Electricity News in October 2019

California faces huge power cuts as wildfires rage

California Wildfire Power Shut-Offs escalate as PG&E imposes blackouts amid high winds, Getty and Kincade fires, mass evacuations, Sonoma County threats, and a state of emergency, drawing regulatory scrutiny over grid safety and outage scope.

Key Points

Planned utility outages to curb wildfire risk during extreme winds, prompting evacuations and regulatory scrutiny.

✅ PG&E preemptive blackouts under regulator inquiry

✅ Getty and Kincade fires drive mass evacuations

✅ Sonoma County under threat amid high winds

Pacific Gas & Electric (PG&E) already faces an investigation by regulators after cutting supplies to 970,000 homes and businesses amid California blackouts that raised concerns.

It announced that another 650,000 properties would face precautionary shut-offs.

Wildfires fanned by the strong winds are raging in two parts of the state.

Thousands of residents near the wealthy Brentwood neighbourhood of Los Angeles have been told to evacuate because of a wildfire that began early on Monday.

Further north in Sonoma County, a larger fire has forced 180,000 people from their homes.

California's governor has declared a state-wide emergency.

What about the power cuts?

On Monday regulators announced a formal inquiry into whether energy utilities broke rules by pre-emptively cutting power to an estimated 2.5 million people, amid a blackouts policy debate that intensified, as wildfire risks soared.

They did not name any utilities but analysts said PG&E was responsible for the bulk of the "public safety power shut-offs", and later faced a Camp Fire guilty plea that underscored its liabilities.

The company filed for bankruptcy in January after facing hundreds of lawsuits from victims of wildfires in 2017 and 2018.

Of the 970,000 properties hit by the most recent cuts, under half had their services back by Monday, and some sought help through wildfire assistance programs, the Associated Press reported.

Despite criticism that the precautionary blackouts were too widespread and too disruptive, PG&E said more would come on Tuesday and Wednesday because further strong winds were expected.

The company said it had logged more than 20 preliminary reports of damage to its network from the most recent windstorm.

In a video posted to Twitter on Saturday, Governor Gavin Newsom said the power cuts were "infuriating everyone, and rightfully so".

Where are the fires now?

In Los Angeles, the Getty Fire has burned over 600 acres (242 ha) and about 10,000 buildings are in the mandatory evacuation zone.

At least eight homes have been destroyed and five others damaged.

"If you are in an evacuation zone, don't screw around," Mr Schwarzenegger tweeted. "Get out."

LA fire chief Ralph Terrazas said fire crews had been "overwhelmed" by the scale of the fires.

"They had to make some tough decisions on which houses they were able to protect," he said.

"Many times it depends on where the ember lands. I saw homes that were adjacent to homes that were totally destroyed, without any damage."

In northern California, schools remain closed in Sonoma County, where tens of thousands of homes and businesses are under threat.

Sonoma has been ravaged by the Kincade Fire, which started on Wednesday and has burned through 50,000 acres of land, fanned by the winds.

The Kincade Fire began seven minutes after a nearby power line was damaged, and power lines may have started fires according to reports, but PG&E has not yet confirmed if the power glitch started the blaze.

About 180,000 people have been ordered to evacuate, with roads around Santa Rosa north of San Francisco packed with cars as people tried to flee.

There are fears the flames could cross the 101 highway and enter areas that have not seen wildfires since the 1940s.

Related News

US Electricity Market Reforms could save Consumers $7bn

PJM and MISO Electricity-Market Reforms promise consumer savings by enabling renewables, wind, solar, and storage participation in wholesale markets, enhancing grid flexibility, reliability services, and real-time pricing across the Midwest, Great Lakes, and Mid-Atlantic.

Key Points

Market rule updates enabling renewables and storage, improving reliability and lowering consumer costs.

✅ Removes barriers to renewables, storage, demand response

✅ Improves intermarket links and real-time price signals

✅ Rewards flexible resources and reliability services

Electricity-market reforms to enable more renewables generation and storage in the Midwest, Great Lakes, and Mid-Atlantic could save consumers in the US and Canada more than $6.9 billion a year, according to a new report.

The findings may have major implications for consumer groups, large industrial companies, businesses, and homeowners in those regions, said the Wind-Solar Alliance, (WSA), which commissioned the Customer Focused and Clean report.

The WSA is a non-profit organisation supporting the growth of renewables. American Wind Energy Association CEO Tom Kiernan is listed as WSA secretary, amid ongoing debates about the US wind market today.

"Consumers are looking for clean energy, affordable and reliable energy that will keep their monthly electricity bills low," said Kristin Munsch, president of the Board of the Consumer Advocates of the PJM States, which represents over 65 million consumers in 13 states.

"There is great potential to achieve those goals with the cost-effective integration of wind, solar and battery storage plants into our wholesale power markets."

The report found the average residential customer in the PJM and Midcontinent Independent System Operator (MISO) regions, covering 29 US states and the Canadian province of Manitoba, could each save up to $48 a year as lower wholesale electricity prices materialize with significantly more wind, solar and storage on the grid.

The average annual home electricity, for example in New Jersey, in the PJM region, was just over $106 in 2018, according to the US Energy Information Administration.

The latest report quantifies the findings of a previous one for the WSA, published in November 2018, which found that outdated wholesale market rules in the US were preventing full participation by renewable energy, including wind power.

Outdated rules

"The existing wholesale power market rules were largely developed for slower-to-react conventional generators, such as coal and nuclear plants," said Michael Milligan, president of Milligan Grid Solutions and co-author of the new report.

"This report demonstrates the benefits of updating the rules to better accommodate the characteristics and potential contributions of wind and solar and other newer sources of low-cost generation."

With more renewables generation on the grid, customers would benefit the most from increasing power-system flexibility through market structures, the new report concluded. It called for the removal of artificial barriers preventing renewables, storage and demand response from participating in markets.

The report also advocated improving the connections between markets, thereby lowering transaction costs of imports and exports between neighbouring systems.

"There are currently artificial barriers that are preventing the full participation of renewables, storage and other new technologies in the PJM and MISO markets," said Michael Goggin, vice president of Grid Strategies and co-author of the report.

"Providing consumers with a real-time price signal that allows them to adjust their demand, rewarding flexible resources for their capabilities through improved market design, and allowing renewable and storage resources to participate in reliability-services markets would yield the greatest consumer benefits," he said.

PJM and MISO, which incorporate some of the windiest areas of the country, are currently reviewing their market designs as part of a broader grid overhaul underway.

Related News

Smart grid and system improvements help avoid more than 500,000 outages over the summer

ComEd Smart Grid Reliability drives outage reduction across Illinois, leveraging smart switches, grid modernization, and peak demand programs to keep customers powered, improve power quality, and enhance energy savings during extreme weather and severe storms.

Key Points

ComEd's smart grid performance, cutting outages and improving power quality to enhance reliability and customer savings.

✅ Smart switches reroute power to avoid customer interruptions

✅ Fewer outages during extreme weather across northern Illinois

✅ Peak Time Savings rewards for reduced peak demand usage

While the summer of 2019 set records for heat and brought severe storms, ComEd customers stayed cool thanks to record-setting reliability during the season. These smart grid investments over the last seven years helped to set records in key reliability measurements, including frequency of outages metrics, and through smart switches that reroute power around potential problem areas, avoided more than 538,000 customer interruptions from June to August.

"In a summer where we were challenged by extreme weather, we saw our smart grid investments and our people continue to deliver the highest levels of reliability, backed by extensive disaster planning across utilities, for the families and businesses we serve," said Joe Dominguez, CEO of ComEd. "We're proud to deliver the most affordable, cleanest and, as we demonstrated this summer, most reliable energy to our customers. I want to thank our 6,000 employees who work around the clock in often challenging conditions to power our communities."

ComEd has avoided more than 13 million customer interruptions since 2012, due in part to smart grid and system improvements. The avoided outages have resulted in $2.4 billion in estimated savings to society. In addition to keeping energy flowing for residents, strong power reliability continues to help persuade industrial and commercial companies to expand in northern Illinois and Chicago. The GridWise Alliance recently recognized Illinois as the No. 2 state in the nation for its smart grid implementation.

"Our smart grid investments has vastly improved the infrastructure of our system," said Terry Donnelly, ComEd president and chief operating officer. "We review the system and our operations continually to make sure we're investing in areas that benefit the greatest number of customers, and to prepare for public-health emergencies as well. On a daily basis and during storms or to reduce wildfire risk when necessary, our customers are seeing fewer and fewer interruptions to their lives and businesses."

ComEd customers also set records for energy savings this summer. Through its Peak Time Savings program and other energy-efficiency programs offered by utilities, ComEd empowered nearly 300,000 families and individuals to lower their bills by a total of more than $4 million this summer for voluntarily reducing their energy use during times of peak demand. Since the Peak Time Savings program launched in 2015, participating customers have earned a total of more than $10 million in bill credits.

Related News

Offshore wind is set to become a $1 trillion business

Offshore wind power accelerates low-carbon electrification, leveraging floating turbines, high capacity factors, HVDC transmission, and hydrogen production to decarbonize grids, cut CO2, and deliver competitive, reliable renewable energy near demand centers.

Key Points

Offshore wind power uses offshore turbines to deliver low-carbon electricity with high capacity factors and falling costs.

✅ Sea-based wind farms with 40-50% capacity factors

✅ Floating turbines unlock deep-water, far-shore resources

✅ Enables hydrogen production and strengthens grid reliability

The need for affordable low-carbon technologies is greater than ever

Global energy-related CO2 emissions reached a historic high in 2018, driven by an increase in coal use in the power sector. Despite impressive gains for renewables, fossil fuels still account for nearly two-thirds of electricity generation, the same share as 20 years ago. There are signs of a shift, with increasing pledges to decarbonise economies and tackle air pollution, and with World Bank support helping developing countries scale wind, but action needs to accelerate to meet sustainable energy goals. As electrification of the global energy system continues, the need for clean and affordable low-carbon technologies to produce this electricity is more pressing than ever. This World Energy Outlook special report offers a deep dive on a technology that today has a total capacity of 23 GW (80% of it in Europe) and accounts for only 0.3% of global electricity generation, but has the potential to become a mainstay of the world's power supply. The report provides the most comprehensive analysis to date of the global outlook for offshore wind, its contributions to electricity systems and its role in clean energy transitions.

The offshore wind market has been gaining momentum

The global offshore wind market grew nearly 30% per year between 2010 and 2018, benefitting from rapid technology improvements. Over the next five years, about 150 new offshore wind projects are scheduled to be completed around the world, pointing to an increasing role for offshore wind in power supplies. Europe has fostered the technology's development, led by the UK offshore wind sector alongside Germany and Denmark. The United Kingdom and Germany currently have the largest offshore wind capacity in operation, while Denmark produced 15% of its electricity from offshore wind in 2018. China added more capacity than any other country in 2018.

The untapped potential of offshore wind is vast

The best offshore wind sites could supply more than the total amount of electricity consumed worldwide today. And that would involve tapping only the sites close to shores. The IEA initiated a new geospatial analysis for this report to assess offshore wind technical potential country by country. The analysis was based on the latest global weather data on wind speed and quality while factoring in the newest turbine designs. Offshore wind's technical potential is 36 000 TWh per year for installations in water less than 60 metres deep and within 60 km from shore. Global electricity demand is currently 23 000 TWh. Moving further from shore and into deeper waters, floating turbines could unlock enough potential to meet the world's total electricity demand 11 times over in 2040. Our new geospatial analysis indicates that offshore wind alone could meet several times electricity demand in a number of countries, including in Europe, the United States and Japan. The industry is adapting various floating foundation technologies that have already been proven in the oil and gas sector. The first projects are under development and look to prove the feasibility and cost-effectiveness of floating offshore wind technologies.

Offshore wind's attributes are very promising for power systems

New offshore wind projects have capacity factors of 40-50%, as larger turbines and other technology improvements are helping to make the most of available wind resources. At these levels, offshore wind matches the capacity factors of gas- and coal-fired power plants in some regions – though offshore wind is not available at all times. Its capacity factors exceed those of onshore wind and are about double those of solar PV. Offshore wind output varies according to the strength of the wind, but its hourly variability is lower than that of solar PV. Offshore wind typically fluctuates within a narrower band, up to 20% from hour to hour, than solar PV, which varies up to 40%.

Offshore wind's high capacity factors and lower variability make its system value comparable to baseload technologies, placing it in a category of its own – a variable baseload technology. Offshore wind can generate electricity during all hours of the day and tends to produce more electricity in winter months in Europe, the United States and China, as well as during the monsoon season in India. These characteristics mean that offshore wind's system value is generally higher than that of its onshore counterpart and more stable over time than that of solar PV. Offshore wind also contributes to electricity security, with its high availability and seasonality patterns it is able to make a stronger contribution to system needs than other variable renewables. In doing so, offshore wind contributes to reducing CO2 and air pollutant emissions while also lowering the need for investment in dispatchable power plants. Offshore wind also has the advantage of avoiding many land use and social acceptance issues that other variable renewables are facing.

Offshore wind is on track to be a competitive source of electricity

Offshore wind is set to be competitive with fossil fuels within the next decade, as well as with other renewables including solar PV. The cost of offshore wind is declining and is set to fall further. Financing costs account for 35% to 50% of overall generation cost, and supportive policy frameworks are now enabling projects to secure low cost financing in Europe, with zero-subsidy tenders being awarded. Technology costs are also falling. The levelised cost of electricity produced by offshore wind is projected to decline by nearly 60% by 2040. Combined with its relatively high value to the system, this will make offshore wind one of the most competitive sources of electricity. In Europe, recent auctions indicate that offshore wind will soon beat new natural gas-fired capacity on cost and be on a par with solar PV and onshore wind. In China, offshore wind is set to become competitive with new coal-fired capacity around 2030 and be on par with solar PV and onshore wind. In the United States, recent project proposals indicate that offshore wind will soon be an affordable option, even as the 1 GW timeline continues to evolve, with potential to serve demand centres along the country's east coast.

Innovation is delivering deep cost reductions in offshore wind, and transmission costs will become increasingly important. The average upfront cost to build a 1 gigawatt offshore wind project, including transmission, was over $4 billion in 2018, but the cost is set to drop by more than 40% over the next decade. This overall decline is driven by a 60% reduction in the costs of turbines, foundations and their installation. Transmission accounts for around one-quarter of total offshore wind costs today, but its share in total costs is set to increase to about one-half as new projects move further from shore. Innovation in transmission, for example through work to expand the limits of direct current technologies, will be essential to support new projects without raising their overall costs.

Offshore wind is set to become a $1 trillion business

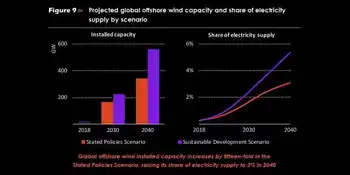

Offshore wind power capacity is set to increase by at least 15-fold worldwide by 2040, becoming a $1 trillion business. Under current investment plans and policies, the global offshore wind market is set to expand by 13% per year, reflecting its growth despite Covid-19 in recent years, passing 20 GW of additions per year by 2030. This will require capital spending of $840 billion over the next two decades, almost matching that for natural gas-fired or coal-fired capacity. Achieving global climate and sustainability goals would require faster growth: capacity additions would need to approach 40 GW per year in the 2030s, pushing cumulative investment to over $1.2 trillion.

The promising outlook for offshore wind is underpinned by policy support in an increasing number of regions. Several European North Seas countries – including the United Kingdom, Germany, the Netherlands and Denmark – have policy targets supporting offshore wind. Although a relative newcomer to the technology, China is quickly building up its offshore wind industry, aiming to develop a project pipeline of 10 GW by 2020. In the United States, state-level targets and federal incentives are set to kick-start the U.S. offshore wind surge in the coming years. Additionally, policy targets are in place and projects under development in Korea, Japan, Chinese Taipei and Viet Nam.

The synergies between offshore wind and offshore oil and gas activities provide new market opportunities. Since offshore energy operations share technologies and elements of their supply chains, oil and gas companies started investing in offshore wind projects many years ago. We estimate that about 40% of the full lifetime costs of an offshore wind project, including construction and maintenance, have significant synergies with the offshore oil and gas sector. That translates into a market opportunity of $400 billion or more in Europe and China over the next two decades. The construction of foundations and subsea structures offers potential crossover business, as do practices related to the maintenance and inspection of platforms. In addition to these opportunities, offshore oil and gas platforms require electricity that is often supplied by gas turbines or diesel engines, but that could be provided by nearby wind farms, thereby reducing CO2 emissions, air pollutants and costs.

Offshore wind can accelerate clean energy transitions

Offshore wind can help drive energy transitions by decarbonising electricity and by producing low-carbon fuels. Over the next two decades, its expansion could avoid between 5 billion and 7 billion tonnes of CO2 emissions from the power sector globally, while also reducing air pollution and enhancing energy security by reducing reliance on imported fuels. The European Union is poised to continue leading the wind energy at sea in Europe industry in support of its climate goals: its offshore wind capacity is set to increase by at least fourfold by 2030. This growth puts offshore wind on track to become the European Union's largest source of electricity in the 2040s. Beyond electricity, offshore wind's high capacity factors and falling costs makes it a good match to produce low-carbon hydrogen, a versatile product that could help decarbonise the buildings sector and some of the hardest to abate activities in industry and transport. For example, a 1 gigawatt offshore wind project could produce enough low-carbon hydrogen to heat about 250 000 homes. Rising demand for low-carbon hydrogen could also dramatically increase the market potential for offshore wind. Europe is looking to develop offshore "hubs" for producing electricity and clean hydrogen from offshore wind.

It's not all smooth sailing

Offshore wind faces several challenges that could slow its growth in established and emerging markets, but policy makers and regulators can clear the path ahead. Developing efficient supply chains is crucial for the offshore wind industry to deliver low-cost projects. Doing so is likely to call for multibillion-dollar investments in ever-larger support vessels and construction equipment. Such investment is especially difficult in the face of uncertainty. Governments can facilitate investment of this kind by establishing a long-term vision for offshore wind and by drawing on U.K. policy lessons to define the measures to be taken to help make that vision a reality. Long-term clarity would also enable effective system integration of offshore wind, including system planning to ensure reliability during periods of low wind availability.

The success of offshore wind depends on developing onshore grid infrastructure. Whether the responsibility for developing offshore transmission lies with project developers or transmission system operators, regulations should encourage efficient planning and design practices that support the long-term vision for offshore wind. Those regulations should recognise that the development of onshore grid infrastructure is essential to the efficient integration of power production from offshore wind. Without appropriate grid reinforcements and expansion, there is a risk of large amounts of offshore wind power going unused, and opportunities for further expansion could be stifled. Development could also be slowed by marine planning practices, regulations for awarding development rights and public acceptance issues.

The future of offshore wind looks bright but hinges on the right policies

The outlook for offshore wind is very positive as efforts to decarbonise and reduce local pollution accelerate. While offshore wind provides just 0.3% of global electricity supply today, it has vast potential around the world and an important role to play in the broader energy system. Offshore wind can drive down CO2 emissions and air pollutants from electricity generation. It can also do so in other sectors through the production of clean hydrogen and related fuels. The high system value of offshore wind offers advantages that make a strong case for its role alongside other renewables and low-carbon technologies. Government policies will continue to play a critical role in the future of offshore wind and the overall pace of clean energy transitions around the world.

Related News

BloombergNEF: World offshore wind costs 'drop 32% per cent'

Global Renewable LCOE Trends reveal offshore wind costs down 32%, with 10MW turbines, lower CAPEX and OPEX, and parity for solar PV and onshore wind in Europe, China, and California, per BloombergNEF analysis.

Key Points

Benchmarks showing falling LCOE for offshore wind, onshore wind, and solar PV, driven by larger turbines and lower CAPEX

✅ Offshore wind LCOE $78/MWh; $53-64/MWh in DK/NL excl. transmission

✅ Onshore wind $47/MWh; solar PV $51/MWh, best $26-36/MWh

✅ Cost drivers: 10MW turbines, lower CAPEX/OPEX, weak China demand

World offshore wind costs have fallen 32% from just a year ago and 12% compared with the first half of 2019, according to a BNEF long-term outlook from BloombergNEF.

In its latest Levelized Cost of Electricity (LCOE) Update, BloombergNEF said its current global benchmark LCOE estimate for offshore wind is $78 a megawatt-hour.

“New offshore wind projects throughout Europe, including the UK's build-out, now deploy turbines with power ratings up to 10MW, unlocking CAPEX and OPEX savings,” BloombergNEF said.

In Denmark and the Netherlands, it expects the most recent projects financed to achieve $53-64/MWh excluding transmission.

New solar and onshore wind projects have reached parity with average wholesale power prices in California and parts of Europe, while in China levelised costs are below the benchmark average regulated coal price, according to BloombergNEF.

The company's global benchmark levelized cost figures for onshore wind and PV projects financed in the last six months are at $47 and $51 a megawatt-hours, underscoring that renewables are now the cheapest new electricity option in many regions, down 6% and 11% respectively compared with the first half of 2019.

BloombergNEF said for wind this is mainly down to a fall in the price of turbines – 7% lower on average globally compared with the end of 2018.

In China, the world’s largest solar market, the CAPEX of utility-scale PV plants has dropped 11% in the last six months, reaching $0.57m per MW.

“Weak demand for new plants in China has left developers and engineering, procurement and construction firms eager for business, and this has put pressure on CAPEX,” BloombergNEF said.

It added that estimates of the cheapest PV projects financed recently – in India, Chile and Australia – will be able to achieve an LCOE of $27-36/MWh, assuming competitive returns for their equity investors.

Best-in-class onshore wind farms in Brazil, India, Mexico and Texas can reach levelized costs as low as $26-31/MWh already, the research said.

Programs such as the World Bank wind program are helping developing countries accelerate wind deployment as costs continue to drop.

BloombergNEF associate in the energy economics team Tifenn Brandily said: “This is a three- stage process. In phase one, new solar and wind get cheaper than new gas and coal plants on a cost-of- energy basis.

“In phase two, renewables reach parity with power prices. In phase three, they become even cheaper than running existing thermal plants.

“Our analysis shows that phase one has now been reached for two-thirds of the global population.

“Phase two started with California, China and parts of Europe. We expect phase three to be reached on a global scale by 2030.

“As this all plays out, thermal power plants will increasingly be relegated to a balancing role, looking for opportunities to generate when the sun doesn’t shine or the wind doesn’t blow.”

Related News

DOE Announces $28M Award for Wind Energy

DOE Wind Energy Funding backs 13 R&D projects advancing offshore wind, distributed energy, and utility-scale turbines, including microgrids, battery storage, nacelle and blade testing, tall towers, and rural grid integration across the United States.

Key Points

DOE Wind Energy Funding is a $28M R&D effort in offshore, distributed, and utility-scale wind to lower cost and risk.

✅ $6M for rural microgrids, storage, and grid integration.

✅ $7M for offshore R&D, nacelle and long-blade testing.

✅ Up to $10M demos; $5M for tall tower technology.

The U.S. Department of Energy announced that in order to advance wind energy in the U.S., 13 projects have been selected to receive $28 million. Project topics focus on technology development while covering distributed, offshore wind growth and utility-scale wind found on land.

The selections were announced by the DOE’s Assistant Secretary for the Office of Energy Efficiency and Renewable Energy, Daniel R. Simmons, at the American Wind Energy Association Offshore Windpower Conference in Boston, as New York's offshore project momentum grows nationwide.

Wind Project Awards

According to the DOE, four Wind Innovations for Rural Economic Development projects will receive a total of $6 million to go toward supporting rural utilities via facilitating research drawing on U.K. wind lessons for deployment that will allow wind projects to integrate with other distributed energy resources.

These endeavors include:

Bergey WindPower (Norman, Oklahoma) working on developing a standardized distributed wind/battery/generator micro-grid system for rural utilities;

Electric Power Research Institute (Palo Alto, California) working on developing modeling and operations for wind energy and battery storage technologies, as large-scale projects in New York progress, that can both help boost wind energy and facilitate rural grid stability;

Iowa State University (Ames, Iowa) working on optimization models and control algorithms to help rural utilities balance wind and other energy resources; and

The National Rural Electric Cooperative Association (Arlington, Virginia) providing the development of standardized wind engineering options to help rural-area adoption of wind.

Another six projects are to receive a total of $7 million to facilitate research and development in offshore wind, as New York site investigations advance, with these projects including:

Clemson University (North Charleston, South Carolina) improving offshore-scale wind turbine nacelle testing via a “hardware-in-the-loop capability enabling concurrent mechanical, electrical and controller testing on the 7.5-megawatt dynamometer at its Wind Turbine Drivetrain Testing Facility to accelerate 1 GW on the grid progress”; and

The Massachusetts Clean Energy Center (Boston) upgrading its Wind Technology Testing Center to facilitate structural testing of 85- to 120-meter-long (roughly 278- to 393-foot-long) blades, as BOEM lease requests expand, among other projects.

Additionally, two offshore wind technology demonstration projects will receive up to $10 million for developing initiatives connected to reducing wind energy risk and cost. One last project will also be granted $5 million for the development of tall tower technology that can help overcome restrictions associated with transportation.

“These projects will be instrumental in driving down technology costs and increasing consumer options for wind across the United States as part of our comprehensive energy portfolio,” said Simmons.

Related News

Amazon launches new clean energy projects in US, UK

Amazon Renewable Energy Projects advance net zero goals with a Scotland wind farm PPA and US solar farms in North Carolina and Virginia, delivering clean power, added capacity, and lower carbon emissions across cloud operations.

Key Points

Amazon initiatives adding wind and solar capacity in the UK and US to cut carbon and power cloud operations.

✅ Largest UK corporate wind PPA on Scotland Kintyre Peninsula

✅ Two US solar farms in North Carolina and Virginia

✅ 265 MW added capacity, 668,997 MWh clean power annually

Amazon is launching three renewable energy projects in the United States and the United Kingdom that support Amazon’s commitment to using net zero carbon energy by 2040.

The U.K. project is a wind farm on the Kintyre Peninsula in Scotland, aligned with a 10 GW renewables contract boosting the U.K. grid. It will generate 168,000 megawatt hours (MWh) of clean energy each year, enough to power 46,000 U.K. homes. It will be the largest corporate wind power purchase agreement (PPA) in the U.K.

Offshore wind energy in the UK is powering up rapidly, complementing onshore developments.

The other two are solar projects – one in Warren County, N.C, and the other in Prince George County, Va, reflecting broader US solar and wind growth trends nationwide. Together, they are expected to generate 500,997 MWh of energy annually. It is Amazon’s second renewable energy project in North Carolina, following the Amazon Wind Farm US East operated by Avangrid Renewables, and eighth in Virginia.

The three new Amazon wind and solar projects – which are expected to be in operation in 2012 — will provide 265 MW of additional renewable capacity, and align with U.K. wind power lessons for the U.S. market nationwide.

“In addition to the environmental benefits inherently associated with running applications in the cloud, Amazon is committed to minimizing our carbon emissions and reaching 80% renewable energy use across the company by 2024. We’ve announced eight projects this year and have more projects on the horizon – and we’re committed to investing in renewable energy as a critical step toward addressing our carbon footprint globally,” Kara Hurst, director of sustainability at Amazon, said. “With nearly 70 renewable energy projects around the globe – including 54 solar rooftops – we are making significant progress towards reaching Amazon’s company-wide commitment to reach 100% renewable energy by 2030.”

Amazon has launched 18 utility-scale wind and solar renewable energy projects to date, and in parallel, Duke Energy Renewables has acquired three California solar projects, underscoring sector momentum. They will generate over 1,600 MW of renewable capacity and deliver more than 4.6 million MWh of clean energy annually. Amazon has also installed more than 50 solar rooftops on fulfillment centers and sort centers around the world. They generate 98 MW of renewable capacity and deliver 130,000 MWh of clean energy annually.

“Today’s announcement by Amazon is another important step for North Carolina’s clean energy plan that will increase our reliance on renewables and reduce our greenhouse gas emissions,” North Carolina Governor Roy Cooper said. “Not only is this the right thing to do for our planet, it’s the right thing to do for our economy. More clean energy jobs means better jobs for North Carolina families.”

Amazon reports on its sustainability commitments, initiatives, and performance on a new web site the company recently launched. It includes information on Amazon’s carbon footprint and other metrics and updates the company’s progress towards reaching The Climate Pledge.

“It’s wonderful to see the announcement of these new projects, helping bring more clean energy to the Commonwealth of Virginia where Amazon is already recognized as a leader in bringing renewable energy projects online,” Virginia Governor Ralph Northam said. “These solar farms help reaffirm the Commonwealth’s role as a leading producer of clean energy in the U.S., helping take the nation forward in responding to climate change.”

Related News

Ontario hydro rates set to increase Nov. 1, Ontario Energy Board says

Ontario Electricity Rebate clarifies hydro rates as OEB aligns bills with inflation, shows true cost per kilowatt hour, and replaces Fair Hydro Plan; transparent on-bill credit offsets increases tied to nuclear refurbishment and supply costs.

Key Points

A line-item credit on Ontario hydro bills that offsets higher electricity costs and reflects OEB-set rates.

✅ Starts Nov. 1 with rates in line with inflation

✅ Shows true per-kWh cost plus separate rebate line

✅ Driven by nuclear refurbishment and supply costs

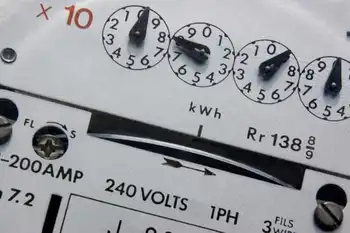

The Ontario Energy Board says electricity rate changes for households and small businesses will be going up starting next week.

The agency says rates are scheduled to increased by about $1.99 or nearly 2% for a typical residential customer who uses 700 kilowatt hours per month.

The provincial government said in March it would continue to subsidize hydro rates, through legislation to lower rates, and hold any increases to the rate of inflation.

The OEB says the new rates, which the board says are “in line” with inflation, will take effect Nov. 1 as changes for electricity consumers roll out and could be noticed on bills within a few weeks of that date.

Prices are increasing partly due to government legislation aimed at reflecting the actual cost of supply on bills, and partly due to the refurbishment of nuclear facilities, contributing to higher hydro bills for some consumers.

So, effective November 1, Ontario electricity bills will show the true cost of power, after a period of a fixed COVID-19 hydro rate, and will include the new Ontario Electricity Rebate.

Previously the electricity rebate was concealed within the price-per-kilowatt-hour line item on electricity statements, prompting Hydro One bill redesign discussions to improve clarity. This meant customers could not see how much the government rebate was reducing their monthly costs, and bills did not display the true cost of electricity used.

"People deserve facts and accountability, especially when it comes to hydro costs," said Energy Minister Rickford.

The new Ontario Electricity Rebate will appear as a transparent on-bill line item and will replace the former government's Fair Hydro Plan says a government news release. This change comes in response to the Auditor General's special report on the former government's Fair Hydro Plan which revealed that "the government created a needlessly complex accounting/financing structure for the electricity rate reduction in order to avoid showing a deficit or an increase in net debt."

"The Electricity Distributors Association commends the government's commitment to making Ontario's electricity bills more transparent," said Teresa Sarkesian, President of the Electricity Distributors Association. "As the part of our electricity system that is closest to customers, local hydro utilities appreciated the opportunity to work with the government on implementing this important initiative. We worked to ensure that customers who receive their electricity bill will have a clear understanding of the true cost of power and the amount of their on-bill rebate. Local hydro utilities are focused on making electricity more affordable, reducing red tape, and providing customers with a modern and reliable electricity system that works for them."

The average customer will see the electricity line on their bill rise, showing the real cost per kilowatt hour. The new Ontario Electricity Rebate will compensate for that rise, and will be displayed as a separate line item on hydro bills. The average residential bill will rise in line with the rate of inflation.

Related News

Renewable power developers discover more energy sources make better projects

Hybrid renewable energy projects integrate wind, solar, and battery storage to enhance grid reliability, reduce curtailment, and provide dispatchable power in markets like Alberta, leveraging photovoltaic tracking, overbuilt transformers, and improved storage economics.

Key Points

Hybrid renewable energy projects combine wind, solar, and storage to deliver reliable, dispatchable clean power.

✅ Combine wind, solar, and batteries for steady, dispatchable output

✅ Lower curtailment by using shared transformers and smart inverters

✅ Boost farm income via leases; diversify risk from oil and gas

Third-generation farmer James Praskach has been burned by the oil and gas sector and watched wicked weather pound his crops flat, but he is hoping a new kind of energy -- the renewable kind -- will pay dividends.

The 39-year-old is part of a landowner consortium that is hosting the sprawling 300-megawatt Blackspring Ridge wind power project in southeastern Alberta.

He receives regular lease payments from the $600-million project that came online in 2014, even though none of the 166 towering wind turbines that surround his land are actually on it.

His lease payments stand to rise, however, when and if the proposed 77-MW Vulcan Solar project, which won regulatory approval in 2016, is green-lighted by developer EDF Renewables Inc.

The panels would cover about 400 hectares of his family's land with nearly 300,000 photovoltaic solar panels in Alberta, installed on racks designed to follow the sun. It would stand in the way of traditional grain farming of the land, but that wouldn't have been a problem this year, Praskach says.

"This year we actually had a massive storm roll through. And we had 100 per cent hail damage on all of (the Vulcan Solar lands). We had canola, peas and barley on it this year," he said, adding the crop was covered by insurance.

Meanwhile, poor natural gas prices and a series of oilpatch financial failures mean rents aren't being paid for about half of the handful of gas wells on his land, showing how a province that is a powerhouse for both fossil and green energy can face volatility -- he's appealed to the Alberta surface Rights Board for compensation.

"(Solar power) would definitely add a level of security for our farming operations," said Praskach.

Hybrid power projects that combine energy sources are a growing trend as selling renewable energy gains traction across markets. Solar only works during the day and wind only when it is windy so combining the two -- potentially with battery storage or natural gas or biomass generation -- makes the power profile more reliable and predictable.

Globally, an oft-cited example is on El Hierro, the smallest of the Canary Islands, where wind power is used to pump water uphill to a reservoir in a volcanic crater so that it can be released to provide hydroelectric power when needed. At times, the project has provided 100 per cent of the tiny island's energy needs.

Improvements in technology such as improving solar and wind power and lower costs for storage mean it is being considered as a hybrid add-on for nearly all of its renewable power projects, said Dan Cunningham, manager of business development at Greengate Power Corp. of Calgary.

Grant Arnold, CEO of developer BluEarth Renewables, agreed.

"The barrier to date, I would say, has been cost of storage but that is changing rapidly," he said. "We feel that wind and storage or solar and storage will be a fundamental way we do business within five years. It's changing very, very rapidly and it's the product everybody wants."

Vulcan Solar was proposed after Blackspring Ridge came online, said David Warner, associate director of business development for EDF Renewables, which now co-owns the wind farm with Enbridge Inc.

"Blackspring actually had incremental capacity in the main power transformers," he said. "Essentially, it was capable of delivering more energy than Blackspring was producing. It was overbuilt."

Vulcan Solar has been sized to utilize the shortfall without producing so much energy that either will ever have to be constrained, he said. Much of the required environmental work has already been done for the wind farm.

Storage is being examined as a potential addition to the project but implementing it depends on the regulatory system. At present, Alberta's regulators are still working on how to permit and control what they call "dispatchable renewables and storage" systems.

EDF announced last spring it would proceed with the Arrow Canyon Solar Project in Nevada which is to combine 200 MW of solar with 75 MW of battery storage by 2022 -- the batteries are to soak up the sun's power in the morning and dispatch the electricity in the afternoon when Las Vegas casinos' air conditioning is most needed.

What is clear is that renewable energy will continue to grow, with Alberta renewable jobs expected to follow -- in a recent report, the International Energy Agency said global electricity capacity from renewables is set to rise by 50 per cent over the next five years, an increase equivalent to adding the current total power capacity of the United States.

The share of renewables is expected to rise from 26 per cent now to 30 per cent in 2024 but will remain well short of what is needed to meet long-term climate, air quality and energy access goals, it added.

Related News

PG&E says power lines may have started 2 California fires

PG&E Wildfire Blackouts highlight California power shutoffs as high winds and suspected transmission line faults trigger evacuations, CPUC investigations, and grid safety reviews, with utilities weighing risk, compliance, and resilience during Santa Ana conditions.

Key Points

PG&E Wildfire Blackouts are outages during wind-driven fire threats linked to power lines, spurring CPUC investigations.

✅ Wind and line faults suspected amid Lafayette evacuations

✅ CPUC to probe shutoffs, notifications, and compliance

✅ Utilities plan more outages as Santa Ana winds return

Pacific Gas & Electric Co. power lines may have started two wildfires over the weekend in the San Francisco Bay Area, the utility said Monday, even though widespread blackouts were in place to prevent downed lines from starting fires during dangerously windy weather.

The fires described in PG&E reports to state regulators match blazes that destroyed a tennis club and forced evacuations in Lafayette, about 20 miles (32 kilometres) east of San Francisco.

The fires began in a section of town where PG&E had opted to keep the lights on. The sites were not designated as a high fire risk, the company said.

Powerful winds were driving multiple fires across California and forcing power shut-offs intended to prevent blazes, even as electricity prices are soaring across the state as well.

More than 900,000 power customers -- an estimated 2.5 million people -- were in the dark at the height of the latest planned blackout, nearly all of them in PG&E's territory in Northern and central California. By Monday evening a little less than half of those had their service back. But some 1.5 million people in 29 counties will be hit with more shut-offs starting Tuesday because another round of strong winds is expected, a reminder of grid stress during heat waves that test capacity, the utility said.

Southern California Edison had cut off power to 25,000 customers and warned that it was considering disconnecting about 350,000 more as power supply lapses and Santa Ana winds return midweek.

PG&E is under severe financial pressure after its equipment was blamed for a series of destructive wildfires and its 2018 Camp Fire guilty plea compounded liabilities during the past three years. Its stock dropped 24% Monday to close at $3.80 and was down more than 50% since Thursday.

The company reported last week that a transmission tower may have caused a Sonoma County fire that has forced 156,000 people to evacuate.

PG&E told the California Public Utilities Commission that a worker responded to a fire in Lafayette late Sunday afternoon and was told firefighters believed contact between a power line and a communication line may have caused it.

A worker went to another fire about an hour later and saw a fallen pole and transformer. Contra Costa Fire Department personnel on site told the worker they were looking at the transformer as a potential ignition source, a company official wrote.

Separately, the company told regulators that it had failed to notify 23,000 customers, including 500 with medical conditions, before shutting off their power earlier this month during windy weather.

Before a planned blackout, power companies are required to notify customers and take extra care to get in touch with those with medical problems who may not be able to handle extended periods without air conditioning or may need power to run medical devices.

PG&E said some customers had no contact information on file. Others were incorrectly thought to be getting electricity.

After that outage, workers discovered 43 cases of wind-related damage to power lines, transformers and other equipment.

Jennifer Robison, a PG&E spokeswoman, said the company is working with independent living centres to determine how best to serve people with disabilities.

The company faced a growing backlash from regulators and lawmakers, and a judge's order on wildfire risk spending added pressure as well.

U.S. Rep. Josh Harder, a Democrat from Modesto, said he plans to introduce legislation that would raise PG&E's taxes if it pays bonuses to executives while engaging in blackouts.

The Public Utilities Commission plans to open a formal investigation into the blackouts and the broader climate policy debate surrounding reliability within the next month, allowing regulators to gather evidence and question utility officials. If rules are found to be broken, they can impose fines up to $100,000 per violation per day, said Terrie Prosper, a spokeswoman for the commission.

The commission said Monday it also plans to review the rules governing blackouts, will look to prevent utilities from charging customers when the power is off and will convene experts to find grid improvements that might lessen blackouts during next year's fire season, as debates over rate stability in 2025 continue across PG&E's service area.

The state can't continue experiencing such widespread blackouts, "nor should Californians be subject to the poor execution that PG&E in particular has exhibited," Marybel Batjer, president of the California Public Utilities Commission, said in a statement.

Related News

Opinion: Germany's drive for renewable energy is a cautionary tale

Germany Energiewende Lessons highlight climate policy tradeoffs, as renewables, wind and solar face grid constraints, coal phase-out delays, rising electricity prices, and public opposition, informing Canada on diversification, hydro, oil and gas, and balanced transition.

Key Points

Insights from Germany's renewable shift on costs, grid limits, and emissions to guide Canada's balanced energy policy.

✅ Evidence: high power prices, delayed coal exit, limited grid buildout

✅ Land, materials, and wildlife impacts challenge wind and solar scale-up

✅ Diversification: hydro, nuclear, gas, and storage balance reliability

News that Greta Thunberg is visiting Alberta should be welcomed by all Canadians.

The teenaged Swedish environmentalist has focused global attention on the climate change debate like never before. So as she tours our province, where selling renewable energy could be Alberta's next big thing, what better time for a reality check than to look at a country that is furthest ahead in already adapting steps that Greta is advocating.

That country is Germany. And it’s not a pretty sight.

Germany embraced the shift toward renewable energy before anyone else, and did so with gusto. The result?

Germany’s largest newsmagazine Der Spiegel published an article on May 3 of this year entitled “A Botched Job in Germany.” The cover showed broken wind turbines and half-finished transition towers against a dark silhouette of Berlin.

Germany’s renewable energy transition, Energiewende, is a bust. After spending and committing a total of US$580 billion to it from 2000 to 2025.

Why is that? Because it’s been a nightmare of foolish dreams based on hope rather than fact, resulting in stalled projects and dreadfully poor returns.

Last year Germany admitted it had to delay its phase-out of coal and would not meet its 2020 greenhouse gas emissions reduction commitment. Only eight per cent of the transmission lines needed to support this new approach to powering Germany have been built.

Opposition to renewables is growing due to electricity prices rising to the point they are now among the highest in the world. Wind energy projects in Germany are now facing the same opposition that pipelines are here in Canada.

Opposition to renewables in Germany, reports Forbes, is coming from people who live in rural or suburban areas, in opposition to the “urbane, cosmopolitan elites who fetishize their solar roofs and Teslas as a sign of virtue.” Sound familiar?

So, if renewables cannot successfully power Germany, one of the richest and most technologically advanced countries in the world, who can do it better?

The biggest problem with using wind and solar power on a large scale is that the physics just don’t work. They need too much land and equipment to produce sufficient amounts of electricity.

Solar farms take 450 times more land than nuclear power plants to produce the same amount of electricity. Wind farms take 700 times more land than natural gas wells.

The amount of metal required to build these sites is enormous, requiring new mines. Wind farms are killing hundreds of endangered birds.

No amount of marketing or spin can change the poor physics of resource-intensive and land-intensive renewables.

But, wait. Isn’t Norway, Greta’s neighbour, dumping its energy investments and moving into alternative energy like wind farms in a big way?

No, not really. Fact is only 0.8 per cent of Norway’s power comes from wind turbines. The country is blessed with a lot of hydroelectric power, but that’s a historical strength owing to the country’s geography, nothing new.

And yet we’re being told the US$1-trillion Oslo-based Government Pension Fund Global is moving out of the energy sector to instead invest in wind, solar and other alternative energy technologies. According to 350.org activist Nicolo Wojewoda this is “yet another nail in the coffin of the coal, oil, and gas industry.”

Well, no.

Norway’s pension fund is indeed investing in new energy forms, but not while pulling out of traditional investments in oil and gas. Rather, as any prudent fund manager will, they are diversifying by making modest investments in emerging industries such as Alberta's renewable energy surge that will likely pay off down the road while maintaining existing investments, spreading their investments around to reduce risk. Unfortunately for climate alarmists, the reality is far more nuanced and not nearly as explosive as they’d like us to think.

Yet, that’s enough for them to spin this tale to argue Canada should exit oil and gas investment and put all of our money into wind and solar, even as Canada remains a solar power laggard according to experts.

That is not to say renewable energy projects like wind and solar don’t have a place. They do, and we must continue to innovate and research lower-polluting ways to power our societies on the path to zero-emissions electricity by 2035 in Canada.

But like it actually is in Norway, investment in renewables should supplement — not replace — fossil fuel energy systems if we aim for zero-emission electricity in Canada by 2035 without undermining reliability. We need both.

And that’s the message that Greta should hear when she arrives in Canada.

Rick Peterson is the Edmonton-based founder and Beth Bailey is a Calgary-based supporter of Suits and Boots, a national not-for-profit group of investment industry professionals that supports resource sector workers and their families.

Related News

Could selling renewable energy be Alberta's next big thing?

Alberta Renewable Energy Procurement is surging as corporate PPAs drive wind and solar growth, with the Pembina Institute and the Business Renewables Centre linking buyers and developers in Alberta's energy-only market near Medicine Hat.

Key Points

A market-led approach where corporations use PPAs to secure wind and solar power from Alberta projects.

✅ Corporate PPAs de-risk projects and lock in clean power.

✅ Alberta's energy-only market enables efficient transactions.

✅ Skilled workforce supports wind, solar, legal, and financing.

Alberta has big potential when it comes to providing renewable energy, advocates say.

The Pembina Institute says the practice of corporations committing to buy renewable energy is just taking off in Canada, and Alberta has both the energy sector and the skilled workforce to provide it.

Earlier this week, a company owned by U.S. billionaire Warren Buffett announced a large new wind farm near Medicine Hat. It has a buyer for the power.

Sara Hastings-Simon, director of the Pembina's Business Renewables Centre, says this is part of a trend.

"We're talking about the practice of corporate institutions purchasing renewables to meet their own electricity demand. And this is a really well-established driver for renewable energy development in the U.S.," she said. "You may be hearing headlines like Google, Apple and others that are buying renewables and we're helping to bring this practice to Canada."

The Business Renewables Centre (BRC) is a not-for-profit working to accelerate corporate and institutional procurement of renewables in Canada. The group held its inaugural all members event in Calgary on Thursday.

Hastings-Simon says shareholders and investors are encouraging more use of solar and wind power in Canada.

"We have over 10 gigawatts of renewable energy projects in the pipeline that are ready for buyers. And so we see multinational companies coming to Canada to start to procure here, as well as Canadian companies understanding that this is an opportunity for them as well," Hastings-Simon said.

"It's really exciting to see business interests driving renewable energy development."

Sara Hastings-Simon is the director of the Pembina Institute's Business Renewables Centre, which seeks to build up Alberta's renewable energy industry. (Mike Symington/CBC)

Hastings-Simon says renewable procurement could help dispel the narrative that it's all about oil and gas in Alberta by highlighting Alberta as a powerhouse for both green energy and fossil fuels in Canada.

She says the practice started with a handful of tech companies in the U.S. and has become more mainstream there, even as Canada remains a solar laggard to some observers, with more and more large companies wanting to reduce their energy footprint.

He says his U.S.-based organization has been working for years to speed up and expand the renewables market for companies that want to address their own sustainability.

"We try and make that a little bit easier by building out a community that can help to really reinforce each other, share lessons learned, best practices and then drive for transactions to have actual material impact worldwide," he said.

"We're really excited to be working with the Pembina group and the BRC Canada team," he said. "We feel our best value for this is just to support them with our experiences and lessons. They've been basically doing the same thing for many years helping to grow and grow and cultivate the market."

Porter says Alberta's market is more than ready.

"There are some precedent transactions already so people know it can work," he said. "The way Alberta is structured, being an energy-only market is useful. And I think that there is a strong ecosystem of both budget developers and service providers … that can really help these transactions get over the line."

As procurement ramps up, Hastings-Simon says Alberta already has the skilled workers needed to fill renewable energy jobs across the province.

"We have a lot of the knowledge that's needed, and that's everybody from the construction down through the legal and financing — all those pieces of building big projects," she said. "We are seeing increasing interest in people that want to become involved in that industry, and so there is increasing demand for training in things like solar power installation and wind technicians."

Hastings-Simon predicts an increase in demand for both the services and the workers.

"As this industry ramps up, we're going to need to have more workers that are active in those areas," she said. "So I think we can see a very nice increase — both the demand and the number of folks that are able to work in this field."

Related News

How the dirtiest power station in western Europe switched to renewable energy

Drax Biomass Conversion accelerates renewable energy by replacing coal with wood pellets, sustainable forestry feedstock, and piloting carbon capture and storage, supporting the UK grid, emissions cuts, and a net-zero pathway.

Key Points

Drax Biomass Conversion is Drax's shift from coal to biomass with CCS pilots to cut emissions and aid UK's net-zero.

✅ Coal units converted to biomass wood pellets

✅ Sourced from sustainable forestry residues

✅ CCS pilots target lifecycle emissions cuts

A power station that used to be the biggest polluter in western Europe has made a near-complete switch to renewable energy, mirroring broader shifts as Denmark's largest energy company plans to end coal by 2023.

The Drax Power Station in Yorkshire, England, used to spew out millions of tons of carbon dioxide a year by burning coal. But over the past eight years, it has overhauled its operations by converting four of its six coal-fired units to biomass. The plant's owners say it now generates 15% of the country's renewable power, as Britain recently went a full week without coal power for the first time.

The change means that just 6% of the utility's power now comes from coal, as the wider UK coal share hits record lows across the national electricity system. The ultimate goal is to stop using coal altogether.

"We've probably reduced our emissions more than any other utility in the world by transforming the way we generate power," Will Gardner, CEO of the Drax Group, told CNN Business.

Subsidies have helped finance the switch to biomass, which consists of plant and agricultural matter and is viewed as a promising substitute for coal, and utilities such as Nova Scotia Power are also increasing biomass use. Last year, Drax received £789 million ($1 billion) in government support.

Is biomass good for the environment?

While scientists disagree over the extent to which biomass as a fuel is environmentally friendly, and some environmentalists urge reducing biomass use amid concerns about lifecycle emissions, Drax highlights that its supplies come from from sustainably managed and growing forests.

Most of the biomass used by Drax consists of low-grade wood, sawmill residue and trees with little commercial value from the United States. The material is compressed into sawdust pellets.

Gardner says that by purchasing bits of wood not used for construction or furniture, Drax makes it more financially viable for forests to be replanted. And planting new trees helps offset biomass emissions.

Forests "absorb carbon as they're growing, once they reach maturity, they stop absorbing carbon," said Raphael Slade, a senior research fellow at Imperial College London.

But John Sterman, a professor at MIT's Sloan School of Management, says that in the short term burning wood pellets adds more carbon to the atmosphere than burning coal.

That carbon can be absorbed by new trees, but Sterman says the process can take decades.

"If you're looking at five years, [biomass is] not very good ... If you're looking at a century-long time scale, which is the sort of time scale that many foresters plan, then [biomass] can be a lot more beneficial," says Slade.

Carbon capture

Enter carbon capture and storage technology, which seeks to prevent CO2 emissions from entering the atmosphere and has been touted as a possible solution to the climate crisis.

Drax, for example, is developing a system to capture the carbon it produces from burning biomass. But that could be 10 years away.

The Coal King is racing to avoid bankruptcy

The power station is currently capturing just 1 metric ton of CO2 emissions per day. Gardner says it hopes to increase this to 10,000 metric tons per day by the mid to late 2020s.

"The technology works but scaling it up and rolling it out, and financing it, are going to be significant challenges," says Slade.

The Intergovernmental Panel on Climate Change shares this view. The group said in a 2018 report that while the potential for CO2 capture and storage was considerable, its importance in the fight against climate change would depend on financial incentives for deployment, and whether the risks of storage could be successfully managed. These include a potential CO2 pipeline break.

In the United Kingdom, the government believes that carbon capture and storage will be crucial to reaching its goal of achieving net-zero greenhouse gas emissions by 2050, even as low-carbon generation stalled in 2019 according to industry analysis.

It has committed to consulting on a market-based industrial carbon capture framework and in June awarded £26 million ($33 million) in funding for nine carbon capture, usage and storage projects, amid record coal-free generation on the British grid.

Related News

U.S. Senate Looks to Modernize Renewable Energy on Public Land

PLREDA 2019 advances solar, wind, and geothermal on public lands, guiding DOI siting, improving transmission access, streamlining permitting, sharing revenues, and funding conservation to meet climate goals while protecting wildlife and recreation.

Key Points

A bipartisan bill to expand renewables on public lands fund conservation, speed permitting and advance U.S. climate aims.

✅ Targets 25 GW of public-land renewables by 2025

✅ Establishes wildlife conservation and recreation access funds

✅ Streamlines siting, transmission, and equitable revenue sharing

The Senate unveiled its version of a bill the House introduced in July to help the U.S. realize the extraordinary renewable energy potential of our shared public lands.

Senator Martha McSally (R-AZ) and a bipartisan coalition of western Senators introduced a Senate version of draft legislation that will help the Department of the Interior tap the renewable energy potential of our shared public lands. The western Senators represent Arizona, New Mexico, Colorado, Montana, and Idaho.

Elsewhere in the West, lawmakers have moved to modernize Oregon hydropower to streamline licensing, signaling broad regional momentum.

The Public Land Renewable Energy Development Act of 2019 (PLREDA) facilitates siting of solar, wind, and geothermal energy projects on public lands, boosts funding for conservation, and promotes ambitious renewable energy targets that will help the U.S. take action on the climate crisis.

Like the House version, the Senate bill enjoys strong bi-partisan support and industry endorsement. The Senate version makes few notable changes to the bill introduced in July by Representatives Mike Levin (D-CA) and Paul Gosar (R-AZ). It includes:

- A commitment to enhance natural resource conservation and stewardship via the establishment of a fish and wildlife conservation fund that would support conservation and restoration work and other important stewardship activities.

- An ambitious renewable energy production goal for the Department of the Interior to permit a total of 25 gigawatts of renewable energy on public lands by 2025—nearly double the current generating capacity of projects currently on our public lands.

- Establishment of criteria for identifying appropriate areas for renewable energy development using the 2012 Western Solar Plan as a model. Key criteria to be considered include access to transmission lines and likelihood of avoiding or minimizing conflict with wildlife habitat, cultural resources, and other resources and values.

- Improved public access to Federal lands for recreational uses via funds made available for preserving and improving access, including enhancing public access to places that are currently inaccessible or restricted.

- Sharing of revenues raised from renewable energy development on public lands in an equitable manner that benefits local communities near new renewable energy projects and supports the efficient administration of permitting requirements.

- Creating incentives for renewable energy development by giving Interior the authority to reduce rental rates and capacity fees to ensure new renewable energy development remains competitive in the marketplace.

NRDC strongly supports this legislation, and we will do our utmost to facilitate its passage into law. There is no question that in our era of runaway climate change, legislation that balances energy production with environmental conservation and stewardship of our public lands is critical.

PLREDA takes a balanced approach to using our public lands to help lead the U.S. toward a low-carbon future, as states pursue 100% renewable electricity goals nationwide. The bill outlines a commonsense approach for federal agencies to play a meaningful role in combatting climate change.

Related News

Saskatchewan to credit solar panel owners, but not as much as old program did

Saskatchewan Solar Net Metering Program lets rooftop solar users offset at retail rate while earning 7.5 cents/kWh credits for excess energy; rebates are removed, SaskPower balances grid costs with a 100 kW cap.

Key Points

An updated SaskPower plan crediting rooftop solar at 7.5 cents/kWh, offsetting usage at retail rate, without rebates.

✅ Excess energy credited at 7.5 cents/kWh

✅ Offsets on-site use at retail electricity rates

✅ Up to 100 kW generation; no program capacity cap

Saskatchewan has unveiled a new program that credits electricity customers for generating their own solar power, but it won’t pay as much as an older program did or reimburse them with rebates for their costs to buy and install equipment.

The new net metering program takes effect Nov. 1, and customers will be able to use solar to offset their own power use at the retail rate, similar to UK households' right to sell power in comparable schemes, though program details differ.

But they will only get 7.5 cents per kilowatt hour credit on their bills for excess energy they put back into the grid, as seen in Duke Energy payment changes in other jurisdictions, rather than the 14 cents in the previous program.

Dustin Duncan, the minister responsible for Crown-owned SaskPower, says the utility had to consider the interests of people wanting to use rooftop solar and everyone else who doesn’t have or can’t afford the panels, who he says would have to make up for the lost revenue.

Duncan says the idea is to create a green energy option, with wind power gains highlighting broader competitiveness, while also avoiding passing on more of the cost of the system to people who just cannot afford solar panels of their own.

Customers with solar panels will be allowed to generate up to 100 kilowatts of power against their bills.

“It’s certainly my hope that this is going to provide sustainability for the industry, as illustrated by Alberta's renewable surge creating jobs, that they have a program that they can take forward to their potential customers, while at the same time ensuring that we’re not passing onto customers that don’t have solar panels more cost to upkeep the grid,” Duncan said Tuesday.

Saskatchewan NDP leader Ryan Meili said he believes eliminating the rebate and cutting the excess power credit will kill the province’s solar energy, a concern consistent with lagging solar demand in Canada in recent national reports, he said.

“(Duncan) essentially made it so that any homeowner who wants to put up panels would take up to twice as long to pay it back, which effectively prices everybody in the small part of the solar production industry — the homeowners, the farms, the small businesses, the small towns — out of the market,” Meili said.

The province’s old net metering program hit its 16 megawatt capacity ahead of schedule, forcing the program to shut down, while disputes like the Manitoba Hydro solar lawsuit have raised questions about program management elsewhere. It also had a rebate of 20 per cent of the cost of the system, but that rebate has been discontinued.

The new net metering program won’t have any limit on program capacity, or an end date.

According to Duncan, the old program would have had a net negative impact to SaskPower of about $54 million by 2025, but this program will be much less — between $4 million and $5 million.

Duncan said other provinces either have already or are in the process of moving away from rebates for solar equipment, including Nova Scotia's proposed solar charge and similar reforms, and away from the one-to-one credits for power generation.

Related News

Opinion: Fossil-fuel workers ready to support energy transition

Canada Net-Zero Transition unites energy workers, R&D, and clean tech to decarbonize steel and cement with hydrogen, scale renewables, and build hybrid storage, delivering a just transition that strengthens communities and the economy.

Key Points

A national plan to reach net-zero by 2050 via renewables, hydrogen, decarbonization, and a just transition for workers.

✅ Hydrogen for steel and cement decarbonization

✅ Hybrid energy storage and clean tech R&D

✅ Just transition pathways for energy workers

Except for an isolated pocket of skeptics, there is now an almost universal acceptance that climate change is a global emergency that demands immediate and far-reaching action to defend our home and future generations. Yet in Canada we remain largely focused on how the crisis divides us rather than on the potential for it to unite us, despite nationwide progress in electricity decarbonization efforts.

It’s not a case of fossil-fuel industry workers versus the rest, or Alberta versus British Columbia where bridging the electricity gap could strengthen cooperation. We are all in this together. The challenge now is how to move forward in a way that leaves no one behind.

The fossil fuel industry has been — and continues to be — a key driver of Canada’s economy. Both of us had successful careers in the energy sector, but realized, along with an increasing number of energy workers, that the transition we need to cope with climate change could not be accomplished solely from within the industry.

Even as resource companies innovate to significantly reduce the carbon burden of each barrel, the total emission of greenhouse gases from all sources continues to rise. We must seize the opportunity to harness this innovative potential in alternative and complementary ways, mobilizing research and development, for example, to power carbon-intensive steelmaking and cement manufacture from hydrogen or to advance hybrid energy storage systems and decarbonizing Canada's electricity grid strategies — the potential for cross-over technology is immense.

The bottom line is inescapable: we must reach net-zero emissions by 2050 in order to prevent runaway global warming, which is why we launched Iron & Earth in 2016. Led by oilsands workers committed to increasingly incorporating renewable energy projects into our work scope, our non-partisan membership now includes a range of industrial trades and professions who share a vision for a sustainable energy future for Canada — one that would ensure the health and equity of workers, our families, communities, the economy, and the environment.

Except for an isolated pocket of skeptics, there is now an almost universal acceptance that climate change is a global emergency that demands immediate and far-reaching action, including cleaning up Canada's electricity to meet climate pledges, to defend our home and future generations. Yet in Canada we remain largely focused on how the crisis divides us rather than on the potential for it to unite us.

It’s not a case of fossil-fuel industry workers versus the rest, or Alberta versus British Columbia. We are all in this together. The challenge now is how to move forward in a way that leaves no one behind.

The fossil fuel industry has been — and continues to be — a key driver of Canada’s economy. Both of us had successful careers in the energy sector, but realized, along with an increasing number of energy workers, that the transition we need to cope with climate change could not be accomplished solely from within the industry.

Even as resource companies innovate to significantly reduce the carbon burden of each barrel, the total emission of greenhouse gases from all sources continues to rise, underscoring that Canada will need more electricity to hit net-zero, according to the IEA. We must seize the opportunity to harness this innovative potential in alternative and complementary ways, mobilizing research and development, for example, to power carbon-intensive steelmaking and cement manufacture from hydrogen or to advance hybrid energy storage systems — the potential for cross-over technology is immense.