all this may seem like an added nuisance to an EV asset development strategy, there’s significant risk of losing this new asset to third-party providers. This is a much greater burden to utilities than spending the time to properly own the EV opportunity.

Related News

EPA moves to rewrite limits for coal power plant wastewater

EPA Wastewater Rule Rollback signals a move to rewrite 2015 Clean Water Act guidelines for coal-fired power plants, easing wastewater rules as heavy metals, mercury, lead, arsenic, and selenium threaten rivers, lakes, public health.

Key Points

A planned EPA rewrite of 2015 wastewater limits for coal plants, weakening protections against toxic heavy metals.

✅ Targets 2015 Clean Water Act wastewater guidelines

✅ Affects coal-fired steam electric power plants

✅ Raises risks from mercury, lead, arsenic, selenium

The Environmental Protection Agency says it plans to scrap an Obama-era measure limiting water pollution from coal-fired power plants, mirroring moves to replace the Clean Power Plan elsewhere in power-sector policy.

A letter from EPA Administrator Scott Pruitt released Monday as part of a legal appeal and amid a broader rewrite of NEPA rules said he will seek to revise the 2015 guidelines mandating increased treatment for wastewater from steam electric power-generating plants.

Acting at the behest of energy groups and electric utilities who opposed the stricter standards, Pruitt first moved in April to delay implementation of the new guidelines. The wastewater flushed from the coal-fired plants into rivers and lakes typically contains traces of such highly toxic heavy metals as lead, arsenic, mercury and selenium.

“After carefully considering your petitions, I have decided that it is appropriate and in the public interest to conduct a rulemaking to potentially revise (the regulations),” Pruitt wrote in the letter addressed to the pro-industry Utility Water Act Group and the U.S. Small Business Administration.

Pruitt’s letter, dated Friday, was filed Monday with the Fifth Circuit U. S. Court of Appeals in New Orleans, which is hearing legal challenges of the wastewater rule. With Pruitt now moving to rewrite the standards, EPA has asked to court to freeze the legal fight.

While that process moves ahead, EPA’s existing guidelines from 1982 remian in effect. Those standards were set when far less was known about the detrimental impacts of even tiny levels of heavy metals on human health and aquatic life.

“Power plants are by far the largest offenders when it comes to dumping deadly toxics into our lakes and rivers,” said Thomas Cmar, a lawyer for the legal advocacy group Earthjustice. “It’s hard to believe that our government officials right now are so beholden to big business that they are willing to let power plants continue to dump lead, mercury, chromium and other dangerous chemicals into our water supply.”

EPA estimates that the 2015 rule, if implemented, would reduce power plant pollution, consistent with new pollution limits proposed for coal and gas plants, by about 1.4 billion pounds a year. Only about 12 per cent of the nation’s steam electric power plants would have to make new investments to meet the higher standards, according to the agency.

Utilities would need to spend about $480 million on new wastewater treatment systems, resulting in about $500 million in estimated public benefits, such as fewer incidents of cancer and childhood developmental defects.

Related News

San Diego utility offers $10,000 off Nissan Leaf, BMW i3 electric cars

San Diego Gas & Electric EV incentives deliver $10,000 utility discounts plus a $200 EV Climate Credit, stackable with California rebates and federal tax credits on BMW i3 and Nissan Leaf purchases through participating dealers.

Key Points

Utility-backed rebates that cut EV purchase costs and stack with California and federal tax credits for added savings.

✅ $10,000 off BMW i3 or Nissan Leaf via SDG&E partner dealers

✅ Stack with $7,500 federal and up to $4,500 California rebates

✅ $200 annual EV Climate Credit for eligible account holders

For southern California residents, it's an excellent time to start considering the purchase of a BMW i3 or Nissan Leaf electric car as EV sales top 20% in California today.

San Diego Gas & Electric has joined a host of other utility companies in the state in offering incentives towards the purchase of an i3 or a Leaf as part of broader efforts to pursue EV grid stability initiatives in California.

In total, the incentives slash $10,000 from the purchase price of either electric car, and an annual $200 credit to reduce the buyer's electricity bill is included through the EV Climate Credit program, which can complement home solar and battery options for some households.

SDG&E's incentives may be enough to sway some customers into either electric car, but there's better news: the rebates can be combined with state and federal incentives.

The state of California offers a $4,500 purchase rebate for qualified low-income applicants, while others are eligible for $2,500

Additionally, the federal government income-tax credit of up to $7,500 can bring the additional incentives to $10,000 on top of the utility's $10,000.

While the federal and state incentives are subject to qualifications and paperwork established by the two governments, the utility company's program is much more straight forward.

SDG&E simply asks a customer to provide a copy of their utility bill and a discount flyer to any participating BMW or Nissan dealership.

Additional buyers who live in the same household as the utility's primary account holder are also eligible for the incentives, although proof of residency is required.

Nissan is likely funding some of the generous incentives to clear out remaining first-generation Nissan Leafs.

The 2018 Nissan Leaf will be revealed next month and is expected to offer a choice of two battery packs—one of which should be rated at 200 miles of range or more.

SDG&E joins Southern California Edison as the latest utility company to offer discounts on electric cars as California aims for widespread electrification and will need a much bigger grid to support it, though SCE has offered just $450 towards a purchase.

However, the $450 incentive can be applied to new and used electric cars.

Up north, California utility company Pacific Gas & Electric offers $500 towards the purchase of an electric car as well, and is among utilities plotting a bullish course for EV charging infrastructure across the state today.

Two Hawaiian utilities—Kaua'i Island Utility Cooperative and the Hawaiian Electric Company—offered $10,000 rebates similar to those in San Diego from this past January through March.

Those rebates once again were destined for the Nissan Leaf.

SDG&E's program runs through September 30, 2017, or while supplies of the BMW i3 and Nissan Leaf last at participating local dealers.

Related News

Canada could be electric, connected and clean — if it chooses

Canada Clean Energy Transition accelerates via carbon pricing, renewables, EV incentives, energy efficiency upgrades, smart grids, interprovincial transmission, and innovation in hydro, wind, solar, and storage to cut emissions and power sustainable growth.

Key Points

Canada Clean Energy Transition is a shift to renewables, EVs and efficiency powered by smart policy and innovation.

✅ Carbon pricing and EV incentives accelerate adoption

✅ Grid upgrades, storage, and transmission expand renewables

✅ Industry efficiency and smart tech cut energy waste

So, how do we get there?

We're already on our way.

The final weeks of 2016 delivered some progress, as Prime Minister Justin Trudeau and premiers of 11 of the 13 provinces and territories negotiated a new national climate plan. The deal is a game changer. It marks the moment that Canada stopped arguing about whether to tackle climate change and started figuring out how we're going to get there.

We can each be part of the solution by reducing the amount of energy we use, making sure our homes and workplaces are well insulated and choosing energy efficient appliances. When the time comes to upgrade our cars, washing machines and refrigerators, we can take advantage of rebates that cut the cost of electric models. In our homes, we can install smart technology — like automated thermostats — to cut down on energy waste and reduce power bills.

Even industries that use a lot of energy, like mining and manufacturing, could become leaders in sustainability. It would mean investing in energy saving technology, making their operations more efficient and running conveyor belts, robots and other equipment off locally produced renewable electricity.

Meanwhile, laboratories and factories in Ontario, Quebec and British Columbia are making breakthroughs in areas like energy storage, while renewable energy growth in the Prairie Provinces gathers momentum, which will make it possible to access clean power even when the sun isn't shining and the wind isn't blowing.

Liberal leader Justin Trudeau holds a copy of his environmental platform after announcing details of it at Jericho Beach Park in Vancouver, B.C., on Monday June 29, 2015. (Darryl Dyck/Canadian Press)

The scale and speed of Canada's transition to clean energy depends on provincial and federal policies that do things like tax carbon pollution, build interprovincial electricity transmission lines, invest in renewable energy and grid modernization projects that strengthen the system, and increase incentives for electric vehicles.

Of course, even the best policies won't produce lasting results unless Canadians fight for them and take ownership for our role in the energy transition. Global momentum toward clean energy may be "irreversible," as former U.S. President Barack Obama recently wrote in the journal Science — but it's up to us whether Canada catches that wave or misses out.

Fortunately, clean energy has always been part of Canada's DNA.

We can learn from the past

In remote corners of the newly minted Dominion of Canada, rushing rivers turned the waterwheels that powered the lumber mills that built the places we inhabit today. The first electric lights were switched on in Winnipeg shortly after Confederation. By the turn of the 20th century, hydro power was lighting up towns and cities from coast to coast.

Our country is home to some of the world's best clean energy resources, and experts note that zero-emissions electricity by 2035 is possible given our strengths, and fully two-thirds of our power is generated from renewable sources like hydro, wind and solar.

Looking to our heritage, we can make clean growth the next chapter in Canada's history

Recent commitments to phase out coal and invest in clean energy infrastructure mean the share of renewable power in Canada's energy mix is poised to grow. The global shift from fossil fuels to clean energy is opening up huge opportunities and Canada's opportunity in the global electricity market is growing as the country has the expertise to deliver solutions around the world.

Looking to our heritage, we can make clean growth the next chapter in Canada's history — building a nation that's electric, connected and on a practical, profitable path to 2035 zero-emission power for households and industry, stronger than ever.

Related News

Trends in Electricity Prices in Europe: Expect More Volatility

EU Energy Outlook 2050 projects volatile electricity prices as wind, solar PV, and hydropower dominate capacity; natural gas supports dispatchable supply, CO2 prices rise, and e-mobility, storage, and national policy reforms reshape EU power markets.

Key Points

A modeled scenario of EU-28 power markets to 2050, analyzing capacity, prices, and policy impacts across technologies.

✅ Wind and solar dominate capacity; gas remains key dispatchable.

✅ CO2 costs and fuel trends drive price volatility and extremes.

✅ Storage, e-mobility, and policy reforms reshape national markets.

European electricity markets are constantly changing. Revisions of regulations and new laws, e.g. the Electricity Market Act in Germany, affect business decisions and market trends, reflecting Europe's push for electrification across sectors. In our EU Energy Outlook 2050 we provide non-weighted average values of a potential scenario for EU-28 countries (including Norway and Switzerland), based on the fundamental power market model developed by Energy Brainpool.

Power2Sim is a software tool that simulates the hourly electricity prices until the year 2050 for all countries of the European Union along with Norway and Switzerland. Most assumptions for the scenario are based on the IEA. The assumptions are adapted by Energy Brainpool according to national targets for Germany or for France. Results for individual countries vary strongly in some cases. For sound market assessments, solid modeling of individual national markets, including sensitivity analyses, is indispensable.

Supply side: Installed generating capacities in EU-28

Figure 1: Gross generation capacities in GW, source: Energy Brainpool

Generation capacity will be dominated by fluctuating renewable energies, in particular wind, solar PV and hydropower, as can be seen in figure 1. Wind energy is expected to expand to an estimated 30 per cent of overall generation capacity by 2050. With regard to dispatchable fossil fuel capacities, primarily natural gas power plants are planned to be built in Europe. The capacity of coal-fired power plants will fall to 4 per cent of total capacity by 2050. All in all, conventional dispatchable generation capacity will decline from 50 per cent to 30 per cent. Fluctuating capacity will dominate, which in turn will lead to more volatile prices.

- Demand side: coverage of the demand by energy sources in EU-28

Figure 2: Gross electricity production of generation technologies in TWh, source: Energy Brainpool

Electricity generation is expected to increase by 18 per cent till 2050 as a result of higher demand caused by increased electrification of the heat and transport sectors, as more drivers go electric across markets. While the production from coal-fired power plants will decline substantially, the production from natural gas fired power plants will double. In 2050, variable renewable energies will generate some 36 per cent of electricity while over 44 per cent will be produced by dispatchable conventional power plants. Remaining electricity production will come from renewable energy technologies such as biomass power plants.

- Commodity price development

Figure 3: Commodity prices (real EUR2015), source: Energy Brainpool

Commodity prices up to 2020 are based on the prices on the futures markets. The expected price trend of commodities between 2020 to 2050 in our model follows the 450ppm (2° C) scenario of the IEA’s “World Energy Outlook 2016”. The 2° C scenario is primarily achieved by a sharp increase of EUA prices (i.e. CO2 prices in the EU Emission Trading System). As high CO2 prices will lead to lower demand for fossil fuels in the power sector, prices of natural gas and hard coal will remain at a relatively constant level.

- Simulated annual power prices EU 28

Figure 4: Power prices (real EUR2015) and deviation range in national EU-28 markets, source: Energy Brainpool

Power prices until 2020 are influenced strongly by low prices for commodities on the futures markets. The development of electricity prices from 2020 to 2030 is influenced by increasing gas prices (due to higher demand, as more carbon-intensive generation is being shut-down) and CO₂-certificate prices, with U.S. DOE EV demand analysis illustrating how transport electrification can add load. From 2040 onwards electricity prices are expected to remain on a relative constant level despite rising prices for CO₂. The reason is that the high contribution of wind and solar power will increase the periods of low and even negative electricity prices. As we indicated above, these are average prices – they may vary considerably in individual countries.

- Average sales values and sales volumes for wind in EU-28

Figure 5: Sales values (real EUR2015) and volumes wind EU-28, source: Energy Brainpool

The sales value of wind energy will rise till 2040 and thereafter remain at a high level despite increasing installed capacities and simultaneous cannibalisation effects. Sales volumes (share of annual generation at positive spot market prices) will decrease only slightly. The few hours with extreme electricity prices benefit wind power plants which generate positive revenues in these hours.

Sales value is the average weighted price a technology (solar or wind) can achieve in the spot market in all hours during which the price is higher than or equal to 0 EUR/MWh. Sales value represents a more realistic picture of the revenue of renewable energy sources compared to other indices, because it discounts periods in which prices are zero or negative and the sources may be switched off.

- Average sales values and sales volumes for solar in EU-28

Figure 6: Sales value (real EUR2015) and volumes solar in EU-28, source: Energy Brainpool

The sales value of solar energy will rise till 2040 and remain at a high level thereafter, although still below the level of wind energy. This is because of the strong simultaneousness effect of solar power. This results in strong price declines at times of high solar feed-in. The sales volumes on EU average will only decrease slightly. However, in some countries the decline is much steeper.

- Extreme prices EU-28

Figure 7: Number of extreme prices, source: Energy Brainpool

Due to the high share of fluctuating generation capacities, electricity prices will become more volatile. Moreover, extremely high and extremely low prices will occur. Extreme prices are electricity prices equal to/below 0 EUR/MWh and those above 100 EUR/MWh. The anticipated ratio between the two extremes will create new opportunities for market newcomers and new technologies, e.g. storage systems. Extreme prices can be anticipated in Europe from 2026 on.

- E-mobility in the EU-28

Figure 8: Demand of e-mobility in EU-28, source: Energy Brainpool

The future development of e-mobility is a decisive factor for the European and national targets in terms of greenhouse gas emission reductions. If the decarbonisation of the transport sector will genuinely be implemented through e-mobility technologies, electricity demand from EVs will drastically increase. A share of 100 per cent e-mobility in the private transport sector in the EU28 by 2050 will result in an additional electricity demand of around 830 TWh/a, around a quarter of current total European electricity demand.

The development of e-mobility was not taken into account in the results presented above. If it were taken into account however, the increased demand from e-mobility would lead to higher electricity prices. This in turn would incentivise further investments in new generating capacities to cover for surplus demand. If climate goals are to be achieved, e-mobility needs to be powered by carbon free generating technologies. This would lead to a different technology mix than seen in Figure 1.

Related News

Why power companies should be investing in carbon-free electricity

Noncarbon Electricity Investment Strategy helps utilities hedge policy uncertainty, carbon tax risks, and emissions limits by scaling wind, solar, and CCS, avoiding stranded assets while balancing costs, reliability, and climate policy over decades.

Key Points

A strategy for utilities to invest 20-30 percent of capacity in low carbon sources to hedge emissions and carbon risks.

✅ Hedges future carbon tax and emissions limits

✅ Targets 20-30 percent of new generation from clean sources

✅ Reduces stranded asset risk and builds renewables capacity

When utility executives make decisions about building new power plants, a lot rides on their choices. Depending on their size and type, new generating facilities cost hundreds of millions or even billions of dollars. They typically will run for 40 or more years — 10 U.S. presidential terms. Much can change during that time.

Today one of the biggest dilemmas that regulators and electricity industry planners face is predicting how strict future limits on greenhouse gas emissions will be. Future policies will affect the profitability of today’s investments. For example, if the United States adopts a carbon tax 10 years from now, it could make power plants that burn fossil fuels less profitable, or even insolvent.

These investment choices also affect consumers. In South Carolina, utilities were allowed to charge their customers higher rates to cover construction costs for two new nuclear reactors, which have now been abandoned because of construction delays and weak electricity demand. Looking forward, if utilities are reliant on coal plants instead of solar and wind, it will be much harder and more expensive for them to meet future emissions targets, even as New Zealand's electrification push accelerates abroad. They will pass the costs of complying with these targets on to customers in the form of higher electricity prices.

With so much uncertainty about future policy, how much should we be investing in noncarbon electricity generation in the next decade? In a recent study, we proposed optimal near-term electricity investment strategies to hedge against risks and manage inherent uncertainties about the future.

We found that for a broad range of assumptions, 20 to 30 percent of new generation in the coming decade should be from noncarbon sources such as wind and solar energy across markets. For most U.S. electricity providers, this strategy would mean increasing their investments in noncarbon power sources, regardless of the current administration’s position on climate change.

Many noncarbon electricity sources — including wind, solar, nuclear power and coal or natural gas with carbon capture and storage — are more expensive than conventional coal and natural gas plants. Even wind power, which is often mentioned as competitive, is actually more costly when accounting for costs such as backup generation and energy storage to ensure that power is available when wind output is low.

Over the past decade, federal tax incentives and state policies designed to promote clean electricity sources spurred many utilities to invest in noncarbon sources. Now the Trump administration is shifting federal policy back toward promoting fossil fuels. But it can still make economic sense for power companies to invest in more expensive noncarbon technologies if we consider the potential impact of future policies.

How much should companies invest to hedge against the possibility of future greenhouse gas limits? On one hand, if they invest too much in noncarbon generation and the federal government adopts only weak climate policies throughout the investment period, utilities will overspend on expensive energy sources.

On the other hand, if they invest too little in noncarbon generation and future administrations adopt stringent emissions targets, utilities will have to replace high-carbon energy sources with cleaner substitutes, which could be extremely costly.

Economic modeling with uncertainty

We conducted a quantitative analysis to determine how to balance these two concerns and find an optimal investment strategy given uncertainty about future emissions limits. This is a core choice that power companies have to make when they decide what kinds of plants to build.

First we developed a computational model that represents the sectors of the U.S. economy, including electric power. Then we embedded it within a computer program that evaluates decisions in the electric power sector under policy uncertainty.

The model explores different electric power investment decisions under a wide range of future emissions limits with different probabilities of being implemented. For each decision/policy combination, it computes and compares economy-wide costs over two investment periods extending from 2015 to 2030.

We looked at costs across the economy because emissions policies impose costs on consumers and producers as well as power companies. For example, they may lead to higher electricity, fuel or product prices. By seeking to minimize economy-wide costs, our model identifies the investment decision that produces the greatest overall benefits to society.

More investments in clean generation make economic sense

We found that for a broad range of assumptions, the optimal investment strategy for the coming decade is for 20 to 30 percent of new generation to be from noncarbon sources. Our model identified this as the best level because it best positions the United States to meet a wide range of possible future policies at a low cost to the economy.

From 2005-2015, we calculated that about 19 percent of the new generation that came online was from noncarbon sources. Our findings indicate that power companies should put a larger share of their money into noncarbon investments in the coming decade.

While increasing noncarbon investments from a 19 percent share to a 20 to 30 percent share of new generation may seem like a modest change, it actually requires a considerable increase in noncarbon investment dollars. This is especially true since power companies will need to replace dozens of aging coal-fired power plants that are expected to be retired.

In general, society will bear greater costs if power companies underinvest in noncarbon technologies than if they overinvest. If utilities build too much noncarbon generation but end up not needing it to meet emissions limits, they can and will still use it fully. Sunshine and wind are free, so generators can produce electricity from these sources with low operating costs.

In contrast, if the United States adopts strict emissions limits within a decade or two, they could prevent carbon-intensive generation built today from being used. Those plants would become “stranded assets” — investments that are obsolete far earlier than expected, and are a drain on the economy.

Investing early in noncarbon technologies has another benefit: It helps develop the capacity and infrastructure needed to quickly expand noncarbon generation. This would allow energy companies to comply with future emissions policies at lower costs.

Seeing beyond one president

The Trump administration is working to roll back Obama-era climate policies such as the Clean Power Plan, and to implement policies that favor fossil generation. But these initiatives should alter the optimal strategy that we have proposed for power companies only if corporate leaders expect Trump’s policies to persist over the 40 years or more that these new generating plants can be expected to run.

Energy executives would need to be extremely confident that, despite investor pressure from shareholders, the United States will adopt only weak climate policies, or none at all, into future decades in order to see cutting investments in noncarbon generation as an optimal near-term strategy. Instead, they may well expect that the United States will eventually rejoin worldwide efforts to slow the pace of climate change and adopt strict emissions limits.

In that case, they should allocate their investments so that at least 20 to 30 percent of new generation over the next decade comes from noncarbon sources. Sustaining and increasing noncarbon investments in the coming decade is not just good for the environment — it’s also a smart business strategy that is good for the economy.

Related News

U.S. Electricity Sales Projections Continue to Fall

US Electricity Demand Outlook examines EIA forecasts, GDP decoupling, energy efficiency, electrification, electric vehicles, grid load growth, and weather variability to frame long term demand trends and utility planning scenarios.

Key Points

An analysis of EIA projections showing demand decoupling from GDP, with EV adoption and efficiency shaping future grid load.

✅ EIA lowers load growth; demand decouples from GDP.

✅ Efficiency and sector shifts depress kWh sales.

✅ EV adoption could revive load and capacity needs.

Electricity producers and distributors are in an unusual business. The product they provide is available to all customers instantaneously, literally at the flip of a switch. But the large amount of equipment, both hardware and software to do this takes years to design, site and install.

From a long range planning perspective, just as important as a good engineering design is an accurate sales projections. For the US electric utility industry the most authoritative electricity demand projec-tions come from the Department of Energy’s Energy Information Administration (EIA). EIA's compre-hensive reports combine econometric analysis with judgment calls on social and economic trends like the adoption rate of new technologies that could affect future electricity demand, things like LED light-ing and battery powered cars, and the rise of renewables overtaking coal in generation.

Before the Great Recession almost a decade ago, the EIA projected annual growth in US electricity production at roughly 1.5 percent per year. After the Great Recession began, the EIA lowered its projections of US electricity consumption growth to below 1 percent. Actual growth has been closer to zero. While the EIA did not antici-pate the last recession or its aftermath, we cannot fault them on that.

After the event, though, the EIA also trimmed its estimates of economic growth. For the 2015-2030 period it now predicts 2.1 percent economic and 0.3 percent electricity growth, down from previously projections of 2.7 percent and 1.3 percent respectively. (See Figures 1 and 2.)

Table 1. EIA electric generation projections by year of forecast (kWh billions)

Table 2. EIA forecast of GDP by year of forecast (billion 2009 $)

Back in 2007, the EIA figured that every one percent increase in economic activity required a 0.48 percent in-crease in electric generation to support it. By 2017, the EIA calculated that a 1 percent growth in economic activity now only required a 0.14 percent increase in electric output. What accounts for such a downgrade or disconnect between electricity usage and economic growth? And what factors might turn the numbers

around?

First, the US economy lost energy intensive heavy industry like smelting, steel mills and refineries; patterns in China's electricity sector highlight how industrial shifts can reshape power demand. A more service oriented economy (think health care) relies more heavily on the movement of data or information and uses far less power than a manufacturing-oriented economy.

A small volcano in Argentina is about to fuel the next tech boom – and a little known company is going to be right at the center. Early investors stand to gain incredible profits and you can too. Read the report.

Second, internet shopping has hurt so-called "brick and mortar" retailers. Despite the departure of heavy industry, in years past a burgeoning US commercial sector increased its demand and usage of electricity to offset the industrial decline. But not anymore. Energy efficiency measures as well as per-haps greater concern about global warming and greenhouse gas emissions and have cut into electricity sales. “Do more with less” has the right ring to it.

But there may be other components to the ongoing decline in electricity usage. Academic studies show that electricity usage seems to increase with income along an S curve, and flattens out after a certain income level. That is, if you earn $1 billion per year you do not (or cannot) use ten times a much electricity as someone earning only $100 million.

But people at typical, middle income levels increase or decrease electricity usage when incomes rise or fall. The squeeze on middle income families was discussed often in the late presidential campaign. In recent decades an increasing percentage of income has gone to a small percentage of the population at the top of the income scale. This trend probably accounts for some weakness in residential sales. This suggests that government policy addressing income inequality would also boost electricity sales.

Population growth affects demand for electricity as well as the economy as a whole. The EIA has made few changes in its projections, showing 0.7 percent per year population growth in 2015- 2030 in both the 2007 and 2017 forecasts. Recent studies, however, have shown a drop in the birth rate to record lows. More troubling, from a national health perspective is that the average age of death may have stopped rising. Those two factors point to lower population growth, especially if the government also restricts immi-gration. Thus, the US may be approaching a period of rather modest population growth.

All of the above factors point to minimal sales growth for electricity producers in the US--perhaps even lower than the seemingly conservative EIA estimates. But the cloud on the horizon has a silver lining in the shape of an electric car. Both the United Kingdom and France have set dates to end of production of automobiles with internal combustion engines. Several European car makers have declared that 20 percent of their output will be electric vehicles by the early 2020s. If we adopt automobiles powered by electricity and not gasoline or diesel, electricity sales would increase by one third. For the power indus-try, electric vehicles represent the next big thing.

We don’t pretend to know how electric car sales will progress. But assume vehicle turnover rates re-main at the current 7 percent per year and electric cars account for 5 percent of sales in the first five years (as op-posed to 1 percent now), 20 percent in the next five years and 50 percent in the third five year period. Wildly optimistic assumptions? Maybe. By 2030, electric cars would constitute 28 percent of the vehicle fleet. They would add about 10 percent to kilowatt hour sales by that date, assuming that battery efficiencies do not improved by then. Those added sales would require increased electric generation output, with low-emissions sources expected to cover almost all the growth globally. They would also raise long term growth rates for 2015-2030 from the present 0.3 percent to 1.0 percent. The slow upturn in demand should give the electric companies time to gear up so to speak.

In the meantime, weather will continue to play a big role in electricity consumption. Record heat-induced demand peaks are being set here in the US even as surging global demand puts power systems under strain worldwide.

Can we discern a pattern in weather conditions 15 years out? Maybe we can, but that is one topic we don’t expect a government agency to tackle in public right now. Meantime, weather will affect sales more than anything else and we cannot predict the weather. Or can we?

Related News

Ontario looks to build on electricity deal with Quebec

Ontario-Quebec Electricity Deal explores hydro imports, terawatt hours, electricity costs, greenhouse gas cuts, and baseload impacts, amid debates on Pickering nuclear operations and competitive procurement in Ontario's long-term energy planning.

Key Points

A proposed hydro import deal from Quebec, balancing costs, emissions, and reliability for Ontario electricity customers.

✅ Draft 20-year, 8 TWh offer reported by La Presse disputed

✅ Ontario seeks lower costs and GHG cuts versus alternatives

✅ Not a baseload replacement; Pickering closure not planned

Ontario is negotiating a possible energy swap agreement to buy electricity from Quebec, but the government is disputing a published report that it is preparing to sign a deal for enough electricity to power a city the size of Ottawa.

La Presse reported Tuesday that it obtained a copy of a draft, 20-year deal that says Ontario would buy eight terawatt hours a year from Quebec – about 6 per cent of Ontario’s consumption – whether the electricity is consumed or not.

Ontario Energy Minister Glenn Thibeault’s office said the province is in discussions to build on an agreement signed last year for Ontario to import up to two terawatt hours of electricity a year from Quebec.

But his office released a letter dated late last month to his Quebec counterpart, in which Mr. Thibeault said the offer extended in June was unacceptable because it would increase the average residential electricity bill by $30 a year.

“I am hopeful that your continued support and efforts will help to further discussions between our jurisdictions that could lead to an agreement that is in the best interest of both Ontario and Quebec,” Mr. Thibeault wrote July 27 to Pierre Arcand.

Ontario would prepare a “term sheet” for the next stage of discussions ahead of the two ministers meeting at the Energy and Mines Ministers Conference later this month in New Brunswick, Mr. Thibeault wrote.

Any future agreements with Quebec will have to provide a reduction in Ontario electricity rates compared with other alternatives and demonstrate measurable reductions in greenhouse gas emissions, he wrote.

Progressive Conservative Leader Patrick Brown said Ontario doesn’t need eight terawatt hours of additional power and suggested it means the Liberal government is considering closing power facilities such as the Pickering nuclear plant early.

A senior Energy Ministry official said that is not on the table. The government has said it intends to keep operating two units at Pickering until 2022, and the other four units until 2024.

Even if the Quebec offer had been accepted, the energy official said, that power wouldn’t have replaced any of Ontario’s baseload power because it couldn’t have been counted on 24 hours a day, 365 days a year.

The Society of Energy Professionals said Mr. Thibeault was right to reject the deal, but called on him to release the Long-Term Energy Plan – which was supposed to be out this spring – before continuing negotiations.

Some commentators have argued for broader reforms to address Ontario's hydro system challenges, urging policymakers to review all options as negotiations proceed.

The Ontario Energy Association said the reported deal would run counter to the government’s stated energy objectives amid concerns over electricity prices in the province.

“Ontarians will not get the benefit of competition to ensure it is the best of all possible options for the province, and companies who have invested in Ontario and have employees here will not get the opportunity to provide alternatives,” president and chief executive Vince Brescia said in a statement. “Competitive processes should be used for any new significant system capacity in Ontario.”

The Association of Power Producers of Ontario said it is concerned the government is even considering deals that would “threaten to undercut a competitive marketplace and long-term planning.”

“Ontario already has a surplus of energy, so it’s very difficult to see how this deal or any other sole-source deal with Quebec could benefit the province and its ratepayers,” association president and CEO David Butters said in a statement.

The Ontario Waterpower Association also said such a deal with Quebec would “present a significant challenge to continued investment in waterpower in Ontario.”

Related News

Shell’s strategic move into electricity

Shell's Industrial Electricity Supply Strategy targets UK and US industrial customers, leveraging gas-to-power, renewables, long-term PPAs, and energy transition momentum to disrupt utilities, cut costs, and secure demand in the evolving electricity market.

Key Points

Shell will sell power directly to industrial clients, leveraging gas, renewables, and PPAs to secure demand and pricing.

✅ Direct power sales to industrials in UK and US

✅ Leverages gas-to-power, renewables, and flexible sourcing

✅ Targets long-term PPAs, price stability, and demand security

Royal Dutch Shell’s decision to sell electricity direct to industrial customers is an intelligent and creative one. The shift is strategic and demonstrates that oil and gas majors are capable of adapting to a new world as the transition to a lower carbon economy develops. For those already in the business of providing electricity it represents a dangerous competitive threat. For the other oil majors it poses a direct challenge on whether they are really thinking about the future sufficiently strategically.

The move starts small with a business in the UK that will start trading early next year, in a market where the UK’s second-largest electricity operator has recently emerged, signaling intensifying competition. Shell will supply the business operations as a first step and it will then expand. But Britain is not the limit — Shell recently announced its intention of making similar sales in the US. Historically, oil and gas companies have considered a move into electricity as a step too far, with the sector seen as oversupplied and highly politicised because of sensitivity to consumer price rises. I went through three reviews during my time in the industry, each of which concluded that the electricity business was best left to someone else. What has changed? I think there are three strands of logic behind the strategy.

First, the state of the energy market. The price of gas in particular has fallen across the world over the last three years to the point where the International Energy Agency describes the current situation as a “glut”. Meanwhile, Shell has been developing an extensive range of gas assets, with more to come. In what has become a buyer’s market it is logical to get closer to the customer — establishing long-term deals that can soak up the supply, while options such as storing electricity in natural gas pipes gain attention in Europe. Given its reach, Shell could sign contracts to supply all the power needed by the UK’s National Health Service or with the public sector as a whole as well as big industrial users. It could agree long-term contracts with big businesses across the US.

To the buyers, Shell offers a high level of security from multiple sources with prices presumably set at a discount to the market. The mutual advantage is strong. Second, there is the transition to a lower carbon world. No one knows how fast this will move, but one thing is certain: electricity will be at the heart of the shift with power demand increasing in transportation, industry and the services sector as oil and coal are displaced. Shell, with its wide portfolio, can match inputs to the circumstances and policies of each location. It can match its global supplies of gas to growing Asian markets, including China’s 2060 electricity share projections, while developing a renewables-based electricity supply chain in Europe. The new company can buy supplies from other parts of the group or from outside. It has already agreed to buy all the power produced from the first Dutch offshore wind farm at Egmond aan Zee.

The move gives Shell the opportunity to enter the supply chain at any point — it does not have to own power stations any more than it now owns drilling rigs or helicopters. The third key factor is that the electricity market is not homogenous. The business of supplying power can be segmented. The retail market — supplying millions of households — may be under constant scrutiny, as efforts to fix the UK’s electricity grid keep infrastructure in the headlines, with suppliers vilified by the press and governments forced to threaten price caps but supplying power to industrial users is more stable and predictable, and done largely out of the public eye. The main industrial and commercial users are major companies well able to negotiate long-term deals.

Given its scale and reputation, Shell is likely to be a supplier of choice for industrial and commercial consumers and potentially capable of shaping prices. This is where the prospect of a powerful new competitor becomes another threat to utilities and retailers whose business models are already under pressure. In the European market in particular, electricity pricing mechanisms are evolving and public policies that give preference to renewables have undermined other sources of supply — especially those produced from gas. Once-powerful companies such as RWE and EON have lost much of their value as a result. In the UK, France and elsewhere, public and political hostility to price increases have made retail supply a risky and low-margin business at best. If the industrial market for electricity is now eaten away, the future for the existing utilities is desperate.

Shell’s move should raise a flag of concern for investors in the other oil and gas majors. The company is positioning itself for change. It is sending signals that it is now viable even if oil and gas prices do not increase and that it is not resisting the energy transition. Chief executive Ben van Beurden said last week that he was looking forward to his next car being electric. This ease with the future is rather rare. Shareholders should be asking the other players in the old oil and gas sector to spell out their strategies for the transition.