Electricity News in January 2020

Cryptocurrency firm in Plattsburgh fights $1 million electric charge

Coinmint Plattsburgh Dispute spotlights cryptocurrency mining, hydropower electricity rates, a $1M security deposit, Public Service Commission rulings, municipal utility policies, and seasonal migration to Massena data centers as Bitcoin price volatility pressures operations.

Key Points

Legal and energy-cost dispute over crypto mining, a $1,019,503 deposit, and operations in Plattsburgh and Massena.

✅ PSC allows higher rates and requires large security deposits.

✅ Winter electricity spikes drove a $1M deposit calculation.

✅ Coinmint shifted capacity to Massena data centers.

A few years ago, there was a lot of buzz about the North Country becoming the next Silicon Valley of cryptocurrency, even as Maine debated a 145-mile line that could reshape regional power flows. One of the companies to flock here was Coinmint. The cryptomining company set up shop in Plattsburgh in 2017 and declared its intentions to be a good citizen.

Today, Coinmint is fighting a legal battle to avoid paying the city’s electric utility more than $1 million owed for a security deposit. In addition to that dispute, a local property manager says the firm was evicted from one of its Plattsburgh locations.

Companies like Coinmint chose to come to the North Country because of the relatively low electricity prices here, thanks in large part to the hydropower dam on the St. Lawrence River in Massena, and regionally, projects such as the disputed electricity corridor have drawn attention to transmission costs and access. Coinmint operates its North Country Data Center facilities in Plattsburgh and Massena. In both locations, racks of computer servers perform complex calculations to generate cryptocurrency, such as bitcoin.

When cryptomining began to take off in Plattsburgh, the cost of one bitcoin was skyrocketing. That brought hype around the possibility of big business and job creation in the North Country. But cryptomininers like Coinmint were using massive amounts of energy in the winter of 2017-2018, and that season, electric bills of everyday Plattsburgh residents spiked.

Many cryptomining firms operate in a state of flux, beholden to the price of Bitcoin and other cryptocurrencies, even as the end to the 'war on coal' declaration did little to change utilities' choices. When the price of one bitcoin hit $20,000 in 2017, it fell by 30% just days later. That’s one reason why the price of electricity is so critical for companies like Coinmint to turn a profit.

Plattsburgh puts the brakes on “cryptocurrency mining”

In early 2018, Plattsburgh passed a moratorium on cryptocurrency mining operations, after residents complained of higher-than-usual electric bills.

“Your electric bill’s $100, then it’s at $130. Why? It’s because these guys that are mining the bitcoins are riding into town, taking advantage of a situation,” said resident Andrew Golt during a 2018 public hearing.

Coinmint aimed to assuage the worries of residents and other businesses. “At the end of the day we want to be a good citizen in whatever communities we’re in,” Coinmint spokesman Kyle Carlton told NCPR at that 2018 meeting.

“We’re open to working with those communities to figure out whatever solutions are going to work.”

The ban was lifted in Feb. 2019. However, since it didn’t apply to companies that were already mining cryptocurrency in Plattsburgh, Coinmint has operated in the city all along.

Coinmint challenges attempt to protect ratepayers

New rules passed by the New York Public Service Commission in March 2018 allow municipal power authorities including Plattsburgh’s to charge big energy users such as Coinmint higher electricity rates, amid customer backlash in other utility deals. The new rules also require them to put down a security deposit to ensure their bills get paid.

But Coinmint disputes that deposit charge. The company has been embroiled in a legal fight for nearly a year against Plattsburgh Municipal Lighting Department (PMLD) in an attempt to avoid paying the electric utility’s security deposit bill of $1,019,503. That bill is based on an estimate of what would cover two months of electricity use if a company were to leave town without paying its electric bills.

Coinmint would not discuss the dispute on the record with NCPR. Legal documents show the firm argues the deposit charge is inflated, based on a flawed calculation resulting in a charge hundreds of thousands of dollars higher than what it should be.

“Essentially they’re arguing that they should only have to put up some average of their monthly bills without accounting for the fact that winter bills are significantly higher than the average,” said Ken Podolny, an attorney representing the Plattsburgh utility.

The company took legal action in February 2019 against PMLD in the hopes New York’s energy regulator, the Public Service Commission, would agree with Coinmint that the deposit charge was too high. An informal commission hearing officer disagreed, and ruled in October the charge was calculated correctly.

Coinmint appealed the ruling in November and a hearing on the appeal could come as soon as February.

Less than a week after Coinmint lost its initial challenge of the deposit charge, the company made a splashy announcement trumpeting its plans to “migrate its Plattsburgh, New York infrastructure to its Massena, New York location for the 2019-2020 winter season.”

The announcement made no mention of the appeal or the recent ruling against Coinmint. The company attributed its new plan to “exceptionally-high” electricity rates in Plattsburgh, as hydropower transmission projects elsewhere in New England faced their own controversies.

"We recognize some in the Plattsburgh community have blamed our operation for pushing rates higher for everyone so, while we disagree with that assessment, we hope this seasonal migration will have a positive impact on rates for all our neighbors,” said Coinmint cofounder Prieur Leary in the press statement.

“In the event that doesn't happen, we trust the community will look for the real answers for these high costs." Prieur Leary has since been removed from the corporate team page on the company’s website.

The company still operates in Plattsburgh at one of its locations in the city. As for staff, while at least two Coinmint employees have moved from Plattsburgh to Massena, where the company operates a data center inside a former Alcoa aluminum plant, it is unclear how many people in total have made the move.

Coinmint left its second Plattsburgh location in 2019. The company would not discuss that move on the record, yet the circumstances of the departure are murky.

The local property manager of the industrial park site told NCPR, “I have no comment on our evicted tenant Coinmint.” The property owner, California’s Karex Property Management Services, also would not comment regarding the situation, noting that “all staff have been told to not discuss anything regarding our past tenant Coinmint.”

Today, Bitcoin and other cryptocurrencies are worth a fraction of what they were back in 2017 when Coinmint came to the North Country, and now, amid a debate over Bitcoin's electricity use shaping market sentiment, the future of the entire industry here remains uncertain.

Related News

Electric cars will challenge state power grids

Electric Vehicle Grid Integration aligns EV charging with grid capacity using smart charging, time-of-use rates, V2G, and demand response to reduce peak load, enable renewable energy, and optimize infrastructure planning.

Key Points

Aligning EV charging with grid needs via smart charging, TOU pricing, and V2G to balance load and support renewables.

✅ Time-of-use rates shift charging to off-peak hours

✅ Smart charging responds to real-time grid signals

✅ V2G turns fleets into distributed energy storage

When Seattle City Light unveiled five new electric vehicle charging stations last month in an industrial neighborhood south of downtown, the electric utility wasn't just offering a new spot for drivers to fuel up. It also was creating a way for the service to figure out how much more power it might need as electric vehicles catch on.

Seattle aims to have nearly a third of its residents driving electric vehicles by 2030. Washington state is No. 3 in the nation in per capita adoption of plug-in cars, behind California and Hawaii. But as Washington and other states urge their residents to buy electric vehicles — a crucial component of efforts to reduce carbon emissions — they also need to make sure the electric grid can handle it amid an accelerating EV boom nationwide.

The average electric vehicle requires 30 kilowatt hours to travel 100 miles — the same amount of electricity an average American home uses each day to run appliances, computers, lights and heating and air conditioning.

An Energy Department study found that increased electrification across all sectors of the economy could boost national consumption by as much as 38 percent by 2050, in large part because of electric vehicles. The environmental benefit of electric cars depends on the electricity being generated by renewables.

So far, states predict they will be able to sufficiently boost power production. But whether electric vehicles will become an asset or a liability to the grid largely depends on when drivers charge their cars.

Electricity demand fluctuates throughout the day; demand is higher during daytime hours, peaking in the early evening. If many people buy electric vehicles and mostly try to charge right when they get home from work — as many now do — the system could get overloaded or force utilities to deliver more electricity than they are capable of producing.

In California, for example, the worry is not so much with the state’s overall power capacity, but rather with the ability to quickly ramp up production and maintain grid stability when demand is high, said Sandy Louey, media relations manager for the California Energy Commission, in an email. About 150,000 electric vehicles were sold in California in 2018 — 8 percent of all state car sales.

The state projects that electric vehicles will consume 5.4 percent of the state’s electricity, or 17,000 gigawatt hours, by 2030.

Responding to the growth in electric vehicles will present unique challenges for each state. A team of researchers from the University of Texas at Austin estimated the amount of electricity that would be required if every car on the road transitioned to electric. Wyoming, for instance, would need to nudge up its electricity production only 17 percent, while Maine would have to produce 55 percent more.

Efficiency Maine, a state trust that oversees energy efficiency and greenhouse gas reduction programs, offers rebates for the purchase of electric vehicles, part of state efforts to incentivize growth.

“We’re certainly mindful that if those projections are right, then there will need to be more supply,” said Michael Stoddard, the program’s executive director. “But it’s going to unfold over a period of the next 20 years. If we put our minds to it and plan for it, then we should be able to do it.”

A November report sponsored by the Energy Department found that there has been almost no increase in electricity demand nationwide over the past 10 years, while capacity has grown an average of 12 gigawatts per year (1 GW can power more than a half-million homes). That means energy production could climb at a similar rate and still meet even the most aggressive increase in electric vehicles, with proper planning.

Charging during off-peak hours would allow not only many electric vehicles to be added to the roads but also utilities to get more use out of power plants that run only during the limited peak times through improved grid coordination and flexible demand.

Seattle City Light and others are looking at various ways to promote charging during ideal times. One method is time-of-day rates. For the Seattle chargers unveiled last month, users will pay 31 cents per kilowatt hour during peak daytime hours and 17 cents during off-peak hours. The utility will monitor use at its charging stations to see how effective the rates are at shifting charging to more favorable times.

The utility also is working on a pilot program to study charging behavior at home. And it is partnering with customers such as King County Metro that are electrifying large vehicle fleets, including growing electric truck fleets that will demand significant power, to make sure they have both the infrastructure and charging patterns to integrate smoothly.

“Traditionally, our utility approach is to meet the load demand,” said Emeka Anyanwu, energy innovation and resources officer for Seattle City Light.

Instead, he said, the utility is working with customers to see whether they can use existing assets without the need for additional investment.

Numerous analysts say that approach is crucial.

“Even if there’s an overall increase in consumption, it really matters when that occurs,” said Sally Talberg, head of the Michigan Public Service Commission, which oversees the state’s utilities. “The encouragement of off-peak charging and other technology solutions that could come to bear could offset any negative impact.”

One of those solutions is smart charging, a system in which vehicles are plugged in but don’t charge until they receive a signal from the grid that demand has tapered off a sufficient amount. This is often paired with a lower rate for drivers who use it. Several smart-charging pilot programs are being conducted by utilities, although they have not yet been phased in widely, amid ongoing debates over charging control among manufacturers and utilities.

In many places, the increased electricity demand from electric vehicles is seen as a benefit to utilities and rate payers. In the Northwest, electricity consumption has remained relatively stagnant since 2000, despite robust population growth and development. That’s because increasing urbanization and building efficiency have driven down electricity needs.

Electric vehicles could help push electricity consumption closer to utilities’ capacity for production. That would bring in revenue for the providers, which would help defray the costs for maintaining that capacity, lowering rates for all customers.

“Having EV loads is welcome, because it’s environmentally cleaner and helps sustain revenues for utilities,” said Massoud Jourabchi, manager of economic analysis for the Northwest Power and Conservation Council, which develops power plans for the region.

Colorado also is working to promote electric cars, with the aim of putting 940,000 on the road by 2030. The state has adopted California’s zero-emission vehicles mandate, which requires automakers to reach certain market goals for their sales of cars that don’t burn fossil fuels, while extending tax credits for the purchase of such cars, investing in charging stations and electrifying state fleets.

Auto dealers have opposed the mandate, saying it infringes on consumer freedom.

“We think it should be a customer choice, a consumer choice and not a government mandate,” said Tim Jackson, president and chief executive of the Colorado Automobile Dealers Association.

Jackson also said that there’s not yet a strong consumer appetite for electric vehicles, meaning that manufacturers that fail to sell the mandated number of emission-free vehicles would be required to purchase credits, which he thinks would drive up the price of their other models.

Republicans in the state have registered similar concerns, saying electric vehicle adoption should take place based on market forces, not state intervention.

Many in the utility community are excited about the potential for electric cars to serve as mobile energy storage for the grid. Vehicle-to-grid technology, known as V2G, would allow cars charging during the day to take on surplus power from renewable energy sources.

Then, during peak demand times, electric vehicles would return some of that stored energy to the grid. As demand tapers off in the evening, the cars would be able to recharge.

In practice, V2G technology could be especially beneficial if used by heavy-duty fleets, such as school buses or utility vehicles. Those fleets would have substantial battery storage and long periods where they are idle, such as evenings and weekends — and even longer periods such as summer and the holiday season when school is out. The batteries on a bus, Jourabchi said, could store as much as 10 times the electricity needed to power a home for a day.

Related News

Bruce nuclear reactor taken offline as $2.1B project 'officially' begins

Bruce Power Unit 6 refurbishment replaces major reactor components, shifting supply to hydroelectric and natural gas, sustaining Ontario jobs, extending plant life to 2064, and managing radioactive waste along Lake Huron, on-time and on-budget.

Key Points

A 4-year, $2.1B reactor overhaul within a 13-year, $13B program to extend plant life to 2064 and support Ontario jobs.

✅ Unit 6 offline 4 years; capacity shift to hydro and gas

✅ Part of 13-year, $13B program; extends life to 2064

✅ Creates jobs; manages radioactive waste at Lake Huron

The world’s largest nuclear fleet, became a little smaller Monday morning. Bruce Power has began the process to take Unit 6 offline to begin a $2.1 billion project, supported by manufacturing contracts with key suppliers, to replace all the major components of the reactor.

The reactor, which produces enough electricity to power 750,000 homes and reflects higher output after upgrades across the site, will be out of service for the next four years.

In its place, hydroelectric power and natural gas will be utilized more.

Taking Unit 6 offline is just the “official” beginning of a 13-year, $13-billion project to refurbish six of Bruce Power’s eight nuclear reactors, as Ontario advances the Pickering B refurbishment as well on its grid.

Work to extend the life of the nuclear plant started in 2016, and the company recently marked an operating record while supporting pandemic response, but the longest and hardest part of the project - the major component replacement - begins now.

“The Unit 6 project marks the next big step in a long campaign to revitalize this site,” says Mike Rencheck, Bruce Power’s president and CEO.

The overall project is expected to last until 2033, and mirrors life extensions at Pickering supporting Ontario’s zero-carbon goals, but will extend the life of the nuclear plant until 2064.

Extending the life of the Bruce Power nuclear plant will sustain 22,000 jobs in Ontario and add $4 billion a year in economic activity to the province, say Bruce Power officials.

About 2,000 skilled tradespeople will be required for each of the six reactor refurbishments - 4,200 people already work at the sprawling nuclear plant near Kincardine.

It will also mean tons of radioactive nuclear waste will be created that is currently stored in buildings on the Bruce Power site, along the shores of Lake Huron.

Bruce Power restarted two reactors back in 2012, and in later years doubled a PPE donation to support regional health partners. That project was $2-billion over-budget, and three years behind schedule.

Bruce Power officials say this refurbishment project is currently on-time and on-budget.

Related News

WEC Energy Group to buy 80% stake in Illinois wind farm for $345 million

WEC Energy Blooming Grove Investment underscores Midwest renewable energy growth, with Invenergy, GE turbines, and 250 MW wind power capacity, tax credits, PPAs, and utility-scale generation supplying corporate offtakers via long-term contracts.

Key Points

It is WEC Energy's $345M purchase of an 80% stake in Invenergy's 250 MW Blooming Grove wind farm in Illinois.

✅ 94 GE turbines; 250 MW utility-scale wind capacity

✅ Output contracted to two multinational offtakers

✅ Eligible for 100% bonus depreciation and wind tax credits

WEC Energy Group, the parent company of We Energies, is buying an 80% stake in a wind farm, as seen with projects like Enel's 450 MW wind farm coming online, in McLean County, Illinois, for $345 million.

The wind farm, known as the Blooming Grove Wind Farm, is being developed by Invenergy, which recently completed the largest North American wind build with GE partners, a company based in Chicago that develops wind, solar and other power projects. WEC Energy has invested in several wind farms developed by Invenergy.

With the agreement announced Monday, WEC Energy will have invested more than $1.2 billion in wind farms in the Midwest, echoing heartland investment growth across the region. The power from the wind farms is sold to other utilities or companies, as federal initiatives like DOE wind awards continue to support innovation, and the projects are separate from the investments made by WEC Energy's regulated utilities, such as We Energies, in wind power.

The project, which will consist of 94 wind turbines from General Electric, is expected to be completed this year, similar to recent project operations in the sector, and will have a capacity of 250 megawatts, WEC said in a news release.

Affiliates of two undisclosed multinational companies akin to EDF's offshore investment activity have contracted to take all of the wind farm's output.

The investment is expected to be eligible for 100% bonus depreciation and, as wind economics help illustrate key trends, the tax credits available for wind projects, WEC Energy said.

Related News

Current Model For Storing Nuclear Waste Is Incomplete

Nuclear Waste Corrosion accelerates as stainless steel, glass, and ceramics interact in aqueous conditions, driving localized corrosion in repositories like Yucca Mountain, according to Nature Materials research on high-level radioactive waste storage.

Key Points

Degradation of waste forms and canisters from water-driven chemistry, causing accelerated, localized corrosion in storage.

✅ Stainless steel-glass contact triggers severe localized attack

✅ Ceramics and steel co-corrosion observed under aqueous conditions

✅ Yucca Mountain-like chemistry accelerates waste form degradation

The materials the United States and other countries plan to use to store high-level nuclear waste, even as utilities expand carbon-free electricity portfolios, will likely degrade faster than anyone previously knew because of the way those materials interact, new research shows.

The findings, published today in the journal Nature Materials (https://www.nature.com/articles/s41563-019-0579-x), show that corrosion of nuclear waste storage materials accelerates because of changes in the chemistry of the nuclear waste solution, and because of the way the materials interact with one another.

"This indicates that the current models may not be sufficient to keep this waste safely stored," said Xiaolei Guo, lead author of the study and deputy director of Ohio State's Center for Performance and Design of Nuclear Waste Forms and Containers, part of the university's College of Engineering. "And it shows that we need to develop a new model for storing nuclear waste."

Beyond waste storage, options like carbon capture technologies are being explored to reduce atmospheric CO2 alongside nuclear energy.

The team's research focused on storage materials for high-level nuclear waste -- primarily defense waste, the legacy of past nuclear arms production. The waste is highly radioactive. While some types of the waste have half-lives of about 30 years, others -- for example, plutonium -- have a half-life that can be tens of thousands of years. The half-life of a radioactive element is the time needed for half of the material to decay.

The United States currently has no disposal site for that waste; according to the U.S. General Accountability Office, it is typically stored near the nuclear power plants where it is produced. A permanent site has been proposed for Yucca Mountain in Nevada, though plans have stalled. Countries around the world have debated the best way to deal with nuclear waste; only one, Finland, has started construction on a long-term repository for high-level nuclear waste.

But the long-term plan for high-level defense waste disposal and storage around the globe is largely the same, even as the U.S. works to sustain nuclear power for decarbonization efforts. It involves mixing the nuclear waste with other materials to form glass or ceramics, and then encasing those pieces of glass or ceramics -- now radioactive -- inside metallic canisters. The canisters then would be buried deep underground in a repository to isolate it.

At the generation level, regulators are advancing EPA power plant rules on carbon capture to curb emissions while nuclear waste strategies evolve.

In this study, the researchers found that when exposed to an aqueous environment, glass and ceramics interact with stainless steel to accelerate corrosion, especially of the glass and ceramic materials holding nuclear waste.

In parallel, the electrical grid's reliance on SF6 insulating gas has raised warming concerns across Europe.

The study qualitatively measured the difference between accelerated corrosion and natural corrosion of the storage materials. Guo called it "severe."

"In the real-life scenario, the glass or ceramic waste forms would be in close contact with stainless steel canisters. Under specific conditions, the corrosion of stainless steel will go crazy," he said. "It creates a super-aggressive environment that can corrode surrounding materials."

To analyze corrosion, the research team pressed glass or ceramic "waste forms" -- the shapes into which nuclear waste is encapsulated -- against stainless steel and immersed them in solutions for up to 30 days, under conditions that simulate those under Yucca Mountain, the proposed nuclear waste repository.

Those experiments showed that when glass and stainless steel were pressed against one another, stainless steel corrosion was "severe" and "localized," according to the study. The researchers also noted cracks and enhanced corrosion on the parts of the glass that had been in contact with stainless steel.

Part of the problem lies in the Periodic Table. Stainless steel is made primarily of iron mixed with other elements, including nickel and chromium. Iron has a chemical affinity for silicon, which is a key element of glass.

The experiments also showed that when ceramics -- another potential holder for nuclear waste -- were pressed against stainless steel under conditions that mimicked those beneath Yucca Mountain, both the ceramics and stainless steel corroded in a "severe localized" way.

Other Ohio State researchers involved in this study include Gopal Viswanathan, Tianshu Li and Gerald Frankel.

This work was funded in part by the U.S. Department of Energy Office of Science.

Meanwhile, U.S. monitoring shows potent greenhouse gas declines confirming the impact of control efforts across the energy sector.

Related News

$1 billion per year is being spent to support climate change denial

Climate Change Consensus and Disinformation highlights the 97% peer-reviewed agreement on human-caused warming, IPCC warnings, and how fossil fuel lobbying, misinformation, and astroturf tactics echo tobacco denial to mislead media and voters.

Key Points

Explains the 97% scientific consensus and the disinformation that obscures IPCC findings and misleads the public.

✅ 97% peer-reviewed consensus on human-caused climate change

✅ Fossil fuel funding drives denial and media misinformation

✅ IPCC and major scientific bodies confirm severe impacts

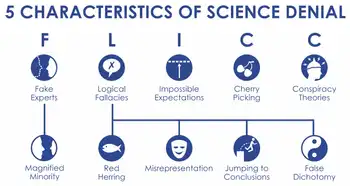

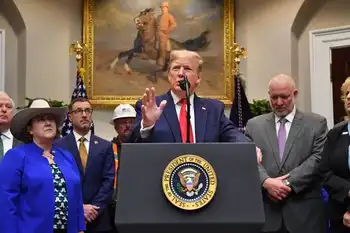

Orson Johnson says there is no scientific consensus on climate change. He’s wrong. A 2015 study by Drexel University’s Robert Brulle found that nearly $1 billion per year is being spent to support climate change denial. Electric utilities, fossil fuel and transportation sectors outspent environmental and renewable energy sectors by more than 10-to-1, undermining efforts to achieve net-zero electricity emissions globally. It is virtually the same strategy that tobacco companies used to deny the dangers of tobacco smoke, spending hundreds of millions of dollars to delay recognition of harm from tobacco smoke for decades, and today Trump's oil policies can similarly influence Wall Street's energy strategy. These are the same debunked sources Johnson quotes in his commentary.

The authors of six independent peer-reviewed papers on the consensus for human-caused climate change examined “the available studies and conclude that the finding of 97% consensus in published climate research is robust and consistent with other surveys of climate scientists and peer-reviewed studies,” according to an abstract in Environmental Research Letters, and public support for action is strong, with most Americans willing to contribute financially to climate solutions. Of the 30,000 scientists (people with a bachelor’s degree or higher in science) Johnson cites, only 39 specialized in climate science.

A new study by the U.N. Intergovernmental Panel on Climate Change draws on momentum from the Katowice climate summit to warn that “The consequences for nature and humanity are sweeping and severe.”

California’s Office of Planning and Research says: “Every major scientific organization in the United States with relevant expertise has confirmed the IPCC’s conclusion, including the National Academy of Sciences, the American Meteorological Society, the American Geophysical Union, and the American Association for the Advancement of Science. The list of international scientific organizations affirming the worldwide consensus on climate change is even longer.”

Former President Obama argued that decarbonization is irreversible as the clean-energy transition accelerates.

This issue is a symptom of an even larger problem. Recently, Facebook announced it would continue to allow political ads that contain obvious lies. America’s corporate news media has been following the same policy for years. Printing stories and commentary with information that is clearly not true or where data has been cherry-picked to strongly imply a lie, such as claims that Ottawa is making electricity more expensive for Albertans, sets up a false equivalence fallacy in which two incompatible arguments appear to be logically equivalent when, in fact, they are not.

Conservatives focus exclusively on progressive income taxes to argue that rich people pay a disproportionate share of taxes while ignoring that they take a disproportionate share of income, and federal income taxes account for less than half of taxes collected, with almost all of the other taxes being heavily regressive. Critics of single-payer healthcare disregard that almost every other developed country on earth has been using single-payer for decades to provide better care with universal coverage at roughly half the cost. Other examples abound, including recent policy milestones like the historic U.S. climate deal that nevertheless become targets of misinformation. We live in a society where truth is no longer truth, reality is supplanted by alternative facts and where crippling polarization is driven by the inability to agree on basic facts.

Related News

Nelson, B.C. Gets Charged Up on a New EV Fast-Charging Station

Nelson DC Fast-Charging EV Station delivers 50-kilowatt DCFC service at the community complex, expanding EV infrastructure in British Columbia with FortisBC, faster than Level 2 chargers, supporting clean transportation, range confidence, and highway corridor travel.

Key Points

A 50 kW public DC fast charger in Nelson, BC, run by FortisBC, providing rapid EV charging at the community complex.

✅ 50 kW DCFC cuts charge time to about 30 minutes

✅ $9 per half hour session; convenient downtown location

✅ Funded by NRCan, BC government, and FortisBC

FortisBC and the City of Nelson celebrated the opening of Nelson's first publicly available direct current fast-charging (DCFC) electric vehicle (EV) station on Friday.

"Adopting EV's is one of many ways for individuals to reduce carbon emissions," said Mayor John Dooley, City of Nelson. "We hope that the added convenience of this fast-charging station helps grow EV adoption among our community, and we appreciate the support from FortisBC, the province and the federal government."

The new station, located at the Nelson and District Community Complex, provides a convenient and faster charge option right in the heart of the commercial district and makes Nelson more accessible for both local and out-of-town EV drivers. The 50-kilowatt station is expected to bring a compact EV from zero to 80 per cent charged in about a half an hour, as compared to the four Level-2 charging stations located in downtown Nelson that require from three to four hours. The cost for a half hour charge at the new DC fast-charging station is $9 per half hour.

This fast-charging station was made possible through a partnership between FortisBC, the City of Nelson, Nelson Hydro, the Province of British Columbia and Natural Resources Canada. As part of the partnership, the City of Nelson is providing the location and FortisBC will own and manage the station.

This is the latest of 12 fast-charging stations FortisBC has built over the last year with support from municipalities and all levels of government, and adds to the five FortisBC-owned Kootenay stations that were opened as part of the accelerate Kootenays initiative in 2018.

All 12 stations were 50 per cent funded by Natural Resources Canada, 25 per cent by BC Ministry of Energy, Mines and Petroleum Resources and the remaining 25 per cent by FortisBC. The funding is provided by Natural Resources Canada's Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative, which aims to establish a coast-to-coast network of fast-chargers along the national highway system, natural gas refueling stations along key freight corridors and hydrogen refueling stations in major metropolitan areas. It is part of the Government of Canada's more than $180-billion Investing in Canada infrastructure plan. The Government of British Columbia is also contributing $300,000 towards the fast-chargers through its Clean Energy Vehicle Public Fast Charging Program.

This station brings the total DCFC chargers FortisBC owns and operates to 17 stations across 14 communities in the southern interior. FortisBC continues to look for opportunities to expand this network as part of its 30BY30 goal of reducing emissions from its customers by 30 per cent by 2030. For more information about the FortisBC electric vehicle fast-charging network, visit: fortisbc.com/electricvehicle.

"Electric vehicles play a key role in building a cleaner future. We are pleased to work with partners like FortisBC and the City of Nelson to give Canadians greener options to drive where they need to go, " said The Honourable Seamus O'Regan, Canada's Minister of Natural Resources.

"Nelson's first public fast-charging EV station increases EV infrastructure in the city, making it easier than ever to make the switch to cleaner transportation. Along with a range of rebates and financial incentives available to EV drivers, it is now more convenient and affordable to go electric and this station is a welcome addition to our EV charging infrastructure," said Michelle Mungall, BC's Minister of Jobs, Economic Development and Competitiveness, and MLA for Nelson Creston.

"Building the necessary DC fast-charging infrastructure, such as the Lillooet fast-charging site in British Columbia, close to highways and local amenities where drivers need them most is a critical step in growing electric vehicle adoption. Collaborations like this are proving to be an effective way to achieve this, and I'd like to thank all the program partners for their commitment in opening this important station, " said Mark Warren, Director of Business Innovation, FortisBC.

Related News

Hydro-Québec will refund a total of $535 million to customers who were account holders in 2018 or 2019

Hydro-Québec Bill 34 Refund issues $535M customer credits tied to electricity rates, consumption-based rebates, and variance accounts, averaging $60 per account and 2.49% of 2018-2019 usage, via bill credits or mailed cheques.

Key Points

A $535M credit refunding 2.49% of 2018-2019 usage to Hydro-Québec customers via bill credits or cheques.

✅ Applies to 2018-2019 consumption; average refund about $60.

✅ Current customers get bill credits; former customers receive cheques.

✅ Refund equals 2.49% of usage from variance accounts under prior rates.

Following the adoption of Bill 34 in December 2019, a total amount of $535 million will be refunded to customers who were Hydro-Québec account holders in 2018 or 2019. This amount was accumulated in variance accounts required under the previous rate system between January 1, 2018, and December 31, 2019.

If you are still a Hydro-Québec customer, a credit will be applied to your bill in the coming weeks, and improving billing layout clarity is a focus in some provinces as well. The amount will be indicated on your bill.

An average refund amount of $60. The refund amount is calculated based on the quantity of electricity that each customer consumed in 2018 and 2019. The refund will correspond to 2,49% of each customer's consumption between January 1, 2018, and December 31, 2019, for an average of approximately $60, while Ontario hydro rates are set to increase on Nov. 1.

The following chart provides an overview of the refund amount based on the type of home. Naturally, the number of occupants, electricity use habits and features of the home, such as insulation and energy efficiency, may have a significant impact on the amount of the refund, and in other provinces, oversight debates continue following a BC Hydro fund surplus revelation.

What if you were an account holder in 2018 or 2019 but you are no longer a Hydro-Québec customer?

People who were account holders in 2018 or 2019, but who are no longer Hydro-Québec customers will receive their credit by cheque, a lump sum credit approach seen elsewhere.

To receive their cheque, these people must get in touch to update their address in one of the following ways:

If they have a Hydro-Québec Customer Space and remember their access code, they can update their profile.

Anyone without a Customer Space or who doesn't remember their access code can fill out the Request for a credit form at the following address: www.hydroquebec.com/credit in which they can indicate the address where they wish to receive their cheque, where applicable.

Those who cannot send us their address online can call 514 385-7252 or 1 888 385-7252 to give it to a customer services representative, as utilities like Hydro One have moved to reconnect customers in some cases. Note that the process will take longer on the phone, especially if the call volume is high.

UPDATE: Hydro-Québec will be returning an additional $35 million to customers under the adoption of Bill 34, amid overcharging allegations reported elsewhere.

Energy Minister Jonatan Julien announced on Tuesday that the public utility will be refunding a total of $535 million to customers between January and April.

The legislation, which was passed in December, allows the Quebec government to take control of the rates charged for electricity in the province, including decisions on whether to seek a rate hike next year under the new framework.

Related News

Electric vehicles to transform the aftermarket … eventually

Heavy-Duty Truck Electrification is disrupting the aftermarket as diesel declines: fewer parts, regenerative braking, emissions rules, e-drives, gearboxes, and software engineering needs reshape service demand, while ICE fleets persist for years.

Key Points

Transition of heavy trucks to EV systems, reducing parts and emissions while reshaping aftermarket service and skills.

✅ 33% fewer parts; regenerative braking slashes brake wear

✅ Diesel share declines; EVs and natural gas slowly gain

✅ Aftermarket shifts to e-drives, gearboxes, software and service

Those who sell parts and repair trucks might feel uneasy when reports emerge about a coming generation of electric trucks.

There are reportedly about 33% fewer parts to consider when internal combustion engines and transmissions are replaced by electric motors. Features such as regenerative braking are expected to dramatically reduce brake wear. As for many of the fluids needed to keep components moving? They can remain in their tanks and drums.

Think of them as disruptors. But presenters during the annual Heavy Duty Aftermarket Dialogue are stressing that the changes are not coming overnight. Chris Patterson, a consultant and former Daimler Trucks North America CEO, noted that the Daimler electrification plan underscores the shift as he counts just 50 electrified heavy trucks in North America.

About 88% of today’s trucks run on diesel, with the remaining 12% mostly powered by gasoline, said John Blodgett, MacKay and Company’s vice-president of sales and marketing. Five years out, even amid talk of an EV inflection point, he expects 1% to be electric, 2% to be natural gas, 12% to be gasoline, and 84% on diesel.

But a decade from now, forecasts suggest a split of 76% diesel, 11% gasoline, 7% electric, and 5% natural gas, with a fraction of a percent relying on hydrogen-electric power. Existing internal combustion engines will still be in service, and need to be serviced, but aftermarket suppliers are now preparing for their roles in the mix, especially as Canada’s EV opportunity comes into focus for North American players.

“This is real, for sure,” said Delphi Technologies CEO Rick Dauch.

Aftermarket support is needed

“As programs are launched five to six years from now, what are the parts coming back?” he asked the crowd. “Braking and steering. The fuel injection business will go down, but not for 20-25 years.” The electric vehicles will also require a gear box and motor.

“You still have a business model,” he assured the crowd of aftermarket professionals.

Shifting emissions standards are largely responsible for the transformation that is occurring. In Europe, Volkswagen’s diesel emissions scandal and future emissions rules of Euro 7 will essentially sideline diesel-powered cars, even as electric buses have yet to take over transit systems. Delphi’s light-duty diesel business has dropped 70% in just five years, leading to plant closures in Spain, France and England.

“We’ve got a billion-dollar business in electrification, last year down $200 million because of the downturn in light-duty diesel controllers,” Dauch said. “We think we’re going to double our electrification business in five years.”

That has meant opening five new plants in Eastern European markets like Turkey, Romania and Poland alone.

Deciding when the market will emerge is no small task, however. One new plant in China offered manufacturing capacity in July 2019, but it has yet to make any electric vehicle parts, highlighting mainstream EV challenges tied to policy shifts, because the Chinese government changed the incentive plans for electric vehicles.

‘All in’ on electric vehicles

Dana has also gone “all in” on electrification, said chairman and CEO Jim Kamsickas, referring to Dana’s work on e-drives with Kenworth and Peterbilt. Its gasket business is focusing on the needs of battery cooling systems and enclosures.

But he also puts the demand for new electric vehicle systems in perspective. “The mechanical piece is still going to be there.”

The demand for the new components and systems, however, has both companies challenged to find enough capable software engineers. Delphi has 1,600 of them now, and it needs more.

“Just being a motor supplier, just being an inverter supplier, just being a gearbox supplier itself, yes you’ll get value out of that. But in the longhaul you’re going to need to have engineers,” Kamsickas said of the work to develop systems.

Dauch noted that Delphi will leave the capital-intensive work of producing batteries to other companies in markets like China and Korea. “We’re going to make the systems that are in between – inverters, chargers, battery management systems,” he said.

Difficult change

But people working for European companies that have been built around diesel components are facing difficult days. Dauch refers to one German village with a population of 1,200, about 800 of whom build diesel engine parts. That business is working furiously to shift to producing gasoline parts.

Electrification will face hurdles of its own, of course. Major cities around the world are looking to ban diesel-powered vehicles by 2050, but they still lack the infrastructure needed to charge all the cars and truck fleet charging at scale, he added.

Kamsickas welcomes the disruptive forces.

“This is great,” he said. “It’s making us all think a little differently. It’s just that business models have had to pivot – for you, for us, for everybody.”

They need to be balanced against other business demands, including evolving cross-border EV collaboration dynamics, too.

Said Kamsickas: “Working through the disruption of electrification, it’s how do you financially manage that? Oh, by the way, the last time I checked there are [company] shareholders and stakeholders you need to take care of.”

“It’s going to be tough,” Dauch agreed, referring to the changes for suppliers. “The next three to four years are really going to be game changes. “There’ll be some survivors and some losers, that’s for sure.”

Related News

British carbon tax leads to 93% drop in coal-fired electricity

Carbon Price Support, the UK carbon tax on power, slashed coal generation, cut CO2 emissions, boosted gas and imports via interconnectors, and signaled effective electricity market decarbonization across Great Britain and the EU.

Key Points

A UK power-sector carbon tax that drove coal off the grid, cut emissions, and shifted generation toward gas and imports.

✅ Coal generation fell from 40% to 3% in six years

✅ Rate rose to £18/tCO2 in 2015, boosting the coal-to-gas switch

✅ Added ~£39 to 2018 bills; imports via interconnectors eased prices

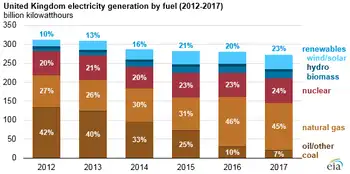

A tax on carbon dioxide emissions in Great Britain, introduced in 2013, has led to the proportion of electricity generated from coal falling from 40% to 3% over six years, a trend mirrored by global coal decline in power generation, according to research led by UCL.

British electricity generated from coal fell from 13.1 TWh (terawatt hours) in 2013 to 0.97 TWh in September 2019, and was replaced by other less emission-heavy forms of generation such as gas, as producers move away from coal in many markets. The decline in coal generation accelerated substantially after the tax was increased in 2015.

In the report, 'The Value of International Electricity Trading', researchers from UCL and the University of Cambridge also showed that the tax—called Carbon Price Support—added on average £39 to British household electricity bills, within the broader context of UK net zero policies shaping the energy transition, collecting around £740m for the Treasury, in 2018.

Academics researched how the tax affected electricity flows to connected countries and interconnector (the large cables connecting the countries) revenue between 2015—when the tax was increased to £18 per tonne of carbon dioxide—and 2018. Following this increase, the share of coal-fired electricity generation fell from 28% in 2015 to 5% in 2018, reaching 3% by September 2019. Increased electricity imports from the continent, alongside the EU electricity demand outlook across member states, reduced the price impact in the UK, and meant that some of the cost was paid through a slight increase in continental electricity prices (mainly in France and the Netherlands).

Project lead Dr. Giorgio Castagneto Gissey (Bartlett Institute for Sustainable Resources, UCL) said: "Should EU countries also adopt a high carbon tax we would likely see huge carbon emission reductions throughout the Continent, as we've seen in Great Britain over the last few years."

Lead author, Professor David Newbery (University of Cambridge), said: "The Carbon Price Support provides a clear signal to our neighbours of its efficacy at reducing CO2 emissions."

The Carbon Price Support was introduced in England, Scotland and Wales at a rate of £4.94 per tonne of carbon dioxide-equivalent and is now capped at £18 until 2021.The tax is one part of the Total Carbon Price, which also includes the price of EU Emissions Trading System permits and reflects global CO2 emissions trends shaping policy design.

Report co-author Bowei Guo (University of Cambridge) said: "The Carbon Price Support has been instrumental in driving coal off the grid, but we show how it also creates distortions to cross-border trade, making a case for EU-wide adoption."

Professor Michael Grubb (Bartlett Institute for Sustainable Resources, UCL) said: "Great Britain's electricity transition is a monumental achievement of global interest, and has also demonstrated the power of an effective carbon price in lowering dependence on electricity generated from coal."

The overall report on electricity trading also covers the value of EU interconnectors to Great Britain, measures the efficiency of cross-border electricity trading and considers the value of post-Brexit decoupling from EU electricity markets, setting these findings against the global energy transition underway.

Published today, the report annex focusing on the Carbon Price Support was produced by UCL to focus on the impact of the tax on British energy bills, with comparisons to Canadian climate policy debates informing grid impacts.

Related News

New Program Set to Fight for 'Electricity Future That Works for People and the Planet'

Energy Justice Program drives a renewables-based transition, challenging utility monopolies with legal action, promoting rooftop solar, distributed energy, public power, and climate justice to decarbonize the grid and protect communities and wildlife nationwide.

Key Points

A climate justice initiative advancing renewables, legal action, and public power to challenge utility monopolies.

✅ Challenges utility barriers to rooftop solar and distributed energy

✅ Advances state and federal policies for equitable, public power

✅ Uses litigation to curb fossil fuel dependence and protect communities

The Center for Biological Diversity on Monday rolled out a new program to push back against the nation's community- and wildlife-harming energy system that the climate advocacy group says is based on fossil fuels and a "centralized monopoly on power."

The goal of the new effort, the Energy Justice Program, is to help forge a path towards a just and renewables-based energy future informed by equitable regulation principles.

"Our broken energy system threatens our climate and our future," said Jean Su, the Energy Justice Program's new director, in a statement. "Utilities were given monopolies to ensure public access to electricity, but these dinosaur corporations are now hurting the public interest by blocking the clean energy transition, including via coal and nuclear subsidy schemes that profit off the fossil fuel era."

"In this era of climate catastrophe," she continued, "we have to stop these outdated monopolies and usher in a new electricity future that works for people and the planet."

To meet those goals, the new program will pursue a number of avenues, including using legal action to fight utilities' obstruction of clean energy efforts, helping communities advance local solar programs through energy freedom strategies in the South, and crafting energy policies on the state, federal, and international levels in step with commitments from major energy buyers to achieve a 90% carbon-free goal by 2030.

Some of that work is already underway. In June the Center filed a brief with a federal court in a bid to block Arizona power utility Salt River Project from slapping a 60-percent electricity rate hike on rooftop solar customers—amid federal efforts to reshape electricity pricing that critics say are being rushed—a move the group described (pdf) as an obstacle to achieving "the energy transition demanded by climate science."

The Center is among the groups in Energy Justice NC. The diverse coalition seeks to end the energy stranglehold in North Carolina held by Duke Energy, which continues to invest in fossil fuel projects even as it touts clean energy and grid investments in the region.

The time for a new energy system, says the Energy Justice Program, is now, as climate change impacts increasingly strain the grid.

"Amid this climate and extinction emergency," said Su, "the U.S. can't afford to stick with the same centralized, profit-driven electricity system that drove us here in the first place. We have to seize this once-in-a-generation opportunity to design a new system of accountable, equitable, truly public power."

Related News

Electricity turns garbage into graphene

Waste-to-Graphene uses flash joule heating to convert carbon-rich trash into turbostratic graphene for composites, asphalt, concrete, and flexible electronics, delivering scalable, low-cost, high-quality material from food scraps, plastics, and tires with minimal processing.

Key Points

A flash heating method converting waste carbon into turbostratic graphene for scalable, low-cost industrial uses.

✅ Converts food scraps, plastics, and tires into graphene

✅ Produces turbostratic flakes that disperse well in composites

✅ Scalable, low-cost process via flash joule heating

Science doesn’t usually take after fairy tales. But Rumpelstiltskin, the magical imp who spun straw into gold, would be impressed with the latest chemical wizardry. Researchers at Rice University report today in Nature that they can zap virtually any source of solid carbon, from food scraps to old car tires, and turn it into graphene—sheets of carbon atoms prized for applications ranging from high-strength plastic to flexible electronics, and debates over 5G electricity use continue to evolve. Current techniques yield tiny quantities of picture-perfect graphene or up to tons of less prized graphene chunks; the new method already produces grams per day of near-pristine graphene in the lab, and researchers are now scaling it up to kilograms per day.

“This work is pioneering from a scientific and practical standpoint” as it promises to make graphene cheap enough to use to strengthen asphalt or paint, says Ray Baughman, a chemist at the University of Texas, Dallas. “I wish I had thought of it.” The researchers have already founded a new startup company, Universal Matter, to commercialize their waste-to-graphene process, while others are digitizing the electrical system to modernize infrastructure.

With atom-thin sheets of carbon atoms arranged like chicken wire, graphene is stronger than steel, conducts electricity and heat better than copper, and can serve as an impermeable barrier preventing metals from rusting, while advances such as superconducting cables aim to cut grid losses. But since its 2004 discovery, high-quality graphene—either single sheets or just a few stacked layers—has remained expensive to make and purify on an industrial scale. That’s not a problem for making diminutive devices such as high-speed transistors and efficient light-emitting diodes. But current techniques, which make graphene by depositing it from a vapor, are too costly for many high-volume applications. And higher throughput approaches, such as peeling graphene from chunks of the mineral graphite, produce flecks composed of up to 50 graphene layers that are not ideal for most applications.

Graphene comes in many forms. Single sheets, which are ideal for electronics and optics, can be grown using a method called chemical vapor deposition. But it produces only tiny amounts. For large volumes, companies commonly use a technique called liquid exfoliation. They start with chunks of graphite, which is just myriad stacked graphene layers. Then they use acids and solvents, as well as mechanical grinding, to shear off flakes. This approach typically produces tiny platelets each made up of 20 to 50 layers of graphene.

In 2014, James Tour, a chemist at Rice, and his colleagues found they could make a pure form of graphene—each piece just a few layers thick—by zapping a form of amorphous carbon called carbon black with a laser. Brief pulses heated the carbon to more than 3000 kelvins, snapping the bonds between carbon atoms; for comparison, researchers have also generated electricity from falling snow using triboelectric effects. As the cloud of carbon cooled, it coalesced into the most stable structure possible, graphene. But the approach still produced only tiny qualities and required a lot of energy.

Two years ago, Luong Xuan Duy, one of Tour’s graduate students, read that other researchers had created metal nanoparticles by zapping a material with electricity, creating the same brief blast of heat behind the success of the laser graphene approach. “I wondered if I could use that to heat a carbon source and produce graphene,” Duy says. So, he put a dash of carbon black in a clear glass vial and zapped it with 400 volts, similar in spirit to electrical weed zapping approaches in agriculture, for about 200 milliseconds. Initially he got junk. But after a bit of tweaking, he managed to create a bright yellowish white flash, indicating the temperature inside the vial was reaching about 3000 kelvins. Chemical tests revealed he had produced graphene.

It turned out to be a type of graphene that is ideal for bulk uses. As the carbon atoms condense to form graphene, they don’t have time to stack in a regular pattern, as they do in graphite. The result is a material known as turbostatic graphene, with graphene layers jumbled at all angles atop one another. “That’s a good thing,” Duy says. When added to water or other solvents, turbostatic graphene remains suspended instead of clumping up, allowing each fleck of the material to interact with whatever composite it’s added to.

“This will make it a very good material for applications,” says Monica Craciun, a materials physicist at the University of Exeter. In 2018, she and her colleagues reported that adding graphene to concrete more than doubled its compressive strength. Tour’s team saw much the same result. When they added just 0.05% by weight of their flash-produced graphene to concrete, the compressive strength rose 25%; graphene added to polydimethylsiloxane, a common plastic, boosted its strength by 250%.

As digital control spreads across energy networks, research to counter ransomware-driven blackouts is increasingly important for grid resilience.

Those results could reignite efforts to use graphene in a wide range of composites. Researchers in Italy reported recently that adding graphene to asphalt dramatically reduces its tendency to fracture and more than doubles its life span. Last year, Iterchimica, an Italian company, began to test a 250-meter stretch of road in Milan paved with graphene-spiked asphalt. Tests elsewhere have shown that adding graphene to paint dramatically improves corrosion resistance.

These applications would require high-quality graphene by the ton. Fortunately, the starting point for flash graphene could hardly be cheaper or more abundant: Virtually any organic matter, including coffee grounds, food scraps, old tires, and plastic bottles, can be vaporized to make the material. “We’re turning garbage into graphene,” Duy says.

Related News

A tidal project in Scottish waters just generated enough electricity to power nearly 4,000 homes

MeyGen Tidal Stream Project delivers record 13.8 GWh to Scotland's grid, showcasing renewable ocean energy. Simec Atlantis Energy's 6 MW array of tidal turbines advances EU power goals and plans an ocean-powered data center.

Key Points

A Scottish tidal energy array exporting record power, using four 1.5 MW turbines and driving renewable innovation.

✅ Delivered 13.8 GWh to the grid in 2019, a project record.

✅ Four 1.5 MW turbines in Phase 1A, 6 MW installed.

✅ Plans include an ocean-powered data center near site.

A tidal power project in waters off the north coast of Scotland, where Scotland’s wind farms also deliver significant output, sent more than 13.8 gigawatt hours (GWh) of electricity to the grid last year, according to an operational update issued Monday. This figure – a record – almost doubled the previous high of 7.4 GWh in 2018.

In total, the MeyGen tidal stream array has now exported more than 25.5 GWh of electricity to the grid since the start of 2017, according to owners Simec Atlantis Energy. Phase 1A of the project is made up of four 1.5 megawatt (MW) turbines.

The 13.8 GWh of electricity exported in 2019 equates to the average yearly electricity consumption of roughly 3,800 “typical” homes in the U.K., where wind power records have been set recently, according to the company, with revenue generation amounting to £3.9 million ($5.09 million).

Onshore maintenance is now set to be carried out on the AR1500 turbine used by the scheme, with Atlantis aiming to redeploy the technology in spring.

In addition to the production of electricity, Atlantis is also planning to develop an “ocean-powered data centre” near the MeyGen project.

The European Commission has described “ocean energy” as being both abundant and renewable, and milestones like the biggest offshore windfarm starting U.K. supply underscore wider momentum, too. It’s estimated that ocean energy could potentially contribute roughly 10% of the European Union’s power demand by the year 2050, according to the Commission.

While tidal power has been around for decades — EDF’s 240 MW La Rance Tidal Power Plant in France was built as far back as 1966, and the country’s first offshore wind turbine has begun producing electricity — recent years have seen a number of new projects take shape.

In December last year, Scottish tidal energy business Nova Innovation was issued with a permit to develop a project in Nova Scotia, Canada, aiming to harness the Bay of Fundy tides in the region further.

In an announcement at the time, the firm said a total of 15 tidal stream turbines would be installed by the year 2023. The project, according to the firm, will produce enough electricity to power 600 homes, as companies like Sustainable Marine begin delivering tidal energy to the Nova Scotia grid.

Elsewhere, a business called Orbital Marine Power is developing what it describes as the world’s most powerful tidal turbine, with grid-supplied output already demonstrated.

The company says the turbine will have a swept area of more than 600 square meters and be able to generate “over 2 MW from tidal stream resources.” It will use a 72-meter-long “floating superstructure” to support two 1 MW turbines.

Related News

For Hydro-Québec, selling to the United States means reinventing itself

Hydro-Quebec hydropower exports deliver low-carbon electricity to New England, sparking debate on greenhouse gas accounting, grid attributes, and REC-style certificates as Quebec modernizes monitoring to verify emissions, integrate renewables, and meet ambitious climate targets.

Key Points

Low-carbon electricity to New England, with improved emissions tracking and verifiable grid attributes.

✅ Deep, narrow reservoirs cut lifecycle GHGs in cold boreal waters

✅ Attribute certificates trace source, type, and carbon intensity

✅ Contracts require facility-level tagging for compliance

For 40 years, through the most vicious interprovincial battles, even as proposals for bridging the Alberta-B.C. gap aimed to improve grid resilience, Canadians could agree on one way Quebec is undeniably superior to the rest of the country.

It’s hydropower, and specifically the mammoth dam system in Northern Quebec that has been paying dividends since it was first built in the 70s. “Quebec continues to boast North America’s lowest electricity prices,” was last year’s business-as-usual update in one trade publication, even as Newfoundland's rate strategy seeks relief for consumers.

With climate crisis looming, that long-ago decision earns even more envy and reflects Canada's electricity progress across the grid today. Not only do they pay less, but Quebeckers also emit the least carbon per capita of any province.

It may surprise most Canadians, then, to hear how most of New England has reacted to the idea of being able to buy permanently into Quebec’s power grid.

Hydro-Québec’s efforts to strike major export deals have been rebuffed in the U.S., by environmentalists more than anyone. They question everything about Quebec hydropower, including asking “is it really low-carbon?”

These doubts may sound nonsensical to regular Quebeckers. But airing them has, in fact, pushed Hydro-Québec to learn more about itself and adopt new technology.

We know far more about hydropower than we knew 40 years ago, including whether it’s really zero-emission (it’s not), how to make it as close to zero-emission as possible, and how to account for it as precisely as new clean energies like solar and wind, underscoring how cleaning up Canada's electricity is vital to meeting climate pledges.

The export deals haven’t gone through yet, but they’ve already helped drag Hydro-Québec—roughly the fourth-biggest hydropower system on the planet—into the climate era.

Fighting to export

One of the first signs of trouble for Quebec hydro was in New Hampshire, almost 10 years ago. People there began pasting protest signs on their barns and buildings. One citizens’ group accused Hydro of planning a “monstrous extension cord” across the state.

Similar accusations have since come from Maine, Massachusetts and New York.

The criticism isn’t coming from state governments, which mostly want a more permanent relationship with Hydro-Québec. They already rely on Quebec power, but in a piecemeal way, topping up their own power grid when needed (with the exception of Vermont, which has a small permanent contract for Quebec hydropower).

Last year, Quebec provided about 15 percent of New England’s total power, plus another substantial amount to New York, which is officially not considered to be part of New England, and has its own energy market separate from the New England grid.

Now, northeastern states need an energy lynch pin, rather than a top-up, with existing power plants nearing the end of their lifespans. In Massachusetts, for example, one major nuclear plant shut down this year and another will be retired in 2021. State authorities want a hydro-based energy plan that would send $10 billion to Hydro-Québec over 20 years.

New England has some of North America’s most ambitious climate goals, with every state in the region pledging to cut emissions by at least 80 percent over the next 30 years.

What’s the downside? Ask the citizens’ groups and nonprofits that have written countless op-eds, organized petitions and staged protests. They argue that hydropower isn’t as clean as cutting-edge clean energy such as solar and wind power, and that Hydro-Québec isn’t trying hard enough to integrate itself into the most innovative carbon-counting energy system. Right as these other energy sources finally become viable, they say, it’s a step backwards to commit to hydro.

As Hydro-Québec will point out, many of these critics are legitimate nonprofits, but others may have questionable connections. The Portland Press Herald in Maine reported in September 2018 that a supposedly grassroot citizens’ group called “Stand Up For Maine” was actually funded by the New England Power Generators Association, which is based in Boston and represents such power plant owners as Calpine Corp., Vistra Energy and NextEra Energy.

But in the end, that may not matter. Arguably the biggest motivator to strike these deals comes not from New England’s needs, but from within Quebec. The province has spent more than $10 billion in the last 15 years to expand its dam and reservoir system, and in order to stay financially healthy, it needs to double its revenue in the next 10 years—a plan that relies largely on exports.

With so much at stake, it has spent the last decade trying to prove it can be an energy of the future.

“Learning as you go”

American critics, justified or not, have been forcing advances at Hydro for a long time.

When the famously huge northern Quebec hydro dams were built at James Bay—construction began in the early 1970s—the logic was purely economic. The term “climate change” didn’t exist. The province didn’t even have an environment department.

The only reason Quebec scientists started trying to measure carbon emissions from hydro reservoirs was “basically because of the U.S.,” said Alain Tremblay, a senior environmental advisor at Hydro Quebec.

Alain Tremblay, senior environmental advisor at Hydro-Québec. Photograph courtesy of Hydro-Québec

In the early 1990s, Hydro began to export power to the U.S., and “because we were a good company in terms of cost and efficiency, some Americans didn't like that,” he said—mainly competitors, though he couldn’t say specifically who. “They said our reservoirs were emitting a lot of greenhouse gases.”

The detractors had no research to back up that claim, but Hydro-Québec had none to refute it, either, said Tremblay. “At that time we didn’t have any information, but from back-of-the envelope calculations, it was impossible to have the emissions the Americans were expecting we have.”

So research began, first to design methods to take the measurements, and then to carry them out. Hydro began a five-year project with a Quebec university.

It took about 10 years to develop a solid methodology, Tremblay said, with “a lot of error and learning-as-you-go.” There have been major strides since then.

“Twenty years ago we were taking a sample of water, bringing it back to the lab and analyzing that with what we call a gas chromatograph,” said Tremblay. “Now, we have an automated system that can measure directly in the water,” reading concentrations of CO2 and methane every three hours and sending its data to a processing centre.

The tools Hydro-Québec uses are built in California. Researchers around the world now follow the same standard methods.

At this point, it’s common knowledge that hydropower does emit greenhouse gases. Experts know these emissions are much higher than previously thought.

Workers on the Eastmain-1 project environmental monitoring program. Photography courtesy of Alain Tremblay.

But Hydro-Québec now has the evidence, also, to rebut the original accusations from the early 1990s and many similar ones today.

“All our research from Université Laval [found] that it’s about a thousand years before trees decompose in cold Canadian waters,” said Tremblay.

Hydro reservoirs emit greenhouse gases because vegetation and sometimes other biological materials, like soil runoff, decay under the surface.

But that decay depends partly on the warmth of the water. In tropical regions, including the southern U.S., hydro dams can have very high emissions. But in boreal zones like northern Quebec (or Manitoba, Labrador and most other Canadian locations with massive hydro dams), the cold, well-oxygenated water vastly slows the process.

Hydro emissions have “a huge range,” said Laura Scherer, an industrial ecology professor at Leiden University in the Netherlands who led a study of almost 1,500 hydro dams around the world.

“It can be as low as other renewable energy sources, but it can also be as high as fossil fuel energy,” in rare cases, she said.

While her study found that climate was important, the single biggest factor was “sizing and design” of each dam, and specifically its shape, she said. Ideally, hydro dams should be deep and narrow to minimize surface area, perhaps using a natural valley.

Hydro-Québec’s first generation of dams, the ones around James Bay, were built the opposite way—they’re wide and shallow, infamously flooding giant tracts of land.

Alain Tremblay, senior environmental advisor at Hydro-Québec testing emission levels. Photography courtesy of Alain Tremblay

Newly built ones take that new information into account, said Tremblay. Its most recent project is the Romaine River complex, which will eventually include four reservoirs near Quebec’s northeastern border with Labrador. Construction began in 2016.

The site was picked partly for its topography, said Tremblay.

“It’s a valley-type reservoir, so large volume, small surface area, and because of that there’s a pretty limited amount of vegetation that’s going to be flooded,” he said.

There’s a dramatic emissions difference with the project built just before that, commissioned in 2006. Called Eastmain, it’s built near James Bay.

“The preliminary results indicate with the same amount of energy generated [by Romaine] as with Eastmain, you’re going to have about 10 times less emissions,” said Tremblay.

Tracing energy to its source

These signs of progress likely won’t satisfy the critics, who have publicly argued back and forth with Hydro about exactly how emissions should be tallied up.

But Hydro-Québec also faces a different kind of growing gap when it comes to accounting publicly for its product. In the New England energy market, a sophisticated system “tags” all the energy in order to delineate exactly how much comes from which source—nuclear, wind, solar, and others—and allows buyers to single out clean power, or at least the bragging rights to say they bought only clean power.

Really, of course, it’s all the same mix of energy—you can’t pick what you consume. But creating certificates prevents energy producers from, in worst-case scenarios, being able to launder regular power through their clean-power facilities. Wind farms, for example, can’t oversell what their own turbines have produced.

What started out as a fraud prevention tool has “evolved to make it possible to also track carbon emissions,” said Deborah Donovan, Massachusetts director at the Acadia Center, a climate-focused nonprofit.

But Hydro-Québec isn’t doing enough to integrate itself into this system, she says.

It’s “the tool that all of our regulators in New England rely on when we are confirming to ourselves that we’ve met our clean energy and our carbon goals. And…New York has a tool just like that,” said Donovan. “There isn’t a tracking system in Canada that’s comparable, though provinces like Nova Scotia are tapping the Western Climate Initiative for technical support.”

Hydro Quebec Chénier-Vignan transmission line crossing the Outaouais river. Photography courtesy of Hydro-Québec

Developing this system is more a question of Canadian climate policy than technology.

Energy companies have long had the same basic tracking device—a meter, said Tanya Bodell, a consultant and expert in New England’s energy market. But in New England, on top of measuring “every time there’s a physical flow of electricity” from a given source, said Bodell, a meter “generates an attribute or a GIS certificate,” which certifies exactly where it’s from. The certificate can show the owner, the location, type of power and its average emissions.

Since 2006, Hydro-Québec has had the ability to attach the same certificates to its exports, and it sometimes does.

“It could be wind farm generation, even large hydro these days—we can do it,” said Louis Guilbault, who works in regulatory affairs at Hydro-Québec. For Quebec-produced wind energy, for example, “I can trade those to whoever’s willing to buy it,” he said.

But, despite having the ability, he also has the choice not to attach a detailed code—which Hydro doesn’t do for most of its hydropower—and to have it counted instead under the generic term of “system mix.”

Once that hydropower hits the New England market, the administrators there have their own way of packaging it. The market perhaps “tries to determine emissions, GHG content,” Guilbault said. “They have their own rules; they do their own calculations.”

This is the crux of what bothers people like Donovan and Bodell. Hydro-Québec is fully meeting its contractual obligations, since it’s not required to attach a code to every export. But the critics wish it would, whether by future obligation or on its own volition.

Quebec wants it both ways, Donovan argued; it wants the benefits of selling low-emission energy without joining the New England system of checks and balances.

“We could just buy undifferentiated power and be done with it, but we want carbon-free power,” Donovan said. “We’re buying it because of its carbon content—that’s the reason.”

Still, the requirements are slowly increasing. Under Hydro-Québec’s future contract with Massachusetts (which still has several regulatory steps to go through before it’s approved) it’s asked to sell the power’s attributes, not just the power itself. That means that, at least on paper, Massachusetts wants to be able to trace the energy back to a single location in Quebec.

“It’s part of the contract we just signed with them,” said Guilbault. “We’re going to deliver those attributes. I’m going to select a specific hydro facility, put the number in...and transfer that to the buyers.”

Hydro-Québec says it’s voluntarily increasing its accounting in other ways. “Even though this is not strictly required,” said spokeswoman Lynn St. Laurent, Hydro is tracking its entire output with a continent-wide registry, the North American Renewables Registry.