Electricity News in October 2022

U.S. Launches $250 Million Program To Strengthen Energy Security For Rural Communities

DOE RMUC Cybersecurity Program supports rural, municipal, and small investor-owned utilities with grants, technical assistance, grid resilience, incident response, workforce training, and threat intelligence sharing to harden energy systems and protect critical infrastructure.

Key Points

A $250M DOE program providing grants to boost rural and municipal utilities' cybersecurity and incident response.

✅ Grants and technical assistance for grid security

✅ Enhances incident response and threat intel sharing

✅ Builds cybersecurity workforce in rural utilities

The U.S. Department of Energy (DOE) today issued a Request for Information (RFI) seeking public input on a new $250 million program to strengthen the cybersecurity posture of rural, municipal, and small investor-owned electric utilities.

Funded by President Biden’s Bipartisan Infrastructure Law and broader clean energy funding initiatives, the Rural and Municipal Utility Advanced Cybersecurity Grant and Technical Assistance (RMUC) Program will help eligible utilities harden energy systems, processes, and assets; improve incident response capabilities; and increase cybersecurity skills in the utility workforce. Providing secure, reliable power to all Americans, with a focus on equity in electricity regulation across communities, will be a key focus on the pathway to achieving President Biden’s goal of a net-zero carbon economy by 2050.

“Rural and municipal utilities provide power for a large portion of low- and moderate-income families across the nation and play a critical role in ensuring the economic security of our nation’s energy supply,” said U.S. Secretary of Energy Jennifer M. Granholm. “This new program reflects the Biden Administration's commitment to improving energy reliability and connecting our nation’s rural communities to resilient energy infrastructure and the transformative benefits that come with it.”

Nearly one in six Americans live in a remote or rural community. Utilities in these communities face considerable obstacles, including difficulty recruiting top cybersecurity talent, inadequate infrastructure, as the aging U.S. power grid struggles to support new technologies, and lack of financial resources needed to modernize and harden their systems.

The RMUC Program will provide financial and technical assistance to help rural, municipal, and small investor-owned electric utilities improve operational capabilities, increase access to cybersecurity services, deploy advanced cyber security technologies, and increase participation of eligible entities in cybersecurity threat information sharing programs and coordination with federal partners initiatives. Priority will be given to eligible utilities that have limited cybersecurity resources, are critical to the reliability of the bulk power system, or those that support our national defense infrastructure.

The Office of Cybersecurity, Energy Security, and Emergency Response (CESER), which advances U.S. energy security objectives, will manage the RMUC Program, providing $250 million dollars in BIL funding over five years. To help inform Program implementation, DOE is seeking input from the cybersecurity community, including eligible utilities and representatives of third parties and organizations that support or interact with these utilities. The RFI seeks input on ways to improve cybersecurity incident preparedness, response, and threat information sharing; cybersecurity workforce challenges; risks associated with technologies deployed on the electric grid; national-scale initiatives to accelerate cybersecurity improvements in these utilities; opportunities to strengthen partnerships and energy security support efforts; the selection criteria and application process for funding awards; and more.

Related News

U.S. Announces $28 Million To Advance And Deploy Hydropower Technology

DOE Hydropower Funding advances clean energy R&D, pumped storage hydropower, retrofits for non-powered dams, and fleet modernization under the Bipartisan Infrastructure Law and Inflation Reduction Act, boosting long-duration energy storage, licensing studies, and sustainability engagement.

Key Points

A $28M DOE initiative supporting hydropower R&D, pumped storage, retrofits, and stakeholder sustainability efforts.

✅ Funds retrofits for non-powered dams, expanding low-impact supply

✅ Backs studies to license new pumped storage facilities

✅ Engages stakeholders on modernization and environmental impacts

The U.S. Department of Energy (DOE) today announced more than $28 million across three funding opportunities to support research and development projects that will advance and preserve hydropower as a critical source of clean energy. Funded through President Biden’s Bipartisan Infrastructure Law, this funding will support the expansion of low-impact hydropower (such as retrofits for dams that do not produce power) and pumped storage hydropower, the development of new pumped storage hydropower facilities, and engagement with key voices on issues like hydropower fleet modernization, sustainability, and environmental impacts. President Biden’s Inflation Reduction Act also includes a standalone tax credit for energy storage, which will further enhance the economic attractiveness of pumped storage hydropower. Hydropower will be a key clean energy source in transitioning away from fossil fuels and meeting President Biden’s goals of 100% carbon pollution free electricity by 2035 through a clean electricity standard policy pathway and a net-zero carbon economy by 2050.

“Hydropower has long provided Americans with significant, reliable energy, which will now play a crucial role in achieving energy independence and protecting the climate,” said U.S. Secretary of Energy Jennifer M. Granholm. “President Biden’s Agenda is funding critical innovations to capitalize on the promise of hydropower and ensure communities have a say in building America’s clean energy future, including efforts to revitalize coal communities through clean projects.”

Hydropower accounts for 31.5% of U.S. renewable electricity generation and about 6.3% of total U.S. electricity generation, with complementary programs to bolster energy security for rural communities supporting grid resilience, while pumped storage hydropower accounts for 93% of U.S. utility-scale energy storage, ensuring power is available when homes and businesses need it, even as the aging U.S. power grid poses challenges to renewable integration.

The funding opportunities include, as part of broader clean energy funding initiatives, the following:

- Advancing the sustainable development of hydropower and pumped storage hydropower by encouraging innovative solutions to retrofit non-powered dams, the development and testing of technologies that mitigate challenges to pumped storage hydropower deployment, as well as opportunities for organizations not extensively engaged with DOE’s Water Power Technologies Office to support hydropower research and development. (Funding amount: $14.5 million)

- Supporting studies that facilitate the FERC licensing process and eventual construction and commissioning of new pumped storage hydropower facilities to facilitate the long-duration storage of intermittent renewable electricity. (Funding amount: $10 million)

- Uplifting the efforts of diverse hydropower stakeholders to discuss and find paths forward on topics that include U.S. hydropower fleet modernization, hydropower system sustainability, and hydropower facilities’ environmental impact. (Funding amount: $4 million)

Related News

Duke Energy Florida's smart-thinking grid improves response, power restoration for customers during Hurricane Ian

Self-healing grid technology automatically reroutes power to reduce outages, speed restoration, and boost reliability during storms like Hurricane Ian in Florida, leveraging smart grid sensors, automation, and grid hardening to support Duke Energy customers.

Key Points

Automated smart grid systems that detect faults and reroute power to minimize outages and accelerate restoration.

✅ Cuts outage duration via automated fault isolation

✅ Reroutes electricity with sensors and distribution automation

✅ Supports storm resilience and faster field crew restoration

As Hurricane Ian made its way across Florida, where restoring power in Florida can take weeks in hard-hit areas, Duke Energy's grid improvements were already on the job helping to combat power outages from the storm.

Smart, self-healing technology, similar to smart grid improvements elsewhere, helped to automatically restore more than 160,000 customer outages and saved nearly 3.3 million hours (nearly 200 million minutes) of total lost outage time.

"Hurricane Ian is a strong reminder of the importance of grid hardening and storm preparedness to help keep the lights on for our customers," said Melissa Seixas, Duke Energy Florida state president. "Self-healing technology is just one of many grid improvements that Duke Energy is making to avoid outages, restore service faster and increase reliability for our customers."

Much like the GPS in your car can identify an accident ahead and reroute you around the incident to keep you on your way, self-healing technology is like a GPS for the grid. The technology can quickly identify power outages and alternate energy pathways to restore service faster for customers when an outage occurs.

Additionally, self-healing technology provides a smart tool to assist crews in the field with power restoration after a major storm like Ian, helping reduce outage impacts and freeing up resources to help restore power in other locations.

Three days after Hurricane Ian exited the state, Duke Energy Florida wrapped up restoration of approximately 1 million customers. This progress enabled the company to deploy more than 550 Duke Energy workers from throughout Florida, as well as contractors from across the country, to help restore power for Lee County Electric Cooperative customers.

Crews worked in Cape Coral and Pine Island, one of the hardest-hit areas in the storm's path, as Canadian power crews have in past storms, and completed power restoration for the majority of customers on Pine Island within approximately one week after arriving to the island.

Prior to Ian in 2022, smart, self-healing technology had helped avoid nearly 250,000 extended customer outages in Florida, similar to Hydro One storm recovery efforts, saving around 285,000 hours (17.1 million minutes) of total lost outage time.

Duke Energy currently serves around 59% of customers in Florida with self-healing capabilities on its main power distribution lines, with a goal of serving around 80% over the next few years.

Related News

BLM Announces Completion of Crimson Energy Storage Project

Crimson Energy Storage Project expands grid capacity with a 350 MW, 1400 MWh utility-scale battery in Riverside County, supporting renewable energy, grid reliability, and carbon-free electricity goals under BLM and DRECP planning.

Key Points

A 350 MW, 1400 MWh grid battery in Riverside County boosting reliability and supporting clean energy goals.

✅ 350 MW capacity, 1400 MWh energy storage system

✅ Enhances grid reliability and integrates renewables

✅ Built on BLM land under the DRECP in California

The Bureau of Land Management announced that construction of the Crimson Energy Storage Project, a 350-megawatt battery storage system in eastern Riverside County, is now complete, and the system is in operation and expanding grid capacity. The battery storage project will provide 1400 megawatt-hours of electricity at full capacity and, aligning with U.S. battery storage trends, is a significant milestone in the Biden-Harris administration’s efforts to modernize America’s power infrastructure in the West and achieve a goal of 100 percent carbon-free electricity by 2035.

“The BLM is proud to support responsible development of renewable energy projects as part of our mission to sustainably manage public lands,” said BLM Director Tracy Stone-Manning. “The Crimson Solar project is one of the largest standalone battery energy storage projects on BLM-managed lands and, as lower-cost batteries accelerate adoption, showcases the agency’s commitment to meeting the Nation’s energy and economic needs with 21st Century technology.”

The Crimson Energy Storage Project created 140 union jobs during peak construction. The storage project is part of the larger Crimson Solar Project, aligning with California solar projects underway, to be constructed at a future date. The entire project includes approximately 2,000 acres of BLM-managed land, located 13 miles west of Blythe in Riverside County.

The Crimson Energy Storage Project is in an area analyzed and identified as suitable for renewable energy development as part of BLM’s Desert Renewable Energy Conservation Plan Land Use Plan Amendment. The Desert Renewable Energy Conservation Plan is a landscape-level plan focused on 10.8 million acres of public lands in the desert regions of seven California counties that helps renewable power developers streamline renewable energy development while conserving unique and valuable desert ecosystems and providing outdoor recreation opportunities. To approve these sites for renewable energy projects, the Department of the Interior and the BLM work with Tribal governments, local communities, state regulators, industry, and other federal agencies on efforts like Wyoming-to-California wind that advance clean energy.

Within the Desert Renewable Energy Conservation Plan planning area, there are 19 renewable energy projects at different stages of review, reflecting record solar and storage growth, with the potential to add approximately 7,000 megawatts of production on BLM California public land.

In 2021, the BLM approved the Crimson Solar Project, which authorized Sonoran West Solar Holdings, LLC, a wholly owned subsidiary of Recurrent Energy, LLC, to construct a 350-megawatt solar photovoltaic facility and 350-megawatt battery storage system, similar to battery storage projects enabling wind integration, with support facilities to generate and deliver power through the Southern California Edison Colorado River Substation.

Related News

Are Net-Zero Energy Buildings Really Coming Soon to Mass?

Massachusetts Energy Code Updates align DOER regulations with BBRS standards, advancing Stretch Code and Specialized Code beyond the Base Energy Code to accelerate net-zero construction, electrification, and high-efficiency building performance across municipal opt-in communities.

Key Points

They are DOER-led changes to Base, Stretch, and Specialized Codes to drive net-zero, electrified, efficient buildings.

✅ Updates apply Base, Stretch, or opt-in Specialized Code.

✅ Targets net-zero by 2050 with electrification-first design.

✅ Municipalities choose code path via City Council or Town Meeting.

Massachusetts will soon see significant updates to the energy codes that govern the construction and alteration of buildings throughout the Commonwealth.

As required by the 2021 climate bill, the Massachusetts Department of Energy Resources (DOER) has recently finalized regulations updating the current Stretch Energy Code, previously promulgated by the state's Board of Building Regulations and Standards (BBRS), and establishing a new Specialized Code geared toward achieving net-zero building energy performance.

The final code has been submitted to the Joint Committee on Telecommunications, Utilities, and Energy for review as required under state law, amid ongoing Connecticut market overhaul discussions that could influence regional dynamics.

Under the new regulations, each municipality must apply one of the following:

Base Energy Code - The current Base Energy Code is being updated by the BBRS as part of its routine updates to the full set of building codes. This base code is the default if a municipality has not opted in to an alternative energy code.

Stretch Code - The updated Stretch Code creates stricter guidelines on energy-efficiency for almost all new constructions and alterations in municipalities that have adopted the previous Stretch Code, paralleling 100% carbon-free target in Minnesota and elsewhere to support building decarbonization. The updated Stretch Code will automatically become the applicable code in any municipality that previously opted-in to the Stretch Code.

Specialized Code - The newly created Specialized Code includes additional requirements above and beyond the Stretch Code, designed to get to ensure that new construction is consistent with a net-zero economy by 2050, similar to Canada's clean electricity regulations that set a 2050 decarbonization pathway. Municipalities must opt-in to adopt the Specialized Code by vote of City Council or Town Meeting.

The new codes are much too detailed to summarize in a blog post. You can read more here. Without going into those details here, it is worth noting a few significant policy implications of the new regulations:

With roughly 90% of Massachusetts municipalities having already adopted the prior version of the Stretch Code, the Commonwealth will effectively soon have a new base code that, even if it does not mandate zero-energy buildings, is nonetheless very aggressive in pushing new construction to be as energy-efficient as possible, as jurisdictions such as Ontario clean electricity regulations continue to reshape the power mix.

Although some concerns have been raised about the cost of compliance, particularly in a period of high inflation, and amid solar demand charge debates in Massachusetts, our understanding is that many developers have indicated that they can work with the new regulations without significant adverse impacts.

Of course, the success of the new codes depends on the success of the Commonwealth's efforts to transition quickly to a zero-carbon electrical grid, supported by initiatives like the state's energy storage solicitation to bolster reliability. If the cost of doing so is higher than expected, there could well be public resistance. If new transmission doesn't get built out sufficiently quickly or other problems occur, such that the power is not available to electrify all new construction, that would be a much more significant problem - for many reasons!

In short, the new regulations unquestionably set the Commonwealth on a course to electrify new construction and squeeze carbon emissions out of new buildings. However, as with the rest of our climate goals, there are a lot of moving pieces, including proposals for a clean electricity standard shaping the power sector that are going to have to come together to make the zero-carbon economy a reality.

Related News

Germany extends nuclear power amid energy crisis

Germany Nuclear Power Extension keeps Isar 2, Neckarwestheim 2, and Emsland running as Olaf Scholz tackles the energy crisis, soaring gas prices, and EU winter demand, prioritizing grid stability amid the Ukraine war.

Key Points

A temporary policy keeping three German reactors online to enhance grid stability and national energy security.

✅ Extends Isar 2, Neckarwestheim 2, and Emsland operations

✅ Addresses EU energy crisis and soaring gas prices

✅ Prioritizes grid stability while coal phase-out advances

German Chancellor Olaf Scholz has ordered the country's three remaining nuclear power stations to keep operating until mid-April, signalling a nuclear U-turn as the energy crisis sparked by Russia's invasion of Ukraine hurts the economy.

Originally Germany planned to phase out all three by the end of this year, continuing its nuclear phaseout policy at the time.

Mr Scholz's order overruled the Greens in his coalition, who wanted two plants kept on standby, to be used if needed.

Nuclear power provides 6% of Germany's electricity.

The decision to phase it out was taken by former chancellor Angela Merkel after Japan's Fukushima nuclear disaster in 2011.

But gas prices have soared since Russia's invasion of Ukraine in February, which disrupted Russia's huge oil and gas exports to the EU, though some officials argue that nuclear would do little to solve the gas issue in the short term. In August Russia turned off the gas flowing to Germany via the Nord Stream 1 undersea pipeline.

After relying so heavily on Russian gas Germany is now scrambling to maintain sufficient reserves for the winter. The crisis has also prompted it to restart mothballed coal-fired power stations, with coal generating about a third of its electricity currently, though the plan is to phase out coal in the drive for green energy.

Last year Germany got 55% of its gas from Russia, but in the summer that dropped to 35% and it is declining further.

EU leaders consider how to cap gas prices

France sends Germany gas for first time amid crisis

Chancellor Scholz's third coalition partner, the liberal Free Democrats (FDP), welcomed his move to keep nuclear power as part of the mix. The three remaining nuclear plants are Isar 2, Neckarwestheim 2 and Emsland, which were ultimately shut down after the extension.

The Social Democrat (SPD) chancellor also called for ministries to present an "ambitious" law to boost energy efficiency and to put into law a phase-out of coal by 2030, aiming for a coal- and nuclear-free economy among major industrial nations.

Last week climate activist Greta Thunberg said it was a "mistake" for Germany to press on with nuclear decommissioning while resorting to coal again, intensifying debate over a nuclear option for climate goals nationwide.

Related News

Electricity is civilization": Winter looms over Ukraine battlefront

Ukraine Power Grid Restoration accelerates across liberated Kharkiv, restoring electricity, heat, and water amid missile and drone strikes, demining operations, blackouts, and winterization efforts, showcasing resilience, emergency repairs, and critical infrastructure recovery.

Key Points

Ukraine's rapid push to repair war-damaged grids, restore heat and water, and stabilize key services before winter.

✅ Priority repairs restore electricity and water in liberated Kharkiv.

✅ Crews de-mine lines and work under shelling, drones, and missiles.

✅ Winterization adds generators, mobile stoves, and large firewood supplies.

On the freshly liberated battlefields of northeast Ukraine, a pile of smashed glass windows outside one Soviet-era block of apartments attests to the violence of six months of Russian occupation, and of Ukraine’s sweeping recent military advances.

Indoors, in cramped apartments, residents lived in the dark for weeks on end.

Now, with a hard winter looming, they marvel at the speed and urgency with which Ukrainian officials have restored another key ingredient to their survival: electric power, a critical effort to keep the lights on this winter across communities.

Among those things governments strive to provide are security, opportunity, and minimal comfort. With winter approaching, and Russia targeting Ukraine’s infrastructure, add to that list heat and light, even as Russia hammers power plants nationwide. It’s requiring a concerted effort.

“Thank God it works! Electricity is civilization – it is everything,” says Antonina Krasnokutska, a retired medical worker, looking affectionately at the lightbulb that came on the day before, and now burns again in her tiny spotless kitchen.

“Without electricity there is no TV, no news, no clothes washing, no charging the phone,” says Ms. Krasnokutska, her gray hair pulled back and a small crucifix around her neck.

“Before, it was like living in the Stone Age,” says her grown son, Serhii Krasnokutskyi, who is more than a head taller. “As soon as it got dark, everyone would go to sleep.”

He shows a picture on his phone from a few days earlier, of a tangle of phone and computer charging cables – including his – plugged in at a local shop with a generator.

“We are very grateful for the people who repaired this electricity, even with shelling continuing,” he says. “They have a very complicated job.”

Indeed, although a lack of power might have been a novel inconvenience during the warm summer season, it increasingly has become a matter of great urgency for Ukrainian citizens and officials.

Coping through Ukraine’s winter with dignity and any degree of security will require courage and perseverance, as the severity and suffering that the season can bring here are being weaponized by Russia, as it seeks to compensate for a string of battlefield losses.

In recent days, Russian attacks have specifically targeted Ukraine’s electrical and other civilian infrastructure – all with the apparent aim of making this winter as hard as possible for Ukrainians, even as Moscow employs other measures to spread the hardship across Europe, while Ukraine helps Spain amid blackouts through grid support.

Ukrainian President Volodymyr Zelenskyy said Monday that Russian barrages across the country with missiles and Iran-supplied kamikaze drones had destroyed 30% of Ukraine’s power stations in the previous eight days, including strikes on western Ukraine that caused outages. Thousands of towns have been left without electricity.

Kharkiv’s challenges

Emblematic of the national challenge is the one facing officials in the northeast Kharkiv region, where Ukraine recaptured more than 3,000 square miles in a September counteroffensive. Ukrainian forces are still making gains on that front, as well as in the south toward Kherson, where Wednesday Russia started evacuating civilians from the first major city it occupied, after launching its three-pronged invasion last February.

Across the Kharkiv region, Ukrainians are stockpiling as much wood, fuel, and food as possible while they still can, and adopting new energy solutions as they prepare, from sources as diverse as the floorboards of destroyed schools and the pine forests in Izium, which are pockmarked with abandoned Russian trenches adjacent to a mass burial site.

“Of course, we have this race against time,” says Serhii Mahdysyuk, the Kharkiv regional director in charge of housing, services, fuel, and energy. “Unfortunately, we probably stand in front of the biggest challenge in Ukraine.”

That is not only because of the scale of liberated territory, he says, but also because the Kharkiv region shares a long border with Russia, as well as with the Russian-controlled areas of the eastern Donbas.

“It’s a great mixture of all threats, and we are sure that shelling and bombings will continue, but we are ready for this,” says Mr. Mahdysyuk. “We know our weak spots that Russia can destroy, but we are prepared for what to do in these situations.”

Ukraine’s battlefield gains have meant a surging need to pick up the pieces after Russian occupation, even as electricity reserves are holding if no new strikes occur, to ensure habitable conditions as more and more surviving residents require services, and as others return to scenes of devastation.

Restoring electricity is the top priority, amid shifting international assistance such as the end of U.S. grid support, because that often restarts running water, too, says Mr. Mahdysyuk. But before that, the area beneath broken power lines must be de-mined.

Indeed, members of an electricity team reconnecting cables on the outskirts of Balakliia – one of the first towns to see power restored, at the end of September – say they lost two fellow workers in the previous two weeks. One died after stepping on an anti-personnel mine, another when his vehicle hit an anti-tank device.

Ukrainian electricity workers restore power lines damaged during six months of Russian military occupation in Balakliia, Ukraine, Sept. 29, 2022. Ukrainians in liberated territory say the restoration of the electrical grid, and with it often the water supply, is a return to civilization.

“For now, our biggest problem is mines,” says the team leader, who gave the name Andrii. “It’s fine within the cities, but in the fields it’s a disaster because it’s very difficult to see them. There is a lot of [them] around here – it will take years and years to get rid of.”

Yet officials only have a few weeks to execute plans to provide for hundreds of thousands of residents in this region, in their various states of need and distress. Some 50 field kitchens capable of feeding 200 to 300 people each have been ordered. Another 1,000 mobile stoves are on their way.

And authorities will provide nearly 200,000 cubic yards of firewood for those who have no access to it, and may have no other means of keeping warm – or where shelling continues to disrupt repairs, says Mr. Mahdysyuk.

“The level of opportunity and resources we have is not the same as the level of destruction,” he says. People in districts and buildings too destroyed to have services restored soon, such as in Saltivka in Kharkiv city, may be moved.

Related News

BMW boss says hydrogen, not electric, will be "hippest thing" to drive

BMW Hydrogen Fuel Cell Strategy positions iX5 and eDrive for zero-emission mobility, leveraging fuel cells, fast refueling, and hydrogen infrastructure as an alternative to BEVs, diversifying drivetrains across premium segments globally, rapidly.

Key Points

BMW's plan to commercialize hydrogen fuel-cell drivetrains like iX5 eDrive for scalable, zero-emission mobility.

✅ Fuel cells enable fast refueling and long range with water vapor only.

✅ Reduces reliance on lithium and cobalt via recyclable materials.

✅ Targets premium SUV iX5; limited pilots before broader rollout.

BMW is hanging in there with hydrogen, a stance mirrored in power companies' hydrogen outlook today. That’s what Oliver Zipse, the chairperson of BMW, reiterated during an interview last week in Goodwood, England.

“After the electric car, which has been going on for about 10 years and scaling up rapidly, the next trend will be hydrogen,” he says. “When it’s more scalable, hydrogen will be the hippest thing to drive.”

BMW has dabbled with the idea of using hydrogen for power for years, even though it is obscure and niche compared to the current enthusiasm surrounding vehicles powered by electricity. In 2005, BMW built 100 “Hydrogen 7” vehicles that used the fuel to power their V12 engines. It unveiled the fuel cell iX5 Hydrogen concept car at the International Motor Show Germany in 2021.

In August, the company started producing fuel-cell systems for a production version of its hydrogen-powered iX5 sport-utility vehicle. Zipse indicated it would be sold in the United States within the next five years, although in a follow-up phone call a spokesperson declined to confirm that point. Bloomberg previously reported that BMW will start delivering fewer than 100 of the iX5 hydrogen vehicles to select partners in Europe, the U.S., and Asia, where Asia leads on hydrogen fuel cells today, from the end of this year.

All told, BMW will eventually offer five different drivetrains to help diversify alternative-fuel options within the group, as hybrids gain renewed momentum in the U.S., Zipse says.

“To say in the U.K. about 2030 or the U.K. and in Europe in 2035, there’s only one drivetrain, that is a dangerous thing,” he says. “For the customers, for the industry, for employment, for the climate, from every angle you look at, that is a dangerous path to go to.”

Zipse’s hydrogen dreams could even extend to the group’s crown jewel, Rolls-Royce, which BMW has owned since 1998. The “magic carpet ride” driving style that has become Rolls-Royce’s signature selling point is flexible enough to be powered by alternatives to electricity, says Rolls-Royce CEO Torsten Müller-Ötvös.

“To house, let’s say, fuel cell batteries: Why not? I would not rule that out,” Müller-Ötvös told reporters during a roundtable conversation in Goodwood on the eve of the debut of the company’s first-ever electric vehicle, Spectre. “There is a belief in the group that this is maybe the long-term future.”

Such a vehicle would contain a hydrogen fuel-cell drivetrain combined with BMW’s electric “eDrive” system. It works by converting hydrogen into electricity to reach an electrical output of up to 125 kW/170 horsepower and total system output of nearly 375hp, with water vapor as the only emission, according to the brand.

Hydrogen’s big advantage over electric power, as EVs versus fuel cells debates note, is that it can supply fuel cells stored in carbon-fiber-reinforced plastic tanks. “There will [soon] be markets where you must drive emission-free, but you do not have access to public charging infrastructure,” Zipse says. “You could argue, well you also don’t have access to hydrogen infrastructure, but this is very simple to do: It’s a tank which you put in there like an old [gas] tank, and you recharge it every six months or 12 months.”

Fuel cells at BMW would also help reduce its dependency on raw materials like lithium and cobalt, because the hydrogen-based system uses recyclable components made of aluminum, steel, and platinum.

Zipse’s continued commitment to prioritizing hydrogen has become an increasingly outlier position in the automotive world. In the last five years, electric-only vehicles have become the dominant alternative fuel — as the age of electric cars dawns ahead of schedule — if not yet on the road, where fewer than 3% of new cars have plugs, at least at car shows and new-car launches.

Rivals Mercedes-Benz and Audi scrapped their own plans to develop fuel cell vehicles and instead have poured tens of billions of dollars into developing pure-electric vehicle, including Daimler's electrification plan initiatives. Porsche went public to finance its own electric aspirations.

BMW will make half of all new-car sales electric by 2030 across the group, with many expecting most drivers to go electric within a decade, which includes MINI and Rolls-Royce.

Related News

BOE Says UK Energy Price Guarantee is Key for Next Rates Call

UK Market Stability Outlook remains febrile as the Bank of England, Treasury, and OBR forecasts shape fiscal policy, interest rates, gilt yields, inflation, energy bills, and pound sterling, with Oct. 31 guidance to reassure investors.

Key Points

A view of investor confidence as BOE policy, fiscal plans, and energy aid shape inflation and interest rates.

✅ Markets await Oct. 31 fiscal statement and OBR projections

✅ Energy support design drives inflation and disposable income

✅ Pound weakness adds imported inflation; rates seen up 75 bps

Bank of England Deputy Governor Dave Ramsden said financial markets are still unsettled about the outlook for the UK and that a Treasury statement due on Oct. 31 may provide some reassurance.

Speaking to the Treasury Committee in Parliament, Ramsden said officials in government and the central bank are dealing with huge economic shocks, notably the surge in energy prices that came with Russia’s attack on Ukraine. Investors are reassessing where interest rates and the fiscal stance are headed.

“Markets remain quite febrile,” Ramsden told members of Parliament in London on Monday. “Things have not settled down yet.”

He described the events following Prime Minister Liz Truss’s ill-fated fiscal statement on Sept. 23, which set out a series of tax cuts funded by borrowing that spooked investors and triggered a rout in UK assets. Ramsden said those events damaged the UK’s credibility among investors, but reversing that program and Truss’s decision to step aside have helped the nation regain confidence.

“Credibility is hard won and easily lost,” Ramsden said. “That credibility is being recovered. That has to be followed through. A return to the kind of stability around policy making and around the framing of fiscal events will be really important.”

He said the issue with the Sept. 23 statement was that “it had one side of the fiscal arithmetic in it” and that the decision to include forecasts from the Office for Budget Responsibility will help underpin the confidence investors have in assessing the UK budget due out next week, including potential moves to end the link between gas and electricity prices for consumers.

“What we are going to get on Oct. 31 will be very important,” Ramsden said, “as it will address measures such as the price cap on household energy bills and other fiscal choices.”

“My sense is that will take account of all the statements on both the revenue and on the spending side.”

The central bank already was getting some information from Chancellor of the Exchequer Jeremy Hunt’s team about the fiscal statement due. Hunt said last week he’d curtail government plans to subsidize household fuel bills in April, when a 16% decrease in energy bills is anticipated, instead of letting it run as long as planned and replace it with a more targeted program.

“To the extent possible, we will obviously have a little bit of time to take account of that before we make our decisions later next week,” Ramsden said.

With Truss stepping down in the next day and handing power to Rishi Sunak, it isn’t certain the Oct. 31 statement will go ahead as planned. Ramsden’s remarks confirm reports that Hunt is preparing to make the statement, amid a free electricity debate in the industry, even before Sunak names his team.

Any hint about what sort of package Hunt will offer on energy is crucial to the BOE’s forecasts. Without aid for energy, consumers will be exposed to high winter heating and electricity costs and to the full force of whatever happens in natural gas and electricity markets, and that will have a big impact on how much disposable income is available to households.

The energy plan, alongside the energy security bill, “will be a key element, as obviously it will have a bearing on the path for inflation, which is critical, but also how much additional support relative to what we were assuming at the time of the September MPC there will be for households at different points in the income distribution,” Ramsden added.

Investors currently expect the BOE to hike rates by 75 basis points next week.

Ramsden also said the BOE is watching the pound’s decline to assess how that changes the outlook for inflation.

“We have to take account of it,” Ramsden said. “When sterling deprreciaties that feeds through to imported inflation. It’s fallen quite significantly. The overall trend is down.”

Related News

UK homes can become virtual power plants to avoid outages

Demand Flexibility Service rewards households and businesses for shifting peak-time electricity use, enhancing grid balancing, energy security, and net zero goals with ESO and Ofgem support, virtual power plants, and 2GW capacity this winter.

Key Points

A grid program paying homes and businesses to shift peak demand, boosting energy security and lowering winter costs.

✅ Pays £3,000/MWh for reduced peak-time usage

✅ Targets at least 2GW via virtual power plants

✅ Rolled out by suppliers with Ofgem and ESO

This month we published our analysis of the British electricity system this winter. Our message is clear: in the base case our analysis indicates that supply margins are expected to be adequate, however this winter will undoubtedly be challenging, with high winter energy costs adding pressure. Therefore, all of us in the electricity system operator (ESO) are working round the clock to manage the system, ensure the flow of energy and do our bit to keep costs down for consumers.

One of the tools we have developed is the demand flexibility service, designed to complement efforts to end the link between gas and electricity prices and reduce bills. From November, this new capability will reward homes and businesses for shifting their electricity consumption at peak times. And we are working with the government, businesses and energy providers to encourage as high a level of take-up as possible. We are confident this innovative approach can provide at least 2 gigawatts of power – about a million homes’ worth.

What began as an initiative to help achieve net zero and keep costs down is also proving to be an important tool in ensuring Britain’s energy security, alongside the Energy Security Bill progressing into law.

We are particularly keen to get businesses involved right across Britain. When the Guardian first reported on this service we had calls from businesses ranging from multinationals to an owner of a fish and chip shop asking how they could do their bit and get signed up.

We can now confirm our proposals for how much people and businesses can be paid for shifting their electricity use outside peak times. We anticipate paying a rate of £3,000 per megawatt hour, reflecting the dynamics of UK natural gas and electricity markets today. Businesses and homes can become virtual power plants and, crucially, get paid like one too. For a consumer that could mean a typical household could save approximately £100, and industrial and commercial businesses with larger energy usage could save multiples of this.

We are working with Ofgem to get this scheme launched in November and for it to be rolled out through energy suppliers. If you are interested in participating, or understanding what you could get paid, please contact your energy supplier.

Innovations such as these have never mattered more. Vladimir Putin’s unlawful aggression means we are facing unprecedented energy market volatility, across the continent where Europe’s worst energy nightmare is becoming reality, and pressures on energy supplies this winter.

As a result of Russia’s war in Ukraine, European gas is scarce and prices are high, prompting Europe to weigh emergency measures to limit electricity prices amid the crisis. Alongside this, France’s nuclear fleet has experienced a higher number of outages than expected. Energy shortages in Europe could have knock-on implications for energy supply in Britain.

We have put in place additional contingency arrangements for this winter. For example, the ability to call on generators to fire-up emergency coal units, even as the crisis is a wake-up call to ditch fossil fuels for many, giving Britain 2GW of additional capacity.

We need to be clear, it is possible that without these measures supply could be interrupted for some customers for limited periods of time. This could eventually force us to initiate a temporary rota of planned electricity outages, meaning that some customers could be without power for up to three hours at a time through a process called the electricity supply emergency code (ESEC).

Under the ESEC process we would advise the public the day before any disconnections. We are working with government and industry on planning for this so that the message can be spread across all communities as quickly and accurately as possible. This would include press conferences, social media campaigns, and working with influencers in different communities.

Related News

Drought, lack of rain means BC Hydro must adapt power generation

BC Hydro drought operations address climate change impacts with hydropower scheduling, reservoir management, water conservation, inflow forecasting, and fish habitat protection across the Lower Mainland and Vancouver Island while maintaining electricity generation from storage facilities.

Key Points

BC Hydro drought operations conserve water, protect fish, and sustain hydropower during extended heat and low inflows.

✅ Proactive reservoir releases protect downstream salmon spawning.

✅ Reduced flows at Puntledge, Coquitlam, and Ruskin/Stave facilities.

✅ System relies on northern storage to maintain electricity supply.

BC Hydro is adjusting its operating plans around power generation as extended heat and little forecast rain continue to impact the province, a report says.

“Unpredictable weather patterns related to climate change are expected to continue in the years ahead and BC Hydro is constantly adapting to these evolving conditions, especially after events such as record demand in 2021 that tested the grid,” said the report, titled “Casting drought: How climate change is contributing to uncertain weather and how BC Hydro’s generation system is adapting.”

The study said there is no concern with BC Hydro being able to continue to deliver power through the drought because there is enough water at its larger facilities, even as issues like crypto mining electricity use draw scrutiny from observers.

Still, it said, with no meaningful precipitation in the forecast, its smaller facilities in the Lower Mainland and on Vancouver Island will continue to see record low or near record low inflows for this time of the year.

“In the Lower Mainland, inflows since the beginning of September are ranked in the bottom three compared to historical records,” the report said.

The report said the hydroelectric system is directly impacted by variations in weather and the record-setting, unseasonably dry and warm weather this fall highlights the impacts of climate change, while demand patterns can be counterintuitive, as electricity use even increased during Earth Hour 2018 in some areas, hinting at challenges to come.

It noted symptoms of climate change include increased frequency of extreme events like drought and intense storms, and rapid glacial melt.

“With the extremely hot and dry conditions, BC Hydro has been taking proactive steps at many of our South Coast facilities for months to conserve water to protect the downstream fish habit,” spokesperson Mora Scott said. “We began holding back water in July and August at some facilities anticipating the dry conditions to help ensure we would have water storage for the later summer and early fall salmon spawning.”

Scott said BC Hydro’s reservoirs play an important role in managing these difficult conditions by using storage and planning releases to provide protection to downstream river flows. The reservoirs are, in effect, a battery waiting to be used for power.

While the dry conditions have had an impact on BC Hydro’s watersheds, several unregulated natural river systems — not related to BC Hydro — have fared worse, with rivers drying up and thousands of fish killed, the report said.

BC Hydro is currently seeing the most significant impacts on operations at Puntledge and Campbell River on Vancouver Island as well as Coquitlam and Ruskin/Stave in the Lower Mainland.

To help manage water levels on Vancouver Island, BC Hydro reduced Puntledge River flows by one-third last week and on the Lower Mainland reduced flows at Coquitlam by one-third and Ruskin/Stave by one quarter.

However, the utility company said, there are no concerns about continued power delivery.

“British Columbians benefit from BC Hydro’s integrated, provincial electricity system, which helps send power across the province, including to Vancouver Island, and programs like the winter payment plan support customers during colder months,” staff said.

Most of the electricity generated and used in B.C. is produced by larger facilities in the north and southeast of the province — and while water levels in those areas are below normal levels, there is enough water to meet the province’s power needs, even as additions like Site C's electricity remain a subject of debate among observers.

The Glacier Media investigation found a quarter of BC Hydro's power comes from the Mica, Revelstoke and Hugh Keenleyside dams on the Columbia River. Some 29% comes from dams in the Peace region, including the under-construction Site C project that has faced cost overruns. At certain points of the year, those reservoirs are reliant on glacier water.

Still, BC Hydro remains optimistic.

Forecasts are currently showing little rain in the near-term; however, historically, precipitation and inflows show up by the end of October. If that does not happen, BC Hydro said it would continue to closely track weather and inflow forecasts to adapt its operations to protect fish, while regional cooperation such as bridging with Alberta remains part of broader policy discussions.

Among things BC Hydro said it is doing to adapt are:

Continuously working to improve its weather and inflow forecasting;

Expanding its hydroclimate monitoring technology, including custom-made solutions that have been designed in-house, as well as upgrading snow survey stations to automated, real-time snow and climate stations, and;

Investing in capital projects — like spillway gate replacements — that will increase resiliency of the system to climate change.

Related News

Clean-energy generation powers economy, environment

Atlin Hydro and Transmission Project delivers First Nation-led clean energy via hydropower to the Yukon grid, replacing diesel, cutting emissions, and creating jobs, with a 69-kV line from Atlin, B.C., supplying about 35 GWh annually.

Key Points

A First Nation-led 8.5 MW hydropower and 69-kV line supplying clean energy to the Yukon, reducing diesel use.

✅ 8.5 MW capacity; ~35 GWh annually to Yukon grid

✅ 69-kV, 92 km line links Atlin to Jakes Corner

✅ Creates 176 construction jobs; cuts diesel and emissions

A First Nation-led clean-power generation project for British Columbia’s Northwest will provide a significant economic boost and good jobs for people in the area, as well as ongoing revenue from clean energy sold to the Yukon.

“This clean-energy project has the potential to be a win-win: creating opportunities for people, revenue for the community and cleaner air for everyone across the Northwest,” said Premier John Horgan. “That’s why our government is proud to be working in partnership with the Taku River Tlingit First Nation and other levels of government to make this promising project a reality. Together, we can build a stronger, cleaner future by producing more clean hydropower to replace fossil fuels – just as they have done here in Atlin.”

The Province is contributing $20 million toward a hydroelectric generation and transmission project being developed by the Taku River Tlingit First Nation (TRTFN) to replace diesel electricity generation in the Yukon, which is also supported by the Government of Yukon and the Government of Canada, and comes as BC Hydro demand fell during COVID-19 across the province.

“Renewable-energy projects are helping remote communities reduce the use of diesel for electricity generation, which reduces air pollution, improves environmental outcomes and creates local jobs,” said Bruce Ralston, Minister of Energy, Mines and Low Carbon Innovation. “This project will advance reconciliation with TRTFN, foster economic development in Atlin and support intergovernmental efforts to reduce greenhouse gas emissions.”

TRTFN is based in Atlin with territory in B.C., the Yukon, and Alaska. TRTFN is an active participant in clean-energy development and, since 2009, has successfully replaced diesel-generated electricity in Atlin with a 2.1-megawatt (MW) hydro facility amid oversight issues such as BC Hydro misled regulator elsewhere in the province today.

TRTFN owns the Tlingit Homeland Energy Limited Partnership (THELP), which promotes economic development through clean energy. THELP plans to expand its hydro portfolio by constructing the Atlin Hydro and Transmission Project and selling electricity to the Yukon via a new transmission line, in a landscape shaped by T&D rates decisions in jurisdictions like Ontario for cost recovery.

The Government of Yukon is requiring its Yukon Energy Corporation (YEC) to generate 97% of its electricity from renewable resources by 2030. This project provides an opportunity for the Yukon government to reduce reliance on diesel generators and to meet future load growth, at a time when Manitoba Hydro's debt pressures highlight utility cost challenges.

The new transmission line between Atlin and the Yukon grid will include a fibre-optic data cable to support facility operations, with surplus capacity that can be used to bring high-speed internet connectivity to Atlin residents for the first time.

“Opportunities like this hydroelectricity project led by the Taku River Tlingit First Nation is a great example of identifying and then supporting First Nations-led clean-energy opportunities that will support resilient communities and provide clean economic opportunities in the region for years to come. We all have a responsibility to invest in projects that benefit our shared climate goals while advancing economic reconciliation.” said George Heyman, Minister of Environment and Climate Change Strategy.

“Thank you to the Government of British Columbia for investing in this important project, which will further strengthen the connection between the Yukon and Atlin. This ambitious initiative will expand renewable energy capacity in the North in partnership with the Taku River Tlingit First Nation while reducing the Yukon’s emissions and ensuring energy remains affordable for Yukoners.“ said Sandy Silver, Premier of Yukon.

“The Atlin Hydro Project represents an important step toward meeting the Yukon’s growing electricity needs and the renewable energy targets in the Our Clean Future strategy. Our government is proud to contribute to the development of this project and we thank the Government of British Columbia and all partners for their contributions and commitment to renewable energy initiatives. This project demonstrates what can be accomplished when communities, First Nations and federal, provincial and territorial governments come together to plan for a greener economy and future.” said John Streicker, Minister Responsible for the Yukon Development Corporation.

“Atlin has enjoyed clean and renewable energy since 2009 because of our hydroelectric project. Over its lifespan, Atlin’s hydro opportunity will prevent more than one million tonnes of greenhouse gases from being created to power the southern Yukon. We are looking forward to the continuation of this project. Our collective dream is to meet our environmental and economic goals for the region and our local community within the next 10 years. We are so grateful to all our partners involved for their financial support, as we continue onward in creating an energy efficient and sustainable North.” said Charmaine Thom, Taku River Tlingit First Nation spokesperson.

Quick Facts:

- The 8.5-MW project is expected to provide an average of 35 gigawatt hours of energy annually to the Yukon. To accomplish this, TRTFN plans to leverage the existing water storage capability of Surprise Lake, add new infrastructure, and send power 92 km north to Jakes Corner, Yukon, along a new 69-kilovolt transmission line.

- The project is expected to cost $253 - 308.5 million, the higher number reflecting recently estimated impacts of inflation and supply chain cost escalation, alongside sector accounting concerns such as deferred BC Hydro costs noted in recent reports.

- The project is expected to have a positive impact on local and provincial economic development in the form of, even as governance debates like Manitoba Hydro board changes draw attention elsewhere:

- 176 full-time positions during construction;

- six to eight full-time positions in operations and maintenance over 40 years; and

- increased business for B.C. contractors.

- Territorial and federal funders have committed $151.1 million to support the project, most recently the $32.2 million committed in the 2022 federal bdget.

Related News

Told "no" 37 times, this Indigenous-owned company brought electricity to James Bay anyway

Five Nations Energy Transmission Line connects remote First Nations to the Ontario power grid, delivering clean, reliable electricity to Western James Bay through Indigenous-owned transmission infrastructure, replacing diesel generators and enabling sustainable community growth.

Key Points

An Indigenous-owned grid link providing reliable power to Western James Bay First Nations, replacing polluting diesel.

✅ Built by five First Nations; fully Indigenous-owned utility

✅ 270 km line connecting remote James Bay communities

✅ Ended diesel dependence; enabled sustainable development

For the Indigenous communities along northern Ontario’s James Bay — the ones that have lived on and taken care of the lands as long as anyone can remember — the new millenium marked the start of a diesel-less future, even as Ontario’s electricity outlook raised concerns about getting dirtier in policy debates.

While the southern part of the province took Ontario’s power grid for granted, despite lessons from Europe’s power crisis about reliability, the vast majority of these communities had never been plugged in. Their only source of power was a handful of very loud diesel-powered generators. Because of that, daily life in the Attawapiskat, Kashechewan and Fort Albany First Nations involved deliberating a series of tradeoffs. Could you listen to the radio while toasting a piece of bread? How many Christmas lights could you connect before nothing else was usable? Was there enough power to open a new school?

The communities wanted a safe, reliable, clean alternative, with Manitoba’s clean energy illustrating regional potential, too. So did their chiefs, which is why they passed a resolution in 1996 to connect the area to Ontario’s grid, not just for basic necessities but to facilitate growth and development, and improve their communities’ quality of life.

The idea was unthinkable at the time — scorned and dismissed by those who held the keys to Ontario’s (electrical) power, much like independent power projects can be in other jurisdictions. Even some in the community didn’t fully understand it. When the idea was first proposed at a gathering of Nishnawbe Aski Nation, which represents 49 First Nations, one attendee said the only way he could picture the connection was as “a little extension cord running through the bush from Moosonee.”

But the leadership of Attawapiskat, Kashechewan and Fort Albany First Nations had been dreaming and planning. In 1997, along with members of Taykwa Tagamou and Moose Cree First Nations, they created the first, and thus far only, fully Indigenous-owned energy company in Canada: Five Nations Energy Inc., as partnerships like an OPG First Nation hydro project would later show in action, too.

Over the next five years, the organization built Omushkego Ishkotayo, the Cree name for the Western James Bay transmission line: “Omushkego” refers to the Swampy Cree people, and “Ishkotayo” to hydroelectric power, while other regions were commissioning new BC generating stations in parallel. The 270-kilometre-long transmission line is in one of the most isolated regions of Ontario, one that can only be accessed by plane, except for a few months in winter when ice roads are strong enough to drive on. The project went online in 2001, bringing reliable power to over 7,000 people who were previously underserved by the province’s energy providers. It also, somewhat controversially, enabled Ontario’s first diamond mine in Attawapiskat territory.

The future the First Nations created 25 years ago is blissfully quiet, now that the diesel generators are shut off. “When the power went on, you could hear the birds,” Patrick Chilton, the CEO of Five Nations Energy, said with a smile. “Our communities were glowing.”

Power, politics and money: Five Nations Energy needed government, banks and builders on board

Chilton took over in 2013 after the former CEO, his brother Ed, passed away. “This was all his idea,” Chilton told The Narwhal in a conversation over Zoom from his office in Timmins, Ont. The company’s story has never been told before in full, he said, because he felt “vulnerable” to the forces that fought against Omushkego Ishkotayo or didn’t understand it, a dynamic underscored by Canada’s looming power problem reporting in recent years.

The success of Five Nations Energy is a tale of unwavering determination and imagination, Chilton said, and it started with his older brother. “Ed was the first person who believed a transmission line was possible,” he said.

In a Timmins Daily Press death notice published July 2, 2013, Ed Chilton is described as having “a quiet but profound impact on the establishment of agreements and enterprises benefitting First Nations peoples and their lands.” Chilton doesn’t describe him that way, exactly.

“If you knew my brother, he was very stubborn,” he said. A certified engineering technologist, Ed was a visionary whose whole life was defined by the transmission line. He was the first to approach the chiefs with the idea, the first to reach out to energy companies and government officials and the one who persuaded thousands of people in remote, underserved communities that it was possible to bring power to their region.

After that 1996 meeting of Nishnawbe Aski Nation, there came a four-year-long effort to convince the rest of Ontario, and the country, the project was possible and financially viable. The chiefs of the five First Nations took their idea to the halls of power: Queen’s Park, Parliament Hill and the provincial power distributor Hydro One (then Ontario Hydro).

“All of them said no,” Chilton said. “They saw it as near to impossible — the idea that you could build a transmission line in the ‘swamp,’ as they called it.” The Five Nations Energy team kept a document at the time tracking how many times they heard no; it topped out at 37.

One of the worst times was in 1998, at a meeting on the 19th floor of the Ontario Hydro building in the heart of downtown Toronto. There, despite all their preparation and planning, a senior member of the Ontario Hydro team told Chilton, Martin and other chiefs “you’ll build that line over my dead body,” Chilton recalled.

At the time, Chilton said, Ontario Hydro was refusing to cooperate: unwilling to let go of its monopoly over transmission lines, but also saying it was unable to connect new houses in the First Nations to diesel generators it said were at maximum capacity. (Ontario Hydro no longer exists; Hydro One declined to comment.)

“There’s always naysayers no matter what you’re doing,” Martin said. “What we were doing had never been done before. So of course people were telling us how we had never managed something of this size or a budget of this size.”

“[Our people] basically told them to blow it up your ass. We can do it,” Chilton said.

So the chiefs of the five nations did something they’d never done before: they went to all of the big banks and many, many charitable foundations trying to get the money, a big ask for a project of this scale, in this location. Without outside support, their pitch was that they’d build it themselves.

This was the hardest part of the process, said Lawrence Martin, the former Grand Chief of Mushkegowuk Tribal Council and a member of the Five Nations Energy board. “We didn’t know how to finance something like this, to get loans,” he told The Narwhal. “That was the toughest task for all of us to achieve.”

Eventually, they got nearly $50 million in funding from a series of financial organizations including the Bank of Montreal, Pacific and Western Capital, the Northern Ontario Heritage Fund Corporation (an Ontario government agency) and the engineering and construction company SNC Lavalin, which did an assessment of the area and deemed the project viable.

And in 1999, Ed Chilton, other members of the Chilton family and the chiefs were able to secure an agreement with Ontario Hydro that would allow them to buy electricity from the province and sell it to their communities.

Related News

Ontario will not renew electricity deal with Quebec

Ontario-Quebec Electricity Trade Agreement ends as Ontario pivots to IESO procurement, hydropower alternatives, natural gas capacity, and energy auctions, impacting grid reliability, power imports, and GHG emissions across both provincial markets.

Key Points

A seven-year power import pact; Ontario will end it, shifting to IESO procurement and gas capacity.

✅ Seasonal hydropower exchange of 2.3 TWh annually.

✅ IESO projects Quebec supply constraints by decade end.

✅ Ontario adds gas, auctions; near-term sector GHGs rise.

The Ontario government does not plan to renew the Ontario-Quebec electricity trade agreement, Radio-Canada is reporting.

The seven-year contract, which expires next year, aims to reduce Ontario's greenhouse gas (GHG) emissions by buying 2.3 Terawatt-hours of electricity from Quebec annually — that corresponds to about seven per cent of Hydro-Quebec's average annual exports.

The announcement comes as the provincially owned Quebec utility continues its legal battle over a plan to export power to Massachusetts.

The Ontario agreement has guaranteed a seasonal exchange of energy, since Quebec has a power surplus in summer, and the province's electricity needs increase in the winter. Ontario plans on exercising its last and only option in the summer of 2026, for a block of 500 megawatts.

The office of the Ontario Minister of Energy Todd Smith says the province will save money by relying "on a competitive procurement process" instead, amid debates over clean, affordable electricity policy in Ontario. And, the Independent Electricity System Operator (IESO), the equivalent of Hydro-Quebec in Ontario, added that, at any rate, Quebec is expected to "run out of electricity in the middle or at the end of the decade."

During the Quebec election campaign, Premier Francois Legault said his province needed to increase hydroelectricity production because he is expecting demand for hydroelectricity to increase by an additional 100 terawatt-hours in the coming decades — half of Hydro-Quebec's current annual output.

Coalition Avenir Quebec pitches more hydro dams to Quebec voters

The provinces will still continue to buy and sell power, reaching deals through annual energy auctions.

Eloise Edom, an associate researcher at Polytechnique Montreal's Institut de l'energie Trottier, says the announcement came as somewhat of a surprise because "we're still talking about a lot of energy."

Hydro-Quebec refused to comment on "the SIERE [Independent Electricity System Operator]'s intentions for the agreement, which ends next year," said company spokesperson Lynn St-Laurent.

No green options

Yet Ontario is running out of electricity, even as questions persist about whether it is embracing clean power to meet demand, in part because of plans to refurbish nuclear reactors at the Bruce and Darlington generator stations.

Windsor has already lost out on a $2.5-billion factory because the region is short of electricity for new industrial loads. And by 2025, Toronto will run out of power for the electrification of its transit system, according to the latest estimates from the IESO.

The Ford government recently announced that it hopes to extend the life of the Pickering nuclear station amid ongoing debate. It is also evaluating the possibility of increasing hydroelectricity production at its existing dams.

For now, Ontario is banking on its natural gas plants to meet demand, which have won most recent IESO tenders for contracts running until 2026. Last Friday, the province announced that it was going to buy an additional 1,500 megawatts by 2027.

"The [Ontario energy] minister's expectations may be that the increase in natural gas prices is temporary and that it will fade," energy economist Jean-Thomas Bernard said. "With this in mind, he probably does not want to sign a long-term contract [with Hydro-Quebec] and prefers to buy electricity on a day-to-day basis and through calls for tenders."

If the Quebec deal expires, Ontario, Canada's second highest GHG emitter, would have to increase its emissions for the sector, at least in the medium term, with electricity getting dirtier as gas fills the gap.

Last year, the IESO found that it would be very difficult to set a moratorium on natural gas before 2030. The IESO must produce a final report on the subject for the energy minister by the end of November.

Related News

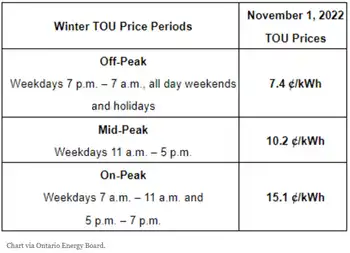

Electricity rates are about to change across Ontario

Ontario Electricity Rate Changes lower OEB Regulated Price Plan costs, adjust Time-of-Use winter hours and tiered thresholds, and modify the Ontario Electricity Rebate, affecting off-peak, mid-peak, and on-peak pricing for households and small businesses.

Key Points

OEB updates lowering RPP prices, shifting TOU hours, adjusting tiers, and modifying the Ontario Electricity Rebate.

✅ Winter TOU: Off-peak 7 p.m.-7 a.m.; weekends, holidays all day.

✅ Tiered pricing adds 400 kWh at lower rate for residential users.

✅ Ontario Electricity Rebate falls to 11.7% from 17% on Nov 1.

Electricity rates are about to change for consumers across Ontario.

On November 1, households and small businesses will see their electricity rates go down under the Ontario Energy Board's (OEB) Regulated Price Plan framework.

Customer's on the OEB's tiered pricing plan will also see their bills lowered on November 1, a shift from the 2021 increase when fixed pricing ended, as winter time-of-use hours and the seasonal change in the killowatt-hour threshold take effect.

Off-peak time-of-use hours will run from 7 p.m. to 7 a.m. during weekdays, including the ultra-low overnight rates option for some customers, and all day on weekends and holidays. On-peak hours will be from 7 a.m. to 11 a.m. and 5 p.m. to 7 p.m. on weekdays, and mid-peak hours from 11 a.m. to 5 p.m. on weekdays.

The winter-tier threshold provides residential customers with an extra 400 kilowatt-hours per month at a lower price during the colder weather, alongside the off-peak price freeze in effect.

The Ontario Electricity Rebate - a pre-tax credit that shows up at the bottom of electricity bills - will also see changes as a hydro rate change takes effect on November 1. Starting next month, the rebate will drop from 17 per cent to 11.7 per cent.

For a typical residential customer, the credit will decrease electricity bills by about $13.91 per month, according to the OEB.

Under the board's winter disconnection ban, electricity providers can't turn off a residential customer's power between November 15, 2022 and April 30, 2023 for failing to pay, and earlier pandemic relief included a fixed COVID-19 hydro rate for customers.

Related News

The American EV boom is about to begin. Does the US have the power to charge it?

EV Charging Infrastructure accelerates with federal funding, NEVI corridors, and Level 2/3 DC fast charging to cut range anxiety, support apartment dwellers, and scale to 500,000 public chargers alongside tax credits and state mandates.

Key Points

The network of public and private hardware, software, and policies enabling reliable Level 2/3 EV charging at scale.

✅ $7,500/$4,000 tax credits spur adoption and charger demand

✅ NEVI funding builds 500,000 public, reliable DC fast chargers

✅ Equity focus: apartment, curbside, bidirectional and inductive tech

Speaking in front of a line of the latest electric vehicles (EVs) at this month’s North American International Auto Show, President Joe Biden declared: “The great American road trip is going to be fully electrified.”

Most vehicles on the road are still gas guzzlers, but Washington is betting big on change, with EV charging networks competing to expand as it hopes that major federal investment will help reach a target set by the White House for 50% of new cars to be electric by 2030. But there are roadblocks – specifically when it comes to charging them all. “Range anxiety,” or how far one can travel before needing to charge, is still cited as a major deterrent for potential EV buyers.

The auto industry recently passed the 5% mark of EV market share – a watershed moment, arriving ahead of schedule according to analysts, before rapid growth. New policies at the state and local level could very well spur that growth: the Inflation Reduction Act, which passed this summer, offers tax credits of $4,000 to purchase a used EV and up to $7,500 for certain new ones. In August, California, the nation’s largest state and economy, announced rules that would ban all new gas-powered cars by 2035, as part of broader grid stability efforts in the state. New York plans to follow.

So now, the race is on to provide chargers to power all those new EVs.

The administration’s target of 500,000 public charging units by 2030 is a far cry from the current count of nearly 50,000, according to the Department of Energy’s estimate. And those new chargers will have to be fast – what’s known as Level 2 or 3 charging – and functional in order to create a truly reliable system, even as state power grids face added demands across regions. Today, many are not.

Last week, the White House approved plans for all 50 states, along with Washington DC, and Puerto Rico, to set up chargers along highways, unlocking $1.5bn in federal funding to that end, as US automakers’ charger buildout to complement public funds. The money comes from the landmark infrastructure bill passed last year, which invests $7.5bn for EV charging in total.

But how much of that money is spent is largely going to be determined at the local level, amid control over charging debates among stakeholders. “It’s a difference between policy and practice,” said Drew Lipsher, the chief development officer at Volta, an EV charging provider. “Now that the federal government has these policies, the question becomes, OK, how does this actually get implemented?” The practice, he said, is up to states and municipalities.

As EV demand spikes, a growing number of cities are adopting policies for EV charging construction. In July, the city of Columbus passed an “EV readiness” ordinance, which will require new parking structures to host charging stations proportionate to the number of total parking spots, with at least one that is ADA-accessible. Honolulu and Atlanta have passed similar measures.

One major challenge is creating a distribution model that can meet a diversity of needs.

At the moment, most EV owners charge their cars at home with a built-in unit, which governments can help subsidize. But for apartment dwellers or those living in multi-family homes, that’s less feasible. “When we’re thinking about the largest pieces of the population, that’s where we need to really be focusing our attention. This is a major equity issue,” said Alexia Melendez Martineau, the policy manager at Plug-In America, an EV consumer advocacy group.

Bringing power to people is one such solution. In Hoboken, New Jersey, Volta is working with the city to create a streetside charging network. “The network will be within a five-minute walk of every resident,” said Lipsher. “Hopefully this is a way for us to really import it to cities who believe public EV charging infrastructure on the street is important.” Similarly, in parts of Los Angeles – as in Berlin and London – drivers can get a charge from a street lamp.

And there may be new technologies that could help, exciting experts and EV enthusiasts alike. That could include the roads themselves charging EVs through a magnetizable concrete technology being piloted in Indiana and Detroit. And bidirectional charging, where, similar to solar panels, drivers can put their electricity back into the grid – or perhaps even to another EV, through what’s known as electric vehicle supply equipment (EVSE). Nissan approved the technology for their Leaf model this month.

Related News

Solar Is Now 33% Cheaper Than Gas Power in US, Guggenheim Says

US Renewable Energy Cost Advantage signals cheaper utility-scale solar and onshore wind versus natural gas, with LCOE declines, tax credits, and climate policy cutting electricity costs for utilities and grids across the United States.

Key Points

Cheaper solar and wind than natural gas, driven by LCOE drops, tax credits, and policy, lowering US electricity costs.

✅ Utility-scale solar is about one-third cheaper than gas

✅ Onshore wind costs roughly 44 percent less than natural gas

✅ Policy and tax credits accelerate renewables and cut power prices

Natural gas’s dominance as power-plant fuel in the US is fading fast as the cost of electricity generated by US wind and solar projects tumbles and as wind and solar surpass coal in the generation mix, according to Guggenheim Securities.

Utility-scale solar is now about a third cheaper than gas-fired power, while onshore wind is about 44% less expensive, Guggenheim analysts led by Shahriar Pourreza said Monday in a note to clients, a dynamic consistent with falling wholesale power prices in several markets today.

“Solar and wind now present a deflationary opportunity for electric supply costs,” the analysts said, which “supports the case for economic deployment of renewables across the US,” as the country moves toward 30% wind and solar and one-fourth of total generation in the near term.

Gas prices have surged amid a global supply crunch after Russia’s invasion of Ukraine, while tax-credit extensions and sweeping US climate legislation have brought down the cost of wind and solar, even as renewables surpassed coal in 2022 nationwide. Renewables-heavy utilities like NextEra Energy Inc. and Allete Inc. stand to benefit, and companies that can boost spending on wind and solar, as wind, solar and batteries dominate the 2023 pipeline, will also see faster growth, Guggenheim said.

Related News

In 2021, 40% Of The Electricity Produced In The United States Was Derived From Non-Fossil Fuel Sources

Renewable Electricity Generation is accelerating the shift from fossil fuels, as wind, solar, and hydro boost the electric power sector, lowering emissions and overtaking nuclear while displacing coal and natural gas in the U.S. grid.

Key Points

Renewable electricity generation is power from non-fossil sources like wind, solar, and hydro to cut emissions.

✅ Driven by wind, solar, and hydro adoption

✅ Reduces fossil fuel dependence and emissions

✅ Increasing share in the electric power sector