Electricity News in March 2018

Vancouver adopts 100 per cent EV-ready policy

Vancouver 100% EV-Ready Policy mandates EV charging in new multi-unit residential buildings, expands DC fast charging, and supports zero-emission vehicles, reducing carbon pollution and improving air quality with BC Hydro and citywide infrastructure upgrades.

Key Points

A city rule making new multi-unit homes EV-ready and expanding DC fast charging to accelerate zero-emission adoption.

✅ 100% EV-ready stalls in all new multi-unit residential builds

✅ Citywide DC fast charging within 10 minutes by 2021

✅ Preferential parking policies for zero-emission vehicles

Vancouver is now one of the first cities in North America to adopt a 100 per cent Electric Vehicle (EV)-ready policy for all new multi-unit residential buildings, aligning with B.C.'s EV expansion efforts across the province.

Vancouver City Council approved the recommendations made in the EV Ecosystem Program Update last week. The previous requirement of 20 per cent EV parking spots meant a limited number of residents had access to an outlet, reflecting charging challenges in MURBs across Canada. The actions will help reduce carbon pollution and improve air quality by increasing opportunities for residents to move away from fossil fuel vehicles.

Vancouver is also expanding charging station infrastructure across the city, and developing a preferential parking policy for zero emissions vehicles, while residents can tap EV charger rebates to support home and workplace charging. Plans are to add more DC fast charging points, which can provide up to 200 kilometres of range in an hour. The goal is to put all Vancouver residents within a 10 minute drive of a DC fast-charging station by 2021.

#google#

A DC fast charger will be installed at Science World, and the number of DC fast chargers available at Empire Fields in east Vancouver will be expanded. BC Hydro will also add DC fast chargers at their head office and in Kerrisdale, as part of a faster charging rollout across the network.

The cost of adding charging infrastructure in the construction phase of a building is much lower than retrofitting a building later on, and EV owners can access home and workplace charging rebates to offset costs, which will save residents up to $3,300 and avoid the more complex process of increasing electrical capacity in the future. Since 2014, the existing requirements have resulted in approximately 20,000 EV-ready stalls in buildings.

Related News

Canadian Scientists say power utilities need to adapt to climate change

Canada Power Grid Climate Resilience integrates extreme weather planning, microgrids, battery storage, renewable energy, vegetation management, and undergrounding to reduce outages, harden infrastructure, modernize utilities, and safeguard reliability during storms, ice events, and wildfires.

Key Points

Canada's grid resilience hardens utilities against extreme weather using microgrids, storage, renewables, and upgrades.

✅ Grid hardening: microgrids, storage, renewable integration

✅ Vegetation management reduces storm-related line contact

✅ Selective undergrounding where risk and cost justify

The increasing intensity of storms that lead to massive power outages highlights the need for Canada’s electrical utilities to be more robust and innovative, climate change scientists say.

“We need to plan to be more resilient in the face of the increasing chances of these events occurring,” University of New Brunswick climate change scientist Louise Comeau said in a recent interview.

The East Coast was walloped this week by the third storm in as many days, with high winds toppling trees and even part of a Halifax church steeple, underscoring the value of storm-season electrical safety tips for residents.

Significant weather events have consistently increased over the last five years, according to the Canadian Electricity Association (CEA), which has tracked such events since 2003.

#google#

Nearly a quarter of total outage hours nationally in 2016 – 22 per cent – were caused by two ice storms, a lightning storm, and the Fort McMurray fires, which the CEA said may or may not be classified as a climate event.

“It (climate change) is putting quite a lot of pressure on electricity companies coast to coast to coast to improve their processes and look for ways to strengthen their systems in the face of this evolving threat,” said Devin McCarthy, vice president of public affairs and U.S. policy for the CEA, which represents 40 utilities serving 14 million customers.

The 2016 figures – the most recent available – indicate the average Canadian customer experienced 3.1 outages and 5.66 hours of outage time.

McCarthy said electricity companies can’t just build their systems to withstand the worst storm they’d dealt with over the previous 30 years. They must prepare for worse, and address risks highlighted by Site C dam stability concerns as part of long-term planning.

“There needs to be a more forward looking approach, climate science led, that looks at what do we expect our system to be up against in the next 20, 30 or 50 years,” he said.

Toronto Hydro is either looking at or installing equipment with extreme weather in mind, Elias Lyberogiannis, the utility’s general manager of engineering, said in an email.

That includes stainless steel transformers that are more resistant to corrosion, and breakaway links for overhead service connections, which allow service wires to safely disconnect from poles and prevents damage to service masts.

Comeau said smaller grids, tied to electrical systems operated by larger utilities, often utilize renewable energy sources such as solar and wind as well as battery storage technology to power collections of buildings, homes, schools and hospitals.

“Capacity to do that means we are less vulnerable when the central systems break down,” Comeau said.

Nova Scotia Power recently announced an “intelligent feeder” pilot project, which involves the installation of Tesla Powerwall storage batteries in 10 homes in Elmsdale, N.S., and a large grid-sized battery at the local substation. The batteries are connected to an electrical line powered in part by nearby wind turbines.

The idea is to test the capability of providing customers with back-up power, while collecting data that will be useful for planning future energy needs.

Tony O’Hara, NB Power’s vice-president of engineering, said the utility, which recently sounded an alarm on copper theft, was in the late planning stages of a micro-grid for the western part of the province, and is also studying the use of large battery storage banks.

“Those things are coming, that will be an evolution over time for sure,” said O’Hara.

Some solutions may be simpler. Smaller utilities, like Nova Scotia Power, are focusing on strengthening overhead systems, mainly through vegetation management, while in Ontario, Hydro One and Alectra are making major investments to strengthen infrastructure in the Hamilton area.

“The number one cause of outages during storms, particularly those with high winds and heavy snow, is trees making contact with power lines,” said N.S. Power’s Tiffany Chase.

The company has an annual budget of $20 million for tree trimming and removal.

“But the reality is with overhead infrastructure, trees are going to cause damage no matter how robust the infrastructure is,” said Matt Drover, the utility’s director for regional operations.

“We are looking at things like battery storage and a variety of other reliability programs to help with that.”

NB Power also has an increased emphasis on tree trimming and removal, and now spends $14 million a year on it, up from $6 million prior to 2014.

O’Hara said the vegetation program has helped drive the average duration of power outages down since 2014 from about three hours to two hours and 45 minutes.

Some power cables are buried in both Nova Scotia and New Brunswick, mostly in urban areas. But both utilities maintain it’s too expensive to bury entire systems – estimated at $1 million per kilometre by Nova Scotia Power.

The issue of burying more lines was top of mind in Toronto following a 2013 ice storm, but that’s city’s utility also rejected the idea of a large-scale underground system as too expensive – estimating the cost at around $15 billion, while Ontario customers have seen Hydro One delivery rates rise in recent adjustments.

“Having said that, it is prudent to do so for some installations depending on site specific conditions and the risks that exist,” Lyberogiannis said.

Comeau said lowering risks will both save money and disruption to people’s lives.

“We can’t just do what we used to do,” said Xuebin Zhang, a senior climate change scientist at Environment and Climate Change Canada.

“We have to build in management risk … this has to be a new norm.”

Related News

US looks to decommission Alaskan military reactor

SM-1A Nuclear Plant Decommissioning details the US Army Corps of Engineers' removal of the Fort Greely reactor, Cold War facility dismantling, environmental monitoring, remote-site power history, and timeline to 2026 under a deactivated nuclear program.

Key Points

Army Corps plan to dismantle Fort Greely's SM-1A reactor and complete decommissioning of remaining systems by 2026.

✅ Built for remote Arctic radar support during the Cold War

✅ High costs beat diesel; program later deemed impractical

✅ Reactor parts removed; residuals monitored; removal by 2026

The US Army Corps of Engineers has begun decommissioning Alaska’s only nuclear power plant, SM-1A, which is located at Fort Greely, even as new US reactors continue to take shape nationwide. The $17m plant closed in 1972 after ten years of sporadic operation. It was out of commission from 1967 to 1969 for extensive repairs. Much of has already been dismantled and sent for disposal, and the rest, which is encased in concrete, is now to be removed.

The plant was built as part of an experimental programme to determine whether nuclear facilities, akin to next-generation nuclear concepts, could be built and operated at remote sites more cheaply than diesel-fuelled plants.

"The main approach was to reduce significant fuel-transportation costs by having a nuclear reactor that could operate for long terms, a concept echoed in the NuScale SMR safety evaluation process, with just one nuclear core," Brian Hearty said. Hearty manages the Army Corps of Engineers’ Deactivated Nuclear Power Plant Program.

#google#

He said the Army built SM-1A in 1962 hoping to provide power reliably at remote Arctic radar sites, where in similarly isolated regions today new US coal plants may still be considered, intended to detect incoming missiles from the Soviet Union at the height of the Cold War. He added that the programme worked but not as well as Pentagon officials had hoped. While SM-1A could be built and operated in a cold and remote location, its upfront costs were much higher than anticipated, and it costs more to maintain than a diesel power plant. Moreover, the programme became irrelevant because of advances in Soviet rocket science and the development of intercontinental ballistic missiles.

Hearty said the reactor was partially dismantled soon after it was shut down. “All of the fuel in the reactor core was removed and shipped back to the Atomic Energy Commission (AEC) for them to either reprocess or dispose of,” he noted. “The highly activated control and absorber rods were also removed and shipped back to the AEC.”

The SM-1A plant produced 1.8MWe and 20MWt, including steam, which was used to heat the post. Because that part of the system was still needed, Army officials removed most of the nuclear-power system and linked the heat and steam components to a diesel-fired boiler. However, several parts of the nuclear system remained, including the reactor pressure vessel and reactor coolant pumps. “Those were either kept in place, or they were cut off and laid down in the tall vapour-containment building there,” Hearty said. “And then they were grouted and concreted in place.” The Corps of Engineers wants to remove all that remains of the plant, but it is as yet unclear whether that will be feasible.

Meanwhile, monitoring for radioactivity around the facility shows that it remains at acceptable levels. “It would be safe to say there’s no threat to human health in the environment,” said Brenda Barber, project manager for the decommissioning. Work is still in its early stages and is due to be completed in 2026 at the earliest. Barber said the Corps awarded the $4.6m contract in December to a Virginia-based firm to develop a long-range plan for the project, similar in scope to large reactor refurbishment efforts elsewhere. Among other things, this will help officials determine how much of the SM-1A will remain after it’s decommissioned. “There will still be buildings there,” she said. “There will still be components of some of the old structure there that may likely remain.”

Related News

US January power generation jumps 9.3% on year: EIA

US January power generation climbed to 373.2 TWh, EIA data shows, with coal edging natural gas, record wind output, record nuclear generation, rising hydro, and stable utility-scale solar amid higher Henry Hub prices.

Key Points

US January power generation hit 373.2 TWh; coal led gas, wind and nuclear set records, with solar edging higher.

✅ Coal 31.8% share; gas 29.4%; coal output 118.7 TWh, gas 109.6 TWh.

✅ Wind hit record 26.8 TWh; nuclear record 74.6 TWh.

✅ Total generation 373.2 TWh, highest January since 2014.

The US generated 373.2 TWh of power in January, up 7.9% from 345.9 TWh in December and 9.3% higher than the same month in 2017, Energy Information Administration data shows.

The monthly total was the highest amount in January since 377.3 TWh was generated in January 2014.

Coal generation totaled 118.7 TWh in January, up 11.4% from 106.58 TWh in December and up 2.8% from the year-ago month, consistent with projections of a coal-fired generation increase for the first time since 2014. It was also the highest amount generated in January since 132.4 TWh in 2015.

For the second straight month, more power was generated from coal than natural gas, as 109.6 TWh came from gas, up 3.3% from 106.14 TWh in December and up 19.9% on the year.

However, the 118.7 TWh generated from coal was down 9.6% from the five-year average for the month, due to the higher usage of gas and renewables and a rising share of non-fossil generation in the overall mix.

#google#

Coal made up 31.8% of the total US power generation in January, up from 30.8% in December but down from 33.8% in January 2017.

Gas` generation share was at 29.4% in the latest month, with momentum from record gas-fired electricity earlier in the period, down from 30.7% in December but up from 26.8% in the year-ago month.

In January, the NYMEX Henry Hub gas futures price averaged $3.16/MMBtu, up 13.9% from $2.78/MMBtu averaged in December but down 4% from $3.29/MMBtu averaged in the year-ago month.

WIND, NUCLEAR GENERATION AT RECORD HIGHS

Wind generation was at a record-high 26.8 TWh in January, up 29.3% from 22.8 TWh in December and the highest amount on record, according to EIA data going back to January 2001. Wind generated 7.2% of the nation`s power in January, as an EIA summer outlook anticipates larger wind and solar contributions, up from 6.6% in December and 6.1% in the year-ago month.

Utility-scale solar generated 3.3 TWh in January, up 1.3% from 3.1 TWh in December and up 51.6% on the year. In January, utility-scale solar generation made up 0.9% of US power generation, during a period when solar and wind supplied 10% of US electricity in early 2018, flat from December but up from 0.6% in January 2017.

Nuclear generation was also at a record-high 74.6 TWh in January, up 1.3% month on month and the highest monthly total since the EIA started tracking it in January 2001, eclipsing the previous record of 74.3 TWh set in July 2008. Nuclear generation made up 20% of the US power in January, down from 21.3% in December and 21.4% in the year-ago month.

Hydro power totaled 25.4 TWh in January, making up 6.8% of US power generation during the month, up from 6.5% in December but down from 8.2% in January 2017.

Related News

Duke Energy will spend US$25bn to modernise its US grid

Duke Energy Clean Energy Strategy targets smart grid upgrades, wind and solar expansion, efficient gas, and high-reliability nuclear, cutting CO2, boosting decarbonization, and advancing energy efficiency and reliability for the Carolinas.

Key Points

A plan investing in smart grids, renewables, gas, and nuclear to cut CO2 and enhance reliability and efficiency by 2030.

✅ US$25bn smart grid upgrades; US$11bn renewables and gas

✅ 40% CO2 reduction and >80% low-/zero-carbon generation by 2030

✅ 2017 nuclear fleet 95.64% capacity factor; ~90 TWh carbon-free

The US power group Duke Energy plans to invest US$25bn on grid modernization over the 2017-2026 period, including the implementation of smart grid technologies to cope with the development of renewable energies, along with US$11bn on the expansion of renewable (wind and solar) and gas-fired power generation capacities.

The company will modernize its fleet and expects more than 80% of its power generation mix to come from zero and lower CO2 emitting sources, aligning with nuclear and net-zero goals, by 2030. Its current strategy focuses on cutting down CO2 emissions by 40% by 2030. Duke Energy will also promote energy efficiency and expects cumulative energy savings - based on the expansion of existing programmes - to grow to 22 TWh by 2030, i.e. the equivalent to the annual usage of 1.8 million households.

#google#

Duke Energy’s 11 nuclear generating units posted strong operating performance in 2017, as U.S. nuclear costs hit a ten-year low, providing the Carolinas with nearly 90 billion kilowatt-hours of carbon-free electricity – enough to power more than 7 million homes.

Globally, China's nuclear program remains on a steady development track, underscoring broader industry momentum.

“Much of our 2017 success is due to our focus on safety and work efficiencies identified by our nuclear employees, along with ongoing emphasis on planning and executing refueling outages to increase our fleet’s availability for producing electricity,” said Preston Gillespie, Duke Energy chief nuclear officer.

Some of the nuclear fleet’s 2017 accomplishments include, as a new U.S. reactor comes online nationally:

- The 11 units achieved a combined capacity factor of 95.64 percent, second only to the fleet’s 2016 record of 95.72 percent, marking the 19th consecutive year of attaining a 90-plus percent capacity factor (a measure of reliability).

- The two units at Catawba Nuclear Station produced more than 19 billion kilowatt-hours of electricity, and the single unit at Harris Nuclear Plant generated more than 8 billion kilowatt-hours, both setting 12-month records.

- Brunswick Nuclear Plant unit 2 achieved a record operating run.

- Both McGuire Nuclear Station units completed their shortest refueling outages ever and unit 1 recorded its longest operating run.

- Oconee Nuclear Station unit 2 achieved a fleet record operating run.

The Robinson Nuclear Plant team completed the station’s 30th refueling outage, which included a main generator stator replacement and other life-extension activities, well ahead of schedule.

“Our nuclear employees are committed to providing reliable, clean electricity every day for our Carolinas customers,” added Gillespie. “We are very proud of our team’s 2017 accomplishments and continue to look for additional opportunities to further enhance operations.”

Related News

NRC Makes Available Turkey Point Renewal Application

Turkey Point Subsequent License Renewal seeks NRC approval for FP&L to extend Units 3 and 4, three-loop pressurized water reactors near Homestead, Miami; public review, docketing, and an Atomic Safety and Licensing Board hearing.

Key Points

The NRC is reviewing FP&L's request to extend Turkey Point Units 3 and 4 operating licenses by 20 years.

✅ NRC will docket if application is complete

✅ Public review and opportunity for adjudicatory hearing

✅ Units commissioned in 1972 and 1973, near Miami

The U.S. Nuclear Regulatory Commission said Thursday that it had made available the first-ever "subsequent license renewal application," amid milestones at nuclear power projects worldwide, which came from Florida Power and Light and applies to the company's Turkey Point Nuclear Generating Station's Units 3 and 4.

The Nuclear Regulatory Commission recently made available for public review the first-ever subsequent license renewal application, which Florida Power & Light Company submitted on Jan. 1.

In the application, FP&L requests an additional 20 years for the operating licenses of Turkey Point Nuclear Generating Units 3 and 4, three-loop, pressurized water reactors located in Homestead, Florida, where the Florida PSC recently approved a municipal solid waste energy purchase, approximately 40 miles south of Miami.

The NRC approved the initial license renewal in June 2002, as new reactors at Georgia's Vogtle plant continue to take shape nationwide. Unit 3 is currently licensed to operate through July 19, 2032. Unit 4 is licensed to operate through April 10, 2033.

#google#

NRC staff is currently reviewing the application, while a new U.S. reactor has recently started up, underscoring broader industry momentum. If the staff determines the application is complete, they will docket it and publish a notice of opportunity to request an adjudicatory hearing before the NRC’s Atomic Safety and Licensing Board.

The first-ever subsequent license renewal application, submitted by Florida Power & Light Company asks for an additional 20 years for the already-renewed operating licenses of Turkey Point, even as India moves to revive its nuclear program internationally, which are currently set to expire in July of 2032 and April of 2033. The two thee-loop, pressurized water reactors, located about 40 miles south of Miami, were commissioned in July 1972 and April 1973.

If the application is determined to be complete, the staff will docket it and publish a notice of opportunity to request an adjudicatory hearing before the NRC’s Atomic Safety and Licensing Board, the agency said.

The application is available for public review on the NRC website. Copies of the application will be available at the Homestead Branch Library in Homestead, the Naraja Branch Library in Homestead and the South Dade Regional Library in Miami.

Related News

Deepwater Wind Eyeing Massachusetts’ South Coast for Major Offshore Wind Construction Activity

Revolution Wind Massachusetts will assemble turbine foundations in New Bedford, Fall River, or Somerset, building a local offshore wind supply chain, creating regional jobs, and leveraging pumped storage and an offshore transmission backbone.

Key Points

An offshore wind project assembling MA foundations, building a local supply chain, jobs, and peak clean power.

✅ 400 MW offshore wind; local fabrication of 1,500-ton foundations

✅ 300+ direct jobs, 600 indirect; MA crew vessel builds and operations

✅ Expandable offshore transmission; pumped storage for peak power

Deepwater Wind will assemble the wind turbine foundations for its Revolution Wind in Massachusetts, and it has identified three South Coast cities – New Bedford, Fall River and Somerset – as possible locations for this major fabrication activity, the company is announcing today.

Deepwater Wind is committed to building a local workforce and supply chain for its 400-megawatt Revolution Wind project, now under review by state and utility officials as Massachusetts advances projects like Vineyard Wind statewide.

“No company is more committed to building a local offshore wind workforce than us,” said Deepwater Wind CEO Jeffrey Grybowski. “We launched America’s offshore wind industry right here in our backyard. We know how to build offshore wind in the U.S. in the right way, and our smart approach will be the most affordable solution for the Commonwealth. This is about building a real industry that lasts.”

#google#

The construction activity will involve welding, assembly, painting, commissioning and related work for the 1,500-ton steel foundations supporting the turbine towers. This foundation-related work will create more than 300 direct jobs for local construction workers during Revolution Wind’s construction period. An additional 600 indirect and induced jobs will support this effort.

In addition, Deepwater Wind is now actively seeking proposals from Massachusetts boat builders for the construction of purpose-built crew vessels for Revolution Wind. Several dozen workers are expected to build the first of these vessels at a local boat-building facility, and another dozen workers will operate this specialty vessel over the life of Revolution Wind. (Deepwater Wind commissioned America’s only offshore wind crew vessel – Atlantic Wind Transfer’s Atlantic Pioneer – to serve the Block Island Wind Farm.)

The company will issue a formal Request for Information to local suppliers in the coming weeks. Deepwater Wind’s additional wind farms serving Massachusetts will require the construction of additional vessels, as will growth along Long Island’s South Shore in the coming years.

These commitments are in addition to Deepwater Wind’s previously-announced plans to use the New Bedford Marine Commerce Terminal for significant construction and staging operations, and to pay $500,000 per year to the New Bedford Port Authority to use the facility. During construction, the turbine marshaling activity in New Bedford is expected to support approximately 700 direct regional construction jobs.

“Deepwater Wind is building a sustainable industry on the South Coast of Massachusetts,” said Matthew Morrissey, Deepwater Wind Vice President Massachusetts. “With Revolution Wind, we are demonstrating that we can build the industry in Massachusetts while enhancing competition and keeping costs low.”

The Revolution Wind project will be built in Deepwater Wind’s federal lease site, under the BOEM lease process, southwest of Martha’s Vineyard. If approved, local construction work on Revolution Wind would begin in 2020, with the project in operations in 2023. Survey work is already underway at Deepwater Wind’s offshore lease area.

Revolution Wind will deliver “baseload” power, allowing a utility-scale renewable energy project for the first time to replace the retiring fossil fuel-fired power plants closing across the region, a transition echoed by Vineyard Wind’s first power milestones elsewhere.

Revolution Wind will be capable of delivering clean energy to Massachusetts utilities when it’s needed most, during peak hours of demand on the regional electric grid. A partnership with FirstLight Power, using its Northfield Mountain hydroelectric pumped storage in Northfield, Massachusetts, makes this peak power offering possible. This is the largest pairing of hydroelectric pumped storage and offshore wind in the world.

The Revolution Wind offshore wind farm will also be paired with a first-of-its-kind offshore transmission backbone. Deepwater Wind is partnering with National Grid Ventures on an expandable offshore transmission network that supports not just Revolution Wind, but also future offshore wind farms, as New York’s biggest offshore wind farm moves forward across the region, even if they’re built by our competitors.

This cooperation is in the best interest of Massachusetts electric customers because it will reduce the amount of electrical infrastructure needed to support the state’s 1,600 MW offshore wind goal. Instead of each subsequent developer building its own standalone cable network, other offshore wind companies could use expandable infrastructure already installed for Revolution Wind, reducing project costs and saving ratepayers money.

Related News

Swiss electricity getting cleaner, says energy report

Switzerland Renewable Power Mix shows 62 percent renewables in 2016, led by hydropower, with solar, wind, and biomass growing as nuclear declines under Energy Strategy 2050, while unverified imports include fossil fueled European market electricity.

Key Points

2016 Swiss power mix: 62% renewables led by hydropower, with nuclear declining and solar, wind, and biomass rising.

✅ Hydropower supplies 56% of electricity consumption.

✅ Other renewables total 5.9%: solar, wind, biomass.

✅ Nuclear share fell to 17% as phaseout advances.

The electricity consumed in Switzerland is ever greener, according to government statistics: some 62% comes from renewable sources, compared with about 25.5% in the U.S. at the time, while nuclear has fallen to 17%.

The figures (in French/German)external link were released on Monday by the Federal Office of Energy, which gathers each year the sources used by electricity providers in Switzerland. The latest report refers to 2016.

As expected, hydropower is the biggest source of juice, at 56%. This marks an increase of 2.5 percentage points on the previous year. Other renewables – solar, wind, biomass and small-scale hydropower – made up 5.9%, a one-point increase on 2015, mirroring gains seen in U.S. solar generation over recent years.

#google#

Taken together, this means that just over three-fifths of electricity provided in the country in 2016 came from renewable sources, a figure helped by the slight decline in the use of nuclear, which fell from 20.7% to 17%, a shift similar to when U.S. renewables became the second-most prevalent source in 2020, reflecting broader trends.

Another 20% comes from unverified sources, which the energy office explains as energy used by high-consuming businesses which is often bought on the European market and not traced within Switzerland. Much of it may be fossil fuel burning.

Overall the figures tie in closely with the government’s Energy Strategy 2050external link, a sweeping plan endorsed by voters last year that aims to completely phase out nuclear by the mid-point of the century, as well as promote renewable sources and reduce consumption, in line with progress such as Germany's 50% clean electricity reported recently.

The electricity consumption figures should not be confused with those for overall energy produced, which (for reasons of import and export) are different: overall, 59% of the production total is hydropower, 33% remains nuclear, 5% other renewable, and 3% fossil fuels, and abroad U.S. renewables hit a 28% monthly record in April, highlighting differing baselines.

Related News

More than a third of Irish electricity to be green within four years

Ireland Wind and Solar Share 2022 highlights IEA projections of over 33% electricity generation from renewables, with variable renewable energy growth, capacity targets, EU policy shifts, and investments accelerating wind and solar deployment.

Key Points

IEA forecasts wind and solar to exceed 33% of Ireland's electricity by 2022, second in variable renewables after Denmark.

✅ IEA expects Ireland to surpass 33% wind and solar by 2022

✅ Denmark leads at ~70%; Germany and UK exceed 25%

✅ Investments and capacity targets drive renewable growth

The share of wind and solar in total electricity generation in Ireland is expected to exceed 33pc by 2022, according to the 'Renewables 2017' report from the International Energy Agency (IEA).

Among the findings, the report says that Denmark is on course to be the world leader in the variable renewable energy sector, with 70pc of its electricity generation expected to come from wind and solar renewables by 2022.

The Nordic country will be followed by Ireland, Germany and the UK, all of which are expected see their share of wind and solar energy in total electricity generation exceed 25pc, according to the IEA report.

In a move to increase the level of wind generation in Ireland, the Government-controlled Ireland Strategic Investment Fund (Isif) teamed up with German solar and wind park operator Capital Stage in January to invest €140m in 20 solar parks in Ireland.

#google#

The parks are being developed by Dublin-based Power Capital, and it marks the first time that Isif has committed to financing solar park developments in this country.

Globally, renewables accounted for almost two-thirds of net new power capacity, with nearly 165 gigawatts (GW) coming online in 2016.

This was a record year that was largely driven by a booming solar market in China and around the world.

In 2016 solar capacity around the world grew by 50pc, reaching over 74 GW, with China's solar PV accounting for almost half of this expansion. In another first, solar energy additions rose faster than any other fuel, surpassing the net growth in coal, the IEA report found.

China alone is responsible for over two-fifths of global renewable capacity growth, which, according to the IEA, is largely driven by concerns about the country's air pollution and capacity targets.

The Asian giant is also the world market leader in hydropower, bioenergy for electricity and heat, and electric vehicles, the IEA report said. In 2016 the United States remained the second largest growth market for renewables.

However, with US President Donald Trump withdrawing the country from the Paris Agreement on climate change, the country's commitment to renewable energy faces policy uncertainty.

Meanwhile, India continues to grow its renewable electricity capacity, and by 2022, the country is expected to more than double its current renewable electricity capacity, according to the IEA. For the first time, this growth over the forecast period (2016-2022) is higher compared with the European Union, according to the report.

Meanwhile in the EU, renewable energy growth over the forecast period is 40pc lower compared with the previous five-year period.

The low forecast in respect of the EU is based on a number of factors, the IEA said, including weaker electricity demand, overcapacity, and limited visibility on forthcoming auction capacity volumes in some markets.

Overall, the Government has committed to generating 40pc of its electricity from renewable energy sources by 2020.

That target is set to be missed, which would see the Government eventually having to fork out hundreds of millions of euro for carbon credits.

Later this year, Ireland will host Europe's biggest summit on Climate Innovation, during which over 50 nationwide events and initiatives will be held.

Related News

India is now the world’s third-largest electricity producer

India Electricity Production 2017 surged to 1,160 BU, ranking third globally; rising TWh output with 334 GW capacity, strong renewables and thermal mix, 7% CAGR in generation, and growing demand, investments, and FDI inflows.

Key Points

India's 2017 power output reached 1,160 BU, third globally, supported by 334 GW capacity, rising renewables, and 7% CAGR.

✅ 1,160 BU generated; third after China and the US

✅ Installed capacity 334 GW; 65% thermal, rising renewables

✅ Generation CAGR ~7%; demand, FDI, investments rising

India now generates around 1,160.1 billion units of electricity in financial year 2017, up 4.72% from the previous year, and amid surging global electricity demand that is straining power systems. The country is behind only China which produced 6,015 terrawatt hours (TWh. 1 TW = 1,000,000 megawatts) and the US (4,327 TWh), and is ahead of Russia, Japan, Germany, and Canada.

India’s electricity production grew 34% over seven years to 2017, and the country now produces more energy than Japan and Russia, which had 27% and 8.77% more electricity generation capacity installed, respectively, than India seven years ago.

India produced 1,160.10 billion units (BU) of electricity–one BU is enough to power 10 million households (one household using average of about 3 units per day) for a month–in financial year (FY) 2017. Electricity production stood at 1,003.525 BU between April 2017-January 2018, according to a February 2018 report by India Brand Equity Foundation (IBEF), a trust established by the commerce ministry.

#google#

With a production of 1,423 BU in FY 2016, India was the third largest producer and the third largest consumer of electricity in the world, behind China (6,015 BU) and the United States (4,327 BU).

With an annual growth rate of 22.6% capacity addition over a decade to FY 2017, renewables beat other power sources–thermal, hydro and nuclear. Renewables, however, made up only 18.79% of India’s energy, up 68.65% since 2007, and globally, low-emissions sources are expected to cover most demand growth in the coming years. About 65% of installed capacity continues to be thermal.

As of January 2018, India has installed power capacity of 334.4 gigawatt (GW), making it the fifth largest installed capacity in the world after European Union, China, United States and Japan, and with much of the fleet coal-based, imported coal volumes have risen at times amid domestic supply constraints.

The government is targeting capacity addition of around 100 GW–the current power production of United Kingdom–by 2022, as per the IBEF report.

Electricity generation grew at 7% annually

India achieved a 34.48% growth in electricity production by producing 1,160.10 BU in 2017 compared to 771.60 BU in 2010–meaning that in these seven years, electricity production in India grew at a compound annual growth rate (CAGR) of 7.03%, while thermal power plants' PLF has risen recently amid higher demand and lower hydro.

Generation capacity grew at 10% annually

Of 334.5 GW installed capacity as of January 2018–up 60% from 132.30 GW in 2007–thermal installed capacity was 219.81 GW. Hydro and renewable energy installed capacity totaled 44.96 GW and 62.85 GW, respectively, said the report.

The CAGR in installed capacity over a decade to 2017 was 10.57% for thermal power, 22.06% for renewable energy–the fastest among all sources of power–2.51% for hydro power and 5.68% for nuclear power.

Growing demand, higher investments will drive future growth

Growing population and increasing penetration of electricity connections, along with increasing per-capita usage would provide further impetus to the power sector, said the report.

Power consumption is estimated to increase from 1,160.1 BU in 2016 to 1,894.7 BU in 2022, as per the report, though electricity demand fell sharply in one recent period.

Increasing investment remained one of the driving factors of power sector growth in the country.

Power sector has a 100% foreign direct investment (FDI) permit, which boosted FDI inflows in the sector.

Total FDI inflows in the power sector reached $12.97 billion (Rs 83,713 crore) during April 2000 to December 2017, accounting for 3.52% of FDI inflows in India, the report said.

Related News

Uzbekistan Looks To Export Electricity To Afghanistan

Surkhan-Pul-e-Khumri Power Line links Uzbekistan and Afghanistan via a 260-kilometer transmission line, boosting electricity exports, grid reliability, and regional trade; ADB-backed financing could open Pakistan's energy market with 24 million kWh daily.

Key Points

A 260-km line to expand Uzbekistan power exports to Afghanistan, ADB-funded, with possible future links to Pakistan.

✅ 260 km Surkhan-Pul-e-Khumri transmission link

✅ +70% electricity exports; up to 24M kWh daily

✅ ADB $70M co-financing; $32M from Uzbekistan

Senior officials with Uzbekistan’s state-run power company have said work has begun on building power cables to Afghanistan that will enable them to increase exports by 70 per cent, echoing regional trends like Ukraine resuming electricity exports after grid repairs.

Uzbekenergo chief executive Ulugbek Mustafayev said in a press conference on March 24 that construction of the Afghan section of the 260-kilometer Surkhan-Pul-e-Khumri line will start in June.

The Asian Development Bank has pledged $70 million toward the final expected $150 million bill of the project. Another $32 million will come from Uzbekistan.

Mustafayev said the transmission line would give Uzbekistan the option of exporting up to 24 million kilowatt hours to Afghanistan daily, similar to Ukraine's electricity export resumption amid shifting regional demand.

“We could potentially even reach Pakistan’s energy market,” he said, noting broader regional ambitions like Iran's bid to be a power hub linking regional grids.

#google#

This project was given fresh impetus by Afghan President Ashraf Ghani’s visit to Tashkent in December, mirroring cross-border energy cooperation such as Iran-Iraq energy talks in the region. His Uzbek counterpart, Shavkat Mirziyoyev, had announced at the time that work was set to begin imminently on the line, which will run from the village of Surkhan in Uzbekistan’s Surkhandarya region to Pul-e-Khumri, a town in Afghanistan just south of Kunduz.

In January, Mirziyoyev issued a decree ordering that the rate for electricity deliveries to Afghanistan be dropped from $0.076 to $0.05 per kilowatt.

Mustafayev said up to 6 billion kilowatt hours of electricity could eventually be sent through the power lines. More than 60 billion kilowatt hours of electricity was produced in Uzbekistan in 2017.

According to Tulabai Kurbonov, an Uzbek journalist specializing in energy issues, the power line will enable the electrification of the the Hairatan-Mazar-i-Sharif railroad joining the two countries. Trains currently run on diesel. Switching over to electricity will help reduce the cost of transporting cargo.

There is some unhappiness, however, over the fact that Uzbekistan plans to sell power to Afghanistan when it suffers from significant shortages domestically and wider Central Asia electricity shortages persist.

"In the villages of the Ferghana Valley, especially in winter, people are suffering from a shortage of electricity,” said Munavvar Ibragimova, a reporter based in the Ferghana Valley. “You should not be selling electricity abroad before you can provide for your own population. What we clearly see here is the favoring of the state’s interests over those of the people.”

Related News

Renewables generated more electricity than brown coal over summer, report finds

Renewables Beat Brown Coal in Australia, as solar and wind surged to nearly 10,000 GWh, stabilizing the grid with battery storage during peak demand, after Hazelwood's closure, Green Energy Markets reported.

Key Points

It describes a 2017-18 summer when solar, wind, and storage generated more electricity than brown coal in Australia.

✅ Solar and wind hit nearly 10,000 GWh in summer 2017-18

✅ Brown coal fell to about 9,100 GWh after Hazelwood closure

✅ Batteries stabilized peak demand; Tesla responded in milliseconds

Renewable energy generated more electricity than brown coal during Australia’s summer for the first time in 2017-18, according to a new report by Green Energy Markets.

Continued growth in solar, as part of Australia's energy transition, pushed renewable generation in Australia to just under 10,000 gigawatt hours between December 2017 and February 2018. With the Hazelwood plant knocked out of the system last year, brown coal’s output in the same period was just over 9,100 GWh.

Renewables produced 40% more than gas over the period, and was exceeded only by black coal, reflecting trends seen in U.S. renewables surpassing coal in 2022.

#google#

The report, commissioned by GetUp, found renewables were generating particularly large amounts of electricity when it was most needed, producing 32% more than brown coal during summer between 11am and 7pm, when demand peaks.

Coal in decline: an energy industry on life support

Solar in particular was working to support the system, on average producing more than Hazelwood was capable of producing between 9am and 5pm.

A further 5,000 megawatts of large-scale renewables projects was under construction in February, supporting 17,445 jobs, while renewables became the second-most prevalent U.S. electricity source in 2020.

GetUp’s campaign director, Miriam Lyons, said the latest renewable energy index showed renewables were keeping the lights on while coal became increasingly unreliable, a trend echoed as renewables surpassed coal in the U.S. in recent years.

“Over summer renewables kept houses cool and lights on during peak demand times when people needed electricity most,” Lyons said. “Meanwhile dirty old coal plants are becoming increasingly unreliable in the heat.

“These ageing clunkers failed 36 times over summer.

“Clean energy rescued people from blackouts this summer. When the clapped-out Loy Yang coal plant tripped, South Australia’s giant Tesla battery reacted in milliseconds to keep the power on.

“It’s clear that a smart electricity grid based on a combination of renewable energy and storage is the best way to deliver clean, affordable energy for all Australians.”

Related News

Electricity deal clinches $100M bitcoin mining operation in Medicine Hat

Medicine Hat Bitcoin Mining Deal delivers 42 MW electricity to Hut 8, enabling blockchain data centres, cryptocurrency mining expansion, and economic diversification in Alberta with low-cost power, land lease, and rapid construction near Unit 16.

Key Points

A pact to supply 42 MW and lease land, enabling Hut 8's blockchain data centres and crypto mining growth in Alberta.

✅ 42 MW electricity from city; land lease near Unit 16

✅ Hut 8 expands to 60.7 MW; blockchain data centres

✅ 100 temporary jobs; 42 ongoing roles in Alberta

The City of Medicine Hat has agreed to supply electricity and lease land to a Toronto-based cryptocurrency mining company, at a time when some provinces are pausing large new crypto loads in a deal that will see $100 million in construction spending in the southern Alberta city.

The city will provide electric energy capacity of about 42 megawatts to Hut 8 Mining Corp., which will construct bitcoin mining facilities near the city's new Unit 16 power plant.

The operation is expected to be running by September and will triple the company's operating power to 60.7 megawatts, Hut 8 said, amid broader investments in new turbines across Canada.

#google#

"The signing of the electricity supply agreement and the land lease represents a key component in achieving our business plan for the roll-out of our BlockBox Data Centres in low-cost energy jurisdictions," said the company's board chairman, Bill Tai, in a release.

"[Medicine Hat] offers stable, cost-competitive utility rates and has been very welcoming and supportive of Hut 8's fast-paced growth plans."

In bitcoin mining operations, rows upon rows of power-consuming computers are used to solve mathematical puzzles in exchange for bitcoins and confirm crytopcurrency transactions. The verified transactions are then added to the public ledger known as the blockchain.

Hut 8's existing 18.7-megawatt mining operation at Drumheller, Alta. — a gated compound filled with rows of shipping containers housing the computers — has so far mined 750 bitcoins. Bitcoin was trading Tuesday morning for about $11,180.

Medicine Hat Mayor Ted Clugston says the deal is part of the city's efforts to diversify its economy.

We've made economic development a huge priority down here because we were hit very, very hard by the oil and gas decline," he said, noting that being the generator and vendor of its own electricity puts the city in a uniquely good position.

"Really we're just turning gas into electricity and they're taking that electricity and turning it into blockchain, or ones and zeroes."

Elsewhere in Canada, using more electricity for heat has been urged by green energy advocates, reflecting broader electrification debates.

Hut 8 says construction of the facility is starting right away and will create about 100 temporary jobs. The project is expected to be finished by the third-quarter of this year.

The Medicine Hat mining operation will generate 42 ongoing jobs for electricians, general labourers, systems technicians and security staff.

Related News

Electricity use actually increased during 2018 Earth Hour, BC Hydro

Earth Hour BC highlights BC Hydro data on electricity use, energy savings, and participation in the Lower Mainland and Vancouver Island amid climate change and hydroelectric power dynamics.

Key Points

BC observance tracking BC Hydro electricity use and conservation during Earth Hour, amid hydroelectric power dominance.

✅ BC Hydro reports rising electricity use during Earth Hour 2018

✅ Savings fell from 2% in 2008 to near zero province-wide

✅ Hydroelectric grid yields low GHG emissions in BC

For the first time since it began tracking electricity use in the province during Earth Hour, BC Hydro said customers used more power during the 60-minute period when lights are expected to dim, mirroring all-time high electricity demand seen recently.

The World Wildlife Fund launched Earth Hour in Sydney, Australia in 2007. Residents and businesses there turned off lights and non-essential power as a symbol to mark the importance of combating climate change.

The event was adopted in B.C. the next year and, as part of that, BC Hydro began tracking the megawatt hours saved.

#google#

In 2008, residents and businesses achieved a two per cent savings in electricity use. But since then, BC Hydro says the savings have plummeted.

The event was adopted in B.C. the next year and, as part of that, BC Hydro began tracking the megawatt hours saved.

In 2008, residents and businesses achieved a two per cent savings in electricity use. But since then, BC Hydro says the savings have plummeted, as record-breaking demand in 2021 and beyond changed consumption patterns.

Lights on

For Earth Hour this year, which took place 8:30-9:30 p.m. on March 24, BC Hydro says electricity use in the Lower Mainland increased by 0.5 per cent, even as it activated a winter payment plan to help customers manage bills. On Vancouver Island it increased 0.6 per cent.

In the province's southern Interior and northern Interior, power use remained the same during the event.

On Friday, the utility released a report called: "lights out". Why Earth Hour is dimming in BC. which explores the decline of energy savings related to Earth Hour in the province.

The WWF says the way in which hydro companies track electricity savings during Earth Hour is not an accurate measure of participation, and tracking of emerging loads like crypto mining electricity use remains opaque, and noted that more countries than ever are turning off lights for the event.

For 2018, the WWF shifted the focus of Earth Hour to the loss of wildlife across the globe.

BC Hydro says in its report that the symbolism of Earth Hour is still important to British Columbians, but almost all power generation in B.C. is hydroelectric, though recent drought conditions have required operational adjustments, and only accounts for one per cent of greenhouse gas emissions.

Related News

Ontario Energy minister downplays dispute between auditor, electricity regulator

Ontario IESO Accounting Dispute highlights tensions over public sector accounting standards, auditor general oversight, electricity market transparency, KPMG advice, rate-regulated accounting, and an alleged $1.3B deficit understatement affecting Hydro bills and provincial finances.

Key Points

A PSAS clash between Ontario's auditor general and the IESO, alleging a $1.3B deficit impact and transparency failures.

✅ Auditor alleges deficit understated by $1.3B

✅ Dispute over PSAS vs US-style accounting

✅ KPMG support, transparency and co-operation questioned

The bad blood between the Ontario government and auditor general bubbled to the surface once again Monday, with the Liberal energy minister downplaying a dispute between the auditor and the Crown corporation that manages the province's electricity market, even as the government pursued legislation to lower electricity rates in the province.

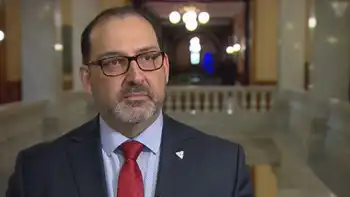

Glenn Thibeault said concerns raised by auditor general Bonnie Lysyk during testimony before a legislative committee last week aren't new and the practices being used by the Independent Electricity System Operator are commonly endorsed by major auditing firms.

"(Lysyk) doesn't like the rate-regulated accounting. We've always said we've relied on the other experts within the field as well, plus the provincial controller," Thibeault said.

#google#

"We believe that we are following public sector accounting standards."

Thibeault said that Ontario Power Generation, Hydro One and many other provinces and U.S. states use the same accounting practices.

"We go with what we're being told by those who are in the field, like KPMG, like E&Y," he said.

But a statement from Lysyk's office Monday disputed Thibeault's assessment.

"The minister said the practices being used by the IESO are common in other jurisdictions," the statement said.

"In fact, the situation with the IESO is different because none of the six other jurisdictions with entities similar to the IESOuse Canadian Public Sector Accounting Standards. Five of them are in the United States and use U.S. accounting standards."

Lysyk said last week that the IESO is using "bogus" accounting practices and her office launched a special audit of the agency late last year after the agency changed their accounting to be more in line with U.S. accounting, following reports of a phantom demand problem that cost customers millions.

Lysyk said the accounting changes made by the IESO impact the province's deficit, understating it by $1.3 billion as of the end of 2017, adding that IESO "stalled" her office when it asked for information and was not co-operative during the audit.

Lysyk's full audit of the IESO is expected to be released in the coming weeks and is among several accounting disputes her office has been engaged in with the Liberal government over the past few years.

Last fall, she accused the government of purposely obscuring the true financial impact of its 25% hydro rate cut by keeping billions in debt used to finance that plan off the province's books. Lysyk had said she would audit the IESO because of its role in the hydro plan's complex accounting scheme.

"Management of the IESO and the board would not co-operate with us, in the sense that they continually say they're co-operating, but they stalled on giving us information," she said last week.

Terry Young, a vice-president with the IESO, said the agency has fully co-operated with the auditor general. The IESO opened up its office to seven staff members from the auditor's office while they did their work.

"We recognize the work that she's doing and to that end we've tried to fully co-operate," he said. "We've given her all of the information that we can."

Young said the change in accounting standards is about ensuring greater transparency in transactions in the energy marketplace.

"It's consistent with many other independent electricity system operators are doing," he said.

Lysyk also criticized IESO's accounting firm, KPMG, for agreeing with the IESO on the accounting standards. She was critical of the firm billing taxpayers for nearly $600,000 work with the IESO in 2017, compared to their normal yearly audit fee of $86,500.

KPMG spokeswoman Lisa Papas said the accounting issues that IESO addressed during 2017 were complex, contributing to the higher fees.

The accounting practices the auditor is questioning are a "difference of professional judgement," she said.

"The standards for public sector organizations such as IESO are principles-based standards and, accordingly, require the exercise of considerable professional judgement," she said in a statement.

"In many cases, there is more than one acceptable approach that is compliant with the applicable standards."

Progressive Conservative energy critic Todd Smith said the government isn't being transparent with the auditor general or taxpayers, aligning with calls for cleaning up Ontario's hydro mess in the sector.

"Obviously, they have some kind of dispute but the auditor's office is saying that the numbers that the government is putting out there are bogus.

Those are her words," he said. "We've always said that we believe the auditor general's are the true numbers for the

province of Ontario."

NDP energy critic Peter Tabuns said the Liberal government has decided to "play with accounting rules" to make its books look better ahead of the spring election, despite warnings that electricity prices could soar if costs are pushed into the future.

Related News

Symantec Proves Russian

Dragonfly energy sector cyberattacks target ICS and SCADA across critical infrastructure, including the power grid and nuclear facilities, using spearphishing, watering-hole sites, supply-chain compromises, malware, and VPN exploits to gain operational access.

Key Points

Dragonfly APT campaigns target energy firms and ICS to gain grid access, risking manipulation and service disruption.

✅ Breaches leveraged spearphishing, watering-hole sites, and supply chains.

✅ Targeted ICS, SCADA, VPNs to pivot into operational networks.

✅ Aimed to enable power grid manipulation and potential outages.

An October, 2017 report by researchers at Symantec Corp., cited by the U.S. government, has linked recent US power grid cyber attacks to a group of hackers it had code-named "Dragonfly", and said it found evidence critical infrastructure facilities in Turkey and Switzerland also had been breached.

The Symantec researchers said an earlier wave of attacks by the same group starting in 2011 was used to gather intelligence on companies and their operational systems. The hackers then used that information for a more advanced wave of attacks targeting industrial control systems that, if disabled, leave millions without power or water.

U.S. intelligence officials have long been concerned about the security of the country’s electrical grid. The recent attacks, condemned by the U.S. government, striking almost simultaneously at multiple locations, are testing the government’s ability to coordinate an effective response among several private utilities, state and local officials, and industry regulators.

#google#

While the core of a nuclear generator is heavily protected, a sudden shutdown of the turbine can trigger safety systems. These safety devices are designed to disperse excess heat while the nuclear reaction is halted, but the safety systems themselves may be vulnerable to attack.

The operating systems at nuclear plants also tend to be legacy controls built decades ago and don’t have digital control systems that can be exploited by hackers.

“Since at least March 2016, Russian government cyber actors… targeted government entities and multiple U.S. critical infrastructure sectors, including the energy, nuclear, commercial facilities, water, aviation, and critical manufacturing sectors,” according to Thursday’s FBI and Department of Homeland Security report. The report did not say how successful the attacks were or specify the targets, but said that the Russian hackers “targeted small commercial facilities’ networks where they staged malware, conducted spearphishing, and gained remote access into energy sector networks.” At least one target of a string of infrastructure attacks last year was a nuclear power facility in Kansas.

Symantec doesn’t typically point fingers at particular nations in its research on cyberattacks, said Eric Chien, technical director of Symantec’s Security Technology and Response division, though he said his team doesn’t see anything it would disagree with in the new federal report. The government report appears to corroborate Symantec’s research, showing that the hackers had penetrated computers and accessed utility control rooms that would let them directly manipulate power systems, he says.

“There were really no more technical hurdles for them to do something like flip off the power,” he said.

And as for the group behind the attacks, Chien said it appears to be relatively dormant for now, but it has gone quiet in the past only to return with new hacks.

“We expect they’re sort of retooling now, and they likely will be back,”

In some cases, Dragonfly successfully broke into the core systems that control US and European energy companies, Symantec revealed.

“The energy sector has become an area of increased interest to cyber-attackers over the past two years,” Symantec said in its report.

“Most notably, disruptions to Ukraine’s power system in 2015 and 2016 were attributed to a cyberattack and led to power outages affecting hundreds of thousands of people. In recent months, there have also been media reports of attempted attacks on the electricity grids in some European countries, as well as reports of companies that manage nuclear facilities in the US being compromised by hackers.

“The Dragonfly group appears to be interested in both learning how energy facilities operate and also gaining access to operational systems themselves, to the extent that the group now potentially has the ability to sabotage or gain control of these systems should it decide to do so. Symantec customers are protected against the activities of the Dragonfly group.”

In recent weeks, senior US intelligence officials said that the Kremlin believes it can launch hacking operations against the West with impunity, including a cyber weapon that can disrupt power grids, according to assessments.

The DHS and FBI report further elaborated: “This campaign comprises two distinct categories of victims: staging and intended targets. The initial victims are peripheral organisations such as trusted third-party suppliers with less-secure networks, referred to as ‘staging targets’ throughout this alert.

“The threat actors used the staging targets’ networks as pivot points and malware repositories when targeting their final intended victims. National Cybersecurity and Communications Integration Center and FBI judge the ultimate objective of the actors is to compromise organisational networks, also referred to as the ‘intended target’.”

According to the US alert, hackers used a variety of attack methods, including spear-phishing emails, watering-hole domains, credential gathering, open source and network reconnaissance, host-based exploitation, and deliberate targeting of ICS infrastructure.

The attackers also targeted VPN software and used password cracking tools.

Once inside, the attackers downloaded tools from a remote server and then carried out a number of actions, including modifying key systems to store plaintext credentials in memory, and built web shells to gain command and control of targeted systems.

“This actors’ campaign has affected multiple organisations in the energy, nuclear, water, aviation, construction and critical manufacturing sectors, with hundreds of victims across the U.S. power grid confirmed,” the DHS said, before outlining a number of steps that IT managers in infrastructure organisations can take to cleanse their systems and defend against Russian hackers. he said.

Related News

US Government Condemns Russia for Power Grid Hacking

Russian Cyberattacks on U.S. Critical Infrastructure target energy grids, nuclear plants, water systems, and aviation, DHS and FBI warn, using spear phishing, malware, and ICS/SCADA intrusion to gain footholds for potential sabotage and disruption.

Key Points

State-backed hacks targeting U.S. energy, nuclear, water and aviation via phishing and ICS access for sabotage.

✅ DHS and FBI detail multi-stage intrusion since 2016

✅ Targets include energy, nuclear, water, aviation, manufacturing

✅ TTPs: spear phishing, lateral movement, ICS reconnaissance

Russia is attacking the U.S. energy grid, with reported power plant breaches unfolding alongside attacks on nuclear facilities, water processing plants, aviation systems, and other critical infrastructure that millions of Americans rely on, according to a new joint analysis by the FBI and the Department of Homeland Security.

In an unprecedented alert, the US Department of Homeland Security (DHS) and FBI have warned of persistent attacks by Russian government hackers on critical US government sectors, including energy, nuclear, commercial facilities, water, aviation and manufacturing.

The alert details numerous attempts extending back to March 2016 when Russian cyber operatives targeted US government and infrastructure.

The DHS and FBI said: “DHS and FBI characterise this activity as a multi-stage intrusion campaign by Russian government cyber-actors who targeted small commercial facilities’ networks, where they staged malware, conducted spear phishing and gained remote access into energy sector networks.

“After obtaining access, the Russian government cyber-actors conducted network reconnaissance, moved laterally and collected information pertaining to industrial control systems.”

The Trump administration has accused Russia of engineering a series of cyberattacks that targeted American and European nuclear power plants and water and electric systems, and could have sabotaged or shut power plants off at will.

#google#

United States officials and private security firms saw the attacks as a signal by Moscow that it could disrupt the West’s critical facilities in the event of a conflict.

They said the strikes accelerated in late 2015, at the same time the Russian interference in the American election was underway. The attackers had compromised some operators in North America and Europe by spring 2017, after President Trump was inaugurated.

In the following months, according to the DHS/FBI report, Russian hackers made their way to machines with access to utility control rooms and critical control systems at power plants that were not identified. The hackers never went so far as to sabotage or shut down the computer systems that guide the operations of the plants.

Still, new computer screenshots released by the Department of Homeland Security have made clear that Russian state hackers had the foothold they would have needed to manipulate or shut down power plants.

“We now have evidence they’re sitting on the machines, connected to industrial control infrastructure, that allow them to effectively turn the power off or effect sabotage,” said Eric Chien, a security technology director at Symantec, a digital security firm.

“From what we can see, they were there. They have the ability to shut the power off. All that’s missing is some political motivation,” Mr. Chien said.

American intelligence agencies were aware of the attacks for the past year and a half, and the Department of Homeland Security and the F.B.I. first issued urgent warnings to utility companies in June, 2017. Both DHS/FBI have now offered new details as the Trump administration imposed sanctions against Russian individuals and organizations it accused of election meddling and “malicious cyberattacks.”

It was the first time the administration officially named Russia as the perpetrator of the assaults. And it marked the third time in recent months that the White House, departing from its usual reluctance to publicly reveal intelligence, blamed foreign government forces for attacks on infrastructure in the United States.

In December, the White House said North Korea had carried out the so-called WannaCry attack that in May paralyzed the British health system and placed ransomware in computers in schools, businesses and homes across the world. Last month, it accused Russia of being behind the NotPetya attack against Ukraine last June, the largest in a series of cyberattacks on Ukraine to date, paralyzing the country’s government agencies and financial systems.

But the penalties have been light. So far, President Trump has said little to nothing about the Russian role in those attacks.

The groups that conducted the energy attacks, which are linked to Russian intelligence agencies, appear to be different from the two hacking groups that were involved in the election interference.

That would suggest that at least three separate Russian cyberoperations were underway simultaneously. One focused on stealing documents from the Democratic National Committee and other political groups. Another, by a St. Petersburg “troll farm” known as the Internet Research Agency, used social media to sow discord and division. A third effort sought to burrow into the infrastructure of American and European nations.

For years, American intelligence officials tracked a number of Russian state-sponsored hacking units as they successfully penetrated the computer networks of critical infrastructure operators across North America and Europe, including in Ukraine.

Some of the units worked inside Russia’s Federal Security Service, the K.G.B. successor known by its Russian acronym, F.S.B.; others were embedded in the Russian military intelligence agency, known as the G.R.U. Still others were made up of Russian contractors working at the behest of Moscow.

Russian cyberattacks surged last year, starting three months after Mr. Trump took office.

American officials and private cybersecurity experts uncovered a series of Russian attacks aimed at the energy, water and aviation sectors and critical manufacturing, including nuclear plants, in the United States and Europe. In its urgent report in June, the Department of Homeland Security and the F.B.I. notified operators about the attacks but stopped short of identifying Russia as the culprit.

By then, Russian spies had compromised the business networks of several American energy, water and nuclear plants, mapping out their corporate structures and computer networks.

They included that of the Wolf Creek Nuclear Operating Corporation, which runs a nuclear plant near Burlington, Kan. But in that case, and those of other nuclear operators, Russian hackers had not leapt from the company’s business networks into the nuclear plant controls.

Forensic analysis suggested that Russian spies were looking for inroads — although it was not clear whether the goal was to conduct espionage or sabotage, or to trigger an explosion of some kind.

In a report made public in October, Symantec noted that a Russian hacking unit “appears to be interested in both learning how energy facilities operate and also gaining access to operational systems themselves, to the extent that the group now potentially has the ability to sabotage or gain control of these systems should it decide to do so.”

The United States sometimes does the same thing. It bored deeply into Iran’s infrastructure before the 2015 nuclear accord, placing digital “implants” in systems that would enable it to bring down power grids, command-and-control systems and other infrastructure in case a conflict broke out. The operation was code-named “Nitro Zeus,” and its revelation made clear that getting into the critical infrastructure of adversaries is now a standard element of preparing for possible conflict.

Reconstructed screenshot fragments of a Human Machine Interface that the threat actors accessed, according to DHS

Sanctions Announced

The US treasury department has imposed sanctions on 19 Russian people and five groups, including Moscow’s intelligence services, for meddling in the US 2016 presidential election and other malicious cyberattacks.

Russia, for its part, has vowed to retaliate against the new sanctions.

The new sanctions focus on five Russian groups, including the Russian Federal Security Service, the country’s military intelligence apparatus, and the digital propaganda outfit called the Internet Research Agency, as well as 19 people, some of them named in the indictment related to election meddling released by special counsel Robert Mueller last month.

In announcing the sanctions, which will generally ban U.S. people and financial institutions from doing business with those people and groups, the Treasury Department pointed to alleged Russian election meddling, involvement in the infrastructure hacks, and the NotPetya malware, which the Treasury Department called “the most destructive and costly cyberattack in history.”

The new sanctions come amid ongoing criticism of the Trump administration’s reluctance to punish Russia for cyber and election meddling. Sen. Mark Warner (D-Va.) said that, ahead of the 2018 mid-term elections, the administration’s decision was long overdue but not enough. “Nearly all of the entities and individuals who were sanctioned today were either previously under sanction during the Obama Administration, or had already been charged with federal crimes by the Special Counsel,” Warner said.

Warning: The Russians Are Coming

In an updated warning to utility companies, DHS/FBI officials included a screenshot taken by Russian operatives that proved they could now gain access to their victims’ critical controls, prompting a renewed focus on protecting the U.S. power grid among operators.

American officials and security firms, including Symantec and CrowdStrike, believe that Russian attacks on the Ukrainian power grid in 2015 and 2016 that left more than 200,000 citizens there in the dark are an ominous sign of what the Russian cyberstrikes may portend in the United States and Europe in the event of escalating hostilities.

Private security firms have tracked the Russian government assaults on Western power and energy operators — conducted alternately by groups under the names Dragonfly campaigns alongside Energetic Bear and Berserk Bear — since 2011, when they first started targeting defense and aviation companies in the United States and Canada.

By 2013, researchers had tied the Russian hackers to hundreds of attacks on the U.S. power grid and oil and gas pipeline operators in the United States and Europe. Initially, the strikes appeared to be motivated by industrial espionage — a natural conclusion at the time, researchers said, given the importance of Russia’s oil and gas industry.

But by December 2015, the Russian hacks had taken an aggressive turn. The attacks were no longer aimed at intelligence gathering, but at potentially sabotaging or shutting down plant operations.

At Symantec, researchers discovered that Russian hackers had begun taking screenshots of the machinery used in energy and nuclear plants, and stealing detailed descriptions of how they operated — suggesting they were conducting reconnaissance for a future attack.

Eventhough the US government enacted sanctions, cybersecurity experts are still questioning where the Russian attacks could lead, given that the United States was sure to respond in kind.

“Russia certainly has the technical capability to do damage, as it demonstrated in the Ukraine,” said Eric Cornelius, a cybersecurity expert at Cylance, a private security firm, who previously assessed critical infrastructure threats for the Department of Homeland Security during the Obama administration.

“It is unclear what their perceived benefit would be from causing damage on U.S. soil, especially given the retaliation it would provoke,” Mr. Cornelius said.

Though a major step toward deterrence, publicly naming countries accused of cyberattacks still is unlikely to shame them into stopping. The United States is struggling to come up with proportionate responses to the wide variety of cyberespionage, vandalism and outright attacks.

Lt. Gen. Paul Nakasone, who has been nominated as director of the National Security Agency and commander of United States Cyber Command, the military’s cyberunit, said during his recent Senate confirmation hearing, that countries attacking the United States so far have little to worry about.

“I would say right now they do not think much will happen to them,” General Nakasone said. He later added, “They don’t fear us.”

Related News

Ireland: We are the global leaders in taking renewables onto the grid

Ireland 65% Renewable Grid Capability showcases world leading integration of intermittent wind and solar, smart grid flexibility, EU-SysFlex learnings, and the Celtic Interconnector to enhance stability, exports, and energy security across the European grid.

Key Points

Ireland can run its isolated power system with 65% variable wind and solar, informing EU grid integration and scaling.

✅ 65% system non-synchronous penetration on an isolated grid

✅ EU-SysFlex roadmap supports large-scale renewables integration

✅ Celtic Interconnector adds 700MW capacity and stability

Ireland is now able to cope with 65% of its electricity coming from intermittent electricity sources like wind and solar, as highlighted by Ireland's green electricity outlook today – an expertise Energy Minister Denish Naugthen believes can be replicated on a larger scale as Europe moves towards 50% renewable power by 2030.

Denis Naughten is an Irish politician who serves as Minister for Communications, Climate Action and Environment since May 2016.

Naughten spoke to editor Frédéric Simon on the sidelines of a EURACTIV event in the European Parliament to mark the launch of EU-SysFlex, an EU-funded project, which aims to create a long-term roadmap for the large-scale integration of renewable energy on electricity grids.

What is the reason for your presence in Brussels today and the main message that you came to deliver?

The reason that I’m here today is that we’re going to share the knowledge what we have developed in Ireland, right across Europe. We are now the global leaders in taking variable renewable electricity like wind and solar onto our grid.